|

市場調查報告書

商品編碼

1822622

自動門市場機會、成長動力、產業趨勢分析及2025-2034年預測Automatic Door Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

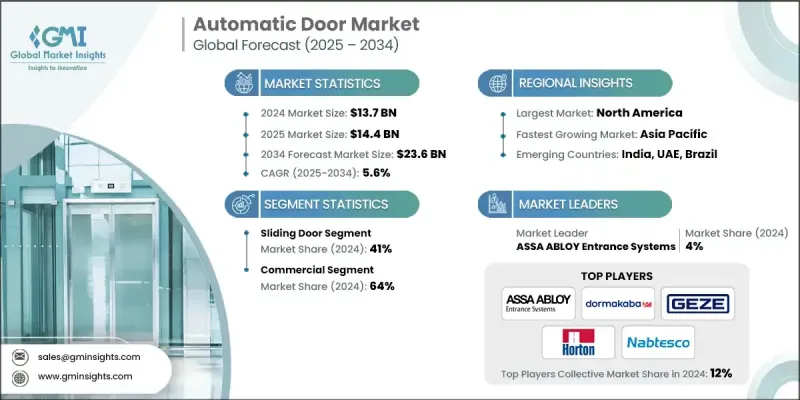

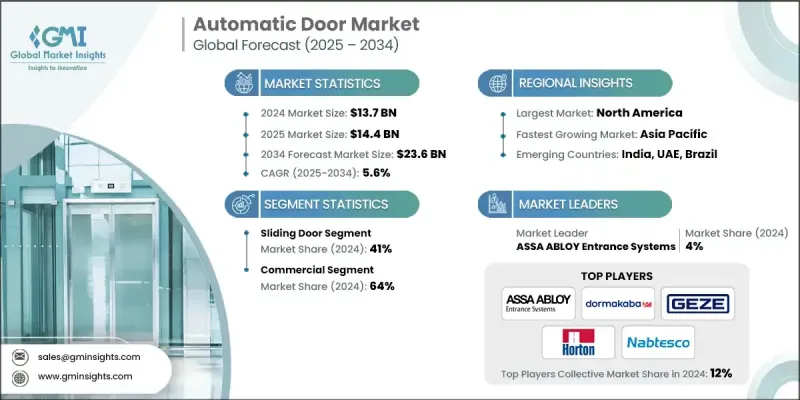

2024 年全球自動門市場價值為 137 億美元,預計到 2034 年將以 5.6% 的複合年成長率成長至 236 億美元。

新冠疫情爆發後,人們的衛生和公共衛生意識增強,顯著加速了向非接觸式技術的轉變。自動門已成為最大程度減少實體接觸點的關鍵解決方案,尤其是在醫院、機場、零售店和辦公大樓等人流量大的環境中。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 137億美元 |

| 預測值 | 236億美元 |

| 複合年成長率 | 5.6% |

滑動門需求不斷成長

2024年,滑動門市場佔據了顯著佔有率,這得益於其在高人流量區域的高效性和最大化空間利用的能力。這類門在機場、醫院和零售連鎖店等商業環境中備受青睞,因為這些場所注重人流的連續性和便利的出入。滑動門外觀時尚現代,通常配備運動感應器,可實現無縫操作。其低摩擦機制和極小的佔地面積使其成為新建和改造專案的實用選擇。隨著建築設計持續強調開放空間和可及性,對滑動自動門的需求仍然強勁,並持續推動市場成長。

商業領域將獲得發展動力

2024年,商業領域收入可觀,這得益於購物中心、辦公大樓、飯店和醫療機構的廣泛應用。這些空間需要可靠、使用者友善的入口系統,能夠在不影響安全性和美觀性的情況下應對持續的人流。商業應用中的自動門不僅能提升使用者體驗,還能透過控制氣流和溫度穩定性來提高能源效率。隨著消費者對便利性和衛生要求的不斷提高,企業正在優先考慮自動入口解決方案,以提高營運效率和客戶滿意度。

區域洞察

北美將成為推動力地區

2024年,北美自動門市場佔據了強勁的市場佔有率,這得益於其強大的基礎設施、嚴格的建築標準以及對無障礙設施的監管重視。在後疫情時代,美國醫療、零售和公共部門建築中非接觸式門禁系統的採用率不斷提高。隨著節能和智慧建築的日益普及,自動門正作為一種功能性和美觀元素融入現代建築。

自動門市場的主要參與者有 Ultra Safe Security Doors、Dormakaba Group、GEZE GmbH、Record USA、Wilcox Door Service Inc.、TORMAX USA Inc.、浙江西康門業有限公司、Royal Boon Edam International BV、松下公司、Stanley Access Technologies(Dormakaba 的一部分)、Vort Industries Automatics。

為了鞏固市場地位,自動門產業的公司正在部署多項有針對性的策略。產品創新仍然是核心,重點是整合物聯網功能、先進的運動感測器和節能組件。公司還投資與建築和智慧建築技術供應商建立策略合作夥伴關係,將自動門融入更廣泛的基礎設施項目。此外,公司正在擴展售後服務、維護合約和客製化選項,以建立客戶忠誠度並確保經常性收入。透過併購和分銷協議進行地理擴張有助於品牌進入新市場,而遵守區域安全和無障礙標準則增強了競爭優勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 都市化與智慧基礎設施

- 更重視衛生和非接觸式訪問

- 能源效率與安全

- 產業陷阱與挑戰

- 前期安裝和維護成本高昂

- 與智慧門相關的網路安全威脅

- 機會

- 智慧建築和智慧城市計畫的全球成長

- 發展中經濟體尚未實現的機遇

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按門類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 貿易統計(HS編碼)

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 多邊環境協定

- 拉丁美洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按門類型,2021 - 2034

- 主要趨勢

- 旋轉門

- 折疊門

- 旋轉門

- 雙折門

- 其他

第6章:市場估計與預測:依功能,2021 - 2034

- 主要趨勢

- 基於感測器

- 基於運動

- 按鈕

- 存取控制

第7章:市場估計與預測:依最終用途,2021 - 2034

- 主要趨勢

- 住宅

- 商業的

- 工業的

第 8 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 馬來西亞

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 多邊環境協定

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第10章:公司簡介

- ASSA ABLOY Entrance Systems

- Dormakaba Group

- GEZE GmbH

- Horton Automatics

- Nabtesco Corporation

- Entrematic

- Panasonic Corporation

- Record USA

- Royal Boon Edam International BV

- Stanley Access Technologies (a part of Dormakaba)

- TORMAX USA Inc.

- Ultra Safe Security Doors

- Vortex Industries, Inc.

- Wilcox Door Service Inc.

- Zhejiang Seacon Door Technology Co., Ltd.

The Global Automatic Door Market was valued at USD 13.7 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 23.6 billion by 2034.

The heightened awareness of hygiene and public health, after the COVID-19 pandemic, has significantly accelerated the shift toward contactless technologies. Automatic doors have become a critical solution in minimizing physical touchpoints, especially in high-traffic environments such as hospitals, airports, retail stores, and office buildings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.7 Billion |

| Forecast Value | $23.6 Billion |

| CAGR | 5.6% |

Rising Demand for Sliding Door

The sliding door segment held a significant share in 2024, driven by its efficiency in high-traffic areas and ability to maximize space. These doors are favored in commercial environments such as airports, hospitals, and retail chains where continuous flow and ease of access are essential. Sliding doors offer a sleek, modern look and are often equipped with motion sensors for seamless operation. Their low-friction mechanism and minimal footprint make them a practical choice for both new constructions and retrofits. As building designs continue to emphasize open spaces and accessibility, demand for sliding automatic doors remains strong, contributing steadily to market growth.

Commercial Segment to Gain Traction

The commercial segment generated sizeable revenues in 2024, owing to the widespread adoption across shopping malls, office buildings, hospitality venues, and healthcare facilities. These spaces require reliable, user-friendly entry systems that can handle constant foot traffic without compromising on safety or aesthetics. Automatic doors in commercial applications not only improve user experience but also support energy efficiency by controlling airflow and temperature stability. As consumer expectations for convenience and hygiene continue to rise, businesses are prioritizing automated entry solutions to enhance operational efficiency and customer satisfaction.

Regional Insights

North America to Emerge as a Propelling Region

North America automatic door market held a robust share in 2024, backed by strong infrastructure, high construction standards, and regulatory emphasis on accessibility. The United States has witnessed increased adoption of touchless entry systems across healthcare, retail, and public sector buildings in the post-pandemic era. With a growing focus on energy-efficient and smart buildings, automatic doors are being integrated into modern construction as a functional and aesthetic element.

Major players in the automatic door market are Ultra Safe Security Doors, Dormakaba Group, GEZE GmbH, Record USA, Wilcox Door Service Inc., TORMAX USA Inc., Zhejiang Seacon Door Technology Co., Ltd., Royal Boon Edam International B.V., Panasonic Corporation, Stanley Access Technologies (a part of Dormakaba), Vortex Industries, Inc., Entrematic, ASSA ABLOY Entrance Systems, Nabtesco Corporation, and Horton Automatics.

To strengthen their market position, companies in the automatic door industry are deploying several targeted strategies. Product innovation remains central, with a focus on integrating IoT capabilities, advanced motion sensors, and energy-efficient components. Firms are also investing in strategic partnerships with construction and smart building technology providers to embed automatic doors into broader infrastructure projects. In addition, after-sales services, maintenance contracts, and customization options are being expanded to build customer loyalty and ensure recurring revenue. Geographic expansion through mergers, acquisitions, and distribution agreements helps brands access new markets, while adherence to regional safety and accessibility standards strengthens their competitive edge.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Door type

- 2.2.3 Function

- 2.2.4 End Use

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urbanization & Smart Infrastructure

- 3.2.1.2 Improving focus on hygiene & contactless access

- 3.2.1.3 Energy efficiency & security

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Large up-front installation and maintenance costs

- 3.2.2.2 Cybersecurity threats associated with smart door

- 3.2.3 Opportunities

- 3.2.3.1 Global growth of smart building and smart city initiatives

- 3.2.3.2 Unrealized opportunities in developing economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By door type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Door Type, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Swinging door

- 5.3 Folding door

- 5.4 Revolving door

- 5.5 Bi-fold doors

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Function, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Sensor based

- 6.3 Motion based

- 6.4 Push button

- 6.5 Access control

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Industrial

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Malaysia

- 9.4.7 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 ASSA ABLOY Entrance Systems

- 10.2 Dormakaba Group

- 10.3 GEZE GmbH

- 10.4 Horton Automatics

- 10.5 Nabtesco Corporation

- 10.6 Entrematic

- 10.7 Panasonic Corporation

- 10.8 Record USA

- 10.9 Royal Boon Edam International B.V.

- 10.10 Stanley Access Technologies (a part of Dormakaba)

- 10.11 TORMAX USA Inc.

- 10.12 Ultra Safe Security Doors

- 10.13 Vortex Industries, Inc.

- 10.14 Wilcox Door Service Inc.

- 10.15 Zhejiang Seacon Door Technology Co., Ltd.