|

市場調查報告書

商品編碼

1822641

運動防護裝備市場機會、成長動力、產業趨勢分析及2025-2034年預測Sports Protective Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

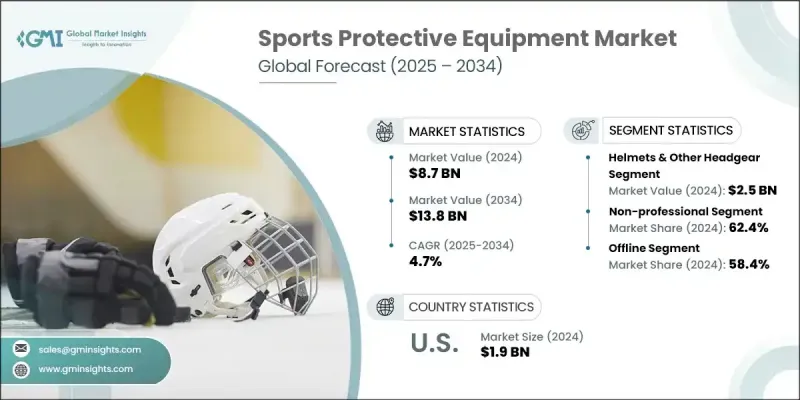

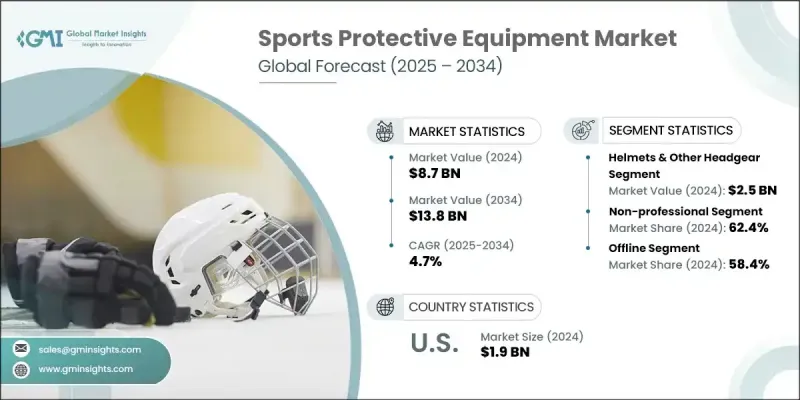

2024 年全球運動防護裝備市場價值為 87 億美元,預計到 2034 年將以 4.7% 的複合年成長率成長至 138 億美元。

運動防護裝備對於最大限度地降低身體活動的受傷風險至關重要,涵蓋頭盔、護具、護墊和其他身體保護裝置等。隨著運動在休閒和專業層面越來越受歡迎,對這些產品的需求持續攀升。健身意識的增強以及消費者在健康和運動參與方面的支出不斷增加,進一步推動了市場的擴張。業餘和有組織體育運動對安全的關注度不斷提高,促使先進防護裝備得到廣泛採用,這促使製造商提供符合安全標準的高品質解決方案。人們對頭部受傷、骨折和肌肉拉傷的擔憂日益加劇,這更凸顯了定期更換磨損或損壞裝備的重要性。隨著公眾對學校、學院和體育項目的健身和安全要求的日益關注,對可靠舒適防護的需求繼續推動市場發展。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 87億美元 |

| 預測值 | 138億美元 |

| 複合年成長率 | 4.7% |

2024年,頭盔和頭部防護裝備市場規模達25億美元,預計2034年將以4.7%的複合年成長率成長。該領域的成長得益於人們對頭部創傷和腦損傷的認知不斷提高,以及競技和非競技運動領域新的安全規程的訂定。智慧頭盔、多密度泡棉襯墊和碳纖維外殼等防護設計的創新,正推動製造商不斷升級產品,使其在保持最大抗衝擊性能的同時,提升舒適度和透氣性。

非專業領域在2024年佔據了62.4%的佔有率,預計到2034年將以4.6%的複合年成長率成長。這一主導地位反映了人們對休閒和健身活動的參與度日益提高。隨著越來越多的人追求積極的生活方式,健身房、健身工作室、學校和社區運動項目的需求激增。該領域的消費者優先考慮既方便又可靠的防護裝備,這推動了頭盔、護墊和其他通用裝備的購買增加。

2024年,美國運動防護裝備市場規模達19億美元,持續維持北美運動防護裝備產業的領先地位。美國蓬勃發展的體育文化、積極參與有組織的聯賽以及政府強制執行的安全標準持續推動著運動防護裝備的銷售成長。廣泛的零售通路和持續的產品改進提升了運動防護裝備的可及性。全民對接觸性和高速運動的熱情持續推動著運動防護裝備需求的穩定成長,而運動專用裝備的創新則進一步鞏固了市場領先地位。

全球運動防護裝備市場的知名企業包括 Puma、Schutt Sports、Adidas、Warrior Sports、Nike、Warrix、Mizuno、BRG Sports、Harrow Sports、McDavid、Amer Sports、Rawlings Sporting Goods、Shock Doctor、Under Armour 和 Bauer Hockey。為了保持競爭力,運動防護裝備市場的公司專注於推出採用先進材料製成的符合人體工學設計、重量輕且性能高的商品。各品牌正在利用運動員代言並投資於有針對性的行銷,以提高在青少年和非專業用戶中的知名度。許多品牌正在整合衝擊感測器和穿戴式追蹤系統等智慧技術,以增強產品吸引力。公司也透過電子商務和專業運動零售管道擴大分銷,使防護裝備更容易獲得。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 國內和國際體育賽事日益普及

- 網路銷售趨勢成長

- 消費者在體育器材上的支出增加

- 消費者健康和健身意識的增強

- 增加體育活動參與度

- 產業陷阱與挑戰

- 仿冒品數量增加

- 原料成本不斷上漲

- 機會

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 貿易分析(HS編碼:95069960)

- 主要進口國家

- 主要出口國

- 價格趨勢

- 按地區

- 按產品

- 監理框架

- 標準和認證

- 環境法規

- 進出口法規

- 波特的分析

- PESTEL分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 防護眼鏡

- 風鏡

- 護眼罩

- 臉部防護和護齒

- 頭盔和其他頭飾

- 護肩

- 護脛

- 護膝

- 其他

第6章:市場估計與預測:依用途 2021-2034

- 主要趨勢

- 專業的

- 非專業

第7章:市場估計與預測:依價格區間,2021-2034

- 主要趨勢

- 低(<25 美元)

- 中(25-50美元)

- 高(>50 美元)

第8章:市場估計與預測:依體育項目,2021-2034

- 主要趨勢

- 球類運動

- 排球

- 足球

- 手球

- 籃球

- 其他

- 賽車運動

- 騎馬

- 賽車

- 自行車比賽

- 騎自行車

- 其他

- 水上運動

- 游泳

- 潛水

- 衝浪

- 帆船

- 其他

- 溜冰

- 滑雪

- 蟋蟀

- 曲棍球

- 其他

第9章:市場估計與預測:依消費者群體,2021-2034

- 主要趨勢

- 男士

- 女性

- 孩子們

第 10 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要動向:按配銷通路

- 線上通路

- 電子商務

- 公司網站

- 線下通路

- 專賣店

- 大型零售商店

- 其他

第 11 章:市場估計與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 馬來西亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第 12 章:公司簡介

- Adidas

- Amer Sports

- Bauer Hockey

- BRG Sports

- McDavid

- Mizuno

- Nike

- Puma

- Harrow Sports

- Rawlings Sporting Goods

- Schutt Sports

- Shock Doctor

- Under Armour

- Warrior Sports

- Warrix

The Global Sports Protective Equipment Market was valued at USD 8.7 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 13.8 billion by 2034.

Sports protective equipment is essential for minimizing injury risk during physical activities, covering gear such as helmets, guards, pads, and other body protectors. The demand for these products continues to climb as sports become more popular at both recreational and professional levels. Fitness awareness and increasing consumer expenditure on health and athletic participation have further fueled market expansion. Enhanced attention to safety in amateur and organized sports has led to widespread adoption of advanced protective gear, encouraging manufacturers to deliver high-quality solutions that comply with safety standards. Rising concerns over head injuries, fractures, and muscle strain have reinforced the importance of regularly replacing worn or damaged gear. With greater public interest in fitness and safety mandates across schools, colleges, and athletic programs, the need for reliable and comfortable protection continues to drive market momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.7 Billion |

| Forecast Value | $13.8 Billion |

| CAGR | 4.7% |

In 2024, the helmets and head protection gear segment generated USD 2.5 billion and is projected to grow at a CAGR of 4.7% through 2034. This segment's growth is tied to increasing awareness around head trauma and brain injuries, as well as new safety protocols in competitive and non-competitive sports. Innovations in protective design, such as smart helmets, multi-density foam liners, and carbon fiber shells, are pushing manufacturers to upgrade offerings with features that enhance comfort and ventilation while maintaining maximum impact resistance.

The non-professional segment held a 62.4% share in 2024 and is expected to grow at a CAGR of 4.6% through 2034. This dominance reflects growing involvement in leisure and fitness activities. Demand from gyms, fitness studios, schools, and community sports programs has surged as more individuals pursue active lifestyles. Consumers in this segment prioritize protective gear that is both accessible and reliable, supporting increased purchases of helmets, pads, and other gear designed for general use.

United States Sports Protective Equipment Market generated USD 1.9 billion in 2024, maintaining its lead in the North American sports protective equipment industry. The country's robust sporting culture, strong participation in organized leagues, and government-enforced safety standards continue to boost sales. Widespread retail availability and ongoing product advancements have increased accessibility. National interest in contact and high-speed sports continues to contribute to steady demand, while innovations in sport-specific gear further sustain market leadership.

Prominent players in the Global Sports Protective Equipment Market include Puma, Schutt Sports, Adidas, Warrior Sports, Nike, Warrix, Mizuno, BRG Sports, Harrow Sports, McDavid, Amer Sports, Rawlings Sporting Goods, Shock Doctor, Under Armour, and Bauer Hockey. To maintain competitive strength, companies in the sports protective equipment market are focused on launching ergonomically designed, lightweight, and high-performance products made with advanced materials. Brands are leveraging athlete endorsements and investing in targeted marketing to boost visibility among youth and non-professional users. Many are integrating smart technologies such as impact sensors and wearable tracking systems to enhance product appeal. Companies are also expanding distribution through both e-commerce and specialty sports retail channels, making protective gear more accessible.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Usage

- 2.2.4 Price range

- 2.2.5 Consumer group

- 2.2.6 Sport

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing popularity of national and international sports events

- 3.2.1.2 Increase in the trend of online sales

- 3.2.1.3 Rise in consumer spending on sports equipment

- 3.2.1.4 Increase in growth of consumer awareness regarding health and fitness

- 3.2.1.5 Increase in participation of sports activities

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Increase in number of counterfeit products

- 3.2.2.2 Growing cost of raw materials

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Trade analysis (HS Code: 95069960)

- 3.6.1 Top importing countries

- 3.6.2 Top exporting countries

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Regulatory framework

- 3.8.1 Standards and certifications

- 3.8.2 Environmental regulations

- 3.8.3 Import export regulations

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034, (USD Billion; Million Units)

- 5.1 Key trends

- 5.2 Protective eyewear

- 5.2.1 Goggles

- 5.2.2 Eye shield

- 5.3 Face protection & mouth guards

- 5.4 Helmets & other headgear

- 5.5 Shoulder guards

- 5.6 Shin guards

- 5.7 Knee pads

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Usage 2021-2034, (USD Billion; Million Units)

- 6.1 Key trends

- 6.2 Professional

- 6.3 Non-professional

Chapter 7 Market Estimates & Forecast, By Price Range, 2021-2034, (USD Billion; Million Units)

- 7.1 Key trends

- 7.2 Low (<25$)

- 7.3 Mid (25$-50$)

- 7.4 High (>50$)

Chapter 8 Market Estimates & Forecast, By Sport, 2021-2034, (USD Billion; Million Units)

- 8.1 Key trends

- 8.2 Ball based sports

- 8.2.1 Volleyball

- 8.2.2 Football

- 8.2.3 Handball

- 8.2.4 Basketball

- 8.2.5 Others

- 8.3 Racing sports

- 8.3.1 Horse riding

- 8.3.2 Auto racing

- 8.3.3 Bike racing

- 8.3.4 Cycling

- 8.3.5 Others

- 8.4 Water based sports

- 8.4.1 Swimming

- 8.4.2 Diving

- 8.4.3 Surfing

- 8.4.4 Sailing

- 8.4.5 Others

- 8.5 Skating

- 8.6 Skiing

- 8.7 Cricket

- 8.8 Hockey

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By Consumer Group, 2021-2034, (USD Billion; Million Units)

- 9.1 Key trends

- 9.2 Men

- 9.3 Women

- 9.4 Kids

Chapter 10 Market Estimates & Forecast, By Distribution channel, 2021-2034, (USD Billion; Million Units)

- 10.1 Key trends, by distribution channel

- 10.2 Online channels

- 10.2.1 E-commerce

- 10.2.2 Company websites

- 10.3 Offline channels

- 10.3.1 Specialty Stores

- 10.3.2 Mega Retail stores

- 10.3.3 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034, (USD Billion; Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Malaysia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Adidas

- 12.2 Amer Sports

- 12.3 Bauer Hockey

- 12.4 BRG Sports

- 12.5 McDavid

- 12.6 Mizuno

- 12.7 Nike

- 12.8 Puma

- 12.9 Harrow Sports

- 12.10 Rawlings Sporting Goods

- 12.11 Schutt Sports

- 12.12 Shock Doctor

- 12.13 Under Armour

- 12.14 Warrior Sports

- 12.15 Warrix