|

市場調查報告書

商品編碼

1822602

自我血糖監測設備市場機會、成長動力、產業趨勢分析及2025-2034年預測Self-Monitoring Blood Glucose Monitoring Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

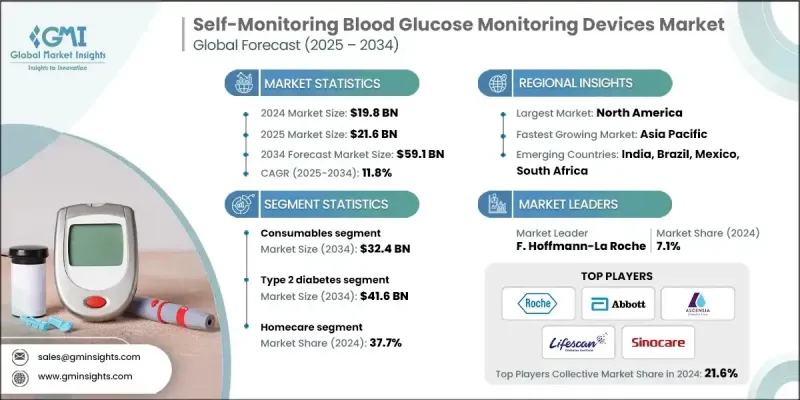

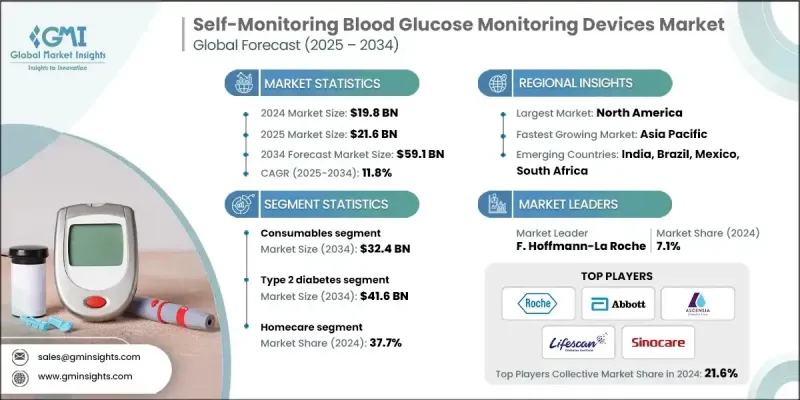

根據 Global Market Insights Inc. 發布的最新報告,全球自我監測血糖監測設備市場規模在 2024 年估計為 198 億美元,預計將從 2025 年的 216 億美元成長到 2034 年的 591 億美元,複合年成長率為 11.8%。

全球1型和第2型糖尿病病例激增,尤其是在新興市場,這推動了對便利可靠的SMBG設備的需求,這些設備可用於日常血糖監測。久坐的生活方式、不健康的飲食以及不斷上升的肥胖率導致糖尿病發病率上升,越來越多的人被診斷出糖尿病,並且患病年齡越來越小,人群分佈也越來越廣泛。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 198億美元 |

| 預測值 | 591億美元 |

| 複合年成長率 | 11.8% |

消耗品需求不斷成長

2024年,耗材市場在試紙、採血針和質控液的推動下佔據了顯著佔有率。由於這些產品是日常監測的必需品,其需求持續高企,推動了市場穩定成長。由於試紙更換週期頻繁,其在耗材銷售中佔據主導地位。隨著消費者追求更準確、更便利的檢測,各公司不斷創新,生產出只需少量血液樣本即可快速獲得結果的試紙。耗材市場的擴張對於維持患者依從性至關重要,並且持續吸引旨在確保長期客戶忠誠度的行業參與者的大量投資。

2型糖尿病盛行率上升

2024年,第2型糖尿病細分市場收入可觀,這反映了全球生活型態相關糖尿病病例的上升。 2型糖尿病患者通常需要定期監測血糖,以便在飲食和藥物治療的同時有效管理病情。隨著人們對疾病管理的認知不斷提高,以及醫療保健提供者強調血糖控制在預防併發症方面的重要性,這個細分市場正在快速成長。 SMBG設備價格實惠且易於使用,使其成為第2型糖尿病患者不可或缺的工具。

家庭護理將獲得青睞

受以患者為中心和遠距醫療管理趨勢的推動,家庭護理領域在2024年佔據了顯著佔有率。越來越多的人選擇在家中舒適地監測血糖水平,這得益於便利性、隱私性以及遠距醫療服務的不斷擴展。該領域受益於技術進步,包括相容於智慧型手機的設備和能夠與醫療專業人員即時共享資料的數位健康平台。家庭護理的普及也與臨床環境之外對慢性病管理的日益重視相契合。

區域洞察

北美將成為利潤豐厚的地區

2024年,北美自我血糖監測設備市場佔據了顯著佔有率。強大的醫療基礎設施、高糖尿病盛行率以及廣泛的保險覆蓋,共同推動了此類設備的強勁需求。該地區消費者注重準確性、便利性以及與數位健康生態系統的融合,這推動了製造商的快速創新。此外,主要行業參與者的參與和完善的監管環境確保了產品的高品質標準和可靠性。

自我監測血糖監測設備市場的主要參與者有 All Medicus、DarioHealth、B. Braun Melsungen、Ypsomed Holding、Sanofi、Bionime Corporation、AgaMatrix、Nova Biomedical、LifeScan、Arkray、Omnis Health、Sinocare、Abbott Laboratories、F. Hoffmann-Laabetes 和 Ascens。

為了鞏固市場地位,自我血糖監測設備市場的公司正大力關注創新、合作夥伴關係和患者參與。產品開發注重準確性、易用性和連接性,許多製造商推出了支援應用程式的血糖儀,可與更廣泛的數位健康平台整合。與醫療保健提供者和保險公司的策略合作,正在透過報銷計劃和捆綁式醫療方案擴大設備的可及性。公司也正在投資教育項目,以提高患者的認知度和依從性,尤其是在新興市場。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 全球糖尿病盛行率不斷上升

- 政府採取措施提高民眾意識

- 已開發國家自我監測血糖監測設備的技術進步

- 產業陷阱與挑戰

- 發展中國家先進設備和配件成本高昂

- 嚴格的監管要求

- 市場機會

- 新興市場的擴張

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 技術進步

- 當前的技術趨勢

- 新興技術

- 供應鏈和分銷分析

- 報銷場景

- 2024年定價分析

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略儀表板

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 自我監測血糖儀

- 耗材

- 測試條

- 刺血針

第6章:市場估計與預測:按應用,2021 - 2034

- 主要趨勢

- 1型糖尿病

- 2型糖尿病

- 妊娠糖尿病

第7章:市場估計與預測:依最終用途,2021 - 2034

- 主要趨勢

- 醫院

- 門診手術中心

- 診斷中心

- 居家護理

- 其他最終用途

第8章:市場估計與預測:按國家/地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 荷蘭

- 瑞典

- 比利時

- 丹麥

- 芬蘭

- 挪威

- 立陶宛

- 拉脫維亞

- 愛沙尼亞

- 俄羅斯

- 波蘭

- 瑞士

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 台灣

- 印尼

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥倫比亞

- 智利

- 秘魯

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 埃及

- 以色列

- 科威特

- 卡達

第9章:公司簡介

- Abbott Laboratories

- AgaMatrix

- All Medicus

- Arkray

- Ascensia Diabetes Care Holdings

- B. Braun Melsungen

- Bionime Corporation

- DarioHealth

- F. Hoffmann-La Roche

- LifeScan

- Nova Biomedical

- Omnis Health

- Sanofi

- Sinocare

- Ypsomed Holding

The global self-monitoring blood glucose monitoring devices market was estimated at USD 19.8 billion in 2024 and is expected to grow from USD 21.6 billion in 2025 to USD 59.1 billion in 2034, at a CAGR of 11.8%, according to the latest report published by Global Market Insights Inc.

The global surge in type 1 and type 2 diabetes cases, particularly in emerging markets, is driving demand for convenient and reliable SMBG devices for daily glucose tracking. As sedentary lifestyles, unhealthy diets, and rising obesity rates contribute to a higher incidence of diabetes, more individuals are being diagnosed at younger ages and across wider demographics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.8 Billion |

| Forecast Value | $59.1 Billion |

| CAGR | 11.8% |

Rising Demand for Consumables

The consumables segment held a notable share in 2024, driven by test strips, lancets, and control solutions. As these items are essential for daily monitoring, their demand remains consistently high, driving steady market growth. Test strips dominate consumables sales due to their frequent replacement cycles. As consumers seek more accurate and convenient testing, companies are innovating to produce strips that require smaller blood samples and deliver faster results. The consumables segment's expansion is critical for maintaining patient adherence, and it continues to attract substantial investment from industry players aiming to secure long-term customer loyalty.

Rising Prevalence of Type 2 Diabetes

The type 2 diabetes segment generated significant revenues in 2024, reflecting the global rise in lifestyle-related diabetes cases. Patients with type 2 diabetes often require regular glucose monitoring to manage their condition effectively alongside diet and medication. This segment is growing rapidly as awareness about disease management improves and healthcare providers emphasize the importance of glycemic control in preventing complications. The affordability and ease of use of SMBG devices for type 2 diabetes patients make them indispensable tools.

Homecare to Gain Traction

The homecare segment held a significant share in 2024, driven by the trend toward patient-centered and remote healthcare management. More individuals prefer monitoring their blood glucose levels from the comfort of their homes, motivated by convenience, privacy, and the ongoing expansion of telehealth services. This segment benefits from technological advancements, including smartphone-compatible devices and digital health platforms that enable real-time data sharing with healthcare professionals. Homecare adoption also aligns with the increasing emphasis on chronic disease management outside clinical settings.

Regional Insights

North America to Emerge as a Lucrative Region

North America self-monitoring blood glucose monitoring devices market generated a notable share in 2024. Strong healthcare infrastructure, high diabetes prevalence, and widespread insurance coverage contribute to robust demand for these devices. Consumers in this region prioritize accuracy, convenience, and integration with digital health ecosystems, which has pushed manufacturers to innovate rapidly. Additionally, the presence of major industry players and a well-established regulatory environment ensures high-quality standards and product reliability.

Major players in the self-monitoring blood glucose monitoring devices market are All Medicus, DarioHealth, B. Braun Melsungen, Ypsomed Holding, Sanofi, Bionime Corporation, AgaMatrix, Nova Biomedical, LifeScan, Arkray, Omnis Health, Sinocare, Abbott Laboratories, F. Hoffmann-La Roche, and Ascensia Diabetes Care Holdings.

To strengthen their market foothold, companies in the self-monitoring blood glucose monitoring devices market are focusing heavily on innovation, partnerships, and patient engagement. Product development emphasizes accuracy, ease of use, and connectivity, with many manufacturers launching app-enabled meters that integrate with broader digital health platforms. Strategic collaborations with healthcare providers and insurance companies are expanding device accessibility through reimbursement schemes and bundled care programs. Companies are also investing in educational initiatives to improve patient literacy and adherence, especially in emerging markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of diabetes worldwide

- 3.2.1.2 Government initiatives for increasing awareness among people

- 3.2.1.3 Technological advancements of self-monitoring blood glucose monitoring devices in developed countries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced devices and accessories in developing countries

- 3.2.2.2 Stringent regulatory requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain and distribution analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Self-monitoring blood glucose meters

- 5.3 Consumables

- 5.3.1 Testing strips

- 5.3.2 Lancets

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Type 1 diabetes

- 6.3 Type 2 diabetes

- 6.4 Gestational diabetes

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital

- 7.3 Ambulatory surgical centers

- 7.4 Diagnostic centers

- 7.5 Homecare

- 7.6 Other end use

Chapter 8 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 UK

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.3.7 Sweden

- 8.3.8 Belgium

- 8.3.9 Denmark

- 8.3.10 Finland

- 8.3.11 Norway

- 8.3.12 Lithuania

- 8.3.13 Latvia

- 8.3.14 Estonia

- 8.3.15 Russia

- 8.3.16 Poland

- 8.3.17 Switzerland

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Taiwan

- 8.4.7 Indonesia

- 8.4.8 Vietnam

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Colombia

- 8.5.5 Chile

- 8.5.6 Peru

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Turkey

- 8.6.5 Egypt

- 8.6.6 Israel

- 8.6.7 Kuwait

- 8.6.8 Qatar

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 AgaMatrix

- 9.3 All Medicus

- 9.4 Arkray

- 9.5 Ascensia Diabetes Care Holdings

- 9.6 B. Braun Melsungen

- 9.7 Bionime Corporation

- 9.8 DarioHealth

- 9.9 F. Hoffmann-La Roche

- 9.10 LifeScan

- 9.11 Nova Biomedical

- 9.12 Omnis Health

- 9.13 Sanofi

- 9.14 Sinocare

- 9.15 Ypsomed Holding