|

市場調查報告書

商品編碼

1822590

海洋感測器市場機會、成長動力、產業趨勢分析及2025-2034年預測Marine Sensors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

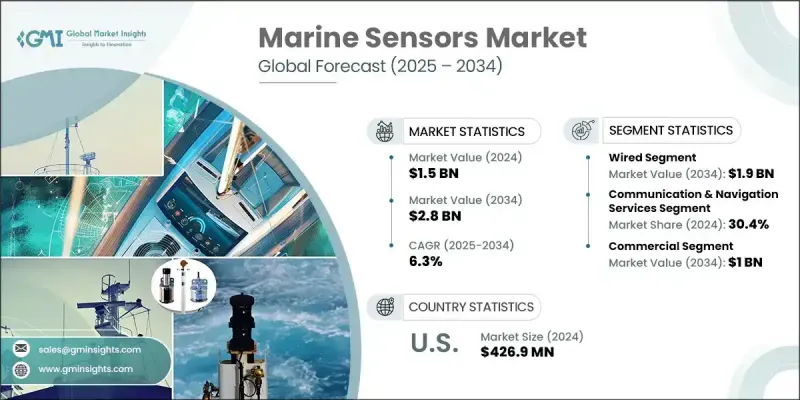

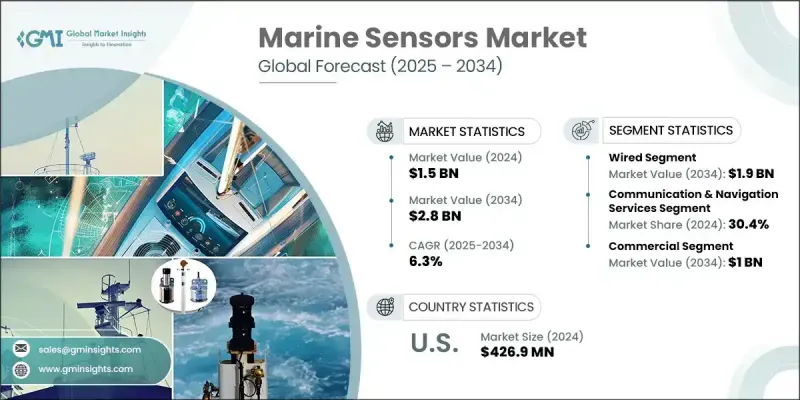

2024 年全球海洋感測器市場價值為 15 億美元,預計到 2034 年將以 6.3% 的複合年成長率成長至 28 億美元。

推動這一成長的關鍵促進因素包括潛艇監視基礎設施的安裝、港口設施的現代化以及全球海上貿易的不斷成長。隨著海上航線持續主導全球物流,對先進感測系統的需求也隨之加速。這些技術正在提升港口導航、貨物裝卸和船舶交通管理的營運績效。為此,製造商正在設計多功能、緊湊型感測器,以便靈活部署,尤其是在自主系統和緊湊型船舶上。光纖感測等技術創新因其在具有挑戰性的水下環境中的精確性和耐用性而日益受到關注。此外,設計也顯著轉向永續設計,強調可回收組件、最低能耗和環保的部署方法,進一步提升了其在商業和國防領域的價值主張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 15億美元 |

| 預測值 | 28億美元 |

| 複合年成長率 | 6.3% |

預計到2034年,有線海洋感測器將創造19億美元的市場價值,憑藉其在惡劣海洋環境中持續的資料傳輸和穩健性,其重要性將持續顯現。其可靠性使其成為港口和海上能源設施等固定地點長期部署的理想選擇。目前,相關研究正致力於增強其防腐性能,以延長其使用壽命並提高現場成本效益。這些有線系統的耐用性和精度始終無與倫比,使其成為全球海洋基礎設施骨幹的重要組成部分。

2024年,通訊和導航領域佔了30.4%的佔有率。該領域見證了最佳化海上態勢感知和安全協議的技術日益融合。現代系統旨在將各種感測器輸出合併成統一的作戰影像,從而增強導航、航線最佳化和防撞的即時決策能力。全球海上交通量的不斷成長推動了此類系統的接受和部署,它們為商業航運和國防導航工作提供了關鍵資料。

2024年,北美海洋感測器市場佔據31.6%的市場佔有率,預計到2034年將以5.8%的複合年成長率成長。該地區對海事安全基礎設施、海上再生能源和先進環境監測系統不斷成長的投資,推動了該地區市場的擴張。智慧感測器技術的採用正在增強該地區在港口自動化、船舶追蹤以及商業和國防應用合規管理方面的能力。創新仍然是一個關鍵主題,北美企業正在持續採用下一代感測器技術,以在不斷變化的市場環境中保持競爭力。

影響海洋感測器市場的關鍵參與者包括霍尼韋爾、康斯伯格海事、佳明、伊頓、柯蒂斯-萊特、Nortek、古野和 NKE Marine Electronics。這些公司引領著該領域的發展和創新,提供滿足現代海洋生態系統複雜需求的尖端感測器技術。為了鞏固市場地位,領先的海洋感測器公司正在大力投資研發,以提高感測器的精度、耐用性和整合能力。各公司正專注於小型化和多功能系統,以便在自主船舶和緊湊型平台上無縫部署。另一項關鍵策略是開發支援永續營運的感測器,使用可回收材料和節能組件。與國防組織和商業航運實體的合作正在擴大應用範圍,而光纖技術的持續升級有助於在極端條件下保持效能。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 全球海上貿易擴張與港口現代化

- 增加海軍水下監視系統的部署

- 嚴格的海事安全與環境法規

- 自主和無人駕駛船舶的採用率不斷上升

- 對即時導航和監控系統的需求不斷增加

- 產業陷阱與挑戰

- 先進感測器系統的安裝和維護成本高昂

- 水下作業範圍有限且環境限制

- 市場機會

- 人工智慧和機器學習的整合,用於預測海洋分析

- 擴大海上再生能源項目,包括風電場

- 數位孿生科技在海事作業的應用日益廣泛

- 加強海洋保護計畫的公私合作

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 新興商業模式

- 合規性要求

- 國防預算分析

- 全球國防開支趨勢

- 區域國防預算分配

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 重點國防現代化項目

- 預算預測(2025-2034)

- 對產業成長的影響

- 各國國防預算

- 供應鏈彈性

- 地緣政治分析

- 勞動力分析

- 數位轉型

- 合併、收購和策略夥伴關係格局

- 風險評估與管理

- 主要合約授予(2021-2024)

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 關鍵參與者的競爭基準

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理位置比較

- 全球足跡分析

- 服務網路覆蓋

- 各地區市場滲透率

- 競爭定位矩陣

- 領導者

- 挑戰者

- 追蹤者

- 利基市場參與者

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年關鍵發展

- 併購

- 夥伴關係與合作

- 技術進步

- 擴張和投資策略

- 數位轉型舉措

- 新興/新創企業競爭對手格局

第5章:市場估計與預測:按感測器類型,2021 - 2034

- 主要趨勢

- 壓力感測器

- 溫度感測器

- 力感測器

- 扭力感測器

- 速度感測器

- 位置和位移感測器

- 液位感測器

- 接近感測器

- 流量感測器

- 光學感測器

- 運動感應器

- 雷達感測器

- 煙霧偵測感應器

- GPS 感應器

- 聲學感測器

- 電流感測器

- 其他

第6章:市場估計與預測:依連結性,2021 - 2034 年

- 主要趨勢

- 有線

- 無線的

第7章:市場估計與預測:按應用,2021 - 2034

- 主要趨勢

- 情報、監視和偵察

- 通訊和導航服務

- 環境監測

- 暖通空調系統

- 燃料和推進系統

- 其他

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 商業的

- 遊輪

- 客運渡輪

- 遊艇

- 油輪

- 散貨船

- 貨船

- 其他

- 軍事與國防

- 航空母艦

- 兩棲艦艇

- 護衛艦

- 驅逐艦

- 潛水艇

- 其他

- 無人水下航行器

- 自主水下航行器

- 遙控水下航行器

- 其他

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球關鍵參與者

- Kongsberg Maritime

- Teledyne Marine

- Thales

- Garmin

- Furuno

- 區域關鍵參與者

- 北美洲

- Honeywell

- Northrop Grumman

- Curtiss-Wright

- Rockwell Collins

- 歐洲

- Eaton

- Sonardyne

- SBG Systems

- Trensor

- 亞太地區

- NKE Marine Electronics

- Nortek

- Senmatic

- 北美洲

- 利基市場參與者/顛覆者

- Sea-Bird Scientific

- Siren Marine

- TE Connectivity

- Xylem

The Global Marine Sensors Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 2.8 billion by 2034.

Key drivers fueling this growth include the installation of submarine surveillance infrastructure, the modernization of port facilities, and rising global maritime trade. As sea routes continue to dominate global logistics, the demand for advanced sensing systems has accelerated. These technologies are improving operational performance across port navigation, cargo handling, and vessel traffic management. In response, manufacturers are engineering multi-functional, compact sensors that allow for flexible deployment, particularly on autonomous systems and compact marine vessels. Technological innovations, such as fiber-optic-based sensing, are gaining traction due to their accuracy and durability in challenging underwater environments. There is also a notable pivot toward sustainable design, emphasizing recyclable components, minimal energy usage, and eco-conscious deployment methods-further enhancing their value proposition in both commercial and defense sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $2.8 Billion |

| CAGR | 6.3% |

The wired marine sensors are projected to generate USD 1.9 billion by 2034, maintaining their relevance due to consistent data delivery and robustness in harsh marine environments. Their reliability makes them ideal for long-term deployments in fixed locations such as harbors and offshore energy installations. Continued research is being channeled into enhancing their anti-corrosive properties to boost performance longevity and cost-efficiency in the field. The durability and precision of these wired systems remain unmatched, making them essential to the backbone of marine infrastructure across the globe.

The communication and navigation segment held a 30.4% share in 2024. This segment has witnessed increased integration of technologies that optimize maritime situational awareness and safety protocols. Modern systems are designed to merge various sensor outputs into a unified operational picture, enhancing real-time decision-making for navigation, route optimization, and collision prevention. The growing volume of maritime traffic globally is driving the acceptance and deployment of such systems, which provide critical data for both commercial shipping and defense navigation efforts.

North America Marine Sensors Market held a 31.6% share in 2024 and is projected to grow at a CAGR of 5.8% through 2034. Market expansion across the region is being supported by growing investments in maritime safety infrastructure, offshore renewable energy, and advanced environmental monitoring systems. Adoption of smart sensor technologies is enhancing the region's capabilities in port automation, vessel tracking, and compliance management across commercial and defense applications. Innovation remains a key theme as North American companies continue to adopt next-gen sensor technologies to remain competitive in this evolving landscape.

Key players shaping the Marine Sensors Market include Honeywell, Kongsberg Maritime, Garmin, Eaton, Curtiss-Wright, Nortek, Furuno, and NKE Marine Electronics. These companies are leading developments and innovation in the field, delivering cutting-edge sensor technologies that meet the complex needs of the modern maritime ecosystem. To solidify their market position, leading marine sensor companies are investing heavily in R&D to enhance sensor precision, durability, and integration capabilities. Firms are focusing on miniaturization and multifunctional systems to enable seamless deployment on autonomous vessels and compact platforms. Another key strategy involves developing sensors that support sustainable operations, using recyclable materials and energy-efficient components. Partnerships with defense organizations and commercial shipping entities are expanding application reach, while continuous upgrades to fiber-optic technology help maintain performance in extreme conditions.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Sensor type trends

- 2.2.2 Connectivity trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.2.5 Regional trends

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of global maritime trade and port modernization

- 3.2.1.2 Increasing deployment of naval underwater surveillance systems

- 3.2.1.3 Stringent maritime safety and environmental regulations

- 3.2.1.4 Rising adoption of autonomous and unmanned marine vessels

- 3.2.1.5 Increasing demand for real-time navigation and monitoring systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High installation and maintenance costs of advanced sensor systems

- 3.2.2.2 Limited operational range and environmental constraints underwater

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI and machine learning for predictive marine analytics

- 3.2.3.2 Expansion of offshore renewable energy projects, including wind farms

- 3.2.3.3 Growing adoption of digital twin technology in maritime operations

- 3.2.3.4 Increasing public-private partnerships for marine conservation projects

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Defense budget analysis

- 3.11 Global defense spending trends

- 3.12 Regional defense budget allocation

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia Pacific

- 3.12.4 Middle East and Africa

- 3.12.5 Latin America

- 3.13 Key defense modernization programs

- 3.14 Budget forecast (2025-2034)

- 3.14.1 Impact on industry growth

- 3.14.2 Defense budgets by country

- 3.15 Supply chain resilience

- 3.16 Geopolitical analysis

- 3.17 Workforce analysis

- 3.18 Digital transformation

- 3.19 Mergers, acquisitions, and strategic partnerships landscape

- 3.20 Risk assessment and management

- 3.21 Major contract awards (2021-2024)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Sensor Type, 2021 - 2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Pressure sensors

- 5.3 Temperature sensors

- 5.4 Force sensors

- 5.5 Torque sensors

- 5.6 Speed sensors

- 5.7 Position & displacement sensors

- 5.8 Level sensors

- 5.9 Proximity sensors

- 5.10 Flow sensors

- 5.11 Optical sensors

- 5.12 Motion sensors

- 5.13 Radar sensors

- 5.14 Smoke detection sensors

- 5.15 GPS sensors

- 5.16 Acoustic sensors

- 5.17 Current sensors

- 5.18 Others

Chapter 6 Market Estimates and Forecast, By Connectivity, 2021 - 2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Wired

- 6.3 Wireless

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 Intelligence, surveillance & reconnaissance

- 7.3 Communication & navigation services

- 7.4 Environmental monitoring

- 7.5 HVAC system

- 7.6 Fuel & propulsion system

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 Commercial

- 8.2.1 Cruise ship

- 8.2.2 Passenger ferries

- 8.2.3 Yachts

- 8.2.4 Tankers

- 8.2.5 Bulk carriers

- 8.2.6 Cargo ships

- 8.2.7 Others

- 8.3 Military & defense

- 8.3.1 Aircraft carriers

- 8.3.2 Amphibious ships

- 8.3.3 Frigates

- 8.3.4 Destroyers

- 8.3.5 Submarines

- 8.3.6 Others

- 8.4 Unmanned underwater vehicles

- 8.4.1 Autonomous underwater vehicles

- 8.4.2 Remotely operated underwater vehicles

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million & Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Key Players

- 10.1.1 Kongsberg Maritime

- 10.1.2 Teledyne Marine

- 10.1.3 Thales

- 10.1.4 Garmin

- 10.1.5 Furuno

- 10.2 Regional Key Players

- 10.2.1 North America

- 10.2.1.1 Honeywell

- 10.2.1.2 Northrop Grumman

- 10.2.1.3 Curtiss-Wright

- 10.2.1.4 Rockwell Collins

- 10.2.2 Europe

- 10.2.2.1 Eaton

- 10.2.2.2 Sonardyne

- 10.2.2.3 SBG Systems

- 10.2.2.4 Trensor

- 10.2.3 APAC

- 10.2.3.1 NKE Marine Electronics

- 10.2.3.2 Nortek

- 10.2.3.3 Senmatic

- 10.2.1 North America

- 10.3 Niche Players / Disruptors

- 10.3.1 Sea-Bird Scientific

- 10.3.2 Siren Marine

- 10.3.3 TE Connectivity

- 10.3.4 Xylem