|

市場調查報告書

商品編碼

1822646

避孕藥市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Contraceptives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

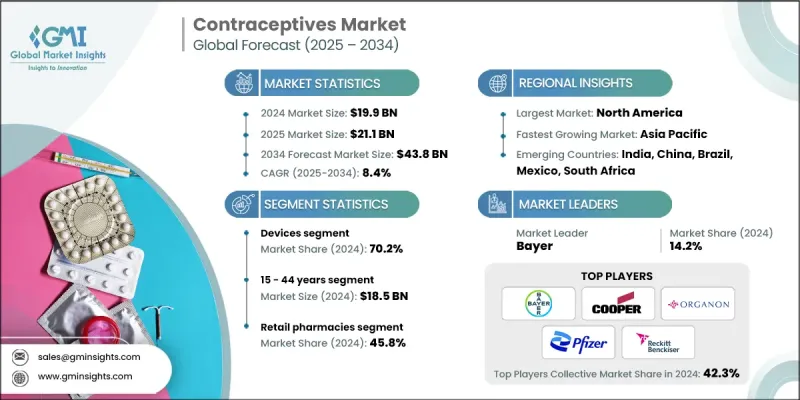

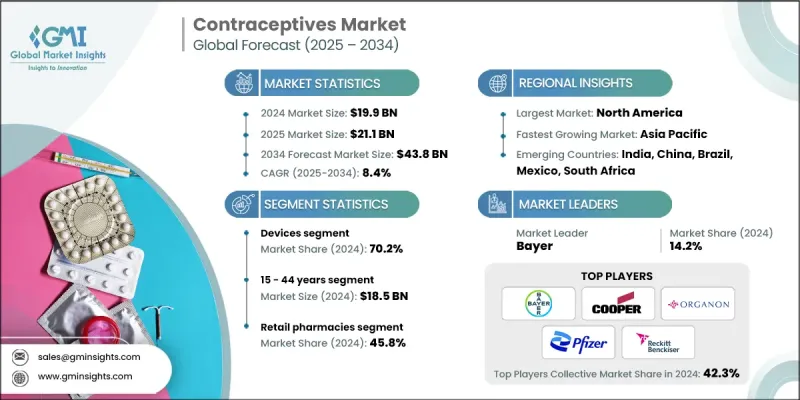

根據 Global Market Insights Inc. 發布的最新報告,全球避孕藥具市場規模預計在 2024 年為 199 億美元,預計將從 2025 年的 211 億美元成長到 2034 年的 438 億美元,複合年成長率為 8.4%。

圍繞生殖權利和計劃生育的公共衛生運動和教育日益增多,提高了人們對避孕措施的認知和接受度。非政府組織和政府計劃(例如聯合國人口基金會、世界衛生組織)正在推動已開發地區和發展中地區獲得現代避孕措施。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 199億美元 |

| 預測值 | 438億美元 |

| 複合年成長率 | 8.4% |

設備採用率不斷上升

受長效和可逆避孕需求不斷成長的推動,2024年,避孕器械市場佔據了顯著佔有率。子宮內避孕器 (IUD)、保險套和植體等產品因其功效和便利性而日益受到青睞。其中,激素類和銅基IUD憑藉其高成功率和長期保護作用,仍是首選。市場參與者正專注於產品創新、提升舒適度和延長使用時間,以吸引更廣泛的客戶群。

15-44歲族群盛行率上升

15-44歲年齡層由於處於生育年齡且積極參與計劃生育,在2024年佔據了相當大的佔有率。這一年齡層的驅動力在於推遲懷孕的願望以及青少年和年輕人日益成長的性健康意識。不斷擴大的教育覆蓋範圍、數位健康平台以及有針對性的行銷活動,正在幫助這一年齡層規範避孕措施的使用。各大公司正在調整其宣傳訊息,強調生活方式的兼容性、易用性和可及性,以引起這一年齡層的共鳴。此外,為了吸引這一年齡層注重隱私的用戶,該公司還推出了訂閱模式和謹慎的配送服務。

零售藥局將獲得發展動力

2025-2034年,零售藥局市場將以可觀的複合年成長率成長,這得益於便利性、可近性和消費者匿名性。隨著口服避孕藥和應急藥的非處方藥供應日益增加,該市場正穩步成長。此外,藥局營業時間的延長、城鄉結合部地區滲透率的提高以及藥劑師在生殖健康諮詢中日益重要的作用也使該市場受益。為了增強影響力,製藥公司正在與大型零售連鎖店建立合作夥伴關係,提供促銷折扣,並確保產品供應的穩定性。

區域洞察

北美將成為利潤豐厚的地區

2024年,北美避孕藥市場收入可觀,這得益於消費者的高認知度、優惠的報銷政策以及完善的醫療基礎設施。由於荷爾蒙避孕藥、子宮內避孕器和緊急避孕藥的廣泛應用,美國在該地區處於領先地位。根據最近的估計,北美市場價值超過80億美元,並且隨著數位處方和直接面對消費者的遠距醫療服務的日益普及,預計將穩步成長。在該地區營運的公司專注於獲得FDA批准、實現產品多元化以及擴展其線上銷售平台,以滿足不斷變化的消費者行為。

避孕藥市場的主要參與者有 HLL Lifecare(印度)、輝瑞、LifeStyles Healthcare、Church & Dwight、Exeltis、利潔時、CooperSurgical、Medintim(Kessel)、Organon、Pregna International、Evofem Biosciences、Mayne Pharma、Agile Therapeutics、拜耳、Ascience)。

為了維持並提升自身地位,避孕藥市場中的公司正在採取一系列產品創新、區域擴張和以客戶為中心的措施。其中最突出的策略之一是投資研發,以開發更安全、更有效、更方便使用者的產品,包括非荷爾蒙避孕藥和男性避孕藥。此外,各大品牌正在利用數位平台進行直接互動,提供遠距醫療諮詢和線上履行服務,以滿足消費者對便利性的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 已開發國家有利的監管環境

- 計劃性延遲妊娠的傾向日益增強

- 發展中經濟體未滿足的避孕需求很高

- 性傳染病(STD)盛行率不斷上升

- 產業陷阱與挑戰

- 避孕藥的副作用

- 市場機會

- 長效可逆避孕藥(LARC)需求成長

- 非荷爾蒙和天然避孕替代品的興起趨勢

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 當前的技術趨勢

- 新興技術

- 2024年定價分析

- 消費者行為分析

- 供應鏈分析

- 品牌分析

- 頂尖公司的商業模式

- CooperSurgical

- 利潔時

- 市場進入策略分析

- 差距分析

- 波特的分析

- PESTEL分析

- 未來市場趨勢

- 價值鏈分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 多邊環境協定

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 裝置

- 保險套

- 男性

- 女性

- 子宮內避孕器

- 荷爾蒙子宮內避孕器

- 銅子宮內避孕器

- 陰道環

- 皮下植入物

- 隔膜

- 避孕海綿

- 保險套

- 藥物

- 口服避孕藥

- 注射避孕藥

- 外用避孕藥

第6章:市場估計與預測:按年齡層,2021 - 2034 年

- 主要趨勢

- 15 - 44歲

- 44歲以上

第7章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 零售藥局

- 醫院藥房

- 線上通路

- 其他分銷管道

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Agile Therapeutics

- Bayer

- Church & Dwight

- CooperSurgical

- Evofem Biosciences

- Exeltis

- HLL Lifecare (India)

- HRA Pharma / Perrigo (OTC)

- LifeStyles Healthcare

- Mayne Pharma

- Medintim (Kessel)

- Organon

- Pfizer

- Pregna International

- Reckitt

The global contraceptives market was estimated at USD 19.9 billion in 2024 and is expected to grow from USD 21.1 billion in 2025 to USD 43.8 billion by 2034, at a CAGR of 8.4%, according to the latest report published by Global Market Insights Inc.

Growing public health campaigns and education around reproductive rights and family planning are increasing awareness and acceptance of contraceptives. NGOs and government initiatives (e.g., UNFPA, WHO) are promoting access to modern contraceptives in both developed and developing regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.9 Billion |

| Forecast Value | $43.8 Billion |

| CAGR | 8.4% |

Rising Adoption of Devices

The devices segment held a notable share in 2024, driven by the growing demand for long-acting and reversible contraceptive options. Products such as intrauterine devices (IUDs), condoms, and implants are increasingly favored for their efficacy and convenience. Among these, hormonal and copper-based IUDs remain the top choices due to their high success rates and long-term protection. Market players are focusing on product innovation, enhanced comfort, and extended duration of use to attract a wider customer base.

Increasing Prevalence Among 15-44 Years

The 15-44 years segment held a sizeable share in 2024 owing to their reproductive age and active participation in family planning. This segment is driven by the desire to delay pregnancies and the rising need for sexual health awareness among adolescents and young adults. Increased educational outreach, digital health platforms, and targeted marketing campaigns are helping to normalize contraceptive use among this demographic. Companies are tailoring their messaging to resonate with this audience by emphasizing lifestyle compatibility, ease of use, and access. Subscription models and discreet delivery services have also been introduced to appeal to privacy-conscious users in this segment.

Retail Pharmacies to Gain Traction

The retail pharmacies segment will grow at a decent CAGR during 2025-2034, backed by convenience, accessibility, and anonymity to consumers. With the growing over-the-counter availability of oral contraceptives and emergency pills, this segment is witnessing steady growth. The segment also benefits from extended pharmacy hours, growing penetration in semi-urban areas, and pharmacists' increasing role in reproductive health counseling. To strengthen their presence, pharmaceutical companies are forming partnerships with major retail chains, offering promotional discounts, and ensuring consistent product availability.

Regional Insights

North America to Emerge as a Lucrative Region

North America contraceptives market generated significant revenues in 2024, supported by high consumer awareness, favorable reimbursement policies, and robust healthcare infrastructure. The United States leads the region due to the widespread adoption of hormonal contraceptives, IUDs, and emergency contraceptive pills. As of recent estimates, the market in North America was valued at over USD 8 billion and is projected to grow steadily with the increasing availability of digital prescriptions and direct-to-consumer telehealth services. Companies operating in this region are focused on FDA approvals, product diversification, and expanding their online sales platforms to meet evolving consumer behavior.

Major players in the contraceptives market are HLL Lifecare (India), Pfizer, LifeStyles Healthcare, Church & Dwight, Exeltis, Reckitt, CooperSurgical, Medintim (Kessel), Organon, Pregna International, Evofem Biosciences, Mayne Pharma, Agile Therapeutics, Bayer, HRA Pharma / Perrigo (OTC).

To maintain and grow their position, companies in the contraceptives market are employing a mix of product innovation, regional expansion, and customer-centric initiatives. One of the most prominent strategies involves investing in R&D to develop safer, more effective, and user-friendly products, including non-hormonal and male contraceptive options. Additionally, brands are leveraging digital platforms for direct engagement, offering telehealth consultations and online fulfillment services to meet the demand for convenience.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Age group trends

- 2.2.4 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Favourable regulatory scenario in developed nations

- 3.2.1.2 Growing inclination towards planned delayed pregnancy

- 3.2.1.3 High unmet contraceptive needs in developing economies

- 3.2.1.4 Increasing prevalence of sexually transmitted diseases (STD)

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adverse effects of contraceptive drugs

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in demand for long-acting reversible contraceptives (LARCs)

- 3.2.3.2 Rising trend of non-hormonal and natural contraceptive alternatives

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 MEA

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis, 2024

- 3.7 Consumer behaviour analysis

- 3.8 Supply chain analysis

- 3.9 Brand analysis

- 3.10 Business model of top companies

- 3.10.1 CooperSurgical

- 3.10.2 Reckitt

- 3.11 Go-to-Market strategy analysis

- 3.12 Gap analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

- 3.15 Future market trends

- 3.16 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 Latin America

- 4.3.6 MEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Devices

- 5.2.1 Condoms

- 5.2.1.1 Male

- 5.2.1.2 Female

- 5.2.2 Intra-uterine devices

- 5.2.2.1 Hormonal IUD

- 5.2.2.2 Copper IUD

- 5.2.3 Vaginal rings

- 5.2.4 Subdermal implants

- 5.2.5 Diaphragms

- 5.2.6 Contraceptive sponges

- 5.2.1 Condoms

- 5.3 Drugs

- 5.3.1 Oral contraceptive pills

- 5.3.2 Injectable contraceptives

- 5.3.3 Topical contraceptives

Chapter 6 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 15 - 44 years

- 6.3 Above 44 years

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Retail pharmacies

- 7.3 Hospital pharmacies

- 7.4 Online channels

- 7.5 Other distribution channels

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Agile Therapeutics

- 9.2 Bayer

- 9.3 Church & Dwight

- 9.4 CooperSurgical

- 9.5 Evofem Biosciences

- 9.6 Exeltis

- 9.7 HLL Lifecare (India)

- 9.8 HRA Pharma / Perrigo (OTC)

- 9.9 LifeStyles Healthcare

- 9.10 Mayne Pharma

- 9.11 Medintim (Kessel)

- 9.12 Organon

- 9.13 Pfizer

- 9.14 Pregna International

- 9.15 Reckitt