|

市場調查報告書

商品編碼

1822605

獸醫注射器材市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Veterinary Injectable Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

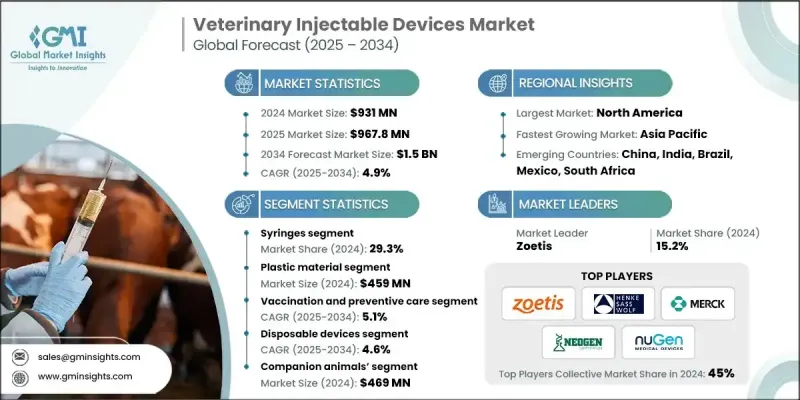

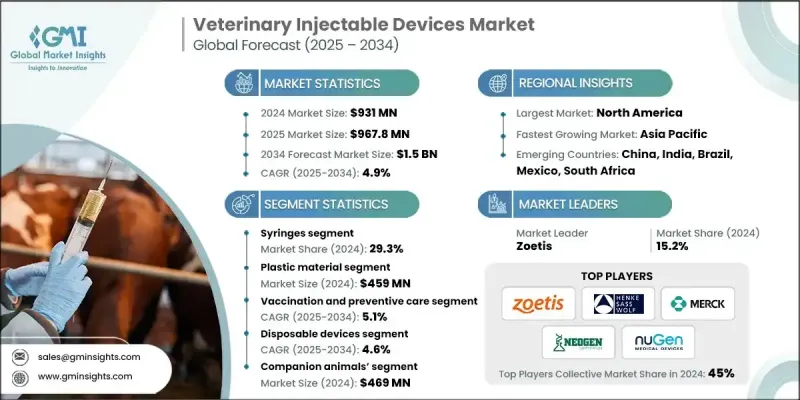

2024 年全球獸醫注射設備市場價值為 9.31 億美元,預計將以 4.9% 的複合年成長率成長,到 2034 年達到 15 億美元。

隨著越來越多的家庭收養寵物並將其視為家庭成員,獸醫就診和預防保健支出大幅增加,從而推動了對用於疫苗接種、治療和療法的高效、安全的注射裝置的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 9.31億美元 |

| 預測值 | 15億美元 |

| 複合年成長率 | 4.9% |

注射器使用率不斷上升

2024年,注射器市場佔據了顯著的佔有率,這得益於其廣泛應用於伴侶動物和家畜的藥物、疫苗和營養給藥。這些設備因其精準度高、操作簡便以及與各種針頭規格和容量的兼容性而備受推崇。由於感染控制仍然是行業重點,獸用預消毒和安全增強型注射器的產量正在增加。

塑膠材質將獲得青睞

塑膠材料憑藉其成本效益、輕質特性和設計靈活性,在2024年佔據了相當大的市場佔有率。從一次性注射器到多劑量注射器,塑膠兼具耐用性和安全性。市場成長的驅動力在於大批量生產需求以及對支持診所和農場環境衛生規範的一次性設備日益成長的需求。製造商也在探索環保生物塑膠和可回收聚合物,以應對日益成長的環境問題並符合永續發展目標。

疫苗接種和預防保健需求不斷成長

2024年,隨著寵物和牲畜疾病預防意識的不斷增強,疫苗接種和預防保健領域創造了可觀的收入。獸醫和動物健康計畫優先考慮注射疫苗,因為它們起效快、療效高,尤其適用於狂犬病、口蹄疫和細小病毒等疾病。快速、精準、減少動物壓力的注射裝置需求旺盛,尤其是在大規模疫苗接種活動中。

區域洞察

北美將成為推動力地區

2024年,北美獸醫注射器械市場佔據了相當大的佔有率,這得益於先進的獸醫醫療保健體系、較高的寵物擁有率以及完善的牲畜管理實踐。動物保健投資的增加、預防性護理方案的廣泛採用以及良好的監管環境,都為市場成長提供了支撐。關鍵參與者的參與和持續的研發投入也鞏固了該地區的主導地位,尤其注重精密器械和數位追蹤系統,以確保劑量的準確性。

獸醫注射設備市場的主要參與者有 Neogen Corporation、Terumo Medical Corporation、Hamilton Company、Serumwerk Bernburg、Allflex USA、Medtronic plc、Zoetis、Henke-Sass、Wolf、Baxter International、NuGen Medical Devices、B. Braun Melsungen、Merck & Co. 和 Micrel Medical Devices。

為了鞏固市場地位,獸用注射器材領域的領先公司正專注於創新、地理擴張和策略合作。產品開發以人體工學設計、無針注射器和自動給藥系統為中心,以減少人為失誤和動物壓力。許多公司正在透過建立本地製造和分銷合作夥伴關係來拓展新興市場,以降低成本並擴大覆蓋範圍。

目錄

第1章:方法論與範圍

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 寵物數量的增加和伴侶動物的人性化

- 不斷成長的動物保健支出和大型動物生產需求

- 人畜共通傳染病控制計畫的普及率不斷上升

- 增加新興市場的獸醫基礎設施和服務可近性

- 產業陷阱與挑戰

- 先進設備和治療費用高昂

- 針刺傷和交叉污染的風險

- 市場機會

- 預充式注射器和自動注射器在獸醫護理中的應用日益增多

- 寵物保險和寵物主人消費意願的提高

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 當前的技術趨勢

- 新興技術

- 未來市場趨勢

- 定價分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 注射器

- 針頭

- 遠端注射設備

- 桿式注射器

- 飛鏢

- 無針注射器系統

- 彈簧式

- 電池供電

- 氣動噴射器

- 自動注射器

- 其他注射裝置

第6章:市場估計與預測:按材料,2021 - 2034 年

- 主要趨勢

- 塑膠

- 金屬

- 玻璃

- 其他材料

第7章:市場估計與預測:按臨床應用,2021 - 2034

- 主要趨勢

- 疫苗接種及預防保健

- 抗感染藥物

- 麻醉和鎮痛

- 生育力和生殖

- 其他臨床應用

第 8 章:市場估計與預測:按用途,2021 年至 2034 年

- 主要趨勢

- 免洗設備

- 可重複使用的設備

第9章:市場估計與預測:按動物類型,2021 - 2034 年

- 主要趨勢

- 伴侶動物

- 牲畜

- 其他動物

第 10 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 獸醫院

- 獸醫診所

- 學術和研究機構

- 其他最終用途

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- Allflex USA

- Baxter International

- B. Braun Melsungen

- Hamilton Company

- Henke-Sass, Wolf

- Merck & Co.

- Medtronic plc

- Micrel Medical Devices

- Neogen Corporation

- NuGen Medical Devices

- Serumwerk Bernburg

- Terumo Medical Corporation

- Zoetis

The Global Veterinary Injectable Devices Market was valued at USD 931 million in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 1.5 billion by 2034.

With more households adopting pets and treating them as family members, there is a significant rise in veterinary visits and preventive care spending-boosting demand for efficient, safe injectable devices for vaccinations, treatments, and therapies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $931 Million |

| Forecast Value | $1.5 Billion |

| CAGR | 4.9% |

Rising adoption of Syringes

The syringes segment held a notable share in 2024, driven by its wide applicability in administering medications, vaccines, and nutrients to both companion and livestock animals. These devices are valued for their precision, ease of use, and compatibility with a range of needle gauges and volumes. As infection control remains a priority, the industry is witnessing increased production of pre-sterilized and safety-enhanced syringes tailored for veterinary use.

Plastic Material to Gain Traction

The plastic materials generated a significant share in 2024 owing to their cost-effectiveness, lightweight nature, and flexibility in design. From disposable syringes to multi-dose injectors, plastic offers a balance of durability and safety. The market growth is driven by high-volume production needs and the rising demand for single-use devices that support hygienic practices in both clinics and farm environments. Manufacturers are also exploring eco-friendly bioplastics and recyclable polymers to address growing environmental concerns and align with sustainability goals.

Rising Demand for Vaccination and Preventive Care

The vaccination and preventive care segment generated significant revenues in 2024, fueled by increasing awareness of disease prevention in both pets and livestock. Veterinarians and animal health programs are prioritizing injectable vaccines for their fast action and high efficacy, especially for diseases like rabies, foot-and-mouth, and parvovirus. Injectable devices designed for speed, accuracy, and reduced stress on animals are in high demand, particularly in large-scale vaccination drives.

Regional Insights

North America to Emerge as a Propelling Region

North America veterinary injectable devices market held a substantial share in 2024, backed by advanced veterinary healthcare systems, high pet ownership rates, and strong livestock management practices. Growth is supported by increased investments in animal wellness, widespread adoption of preventive care protocols, and a favorable regulatory environment. The presence of key players and ongoing R&D efforts also contributes to the region's dominance, with a focus on precision devices and digital tracking systems for dosage accuracy.

Major players involved in the veterinary injectable devices market are Neogen Corporation, Terumo Medical Corporation, Hamilton Company, Serumwerk Bernburg, Allflex USA, Medtronic plc, Zoetis, Henke-Sass, Wolf, Baxter International, NuGen Medical Devices, B. Braun Melsungen, Merck & Co., Micrel Medical Devices.

To strengthen their market position, leading companies in the veterinary injectable devices space are focusing on innovation, geographic expansion, and strategic collaborations. Product development is centered around ergonomic designs, needle-free injectors, and automated dosing systems to reduce human error and animal stress. Many players are expanding into emerging markets by setting up local manufacturing and distribution partnerships to lower costs and improve reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Material trends

- 2.2.4 Clinical applications trends

- 2.2.5 Usage trends

- 2.2.6 Animal type trends

- 2.2.7 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet population and humanization of companion animals

- 3.2.1.2 Growing animal health spending and large animal production needs

- 3.2.1.3 Rising prevalence of zoonotic and infectious disease control programs

- 3.2.1.4 Increasing veterinary infrastructure and service access in emerging markets

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced devices and treatment

- 3.2.2.2 Risk of needle-stick injuries and cross-contamination

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption of prefilled syringes and autoinjectors in veterinary care

- 3.2.3.2 Rising pet insurance and willingness to spend by pet owners

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Syringes

- 5.3 Needles

- 5.4 Remote injectable devices

- 5.4.1 Pole syringes

- 5.4.2 Darts

- 5.5 Needle free injector systems

- 5.5.1 Spring-loaded

- 5.5.2 Battery-powered

- 5.5.3 Gas powered jet injector

- 5.6 Auto-injectors

- 5.7 Other injectable devices

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Metal

- 6.4 Glass

- 6.5 Other materials

Chapter 7 Market Estimates and Forecast, By Clinical Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Vaccination and preventive care

- 7.3 Anti-infectives

- 7.4 Anesthesia and analgesia

- 7.5 Fertility and reproduction

- 7.6 Other clinical applications

Chapter 8 Market Estimates and Forecast, By Usage, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Disposable devices

- 8.3 Reusable devices

Chapter 9 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Companion animals

- 9.3 Livestock animals

- 9.4 Other animals

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Veterinary hospitals

- 10.3 Veterinary clinics

- 10.4 Academic and research institutes

- 10.5 Other end use

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Allflex USA

- 12.2 Baxter International

- 12.3 B. Braun Melsungen

- 12.4 Hamilton Company

- 12.5 Henke-Sass, Wolf

- 12.6 Merck & Co.

- 12.7 Medtronic plc

- 12.8 Micrel Medical Devices

- 12.9 Neogen Corporation

- 12.10 NuGen Medical Devices

- 12.11 Serumwerk Bernburg

- 12.12 Terumo Medical Corporation

- 12.13 Zoetis