|

市場調查報告書

商品編碼

1822584

光電倍增管 (PMT) 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Photomultiplier Tube (PMT) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

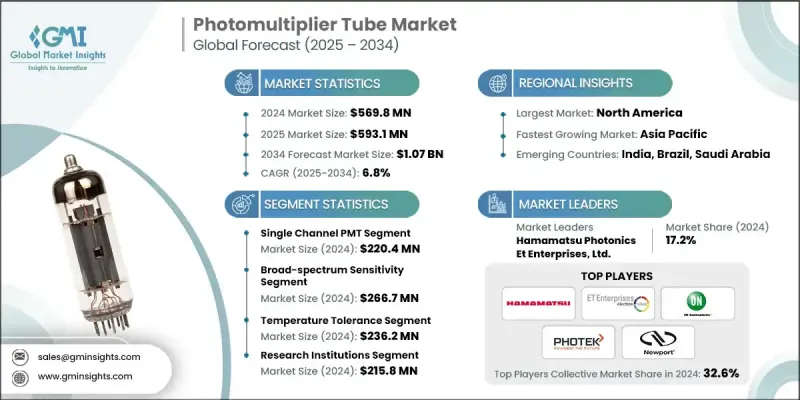

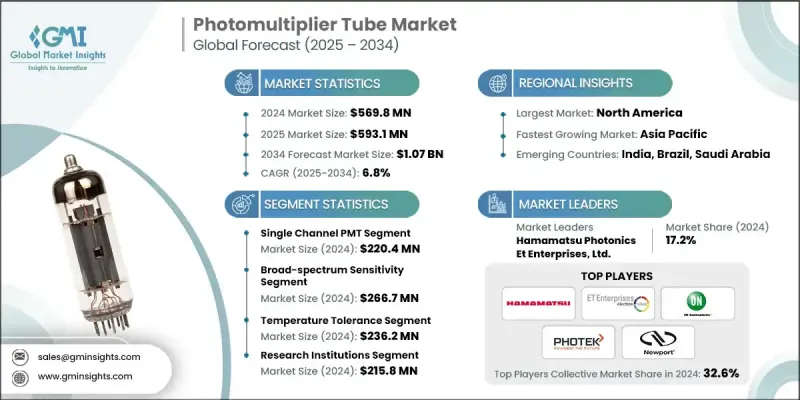

2024 年全球光電倍增管市場價值為 5.698 億美元,預計到 2034 年將以 6.8% 的複合年成長率成長至 10.7 億美元。

光電倍增管有助於偵測極低水平的光,使其成為正子斷層掃描 (PET) 和伽馬射線相機等醫學影像技術中不可或缺的一部分。全球對早期疾病診斷和精準成像的需求日益成長,極大地推動了光電倍增管 (PMT) 在醫療保健領域的應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 5.698億美元 |

| 預測值 | 10.7億美元 |

| 複合年成長率 | 6.8% |

單通道 PMT 獲得青睞

單通道光電倍增管 (PMT) 市場在 2024 年佔據了顯著佔有率,這得益於單輸入源高精度、低雜訊訊號檢測的需求。這類光電倍增管廣泛應用於實驗室研究、醫學影像和分析儀器,這些領域對緊湊尺寸、快速反應時間和可靠性的要求至關重要。儘管多通道替代方案不斷湧現,但單通道光電倍增管憑藉其簡單易用、整合成本低以及在受控環境中久經考驗的性能,仍將保持其市場地位。

廣譜靈敏度的採用率不斷上升

2024年,廣譜靈敏度領域佔據了相當大的佔有率,這得益於能夠在從紫外線(UV)到可見光再到近紅外線(NIR)的寬波長範圍內工作的光電探測器。專為寬光譜響應而設計的光電倍增管(PMT)在螢光光譜、天文學和環境感測領域尤其有價值,因為多波段檢測可以顯著提高訊號清晰度和資料準確性。

耐溫PMT需求不斷成長

2024年,耐高溫領域佔據了永續的市場佔有率,這得益於嚴苛的工業環境、航太和科學實地考察。該領域的光電倍增管 (PMT) 經過精心設計,即使在溫度波動較大或高溫環境下也能保持穩定的增益和低雜訊。這種可靠性確保了其在核子研究或深空觀測等關鍵任務應用中的穩定性能。

區域洞察

北美將成為利潤豐厚的地區

由於高額研發支出、強勁的國防工業以及先進的醫療基礎設施,北美光電倍增管市場在2024年保持強勁成長。核子醫學、國土安全、太空探索和生命科學研究領域的應用持續推動光電倍增管(PMT)在政府實驗室、大學和私人機構之間的整合。憑藉成熟的技術基礎以及領先製造商和系統整合商的強大影響力,該地區對高靈敏度光子學技術的投資持續穩定成長。

光電倍增管 (PMT) 市場的主要參與者有 Photek Ltd、Ametek Inc、Exosens、Thorlabs, Inc.、Jeol Ltd.、Et Enterprises, Ltd.、Newport Corporation、Hamamatsu Photonics、First Sensor AG、Excelitas Technologies Corp.、Broadcom、Laser SueS.

為了鞏固自身地位,光電倍增管 (PMT) 市場中的公司正專注於材料創新、系統整合和市場多元化。許多公司正在投資新的光電陰極技術,以提高更寬光譜範圍內的靈敏度,同時降低雜訊和功耗。與原始設備製造商 (OEM) 和研究機構的策略合作十分常見,這使得公司能夠共同開發客製化的 PMT 解決方案,用於醫療診斷、高能物理和航太的下一代應用。

目錄

第1章:方法論與範圍

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 醫學影像和診斷需求不斷成長

- 高能和核子物理研究的擴展

- 分析和工業儀器的進步

- 環境和輻射監測應用激增

- 航太和航太應用的興起

- 產業陷阱與挑戰

- 固態替代品的競爭日益激烈

- 生產和營運成本高昂

- 市場機會

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 定價策略

- 新興商業模式

- 合規性要求

- 消費者情緒分析

- 專利和智慧財產權分析

- 地緣政治與貿易動態

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 市場集中度分析

- 關鍵參與者的競爭基準

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理位置比較

- 全球足跡分析

- 服務網路覆蓋

- 各地區市場滲透率

- 競爭定位矩陣

- 領導者

- 挑戰者

- 追蹤者

- 利基市場參與者

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年關鍵發展

- 併購

- 夥伴關係與合作

- 技術進步

- 擴張和投資策略

- 數位轉型計劃

- 新興/新創企業競爭對手格局

第5章:市場估計與預測:按類型,2021 - 2034

- 主要趨勢

- 單通道PMT

- 多通道 PMT(多陽極 PMT)

- 微通道板光電倍增管 (MCP-PMT)

- 線性陣列PMT

- 其他

第6章:市場估計與預測:依波長範圍,2021-2034 年

- 主要趨勢

- 紫外線檢測

- 可見光檢測

- 紅外線探測

- 廣譜靈敏度

第7章:市場估計與預測:按最終用途產業,2021-2034 年

- 主要趨勢

- 醫療保健和生命科學

- 研究機構

- 工業和製造業

- 國防與國土安全

- 其他

第8章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Ametek Inc

- Broadcom

- Caen SPA

- Et Enterprises, Ltd.

- Excelitas Technologies Corp.

- Exosens

- First Sensor AG

- Hamamatsu Photonics

- Jeol Ltd.

- Laser Components

- Luxium Solutions

- Newport Corporation

- ON Semiconductor

- Photek Ltd

- Thorlabs, Inc.

The Global Photomultiplier Tube Market was valued at USD 569.8 million in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 1.07 billion by 2034.

The photomultiplier tube helps in detecting extremely low levels of light, making them essential in medical imaging technologies such as positron emission tomography (PET) and gamma cameras. The expanding global demand for early disease diagnosis and precision imaging is significantly boosting PMT adoption in healthcare.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $569.8 Million |

| Forecast Value | $1.07 Billion |

| CAGR | 6.8% |

Single Channel PMT to Gain Traction

The single channel PMT segment held notable share in 2024, driven by high precision, low-noise signal detection from a single input source. These PMTs are widely used in laboratory research, medical imaging, and analytical instrumentation where compact size, fast response time, and reliability are critical. Despite the rise of multi-channel alternatives, single channel PMTs continue to hold their ground due to their simplicity, lower integration cost, and proven performance in controlled environments.

Rising Adoption in Broad Spectrum Sensitivity

The broad-spectrum sensitivity segment held substantial share in 2024 driven by photodetectors that can operate across wide wavelength ranges, from ultraviolet (UV) through visible to near infrared (NIR). PMTs designed for broad spectral responsiveness are particularly valuable in fluorescence spectroscopy, astronomy, and environmental sensing, where multi-band detection can significantly improve signal clarity and data accuracy.

Rising demand in Temperature Tolerance PMT

The temperature tolerance segment held sustainable share in 2024 backed by rugged industrial settings, aerospace, and scientific fieldwork. PMTs in this segment are engineered to maintain stable gain and low noise even when exposed to wide temperature fluctuations or elevated thermal environments. This reliability ensures consistent performance in mission-critical applications, such as nuclear research or deep-space observation.

Regional Insights

North America to Emerge as a Lucrative Region

North America photomultiplier tube market held robust growth in 2024 supported by high levels of R&D spending, a robust defense sector, and advanced healthcare infrastructure. Applications in nuclear medicine, homeland security, space exploration, and life sciences research continue to drive PMT integration across government labs, universities, and private institutions. With a mature technology base and strong presence of leading manufacturers and system integrators, the region witnesses steady investment in high-sensitivity photonics technologies.

Major players involved in the photomultiplier tube (PMT) market are Photek Ltd, Ametek Inc, Exosens, Thorlabs, Inc., Jeol Ltd., Et Enterprises, Ltd., Newport Corporation, Hamamatsu Photonics, First Sensor AG, Excelitas Technologies Corp., Broadcom, Laser Components, ON Semiconductor, Luxium Solutions, Caen S.P.A.

To strengthen their position, companies in the photomultiplier tube (PMT) market are focusing on a mix of material innovation, system integration, and market diversification. Many are investing in new photocathode technologies to enhance sensitivity across broader spectral ranges while simultaneously reducing noise and power consumption. Strategic collaborations with OEMs and research institutions are common, allowing companies to co-develop custom PMT solutions for next-generation applications in medical diagnostics, high-energy physics, and aerospace.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Component trends

- 2.2.2 Training type trends

- 2.2.3 Training device trends

- 2.2.4 Platform type trends

- 2.2.5 end use trends

- 2.2.6 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising Demand in Medical Imaging and Diagnostics

- 3.2.1.2 Expansion of High-Energy and Nuclear Physics Research

- 3.2.1.3 Advancements in Analytical and Industrial Instruments

- 3.2.1.4 Surging Environmental and Radiation Monitoring Applications

- 3.2.1.5 Emergence of Space and Aerospace Applications

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Rising Competition from Solid-State Alternatives

- 3.2.2.2 High Production and Operational Costs

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Consumer sentiment analysis

- 3.13 Patent and IP analysis

- 3.14 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market estimates and forecast, by Type, 2021 - 2034 (USD million)

- 5.1 Key trends

- 5.2 Single Channel PMTs

- 5.3 Multi-Channel PMTs (Multi-Anode PMTs)

- 5.4 Microchannel Plate PMTs (MCP-PMTs)

- 5.5 Linear Array PMTs

- 5.6 Others

Chapter 6 Market estimates and forecast, by Wavelength Range, 2021 - 2034 (USD million)

- 6.1 Key trends

- 6.2 Ultraviolet Detection

- 6.3 Visible Light Detection

- 6.4 Infrared Detection

- 6.5 Broad-spectrum Sensitivity

Chapter 7 Market estimates and forecast, by End Use Industry, 2021 - 2034 (USD million)

- 7.1 Key trends

- 7.2 Healthcare and Life Sciences

- 7.3 Research Institutions

- 7.4 Industrial and Manufacturing

- 7.5 Defense & Homeland Security

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Ametek Inc

- 9.2 Broadcom

- 9.3 Caen S.P.A.

- 9.4 Et Enterprises, Ltd.

- 9.5 Excelitas Technologies Corp.

- 9.6 Exosens

- 9.7 First Sensor AG

- 9.8 Hamamatsu Photonics

- 9.9 Jeol Ltd.

- 9.10 Laser Components

- 9.11 Luxium Solutions

- 9.12 Newport Corporation

- 9.13 ON Semiconductor

- 9.14 Photek Ltd

- 9.15 Thorlabs, Inc.