|

市場調查報告書

商品編碼

1822604

遊艇市場機會、成長動力、產業趨勢分析及2025-2034年預測Yacht Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

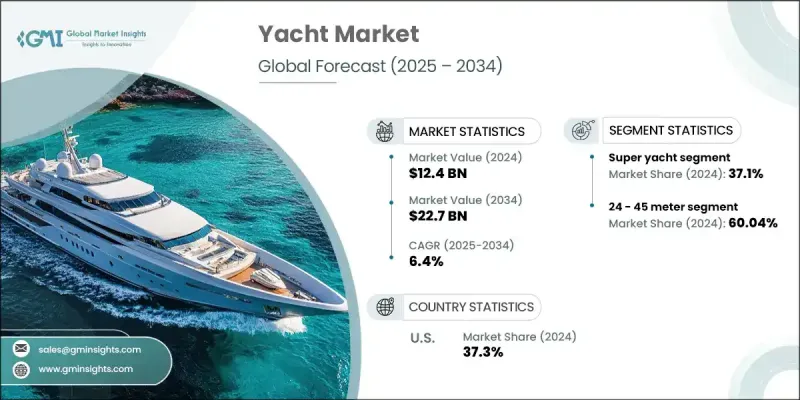

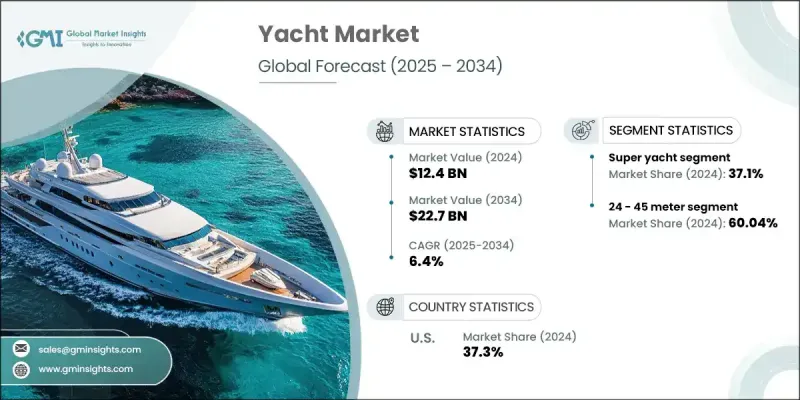

全球遊艇市場規模達124億美元,預計到2034年將以6.4%的複合年成長率成長,達到227億美元,這得益於可支配收入的增加以及奢華和休閒活動日益普及。隨著全球財富的成長,尤其是高淨值人士的財富成長,豪華遊艇作為尊貴身份和個人享受的象徵,其需求日益成長。私人巡航體驗的魅力,加上現代遊艇設計提供的客製化選項,使遊艇成為富裕人士頗具吸引力的生活方式選擇。例如,義大利造船廠Cantiere delle Marche於2024年7月推出了一艘「一次性」的42.6公尺探險遊艇B2。遊艇工程領域的創新,例如燃油效率的提高、導航系統的改進以及環保技術,進一步提升了遊艇對買家的吸引力。

尖端設施和永續特性(例如混合動力推進系統和節能設計)的結合,以滿足兼顧奢華與環保的現代消費者不斷變化的偏好,將推動市場成長。整個遊艇行業按類型、長度、推進力和地區細分。根據類型,預計到2032年,運動遊艇市場的規模將持續成長。運動遊艇配備先進的技術和空氣動力學設計,可提供卓越的航行體驗,並經常出現在著名的帆船賽和帆船比賽中。人們對帆船運動和高階賽事的興趣日益濃厚,再加上遊艇設計和材料的進步,進一步增強了富裕買家和划船愛好者對運動遊艇的渴望。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 124億美元 |

| 預測值 | 227億美元 |

| 複合年成長率 | 6.4% |

預計到2032年,風帆推進型遊艇市場將實現顯著成長,這得益於帆船運動的傳統和環保特性。此外,帆船將優雅、性能和永續性完美結合,吸引了那些欣賞風力航行技巧和經驗的買家。人們對環保意識和減少碳足跡的日益重視,也增加了人們對帆船運動的興趣,使其成為比機動遊艇更環保的替代方案。到2032年,亞太地區遊艇產業規模將大幅成長。這歸因於中高淨值人群的不斷成長,尤其是在中國、印度和澳洲等國家,這些國家日益成長的富裕程度正在刺激對豪華休閒資產的需求。包括碼頭和遊艇俱樂部在內的沿海基礎設施的擴建,為該地區提供了更好的設施和航海機會,進一步增強了遊艇擁有者的吸引力。

目錄

第1章:方法論

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- GMI 專有 AI 系統

- 人工智慧驅動的研究增強

- 來源一致性協議

- 人工智慧準確度指標

- 預測模型

- 初步研究和驗證

- 市場估計的主要趨勢

- 量化市場影響分析

- 生長參數對預測的數學影響

- 情境分析框架

- 一些主要來源(但不限於)

- 資料探勘來源

- 次要

- 付費來源

- 公共資源

- 來源(按地區)

- 次要

- 研究路徑和信心評分

- 研究路徑組成部分:

- 評分組件

- 研究透明度附錄

- 來源歸因框架

- 品質保證指標

- 我們對信任的承諾

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 遊艇製造商和建造商

- 碼頭和基礎設施提供商

- 包機和管理公司

- 維護和改裝服務

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 供應商格局

- 經濟影響評估

- 直接和間接的經濟貢獻

- 各地區GDP貢獻

- 就業創造分析

- 稅收和政府收入

- 貿易平衡和出口影響

- 創造就業機會和技能發展

- 製造業直接就業

- 服務業間接就業

- 技能發展和培訓計劃

- 職涯道路和晉昇機會

- 旅遊和酒店業的聯繫

- 目的地旅遊影響

- 飯店和餐廳整合

- 本地服務提供者的優勢

- 文化和環境影響

- 直接和間接的經濟貢獻

- 市場演變與歷史發展

- 產業起源與早期發展

- 重要的歷史里程碑與轉折點

- 技術演進時間表

- 市場成熟階段

- 產業衝擊力

- 成長動力

- 財富成長和高淨值人士(HNWI)

- 奢華旅遊和休閒活動日益普及

- 技術進步和客製化

- 遊艇租賃市場的擴張

- 加強沿海基礎設施建設

- 產業陷阱與挑戰

- 維護和營運成本高

- 經濟和市場波動

- 市場機會

- 亞太地區的新興市場與財富成長

- 環保且永續的遊艇

- 數位化和智慧遊艇技術

- 遊艇共享和部分所有權模式的成長

- 成長動力

- 成長潛力分析

- 生產統計

- 監管格局

- 國際海事法規

- MARPOL 公約合規性

- 國際海事組織溫室氣體戰略

- NOX Tier III 排放標準

- 區域監理框架

- 歐盟法規

- 地中海繫泊規定

- 美國船舶排放法規

- 亞太地區監理發展

- 環境合規要求

- 碳減排目標

- 廢棄物管理和處理標準

- 海洋保護區限制

- 永續性報告要求

- 安全及安保法規

- 海事勞工公約(MLC 2006)

- 智慧遊艇的網路安全標準

- 船旗國合規要求

- 稅務和法律考慮

- 增值稅結構和影響

- 所有權和註冊要求

- 包機許可證和經營許可證

- 國際海事法規

- 專利分析

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 永續推進系統

- 電動和混合動力遊艇技術

- 氫燃料電池整合

- 替代能源(太陽能、風能)

- 燃油效率最佳化

- 智慧遊艇技術

- 物聯網 (IoT) 整合

- 人工智慧和自動化

- 先進的導航和安全系統

- 連線解決方案(Starlink、5G)

- 設計和材料創新

- 先進複合材料

- 輕量化建築技術

- 環保材料應用

- 模組化和可自訂的設計理念

- 遊艇產業的數位轉型

- 虛擬實境與擴增實境應用

- 數位預訂和包機平台

- 預測性維護技術

- 區塊鏈在遊艇交易中的應用

- 永續推進系統

- 專利分析

- 供應鍊和製造分析

- 全球製造業格局

- 供應鏈結構與動態

- 製造能力和利用率

- 供應鏈的挑戰與機遇

- 用例

- 最佳情況

- 消費者行為分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考慮

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 多邊環境協定

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 新興競爭威脅

- 新市場進入者

- 科技顛覆者

- 替代商業模式

- 競爭情報框架

- 重要新聞和舉措

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:按類型,2021 - 2034

- 主要趨勢

- 飛橋遊艇

- 運動遊艇

- 超級遊艇

- 其他(長航程遊艇、巡洋艦、探險遊艇)

第6章:市場估計與預測:依長度,2021 - 2034

- 主要趨勢

- 24米以下

- 24 - 45米

- 45米以上

第7章:市場估計與預測:按推進方式,2021 - 2034 年

- 主要趨勢

- 引擎

- 帆

- 混合動力/電動

第8章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐人

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- 全球參與者

- Abeking & Rasmussen

- Amels / Damen Yachting

- Benetti

- CRN

- Feadship

- Ferretti Group

- Fincantieri

- Group Beneteau

- Heesen Yachts

- Lurssen

- Malibu Boats

- MasterCraft Boat Holdings

- Oceanco

- Princess Yachts

- Sanlorenzo

- Sea Ray

- The Italian Sea Group

- Sunseeker International

- Viking Yachts

- Yamaha Marine

- 區域參與者

- Turquoise Yachts

- Nimbus Group

- Cheoy Lee Shipyards

- Boston Whaler

- Hatteras Yachts

- Nobiskrug

- Nautique Boat Company

- 新興參與者/顛覆者

- Malibu Boats

- Turquoise Yachts

The Global Yacht market was valued at USD 12.4 billion and is estimated to grow at a CAGR of 6.4% to reach USD 22.7 billion by 2034, driven by increasing disposable incomes and the rising popularity of luxury and recreational activities. With the expanding global wealth, particularly among high-net-worth individuals, there is growing demand for luxury yachts as symbols of prestige and personal indulgence. The allure of private cruising experiences, combined with the customization options available in modern yacht designs are making yachts an attractive lifestyle choice for affluent individuals. For instance, in July 2024, Italian shipyard Cantiere delle Marche launched a "one off" 42.6-metre explorer yacht B2. Innovations in yacht engineering, such as enhanced fuel efficiency, improved navigation systems, and eco-friendly technologies, are further turning yachts more appealing to buyers.

The incorporation of cutting-edge amenities and sustainable features, such as hybrid propulsion systems and energy-efficient designs to cater to the evolving preferences of modern consumers who prioritize both luxury and environmental responsibility will drive the market growth. The overall yacht industry is segmented into type, length, propulsion, and region. Based on type, the market size from the sports yacht segment is anticipated to witness growth through 2032. Sports yachts, equipped with advanced technology and aerodynamics, offer superior sailing experiences and are often featured in prestigious regattas and sailing competitions. The increasing interest in sailing sports and high-profile events, coupled with advancements in yacht design and materials, are further enhancing the desirability of sports yachts among affluent buyers and racing aficionados.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.4 Billion |

| Forecast Value | $22.7 Billion |

| CAGR | 6.4% |

Yacht market from the sail propulsion segment is predicted to record notable gains up to 2032 due to traditional and eco-friendly aspects of sailing. Moreover, sailing yachts offer a unique combination of elegance, performance, and sustainability, appealing to buyers who appreciate the skill and experience involved in navigating by wind power. The growing emphasis on environmental consciousness and reduced carbon footprints has also increased the interest in sailing as a greener alternative to motorized yachting. Asia Pacific yacht industry size will grow significantly through 2032. This is attributed to rising middle and high-net-worth population, particularly in countries like China, India, and Australia, where increasing affluence is fueling the demand for luxury recreational assets. The expansion of coastal infrastructure, including marinas and yacht clubs, is further enhancing the appeal of yacht ownership by providing better facilities and access to sailing opportunities in the region.

Table of Contents

Chapter 1 Methodology

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.1.6 GMI proprietary AI system

- 1.1.6.1 AI-Powered research enhancement

- 1.1.6.2 Source consistency protocol

- 1.1.6.3 AI accuracy metrics

- 1.2 Forecast model

- 1.3 Primary research and validation

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario Analysis Framework

- 1.4 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Secondary

- 1.5.1.1 Paid Sources

- 1.5.1.2 Public Sources

- 1.5.1.3 Sources, by region

- 1.5.1 Secondary

- 1.6 Research Trail & Confidence Scoring

- 1.6.1 Research Trail Components:

- 1.6.2 Scoring Components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Length

- 2.2.4 Propulsion

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Yacht manufacturers and builders

- 3.1.1.2 Marina and infrastructure providers

- 3.1.1.3 Charter and management companies

- 3.1.1.4 Maintenance and refit services

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.1.1 Supplier landscape

- 3.2 Economic impact assessment

- 3.2.1 Direct and indirect economic contributions

- 3.2.1.1 GDP contribution by region

- 3.2.1.2 Employment generation analysis

- 3.2.1.3 Tax revenue and government income

- 3.2.1.4 Trade balance and export impact

- 3.2.2 Employment generation and skills development

- 3.2.2.1 Direct employment in manufacturing

- 3.2.2.2 Indirect employment in services

- 3.2.2.3 Skill development and training programs

- 3.2.2.4 Career pathway and advancement opportunities

- 3.2.3 Tourism and hospitality sector linkages

- 3.2.3.1 Destination tourism impact

- 3.2.3.2 Hotel and restaurant integration

- 3.2.3.3 Local service provider benefits

- 3.2.3.4 Cultural and environmental impact

- 3.2.1 Direct and indirect economic contributions

- 3.3 Market evolution and historical development

- 3.3.1 Industry genesis and early development

- 3.3.2 Key historical milestones and turning points

- 3.3.3 Technology evolution timeline

- 3.3.4 Market maturation phases

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Rising wealth and high net-worth individuals (HNWIs)

- 3.4.1.2 Growing popularity of luxury tourism and leisure activities

- 3.4.1.3 Technological advancements and customization

- 3.4.1.4 Expansion of yacht charter market

- 3.4.1.5 Increasing coastal infrastructure development

- 3.4.2 Industry pitfalls and challenges

- 3.4.2.1 High maintenance and operating costs

- 3.4.2.2 Economic and market volatility

- 3.4.3 Market opportunities

- 3.4.3.1 Emerging markets and increasing wealth in Asia-Pacific

- 3.4.3.2 Eco-friendly and sustainable yachts

- 3.4.3.3 Digitalization and smart yacht technologies

- 3.4.3.4 Growth of yacht sharing and fractional ownership models

- 3.4.1 Growth drivers

- 3.5 Growth potential analysis

- 3.6 Production statistics

- 3.7 Regulatory landscape

- 3.7.1 International maritime regulations

- 3.7.1.1 MARPOL convention compliance

- 3.7.1.2 IMO greenhouse gas strategy

- 3.7.1.3 NOX tier III emissions standards

- 3.7.2 Regional Regulatory Frameworks

- 3.7.2.1 European union regulations

- 3.7.2.2 Mediterranean mooring regulations

- 3.7.2.3 U.S. marine emissions rules

- 3.7.2.4 Asia-Pacific regulatory developments

- 3.7.3 Environmental compliance requirements

- 3.7.3.1 Carbon emission reduction targets

- 3.7.3.2 Waste management and treatment standards

- 3.7.3.3 Marine protected area restrictions

- 3.7.3.4 Sustainability reporting requirements

- 3.7.4 Safety and security regulations

- 3.7.4.1 Maritime labour convention (MLC 2006)

- 3.7.4.2 Cybersecurity standards for smart yachts

- 3.7.4.3 Flag state compliance requirements

- 3.7.5 Tax and Legal Considerations

- 3.7.5.1 VAT structures and implications

- 3.7.5.2 Ownership and registration requirements

- 3.7.5.3 Charter license and operating permits

- 3.7.1 International maritime regulations

- 3.8 Patent analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Technology and innovation landscape

- 3.11.1 Sustainable propulsion systems

- 3.11.1.1 Electric and hybrid yacht technologies

- 3.11.1.2 Hydrogen fuel cell integration

- 3.11.1.3 Alternative energy sources (solar, wind)

- 3.11.1.4 Fuel efficiency optimization

- 3.11.2 Smart yacht technologies

- 3.11.2.1 Internet of things (IoT) integration

- 3.11.2.2 Artificial intelligence and automation

- 3.11.2.3 Advanced navigation and safety systems

- 3.11.2.4 Connectivity solutions (Starlink, 5G)

- 3.11.3 Design and materials innovation

- 3.11.3.1 Advanced composite materials

- 3.11.3.2 Lightweight construction technologies

- 3.11.3.3 Eco-friendly material applications

- 3.11.3.4 Modular and customizable design concepts

- 3.11.4 Digital transformation in yachting

- 3.11.4.1 Virtual reality and augmented reality applications

- 3.11.4.2 Digital booking and charter platforms

- 3.11.4.3 Predictive maintenance technologies

- 3.11.4.4 Blockchain applications in yacht transactions

- 3.11.1 Sustainable propulsion systems

- 3.12 Patent analysis

- 3.13 Supply Chain And Manufacturing Analysis

- 3.13.1 Global manufacturing landscape

- 3.13.2 Supply chain structure and dynamics

- 3.13.3 Manufacturing capacity and utilization

- 3.13.4 Supply chain challenges and opportunities

- 3.14 Use cases

- 3.15 Best-case scenario

- 3.16 Consumer behaviour analysis

- 3.17 Sustainability and Environmental Aspects

- 3.17.1 Sustainable practices

- 3.17.2 Waste reduction strategies

- 3.17.3 Energy efficiency in production

- 3.17.4 Eco-friendly Initiatives

- 3.17.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Emerging competitive threats

- 4.6.1 New market entrants

- 4.6.2 Technology disruptors

- 4.6.3 Alternative business models

- 4.6.4 Competitive intelligence framework

- 4.7 Key news and initiatives

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Flybridge Yacht

- 5.3 Sport Yacht

- 5.4 Super Yachts

- 5.5 Others (Long Range, Cruisers, Expedition Yachts)

Chapter 6 Market Estimates & Forecast, By Length, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Below 24 meter

- 6.3 24 - 45 meter

- 6.4 Above 45 meter

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Motor

- 7.3 Sail

- 7.4 Hybrid/electric

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Nordics

- 8.3.7 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Global Players

- 9.1.1 Abeking & Rasmussen

- 9.1.2 Amels / Damen Yachting

- 9.1.3 Benetti

- 9.1.4 CRN

- 9.1.5 Feadship

- 9.1.6 Ferretti Group

- 9.1.7 Fincantieri

- 9.1.8 Group Beneteau

- 9.1.9 Heesen Yachts

- 9.1.10 Lurssen

- 9.1.11 Malibu Boats

- 9.1.12 MasterCraft Boat Holdings

- 9.1.13 Oceanco

- 9.1.14 Princess Yachts

- 9.1.15 Sanlorenzo

- 9.1.16 Sea Ray

- 9.1.17 The Italian Sea Group

- 9.1.18 Sunseeker International

- 9.1.19 Viking Yachts

- 9.1.20 Yamaha Marine

- 9.2 Regional Players

- 9.2.1 Turquoise Yachts

- 9.2.2 Nimbus Group

- 9.2.3 Cheoy Lee Shipyards

- 9.2.4 Boston Whaler

- 9.2.5 Hatteras Yachts

- 9.2.6 Nobiskrug

- 9.2.7 Nautique Boat Company

- 9.3 Emerging Players / Disruptors

- 9.3.1 Malibu Boats

- 9.3.2 Turquoise Yachts