|

市場調查報告書

商品編碼

1822591

鎳氫電池市場機會、成長動力、產業趨勢分析及2025-2034年預測Nickel Metal Hydride Battery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

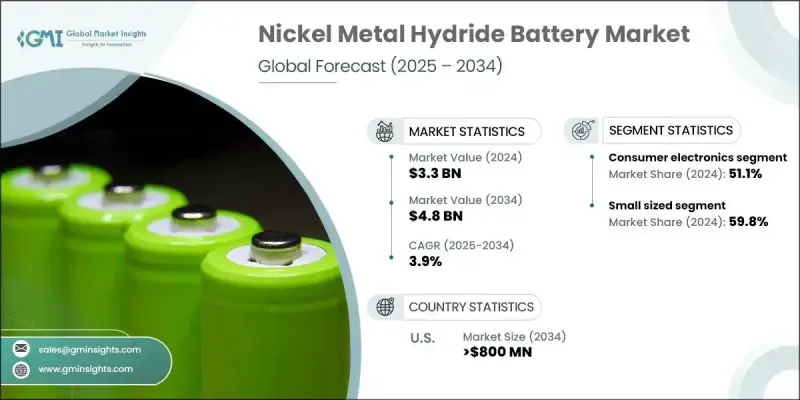

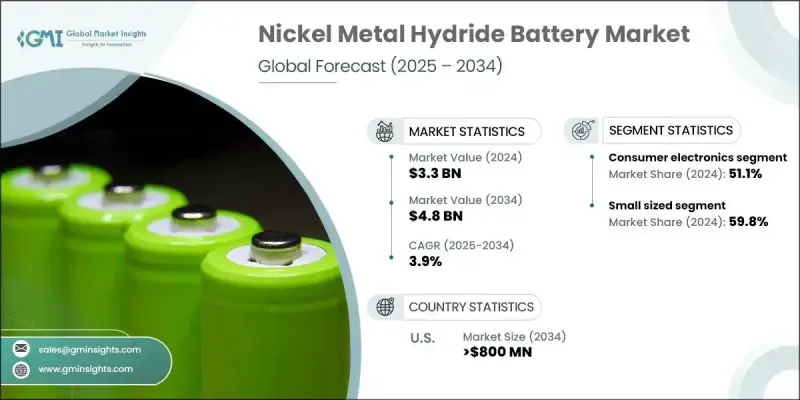

2024 年全球鎳氫電池市場價值為 33 億美元,預計將以 3.9% 的複合年成長率成長,到 2034 年達到 48 億美元。

這一成長的動力源自於消費者日益青睞更具成本效益的鋰離子電池替代品,尤其是在中等容量和麵向消費者的用途。鎳氫 (NiMH) 電池得益於數十年的量產經驗、成熟的供應鏈和最佳化的製造程序,使其成為經濟實惠的選擇。這些可充電電池由羥基氧化鎳正極、吸氫金屬合金負極和氫氧化鉀電解質組成。與已被其廣泛取代的老式鎳鎘電池相比,它們具有更高的能量密度、更長的循環壽命和更環保的特性。鎳氫電池廣泛應用於混合動力和電動車、無線電動工具以及消費性電子產品。該市場成長最快的地區是世界其他地區,這得益於對離網和備用電源系統日益成長的需求,尤其是在電網不穩定的偏遠地區,這些地區需要可靠的充電解決方案。此外,一些國家混合動力汽車的普及率不斷提高也支持了市場擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 33億美元 |

| 預測值 | 48億美元 |

| 複合年成長率 | 3.9% |

2024年,消費性電子產品領域佔了51.1%的市場佔有率,預計到2034年將以2%的複合年成長率成長。該領域的成長主要得益於對充電性能出色、價格實惠且兼容AA和AAA等標準尺寸電池的需求不斷成長。相較於一次性鹼性電池,使用者更喜歡在玩具、相機和手電筒等設備上使用鎳氫電池,因為鎳氫電池能量密度更高、使用壽命更長,這進一步推動了需求成長。

小型電池市場在2024年佔據了59.8%的市場佔有率,預計2025年至2034年的複合年成長率將達到3.1%。由於價格實惠、可充電且用途廣泛,AA、AAA、C和D型鎳氫電池等緊湊型電池的使用日益增多,這顯著促進了這一成長。這些小型電池非常適合遙控器、攜帶式音訊設備和手電筒等日常消費性電子產品,與鎳鎘電池相比,它們擁有更高的能量密度,可以在不增加體積或重量的情況下延長電池續航時間。

美國鎳氫電池市場佔了96%的市場佔有率,預計到2034年將達到8億美元。美國強勁的混合動力汽車市場推動了鎳氫電池市場的主導地位,主要汽車製造商因其安全性、價格實惠和可靠性而選擇鎳氫電池作為其混合動力車隊的動力。此外,嚴格的監管政策鼓勵低排放汽車的發展,這也推動了鎳氫電池作為混合動力應用中鋰離子電池可靠且經濟高效的替代品的普及。

全球鎳氫電池市場的領導者企業包括松下控股公司、比亞迪公司、GS湯淺、FDK株式會社和金山電池。全球鎳氫電池市場的各家公司正在採取多種策略方法來鞏固其市場地位。他們專注於持續創新,以提高電池容量、循環壽命和環保性能,同時降低成本以保持競爭力。與汽車製造商和消費電子公司建立牢固的合作夥伴關係,有助於根據特定行業需求客製化產品。擴大製造能力和最佳化供應鏈可以加快交貨速度並提高成本效益。各公司也正在投資永續發展計劃,以滿足日益成長的監管要求和消費者對環保解決方案的需求。

目錄

第1章:方法論與範圍

第2章:行業洞察

- 2021 - 2034 年產業概要

- 商業趨勢

- 產品類型趨勢

- 應用趨勢

- 區域趨勢

第3章:行業洞察

- 產業生態系統分析

- 原料供應

- 製造商/電池生產商

- 技術開發

- 系統整合商/ OEM

- 分銷管道

- 2021-2034年價格趨勢分析

- 按應用

- 按地區

- 成本結構分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 按地區分析公司市場佔有率

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

- 戰略儀表板

- 策略舉措

- 公司標竿分析

- 創新與技術格局

第5章:市場規模及預測:依產品類型,2021 - 2034

- 主要趨勢

- 小型

- 大尺寸

第6章:市場規模與預測:按應用,2021 - 2034

- 主要趨勢

- 消費性電子產品

- 混合動力和電動車

- 其他

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 義大利

- 英國

- 法國

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 世界其他地區

第8章:公司簡介

- Axiss Technology

- BYD Company

- Camelion Batterien GmbH

- Duracell

- DYNAMIS Batterien GmbH

- EPT Battery

- FDK CORPORATION

- GP Batteries

- Grepow Battery

- GS Yuasa

- Jauch Quartz

- NBCELL

- Panasonic Holdings Corporation

- RPC Corporation

- Saft Group

- Tenergy corporation

- Toshiba Lifestyle Products and Services Corporation

- Toyota Battery

- VARTA AG

- Zeus Battery

The Global Nickel Metal Hydride Battery Market was valued at USD 3.3 billion in 2024 and is estimated to grow at a CAGR of 3.9% to reach USD 4.8 billion by 2034.

This growth is driven by increasing consumer preference for cost-effective battery alternatives to lithium-ion, particularly for mid-capacity and consumer-oriented uses. Nickel metal hydride (NiMH) batteries benefit from decades of mass production, a mature supply chain, and optimized manufacturing processes, making them an economical choice. These rechargeable batteries consist of a nickel oxyhydroxide cathode, a hydrogen-absorbing metal alloy anode, and a potassium hydroxide electrolyte. They offer higher energy density, longer cycle life, and greater environmental friendliness compared to older nickel-cadmium batteries, which they have largely replaced. NiMH batteries find applications across hybrid and electric vehicles, cordless power tools, and consumer electronics. The fastest-growing region in this market is the rest of the world segment, fueled by rising demand for off-grid and backup power systems, especially in remote locations where unreliable grids create a need for dependable rechargeable solutions. Additionally, increasing adoption of hybrid vehicles in several countries supports market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $4.8 Billion |

| CAGR | 3.9% |

In 2024, the consumer electronics segment held a 51.1% share and is anticipated to grow at a CAGR of 2% through 2034. This segment's growth is propelled by growing demand for batteries that offer excellent rechargeability, affordability, and compatibility with standard sizes such as AA and AAA. Users prefer NiMH batteries over disposable alkaline ones for devices like toys, cameras, and flashlights because of their higher energy density and longer operational life, further driving demand.

The small-sized batteries segment held 59.8% share in 2024 and is expected to grow at a CAGR of 3.1% from 2025 to 2034. The increasing use of NiMH batteries in compact formats like AA, AAA, C, and D cells, due to their affordability, rechargeability, and versatility, significantly contributes to this growth. These small formats are ideal for everyday consumer gadgets such as remote controls, portable audio devices, and flashlights, benefiting from superior energy density compared to nickel-cadmium counterparts, which allows for longer runtimes without adding size or weight.

U.S. Nickel Metal Hydride Battery Market held a 96% share and is expected to generate USD 800 million by 2034. The country's strong hybrid vehicle market, supported by major automakers relying on NiMH batteries for their hybrid fleets due to their safety, affordability, and dependability, drives this dominance. Furthermore, stringent regulatory policies encouraging lower-emission vehicles bolster NiMH battery adoption as a trusted and cost-effective alternative to lithium-ion batteries in hybrid applications.

The leading players shaping the Global Nickel Metal Hydride Battery Market include Panasonic Holdings Corporation, BYD Company, GS Yuasa, FDK Corporation, and GP Batteries. Companies in the Global Nickel Metal Hydride Battery Market are adopting several strategic approaches to strengthen their market presence. They are focusing on continuous innovation to improve battery capacity, cycle life, and environmental performance while reducing costs to stay competitive. Building strong partnerships with automobile manufacturers and consumer electronics firms helps tailor products to specific industry needs. Expanding manufacturing capabilities and optimizing supply chains allow for faster delivery and cost efficiency. Firms are also investing in sustainability initiatives to meet growing regulatory requirements and consumer demand for eco-friendly solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Industry Insights

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Product type trends

- 2.4 Application trends

- 2.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw materials supply

- 3.1.2 Manufacturers/cell producers

- 3.1.3 Technology development

- 3.1.4 System integrator/OEM

- 3.1.5 Distribution channels

- 3.2 Price trend analysis, 2021-2034

- 3.2.1 By application

- 3.2.2 By region

- 3.3 Cost structure analysis

- 3.4 Regulatory landscape

- 3.5 Industry impact forces

- 3.5.1 Growth drivers

- 3.5.2 Industry pitfalls & challenges

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL analysis

- 3.8.1 Political factors

- 3.8.2 Economic factors

- 3.8.3 Social factors

- 3.8.4 Technological factors

- 3.8.5 Legal factors

- 3.8.6 Environmental factors

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Rest of World

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Small sized

- 5.3 Large sized

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Consumer electronics

- 6.3 Hybrid and electric vehicles

- 6.4 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 Italy

- 7.3.3 UK

- 7.3.4 France

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.5 Rest of World

Chapter 8 Company Profiles

- 8.1 Axiss Technology

- 8.2 BYD Company

- 8.3 Camelion Batterien GmbH

- 8.4 Duracell

- 8.5 DYNAMIS Batterien GmbH

- 8.6 EPT Battery

- 8.7 FDK CORPORATION

- 8.8 GP Batteries

- 8.9 Grepow Battery

- 8.10 GS Yuasa

- 8.11 Jauch Quartz

- 8.12 NBCELL

- 8.13 Panasonic Holdings Corporation

- 8.14 RPC Corporation

- 8.15 Saft Group

- 8.16 Tenergy corporation

- 8.17 Toshiba Lifestyle Products and Services Corporation

- 8.18 Toyota Battery

- 8.19 VARTA AG

- 8.20 Zeus Battery