|

市場調查報告書

商品編碼

1822615

小瓶適配器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Vial Adaptors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

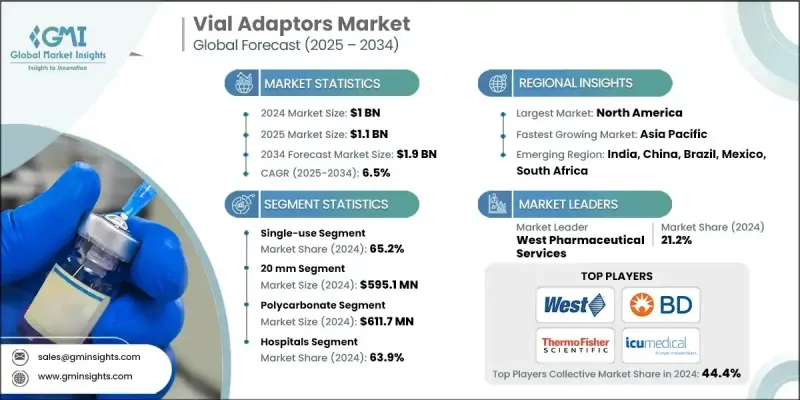

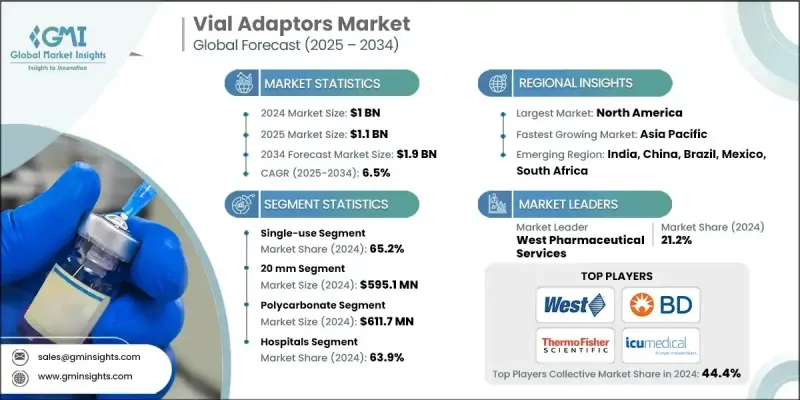

根據 Global Market Insights, Inc. 的最新報告,2024 年全球小瓶轉接器市場價值為 10 億美元,預計將從 2025 年的 11 億美元成長到 2034 年的 19 億美元,複合年成長率為 6.5%。該行業的發展勢頭受到市場對安全藥物無菌重建和疫苗接種的需求,以及減輕醫院和臨床環境中污染風險的需求的推動。

小瓶適配器可在轉移和重建注射藥物時實現「無針」操作,有助於提高安全性和效率,特別是在重症監護、腫瘤科和疫苗接種等關鍵環境中。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 10億美元 |

| 預測值 | 19億美元 |

| 複合年成長率 | 6.5% |

關鍵促進因素:

1. 生物製劑和疫苗的使用日益增多:生物製劑數量的增加和疫苗接種計劃的擴大增加了對安全、高效重組的需求。

2. 感染預防與安全問題:小瓶轉接器提供無針、封閉系統的藥物輸送,防止針刺事故和微生物污染。

3. 簡化醫院和臨床工作流程:這些產品使藥物準備更加容易,節省時間並最大限度地減少藥物錯誤。

4. 監管推動封閉系統轉移裝置 (CSTD):全球建議使用 CSTD 進行癌症和危險藥物處理,這正在加速小瓶適配器的採用。

關鍵參與者:

West Pharmaceutical Services、Thermo Fisher Scientific、Becton, Dickinson and Company 和 ICU Medical 等主要公司佔據了 44.4% 的累積市場。

West 是國內領先的小瓶轉接器供應商,2024 年的市佔率為 21.2%。

主要挑戰:

- 可擴展性:由於某些小瓶適配器可能不適合任何特定的小瓶或藥物配方,因此在許多情況下,客製化解決方案必然會導致庫存工作的複雜性。

- 規模經濟/採購:初始產品投資和沒有本地供應鏈可能會限制醫療系統採用和使用適配器解決方案的能力,尤其是在資源受限的環境中。

- 廢棄物和環境議程:一次性塑膠適配器會產生醫療廢棄物。一些製造商正在研究開發可回收材料適配器的可能性。

1. 依產品類型 - 一次性使用小瓶轉接器

一次性藥瓶適配器憑藉其更佳的感染控制、合規性以及在醫院和實驗室臨床環境中的易用性,在2024年成為市場領導者。它們在化療、免疫接種和重症監護藥物製備方面享有優先使用權。

2. 尺寸 - 20mm,通用

20毫米的尺寸可普遍適用於腫瘤學、傳染病和兒科相關的治療領域。

3. 依材質分類-聚碳酸酯位居第一

2024 年,聚碳酸酯小瓶適配器將佔據主導地位,因為它具有耐用性、耐化學性和透明度,可以在將藥物從小瓶適配器轉移到注射器的過程中進行目視檢查。

4. 依最終用途 - 醫院電力核心需求

2024 年,醫院仍將是藥瓶適配器的主要最終用途,因為此類機構需要無菌、經濟高效的藥物管理系統來滿足大量患者的需求,尤其是在腫瘤科和傳染病科。

5. 按地區分類-北美繼續佔據主導地位

北美繼續主導全球藥瓶適配器市場,其在醫療基礎設施和先進藥物輸送系統方面投入了大量資金。封閉式轉移裝置 (CSTD) 的使用和感染預防措施的推廣也進一步促進了該地區的成長。 2024 年,北美在全球藥瓶適配器市場佔據主導地位,這得益於慢性病患者的增加、高昂的醫療支出以及完善的醫院基礎設施。該地區還擁有許多知名的製藥和生物技術公司,進一步推動了藥瓶適配器在無菌藥物製備中的應用。由於疫苗接種力度的加大以及預充式注射器和封閉式藥物輸送系統的廣泛使用,美國繼續成為藥瓶適配器市場的主要貢獻者。

一些主要的小瓶適配器市場參與者包括 B. Braun、Baxter International、Becton、Dickinson and Company、West Pharmaceutical Services、Yukon Medical、Thermo Fisher Scientific、ICU Medical、Helapet、Epic Medical、CODAN Medizinische Gerate、Miltenyi Biotec、EQUASHpet、Epic Medical、CODAN Medizinische Gerate、Miltenyi Biotec、EQUASHIELD 和 VYGON。

市場領導者正押注於產品創新、合作和法規核准,以保持競爭力。例如,West Pharmaceutical Services 不斷擴展其藥瓶適配器產品組合,以促進生物製劑的安全復溶。 Becton, Dickinson and Company 和 Baxter International 正在將藥瓶適配器納入其輸液和預充式注射器平台,以最大程度地減少污染。此外,各公司也正在投資永續材料/客製尺寸的轉接器,以滿足不同醫院的需求和藥品規格。

目錄

第1章:方法論與範圍

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 慢性病盛行率不斷上升

- 提高對小瓶適配器優勢的認知

- 老年人口增加

- 產業陷阱與挑戰

- 替代品的可用性

- 市場機會

- 生物製劑和生物相似藥的擴張

- 無針給藥系統的需求不斷成長

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 當前的技術趨勢

- 新興技術

- 2024 年按產品類型分類的定價分析

- 全球的

- 一次性使用小瓶轉接器

- 多用途小瓶轉接器

- 北美洲

- 一次性使用小瓶轉接器

- 多用途小瓶轉接器

- 歐洲

- 一次性使用小瓶轉接器

- 多用途小瓶轉接器

- 亞太地區

- 一次性使用小瓶轉接器

- 多用途小瓶轉接器

- 拉丁美洲

- 一次性使用小瓶轉接器

- 多用途小瓶轉接器

- 多邊環境協定

- 一次性使用小瓶轉接器

- 多用途小瓶轉接器

- 差距分析

- 波特的分析

- PESTEL分析

- 未來市場趨勢

- 價值鏈分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲和中東地區

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品類型發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 一次性使用小瓶轉接器

- 通風小瓶轉接器

- 非通氣小瓶轉接器

- 多用途小瓶轉接器

- 通風小瓶轉接器

- 非通氣小瓶轉接器

第6章:市場估計與預測:依產品規模,2021 - 2034 年

- 主要趨勢

- 13毫米

- 20毫米

- 其他產品尺寸

第7章:市場估計與預測:按材料,2021 - 2034 年

- 主要趨勢

- 聚碳酸酯

- 矽酮

- 聚乙烯

- 其他材料

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 其他最終用途

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- B. Braun

- Baxter International

- Becton, Dickinson and Company

- CODAN Medizinische Gerate

- Epic Medical

- EQUASHIELD

- Helapet

- ICU Medical

- Miltenyi Biotec

- Thermo Fisher Scientific

- VYGON

- West Pharmaceutical Services

- Yukon Medical

The global vial adaptors market was valued at USD 1 billion in 2024 and is projected to grow from USD 1.1 billion in 2025 to USD 1.9 billion by 2034, registering a CAGR of 6.5%, according to the latest report by Global Market Insights, Inc. The sector's momentum has been driven by market needs for safe drug sterile reconstitution and vaccinations, as well as a need to mitigate contamination risk in hospitals and clinical environments.

Vial adaptors help improve safety and efficiency by enabling 'needle-free' access when transferring and reconstituting injectable drugs, particularly in critical settings such as critical care, oncology, and vaccine administration.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1 Billion |

| Forecast Value | $1.9 Billion |

| CAGR | 6.5% |

Key Drivers:

1. Increasing use of biologics and vaccines: Increasing numbers of biologic drugs and expanding vaccination programs have increased demand for safe and efficient reconstitution.

2. Infection prevention and safety issues: Vial adaptors provide needle-free, closed-system medication delivery, preventing needlestick accidents and microbial contamination.

3. Streamlining hospital and clinical workflow: These products make drug preparation easier, saving time and minimizing drug errors.

4. Regulatory push to close-system transfer devices (CSTDs): Global recommendations for using CSTDs for cancer and hazardous drug handling are accelerating vial adaptor adoption.

Key Players:

Major players like West Pharmaceutical Services, Thermo Fisher Scientific, Becton, Dickinson and Company, and ICU Medical hold a cumulative market share of 44.4%.

West is the leading domestic vial adaptor supplier with 21.2% market share in 2024.

Key Challenges:

- Scalability:;As some vial adaptors may not fit any particular vial or drug formulation, in many instances, custom solutions would necessarily lead to complexities in inventory efforts.

- Economies of scale/Procurement:;Initial product investments and no local supply chains may limit the medical system's ability to adopt and use adaptor solutions, especially in resource constrained environments.

- Waste and environmental agenda:;The single-use plastic based adaptors contribute to medical waste.;Some manufacturers are investigating the potential to develop recyclable material-based adaptors.;

1. By Product Type - Single-Use Vial Adaptors Lead

Single-use vial adaptors were the market leader in 2024 due to their better infection control, regulatory compliance, and ease of use in hospitals and laboratory clinical settings. They are used in preference in chemotherapy, immunization, and critical care drug preparation.

2. Size - 20mm For Universal Application

A 20mm size offers universal applicability to therapy areas related to oncology, infectious diseases, and pediatrics.

3. Based on Material - Polycarbonate Contributes to 1ST Position

In 2024, polycarbonate based vial adaptors lead the way, based upon durability, chemical resistance, and transparency permitting visual inspection during the transfer of the drug from the vial adapter to the syringe.

4. By End Use - Hospitals Power Core Demand

Hospitals continued to be the major End Uses of vial adaptors in 2024, since such facilities need aseptic, cost-effective drug administration systems to meet high patient loads, particularly in oncology and infectious disease departments.

5. By Region - North America Continues to Dominate

North America continued to dominate the global market for vial adaptors with strong investments in healthcare infrastructure and advanced drug delivery systems. The usage of closed-system transfer devices (CSTDs) and promotion of infection prevention practices additionally enhance regional growth. North America dominated the world vial adaptors market in 2024, aided by increasing numbers of chronic diseases, high expenditure on healthcare, and sound hospital infrastructure. The region is also home to a number of prominent pharmaceutical and biotechnology companies, further driving the adoption of vial adaptors in sterile drug preparation. The US continues to be a dominant contributor because of growing vaccination efforts and extensive use of prefilled syringes and closed drug delivery systems.

Some of the major vial adaptors market players are B. Braun, Baxter International, Becton, Dickinson and Company, West Pharmaceutical Services, Yukon Medical, Thermo Fisher Scientific, ICU Medical, Helapet, Epic Medical, CODAN Medizinische Gerate, Miltenyi Biotec, EQUASHIELD, and VYGON.

Market leaders are placing bets on product innovation, collaborations, and regulatory clearances to remain competitive. An example of this is West Pharmaceutical Services, which continues to expand its portfolio of vial adaptors to facilitate safe reconstitution of biologics.;Becton, Dickinson and Company and Baxter International are incorporating vial adaptors into their infusion and prefilled syringe platforms to minimize contamination. Also, companies are spending money on sustainable materials/ adaptors of custom sizes to satisfy different hospital needs and drug formats.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Product size trends

- 2.2.4 Material trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of chronic conditions

- 3.2.1.2 Rise in awareness regarding advantages of the vial adaptors

- 3.2.1.3 Increase in geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Availability of substitutes

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of biologics and biosimilars

- 3.2.3.2 Growing demand for needle-free drug delivery systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 MEA

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Global vial adaptor market, by volume (Units), 2021 - 2034

- 3.6.1 Pricing analysis, By product type, 2024

- 3.6.2 Global

- 3.6.2.1 Single-use vial adaptors

- 3.6.2.2 Multi-use vial adaptors

- 3.6.3 North America

- 3.6.3.1 Single-use vial adaptors

- 3.6.3.2 Multi-use vial adaptors

- 3.6.4 Europe

- 3.6.4.1 Single-use vial adaptors

- 3.6.4.2 Multi-use vial adaptors

- 3.6.5 Asia Pacific

- 3.6.5.1 Single-use vial adaptors

- 3.6.5.2 Multi-use vial adaptors

- 3.6.6 Latin America

- 3.6.6.1 Single-use vial adaptors

- 3.6.6.2 Multi-use vial adaptors

- 3.6.7 MEA

- 3.6.7.1 Single-use vial adaptors

- 3.6.7.2 Multi-use vial adaptors

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

- 3.11 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Single-use vial adaptors

- 5.2.1 Vented vial adaptors

- 5.2.2 Non-vented vial adaptors

- 5.3 Multi-use vial adaptors

- 5.3.1 Vented vial adaptors

- 5.3.2 Non-vented vial adaptors

Chapter 6 Market Estimates and Forecast, By Product Size, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 13 mm

- 6.3 20 mm

- 6.4 Other product sizes

Chapter 7 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Polycarbonate

- 7.3 Silicone

- 7.4 Polyethylene

- 7.5 Other materials

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 B. Braun

- 10.2 Baxter International

- 10.3 Becton, Dickinson and Company

- 10.4 CODAN Medizinische Gerate

- 10.5 Epic Medical

- 10.6 EQUASHIELD

- 10.7 Helapet

- 10.8 ICU Medical

- 10.9 Miltenyi Biotec

- 10.10 Thermo Fisher Scientific

- 10.11 VYGON

- 10.12 West Pharmaceutical Services

- 10.13 Yukon Medical