|

市場調查報告書

商品編碼

1822600

水暖地板暖氣市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Hydronic Underfloor Heating Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

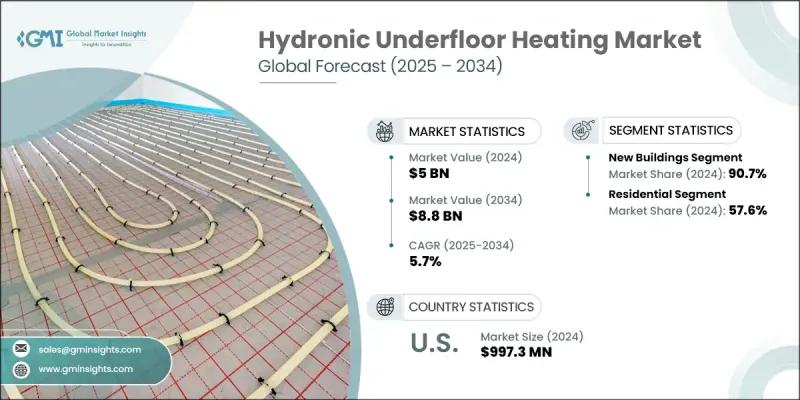

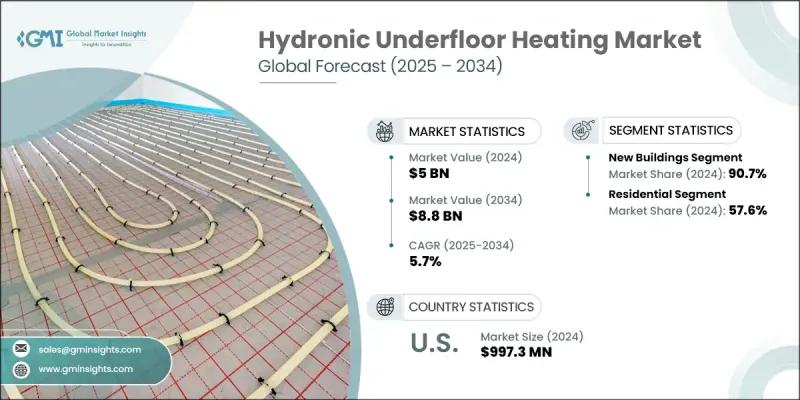

2024年,全球水暖地暖市場規模達50億美元,預計到2034年將以5.7%的複合年成長率成長,達到88億美元,這得益於產品發布和技術創新的激增。智慧恆溫器和先進的控制系統正在徹底改變使用者體驗,在確保精確溫度管理的同時,降低能耗。此外,持續的技術改進使水暖地暖解決方案更易於取得、更有效率,以滿足日益成長的永續供暖需求。例如,Warmup於2022年10月推出了其VLo系列,這是一款低調的水暖地暖系統。

這些系統專為現代建築量身定做,注重舒適性和永續性,易於安裝,並具有更高的能源效率。整體市場按設施、應用和地區分類。根據設施狀況,預計從2024年到2032年,水暖地暖在翻新領域的市佔率將大幅成長。這一成長歸因於渴望在不進行大規模翻新的情況下採用現代供暖技術的屋主和企業日益成長的需求。隨著技術的進步,翻新工程中的安裝已變得無縫銜接,尤其是低調的設計,對現有地板的干擾最小。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 50億美元 |

| 預測值 | 88億美元 |

| 複合年成長率 | 5.7% |

由於其高效性和有效性,預計到2032年,商業應用領域的水暖地暖市場價值將以顯著的複合年成長率成長。越來越多的企業選擇這些系統,不僅是為了提升室內舒適度,也是為了降低能源成本。此技術能夠確保在廣大區域內均勻分佈熱量,在提升員工滿意度和生產力方面發揮關鍵作用。此外,控制系統和能源管理的進步正在拓展該技術的適應性,使其適用於從辦公室到零售店的各種商業環境。從區域來看,由於建築業的蓬勃發展,預計北美水暖地暖市場價值將在2024年至2032年間呈現強勁的複合年成長率。水暖地暖系統因其提供持續節能供暖的能力而被廣泛應用於許多新建築。此外,持續的技術進步也有助於改進系統設計和安裝方法,使其更適用於該地區的各種建築項目。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 原料可用性和採購分析

- 影響價值鏈的關鍵因素

- 中斷

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

- 水暖地板暖氣系統的成本結構分析

- 新興機會和趨勢

- 利用物聯網技術進行數位轉型

- 新興市場滲透

- 投資分析及未來展望

第4章:競爭格局

- 介紹

- 按地區分析公司市場佔有率

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 策略舉措

- 重要夥伴關係與合作

- 重大併購活動

- 產品創新與發布

- 市場擴張策略

- 競爭基準測試

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依設施,2021 - 2034 年

- 主要趨勢

- 新建築

- 改造

第6章:市場規模與預測:按應用,2021 - 2034

- 主要趨勢

- 住宅

- 單戶住宅

- 多戶家庭

- 商業的

- 教育

- 衛生保健

- 零售

- 物流與運輸

- 辦公室

- 飯店業

- 其他

- 工業的

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 墨西哥

第8章:公司簡介

- Alde International Systems AB

- Ambiente

- Amuheat

- Danfoss

- EBERLE Controls GmbH

- HeatLink Group Inc.

- Honeywell International, Inc.

- Hurlcon Hydronic Heating

- Hunt Heating

- MAGNUM Heating BV

- Mitsubishi Electric Corporation

- OMNIE

- REHAU AG

- Robert Bosch GmbH

- Schluter Systems

- Therma-HEXX Corporation

- Uponor Corporation

- Warmboard, Inc.

- Warmup

- Watts

The Global Hydronic Underfloor Heating Market was valued at USD 5 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 8.8 billion by 2034, fueled by a surge in product launches and technological innovations. Smart thermostats and advanced control systems are revolutionizing user experiences, ensuring precise temperature management while curbing energy consumption. Moreover, ongoing technological enhancements are making hydronic underfloor heating solutions more accessible and efficient, aligning with the rising demand for sustainable heating. For instance, in October 2022, Warmup unveiled its VLo line, a low-profile hydronic underfloor heating system.

Tailored for modern buildings, these systems prioritize comfort and sustainability, boasting easy installation and heightened energy efficiency. The overall market is segregated into facility, application, and region. Based on facility, the hydronic underfloor heating industry share from the retrofit segment is estimated to grow at a significant rate from 2024 to 2032. This surge is attributed to the rising demand from homeowners and businesses eager to adopt modern heating technologies without extensive renovations. With technological strides, installations in retrofit scenarios have become seamless, especially with low-profile designs that cause minimal disruption to existing floors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5 Billion |

| Forecast Value | $8.8 Billion |

| CAGR | 5.7% |

Hydronic underfloor heating market value from the commercial application segment is anticipated to expand at a notable CAGR through 2032, due to its efficiency and effectiveness. Businesses are increasingly turning to these systems not just for enhanced indoor comfort but also for reduced energy costs. With the technology ensuring even heat distribution across expansive areas, it is playing a pivotal role in boosting employee satisfaction and productivity. Furthermore, advancements in control systems and energy management are broadening the technology's adaptability, making it suitable for diverse commercial environments, from offices to retail outlets. Regionally, the North America hydronic underfloor heating market value is projected to exhibit a robust CAGR between 2024 and 2032, on account of the growing construction sector. Hydronic underfloor systems are being integrated into many new buildings for their ability to provide consistent and energy-efficient heating. Also, ongoing advancements are helping to enhance system designs and installation methods to make them more suitable for a variety of construction projects across the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Facility trends

- 2.4 Application trends

- 2.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Key factors affecting the value chain

- 3.1.3 Disruptions

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of hydronic underfloor heating systems

- 3.8 Emerging opportunities & trends

- 3.8.1 Digital transformation with IoT technologies

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Product innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Facility, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 New buildings

- 5.3 Retrofit

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Residential

- 6.2.1 Single Family

- 6.2.2 Multi Family

- 6.3 Commercial

- 6.3.1 Education

- 6.3.2 Healthcare

- 6.3.3 Retail

- 6.3.4 Logistics & Transportation

- 6.3.5 Offices

- 6.3.6 Hospitality

- 6.3.7 Others

- 6.4 Industrial

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Mexico

Chapter 8 Company Profiles

- 8.1 Alde International Systems AB

- 8.2 Ambiente

- 8.3 Amuheat

- 8.4 Danfoss

- 8.5 EBERLE Controls GmbH

- 8.6 HeatLink Group Inc.

- 8.7 Honeywell International, Inc.

- 8.8 Hurlcon Hydronic Heating

- 8.9 Hunt Heating

- 8.10 MAGNUM Heating B.V.

- 8.11 Mitsubishi Electric Corporation

- 8.12 OMNIE

- 8.13 REHAU AG

- 8.14 Robert Bosch GmbH

- 8.15 Schluter Systems

- 8.16 Therma-HEXX Corporation

- 8.17 Uponor Corporation

- 8.18 Warmboard, Inc.

- 8.19 Warmup

- 8.20 Watts