|

市場調查報告書

商品編碼

1822603

魚蛋白水解物市場機會、成長動力、產業趨勢分析及2025-2034年預測Fish Protein Hydrolysate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

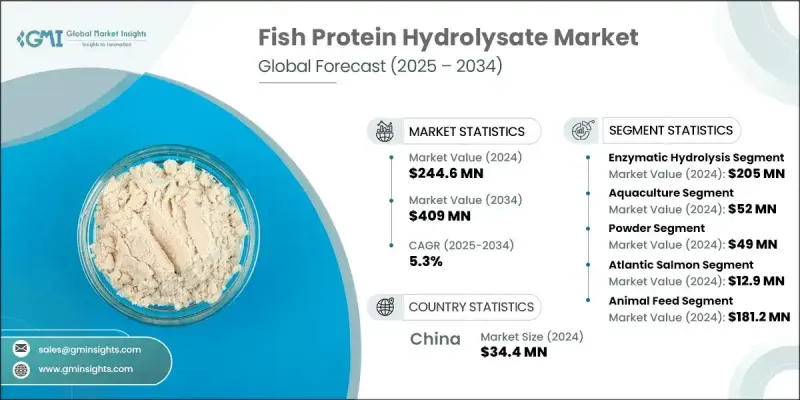

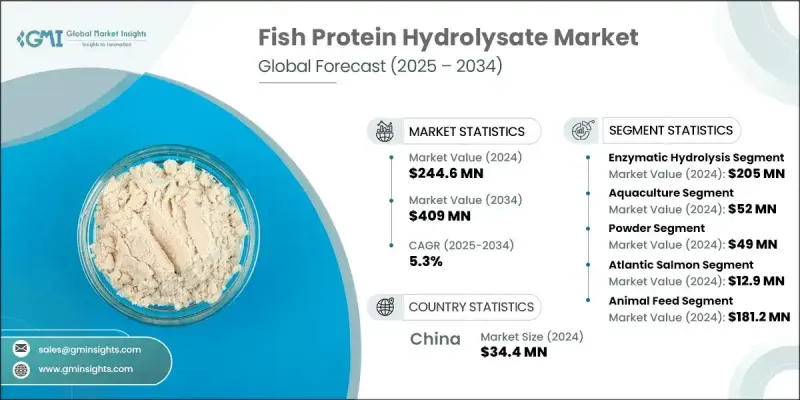

2024年,全球魚類蛋白水解物市場規模達2.446億美元,預計到2034年將以5.3%的複合年成長率成長,達到4.09億美元。市場擴張的動力源自於人們對高品質、富含蛋白質的動物營養成分日益成長的需求,而這些需求的驅動力源自於人們對這些水解物營養優勢的日益認知。魚類蛋白水解物富含必需胺基酸、胜肽和ω-3脂肪酸,可增強動物和寵物的消化率,促進其快速生長,增強免疫功能,並改善其整體健康。全球對更永續、更環保的蛋白質來源的追求,使得人們更加重視利用魚類副產品來生產水解物,進一步推動了市場的發展動能。

包括動物飼料、水產養殖和寵物食品在內的多個行業對魚蛋白水解物的需求不斷成長,是推動這一成長的關鍵因素。這些水解物以其豐富的營養成分而聞名,已被證明對改善動物的生長性能和免疫健康非常有益。隨著全球人口持續重視健康和保健,市場價值因對清潔標籤和永續來源原料的日益青睞而進一步提升,尤其是在寵物食品和功能性食品領域。對環境永續性的日益重視,正在鼓勵各行各業採用替代的、環保的蛋白質來源,這對促進全球範圍內魚蛋白水解物的採用發揮著重要作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.446億美元 |

| 預測值 | 4.09億美元 |

| 複合年成長率 | 5.3% |

魚蛋白水解物市場依生產技術細分,主要方法包括酸水解、酵素水解和自溶水解。酶水解是成長最快的領域,因為它可以生產具有特定功能和營養特性的優質水解物。這種方法利用天然酶,對生產過程的控制性更強,生產的胜肽具有更高的生物活性和消化率,使其成為各行業的首選。

就形態而言,魚蛋白水解物有粉末、液體和糊狀等多種形態,其中粉狀在2024年佔據市場主導地位,佔總收入佔有率的90.1%以上。粉狀水解物之所以受歡迎,很大程度得益於其用途廣泛、易於儲存且保存期限長。粉末狀水解物因其濃縮的蛋白質含量和廣泛的應用相容性,特別適用於動物飼料、寵物食品和功能性食品配方。其較低的腐敗風險也進一步增強了其對製造商和最終用戶的吸引力。

受日益成長的動物營養和水產養殖業對優質蛋白質成分需求的推動,美國魚類蛋白水解物市場規模在2024年達到5,070萬美元。美國強勁的水產養殖業正在推動這一成長,魚類蛋白水解物在功能性食品和膳食補充劑中的應用日益廣泛。隨著消費者和企業持續重視永續性和質量,預計未來幾年美國魚類蛋白水解物市場將持續擴張。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 對天然和永續飼料成分的需求不斷成長

- 提高對魚類蛋白水解物的營養價值的認知

- 轉向優質和特殊寵物食品和動物飼料

- 產業陷阱與挑戰

- 生產成本高、加工方法複雜

- 永續魚類原料供應有限

- 市場機會

- 推動水產養殖業不斷發展的地區更高的採用率和收入成長。

- 能夠進入高階和增值產品領域。

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)

- 主要進口國

- 主要出口國

(註:僅提供重點國家的貿易統計)

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 多邊環境協定

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按技術分類,2021 - 2034 年

- 主要趨勢

- 酸水解

- 自溶水解

- 酵素水解

第6章:市場估計與預測:依形式,2021 - 2034

- 主要趨勢

- 粉末

- 液體

- 貼上

第7章:市場估計與預測:按來源,2021 - 2034

- 主要趨勢

- 鳳尾魚

- 羅非魚

- 鮪魚

- 沙丁魚

- 大西洋鮭魚

- 甲殼類動物

- 軟體動物

- 鱈魚

- 其他(鯡魚、鯖魚)

第 8 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 動物飼料

- 寵物食品

- 貓

- 狗

第9章:市場估計與預測:按牲畜,2021 - 2034 年

- 主要趨勢

- 家禽

- 肉雞

- 圖層

- 豬

- 小牛

- 水產養殖

- 鮭魚

- 鱒魚

- 蝦

- 其他(牡蠣、螃蟹、龍蝦)

- 馬

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第 11 章:公司簡介

- Alaska Protein Recovery

- Bio-Marine Ingredients Ireland

- Copalis Sea

- Diana Aqua

- Hofseth Biocare

- Janatha Fish Meal & Oil Products

- Nutrifish

- Omega Protein

- Rossyew

- SAMPI

- Scanbio Marine

- Sociedad Pesquera Landes

- SOPROPECHE

- TC Union

- Triplenine

The global fish protein hydrolysate market was valued at USD 244.6 million in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 409 million by 2034. The market expansion is driven by the increasing demand for high-quality, protein-rich ingredients in animal nutrition, spurred by growing awareness of the nutritional advantages these hydrolysates provide. Rich in essential amino acids, peptides, and omega-3 fatty acids, fish protein hydrolysates enhance digestibility and support faster growth, better immune function, and overall well-being in animals and pets. The global push for more sustainable and eco-friendly protein sources has led to a greater focus on utilizing fish by-products for hydrolysate production, further boosting the market's momentum.

The rising demand for fish protein hydrolysates across multiple industries-including animal feed, aquaculture, and pet food-is a key factor driving this growth. These hydrolysates, known for their high nutritional content, have proven to be highly beneficial in improving growth performance and immune health in animals. As the global population continues to prioritize health and wellness, the market's value is being further fueled by the increasing preference for clean-label and sustainably sourced ingredients, particularly within the pet food and functional food sectors. The growing emphasis on environmental sustainability is encouraging industries to adopt alternative, eco-friendly protein sources, which plays a significant role in enhancing the adoption of fish protein hydrolysates worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $244.6 Million |

| Forecast Value | $409 Million |

| CAGR | 5.3% |

The fish protein hydrolysate market is segmented by production technology, with key methods including acid hydrolysis, enzymatic hydrolysis, and autolytic hydrolysis. Enzymatic hydrolysis is the fastest-growing segment, as it allows for the production of superior-quality hydrolysates with targeted functional and nutritional properties. This method, which utilizes natural enzymes, provides more control over the process, yielding peptides with enhanced bioactivity and digestibility, making it a preferred choice across various sectors.

In terms of form, fish protein hydrolysates are available in powder, liquid, and paste variations, with the powdered segment dominating the market in 2024, accounting for over 90.1% of the total revenue share. This popularity is largely due to its versatility, ease of storage, and extended shelf life. Powdered hydrolysates are especially favored in animal feed, pet food, and functional food formulations owing to their concentrated protein content and compatibility with diverse applications. The reduced risk of spoilage further increases their appeal to manufacturers and End Uses alike.

The U.S. fish protein hydrolysate market reached USD 50.7 million in 2024, driven by the demand for premium protein ingredients in the growing animal nutrition and aquaculture sectors. The strong aquaculture industry in the U.S. is fueling growth, with fish protein hydrolysates increasingly used in functional foods and dietary supplements. As consumers and businesses alike continue to prioritize sustainability and quality, the U.S. market for fish protein hydrolysates is expected to see sustained expansion in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Form

- 2.2.4 Source

- 2.2.5 Application

- 2.2.6 Livestock

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for natural and sustainable feed ingredients

- 3.2.1.2 Increasing awareness of the nutritional benefits of fish protein hydrolysates

- 3.2.1.3 Shift towards premium and specialty pet food and animal feed

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs and complex processing methods

- 3.2.2.2 Limited availability of sustainable fish raw materials

- 3.2.3 Market opportunities

- 3.2.3.1 Drives higher adoption and revenue growth in regions with growing aquaculture industries.

- 3.2.3.2 Enables entry into premium and value-added product segments.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

( Note: the trade statistics will be provided for key countries only)

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Acid hydrolysis

- 5.3 Autolytic hydrolysis

- 5.4 Enzymatic hydrolysis

Chapter 6 Market Estimates and Forecast, By Form, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Powder

- 6.3 Liquid

- 6.4 Paste

Chapter 7 Market Estimates and Forecast, By Source, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Anchovy

- 7.3 Tilapia

- 7.4 Tuna

- 7.5 Sardine

- 7.6 Atlantic salmon

- 7.7 Crustacean

- 7.8 Molluscs

- 7.9 Codfish

- 7.10 Others (herring, mackerel)

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Animal feed

- 8.3 Petfood

- 8.3.1 Cat

- 8.3.2 Dog

Chapter 9 Market Estimates and Forecast, By Livestock, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Poultry

- 9.2.1 Broilers

- 9.2.2 Layers

- 9.3 Swine

- 9.4 Calves

- 9.5 Aquaculture

- 9.5.1 Salmon

- 9.5.2 Trouts

- 9.5.3 Shrimps

- 9.5.4 Others (oysters, crabs, lobsters)

- 9.6 Equine

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Alaska Protein Recovery

- 11.2 Bio-Marine Ingredients Ireland

- 11.3 Copalis Sea

- 11.4 Diana Aqua

- 11.5 Hofseth Biocare

- 11.6 Janatha Fish Meal & Oil Products

- 11.7 Nutrifish

- 11.8 Omega Protein

- 11.9 Rossyew

- 11.10 SAMPI

- 11.11 Scanbio Marine

- 11.12 Sociedad Pesquera Landes

- 11.13 SOPROPECHE

- 11.14 TC Union

- 11.15 Triplenine