|

市場調查報告書

商品編碼

1822645

乙太網路供電 (PoE) 解決方案市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Power over Ethernet (PoE) Solution Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

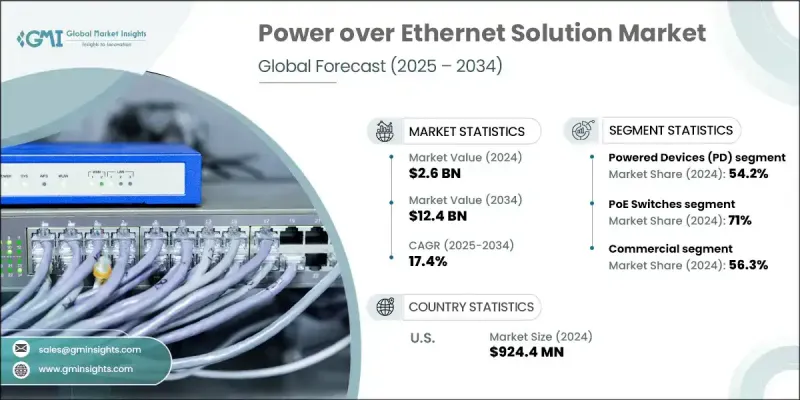

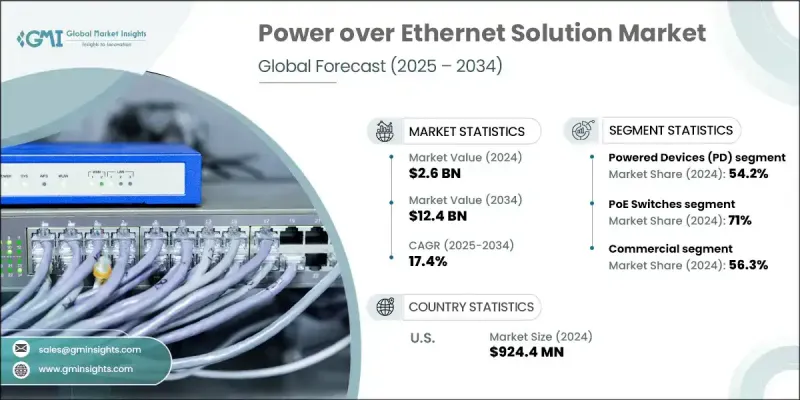

2024 年全球乙太網路網路供電解決方案市值為 26 億美元,預計到 2034 年將以 17.4% 的複合年成長率成長,達到 124 億美元。

這一強勁的成長前景主要源自於全球範圍內對更智慧、更節能基礎設施的日益追求。 PoE 已成為建築現代化的關鍵推動因素,它提供了一種經濟高效且簡化的方式,可透過單一乙太網路電纜傳輸電力和資料。這種方法使智慧型設備(例如照明系統、攝影機和感測器)無需傳統電線即可運行,從而降低了複雜性和安裝成本。各行各業的組織都開始將 PoE 作為一種靈活的解決方案,用於改造和新建智慧基礎設施項目,尤其是在他們尋求簡化營運和增強建築智慧化方面。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 26億美元 |

| 預測值 | 124億美元 |

| 複合年成長率 | 17.4% |

人們對安全和自動化日益成長的關注進一步加速了PoE的部署。基於PoE技術的IP監控解決方案的日益普及,簡化了安裝過程,並顯著降低了部署成本。這些系統允許透過單線傳輸視訊資料和電力,從而減少了對勞動力和基礎設施的需求。同時,在工業4.0實務的推動下,工業領域對物聯網設備的需求顯著成長。從生產車間到物流中心,工廠配備了智慧感測器和連網工具,這些都需要不間斷的電力和資料流。 PoE如今在實現工業環境中無縫、低延遲的通訊和運作方面發揮著至關重要的作用,無需大量重新佈線即可提供可靠性。

2024年,受電設備 (PD) 細分市場以 54.2% 的市佔率領先乙太網路網路供電解決方案市場,預計到 2034 年複合年成長率將達到 19%。物聯網技術在智慧建築、互聯城市基礎設施和工業自動化領域的快速應用推動了這一成長。安防系統、智慧感測器和門禁單元等受電設備擴大採用 PoE 供電,不僅支援高效的能源傳輸,還支援穩定的資料通訊。製造商正在推動多功能產品設計,以支援時尚、節省空間的安裝,同時滿足現代科技需求。

PoE 交換器市場在 2024 年佔據 71% 的市場佔有率,預計在 2025 年至 2034 年期間的複合年成長率將達到 10.4%。企業在擴展其智慧基礎設施(尤其是在辦公環境、安防系統和智慧設施管理方面)時,正積極採用 16 至 48 個連接埠的管理型交換器。這些交換器提供 VLAN 分段、服務品質 (QoS) 和遠端診斷等進階網路功能。對高功率設備日益成長的需求也推動了符合 IEEE 802.3bt 標準的交換器的採用,該標準支援集中電源控制,並可在廣泛的設備生態系統中提高效率。

美國乙太網路供電 (PoE) 解決方案市場佔 86.2% 的市場佔有率,2024 年市場規模達 9.244 億美元。其領先地位得益於先進的數位基礎設施、智慧技術的快速部署以及 VoIP、無線存取點和先進監控設備等 IP 供電系統的廣泛應用。美國政府推動能源效率和智慧城市框架的舉措,進一步加速了 PoE 在住宅、商業和公共部門計畫中的普及。此外,消費者的高認知度和對聯網節能系統的強勁需求,使美國成為該地區的關鍵成長動力。

影響全球乙太網路供電 (PoE) 解決方案市場的關鍵參與者包括意法半導體 (STMicroelectronics)、博通 (Broadcom)、惠普企業 (HPE)、思科系統 (Cisco Systems)、百通 (Belden)、德州儀器 (Texas Instruments)、ADI 公司、Silicon Laboratories、康芯科技公司 (Commpance)。乙太網路解決方案市場的領導公司正透過創新、策略合作和全球擴張等方式鞏固其地位。許多公司正在大力投資研發,以支援 IEEE 802.3bt 等不斷發展的標準,並提高下一代智慧型裝置的功率輸出。擴展產品線以包括針對工業和商業應用量身定做的高階口數交換機和混合系統是另一個優先事項。各公司也正在配合智慧城市計劃,並與物聯網設備製造商合作,以確保無縫整合和互通性。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 供應鏈彈性分析

- 半導體依賴關係映射

- 關鍵部件短缺的影響

- 替代採購策略

- 通路夥伴生態系統

- 系統整合商格局

- VAR/經銷商網路分析

- 直接與間接銷售模式

- 產業衝擊力

- 成長動力

- 物聯網和智慧建築應用激增

- 集中網路管理需求不斷成長

- 擴充需要 PoE++ (802.3bt) 的高功率設備

- 安裝和維護的成本效益

- 產業陷阱與挑戰

- 電纜長度有限(乙太網路限制為 100 公尺)

- 設備相容性和功率限制

- 市場機會

- 進軍高成長地區

- 遠距和全球勞動力

- 進階分析和人工智慧

- 雇主品牌服務

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 技術演進路線圖

- 下一代 PoE 標準(超越 802.3bt)

- 電力傳輸效率的提高

- 與再生能源的整合

- 無線電力傳輸融合

- 區域創新中心分析

- 矽谷技術領導力

- 歐洲永續發展標準的影響

- 亞洲製造業卓越中心

- 新興市場的跨越式發展機遇

- 關鍵參與者的創新管道分析

- 專利格局

- 專利集群和技術護城河

- 成本分解分析

- 客戶獲取成本分析

- 最終使用者情緒和採用障礙

- IT決策者調查洞察

- ROI計算方法

- 從遺留系統遷移的挑戰

- 供應商選擇標準分析

- 新興商業模式

- PoE 即服務 (PaaS) 模型

- 託管 PoE 基礎設施服務

- 基於訂閱的電源管理

- 能源共享和併網機會

- 用例

- 最佳情況

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考慮

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 多邊環境協定

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 重要新聞和舉措

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依組件分類,2021 - 2034 年

- 主要趨勢

- 電源設備 (PSE)

- 末端跨度

- 中跨

- 受電設備(PD)

- IP攝影機

- 網路電話

- 無線存取點

- 網路交換機

- 瘦客戶端

- 智慧照明

第6章:市場估計與預測:按類型,2021 - 2034

- 主要趨勢

- PoE交換機

- 未託管

- 託管

- PoE轉換器

- PoE供電器

- PoE 擴展器/中繼器

- PoE 分配器

第7章:市場估計與預測:依標準,2021 - 2034

- 主要趨勢

- IEEE 802.3af (PoE) - 高達 15.4W

- IEEE 802.3at (PoE+) - 高達 30W

- IEEE 802.3bt (PoE++/4PPoE) - 高達 60-100W

第 8 章:市場估計與預測:按最終用途,2021 - 2034 年

- 主要趨勢

- 商業的

- 住宅

- 工業的

- 其他

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐人

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球參與者

- Analog Devices

- Broadcom

- Cisco Systems

- Dell Technologies

- D-Link

- HPE (Hewlett Packard Enterprise)

- Huawei Technologies

- Juniper Networks

- Microchip Technology

- NETGEAR

- ON Semiconductor

- STMicroelectronics

- Texas Instruments

- TP-Link Technologies

- 關鍵參與者

- Axis Communications

- Belden

- CommScope Holding Company

- Hubbell

- Moxa

- Phihong Technology

- Signify Holding

- Ubiquiti

- Technology Innovators

- Analog Devices

- Kinetic Technologies Holdings

- Maxim Integrated Products

- Microchip Technology

- Monolithic Power Systems

- Silicon Laboratories

The Global Power over Ethernet Solution Market was valued at USD 2.6 billion in 2024 and is estimated to grow at a CAGR of 17.4% to reach USD 12.4 billion by 2034.

This strong growth outlook is primarily driven by the rising push toward smarter, energy-efficient infrastructure worldwide. PoE has become a key enabler in modernizing buildings by offering a cost-effective and simplified way to deliver both power and data over a single Ethernet cable. This method allows smart devices-like lighting systems, cameras, and sensors-to operate without the need for traditional electrical wiring, reducing complexity and installation costs. Organizations across sectors are turning to PoE as a flexible solution for both retrofit and new smart infrastructure projects, especially as they seek to streamline operations and enhance building intelligence.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $12.4 Billion |

| CAGR | 17.4% |

Growing attention to security and automation has further accelerated PoE deployment. The rising adoption of IP-based surveillance solutions that rely on PoE technology is simplifying installations while significantly lowering deployment expenses. These systems allow video data and power to be transmitted via a single line, cutting down on labor and infrastructure needs. In parallel, the industrial sector is seeing a notable rise in demand for IoT-enabled devices, fueled by Industry 4.0 practices. From manufacturing floors to logistics hubs, factories equip themselves with smart sensors and networked tools that require uninterrupted power and data flow. PoE is now playing a vital role in enabling seamless, low-latency communication and operation across industrial environments, offering reliability without extensive rewiring.

In 2024, the Powered Devices (PD) segment led the Power over Ethernet Solution Market with a 54.2% share and is projected to register a CAGR of 19% through 2034. The rapid adoption of IoT technologies across smart buildings, connected city infrastructure, and industrial automation is fueling this growth. Powered devices such as security systems, smart sensors, and access control units are increasingly designed to run on PoE, which supports not only efficient energy transfer but also consistent data communication. Manufacturers are pushing multifunctional product designs that support sleek, space-saving installations while aligning with modern tech preferences.

The PoE switches segment held a 71% share in 2024 and is forecast to grow at a CAGR of 10.4% between 2025 and 2034. Enterprises are embracing managed switches with 16 to 48 ports as they scale their smart infrastructure, particularly in office settings, security systems, and smart facility management. These switches offer advanced network features like VLAN segmentation, Quality of Service (QoS), and remote diagnostics. The growing demand for high-power devices is also pushing the adoption of switches compliant with the IEEE 802.3bt standard, which enables centralized power control and greater efficiency across expansive device ecosystems.

United States Power over Ethernet (PoE) Solution Market held an 86.2% share, generating USD 924.4 million in 2024. This leadership is supported by an advanced digital infrastructure, rapid deployment of smart technologies, and widespread use of IP-powered systems such as VoIP, wireless access points, and advanced surveillance devices. US government initiatives promoting energy efficiency and smart city frameworks are further accelerating PoE adoption across residential, commercial, and public sector projects. Additionally, high consumer awareness and strong demand for networked, power-efficient systems position the country as a key growth driver in the region.

Key players shaping the Global Power over Ethernet (PoE) Solution Market include STMicroelectronics, Broadcom, Hewlett Packard Enterprise (HPE), Cisco Systems, Belden, Texas Instruments, Analog Devices, Silicon Laboratories, CommScope, and Microchip Technology. Leading companies in the power over Ethernet solution market are strengthening their foothold through a combination of innovation, strategic collaborations, and global expansion. Many are investing heavily in R&D to support evolving standards like IEEE 802.3bt and to improve power output for next-gen smart devices. Expanding product lines to include high-port-count switches and hybrid systems tailored for industrial and commercial applications is another priority. Companies are also aligning with smart city initiatives and partnering with IoT device manufacturers to ensure seamless integration and interoperability.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Engagement model

- 2.2.3 Organization size

- 2.2.4 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Supply Chain Resilience Analysis

- 3.2.1 Semiconductor dependency mapping

- 3.2.2 Critical component shortage impact

- 3.2.3 Alternative sourcing strategies

- 3.3 Channel Partner Ecosystem

- 3.3.1 Systems integrators landscape

- 3.3.2 VAR/distributor network analysis

- 3.3.3 Direct vs. indirect sales models

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Surge in IoT and Smart Building Adoption

- 3.4.1.2 Rising Demand for Centralized Network Management

- 3.4.1.3 Expansion of High-Power Devices Requiring PoE++ (802.3bt)

- 3.4.1.4 Cost Efficiency in Installation and Maintenance

- 3.4.2 Industry pitfalls and challenges

- 3.4.2.1 Limited Cable Length (100m Ethernet Limit)

- 3.4.2.2 Device Compatibility and Power Limitations

- 3.4.3 Market opportunities

- 3.4.3.1 Taps into high-growth regions

- 3.4.3.2 Remote & Global Workforce

- 3.4.3.3 Advanced Analytics & AI

- 3.4.3.4 Employer Branding Services

- 3.4.1 Growth drivers

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 Middle East & Africa

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.9.3 Technology Evolution Roadmap

- 3.9.3.1 Next-Generation PoE Standards (Beyond 802.3bt)

- 3.9.3.2 Power Delivery Efficiency Improvements

- 3.9.3.3 Integration with Renewable Energy Sources

- 3.9.3.4 Wireless Power Transmission Convergence

- 3.9.4 Regional Innovation Hubs Analysis

- 3.9.4.1 Silicon Valley Technology Leadership

- 3.9.4.2 European Sustainability Standards Impact

- 3.9.4.3 Asian Manufacturing Excellence Centers

- 3.9.4.4 Emerging Market Leapfrog Opportunities

- 3.9.5 Innovation Pipeline Analysis by Key Players

- 3.10 Patent landscape

- 3.10.1 Patent Clustering and Technology Moats

- 3.11 Cost breakdown analysis

- 3.12 Customer Acquisition Cost Analysis

- 3.13 End Use Sentiment and Adoption Barriers

- 3.13.1 IT Decision Maker Survey Insights

- 3.13.2 ROI Calculation Methodologies

- 3.13.3 Migration from Legacy Systems Challenges

- 3.13.4 Vendor Selection Criteria Analysis

- 3.14 Emerging Business Models

- 3.14.1 PoE-as-a-Service (PaaS) Models

- 3.14.2 Managed PoE Infrastructure Services

- 3.14.3 Subscription-Based Power Management

- 3.14.4 Energy-Sharing and Grid-Tie Opportunities

- 3.15 Use cases

- 3.16 Best-case scenario

- 3.17 Sustainability and environmental aspects

- 3.17.1 Sustainable practices

- 3.17.2 Waste reduction strategies

- 3.17.3 Energy efficiency in production

- 3.17.4 Eco-friendly Initiatives

- 3.17.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Power sourcing equipment (PSE)

- 5.2.1 Endspan

- 5.2.2 Midspan

- 5.3 Powered devices (PD)

- 5.3.1 IP cameras

- 5.3.2 VOIP phones

- 5.3.3 Wireless access points

- 5.3.4 Network switches

- 5.3.5 Thin clients

- 5.3.6 Smart lighting

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 PoE Switches

- 6.2.1 Unmanaged

- 6.2.2 Managed

- 6.3 PoE Converters

- 6.4 PoE Injectors

- 6.5 PoE Extenders/Repeaters

- 6.6 PoE Splitters

Chapter 7 Market Estimates & Forecast, By Standard, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 IEEE 802.3af (PoE) - Up to 15.4W

- 7.3 IEEE 802.3at (PoE+) - Up to 30W

- 7.4 IEEE 802.3bt (PoE++/4PPoE) - Up to 60-100W

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Commercial

- 8.3 Residential

- 8.4 Industrial

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Analog Devices

- 10.1.2 Broadcom

- 10.1.3 Cisco Systems

- 10.1.4 Dell Technologies

- 10.1.5 D-Link

- 10.1.6 HPE (Hewlett Packard Enterprise)

- 10.1.7 Huawei Technologies

- 10.1.8 Juniper Networks

- 10.1.9 Microchip Technology

- 10.1.10 NETGEAR

- 10.1.11 ON Semiconductor

- 10.1.12 STMicroelectronics

- 10.1.13 Texas Instruments

- 10.1.14 TP-Link Technologies

- 10.2 Key Players

- 10.2.1 Axis Communications

- 10.2.2 Belden

- 10.2.3 CommScope Holding Company

- 10.2.4 Hubbell

- 10.2.5 Moxa

- 10.2.6 Phihong Technology

- 10.2.7 Signify Holding

- 10.2.8 Ubiquiti

- 10.3 Technology Innovators

- 10.3.1 Analog Devices

- 10.3.2 Kinetic Technologies Holdings

- 10.3.3 Maxim Integrated Products

- 10.3.4 Microchip Technology

- 10.3.5 Monolithic Power Systems

- 10.3.6 Silicon Laboratories