|

市場調查報告書

商品編碼

1822583

摩托車頂箱市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Motorcycle Top-box Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

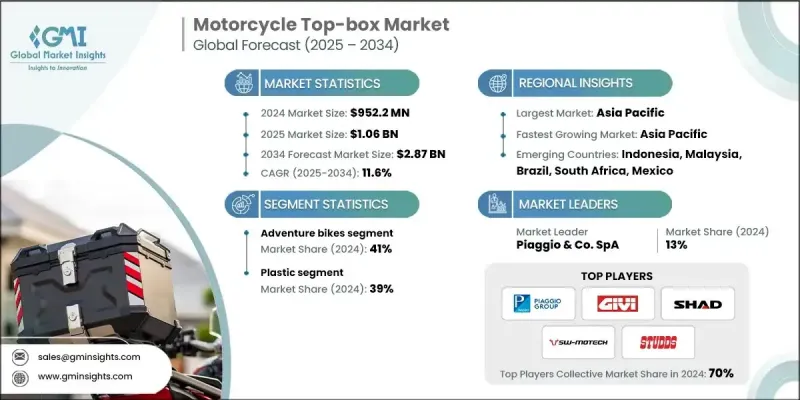

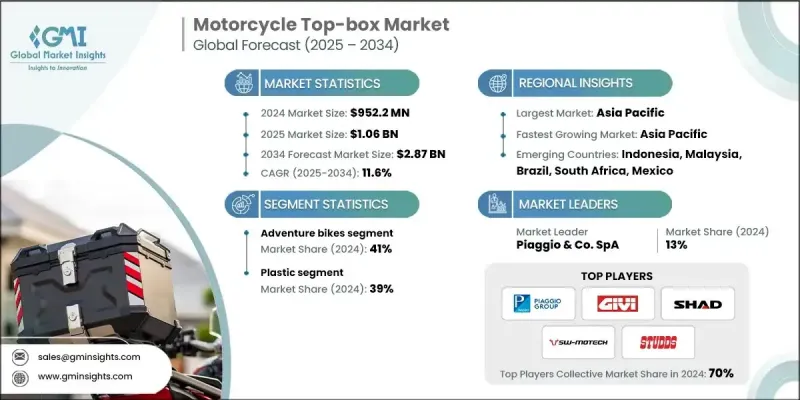

2024 年全球摩托車頂箱市場價值為 9.522 億美元,預計到 2034 年將以 11.6% 的複合年成長率成長至 28.7 億美元。

隨著摩托車廣泛用於休閒和日常通勤,騎士們越來越重視實用安全的收納方案。如果沒有專門的隔層,攜帶頭盔、包包、雜貨、筆記型電腦或工作文件等必需品可能會很困難。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 9.522億美元 |

| 預測值 | 28.7億美元 |

| 複合年成長率 | 11.6% |

探險自行車的普及率不斷上升

2024年,探險摩托車細分市場保持強勁成長,因為騎乘者尋求能夠同時應對公路和越野路況的多功能摩托車。專為該細分市場設計的頂箱注重耐用性、防水性和充足的儲物空間,以容納長途旅行裝備。騎乘者青睞那些配備強化鎖定系統和堅固結構的車型,這些車型能夠抵禦惡劣環境。探險旅行的日益普及,加上愛好者可支配收入的增加,正在推動對高階多功能頂箱的需求。

塑膠將獲得發展動力

2024年,摩托車頂箱市場的塑膠部分憑藉其輕量、經濟高效和用途廣泛的特性,佔據了顯著的市場佔有率。 ABS和聚丙烯等耐衝擊塑膠不僅耐用,還能幫助製造商設計出符合空氣動力學的造型和色彩鮮豔的飾面,吸引注重時尚的騎士。塑膠頂箱具有耐候性和耐腐蝕性,是日常通勤者和休閒騎乘者的理想選擇。隨著對經濟實惠且可靠的儲存解決方案的需求不斷成長,各公司正在透過引入抗紫外線塗層和增強結構來創新,以延長產品使用壽命。塑膠部分在功能性和美觀性之間的平衡仍然是市場擴張的重要驅動力。

區域洞察

亞太地區將成為推動力市場

預計到2034年,亞太地區摩托車頂箱市場將迎來大幅成長,這得益於該地區城鎮人口的不斷成長和摩托車保有量的不斷攀升。在印度、中國和東南亞等國家,摩托車已成為數百萬人必不可少的交通工具,這推動了對實用儲物配件的需求。本地製造商和國際企業正在投資擴大分銷網路,提供價格具競爭力的車型,以滿足不同消費者的偏好。該地區電商平台的蓬勃發展進一步提升了摩托車的可近性,從而加快了市場滲透速度。

摩托車頂箱市場的主要參與者有 Touratech、SHAD、Kappa、Hepco & Becker、BMW Motorrad、SW-Motech、Acerbis Italia、Piaggio & Co.、GIVI 和 STUDDS Accessories。

摩托車頂箱市場的公司正專注於產品創新、拓展分銷管道並提升品牌知名度,以鞏固其市場地位。許多公司正在投資研發,以開發輕便、耐用、防風雨且具有先進安全功能的頂箱,以滿足高階和中端市場的需求。與摩托車製造商的策略合作促成了OEM合作關係,確保了相容性和整合設計。為了吸引不斷成長的線上消費者群體,各大品牌正在增強其電商能力,提供詳細的產品訊息,並改善售後服務。

目錄

第1章:方法論

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- GMI 專有 AI 系統

- 人工智慧驅動的研究增強

- 來源一致性協議

- 人工智慧準確度指標

- 預測模型

- 初步研究和驗證

- 市場估計的主要趨勢

- 量化市場影響分析

- 生長參數對預測的數學影響

- 情境分析框架

- 一些主要來源(但不限於)

- 資料探勘來源

- 次要

- 付費來源

- 公共資源

- 來源(按地區)

- 次要

- 研究路徑和信心評分

- 研究路徑組成部分:

- 評分組件

- 研究透明度附錄

- 來源歸因框架

- 品質保證指標

- 我們對信任的承諾

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 城市地區摩托車保有量不斷上升

- 摩托車旅行和探險活動的成長

- 電子商務與物流業擴張

- 材料和設計的進步

- 智慧功能整合

- 不斷成長的電動自行車市場

- 產業陷阱與挑戰

- 跨模型的相容性問題

- 盜竊和破壞問題

- 市場機會

- 可客製化和模組化設計

- 環保及再生材料產品

- 與乘客應用程式和導航整合

- 新興市場的成長

- 成長動力

- 成長潛力分析

- 專利分析

- 監管格局

- 聯合國歐洲經委會法規合規框架

- 歐盟型式認證系統分析

- 區域安全標準比較

- 市場認證要求

- 技術和創新格局

- 材料技術演變與路線圖

- 先進鋁合金開發

- 高性能塑膠創新(ABS、聚碳酸酯)

- 碳纖維複合材料的進展

- 混合材料解決方案及應用

- 智慧材料整合潛力

- 製造程序創新

- 注塑技術的進步

- 3D列印應用與可擴充性

- 自動化組裝系統實施

- 品質控制和測試創新

- 智慧技術整合框架

- GPS 追蹤系統和精度指標

- 電子鎖機制安全性分析

- 行動應用程式連接和用戶體驗

- 防盜警報系統的有效性

- 物聯網整合和資料分析

- 設計與人體工學創新

- 氣動最佳化技術

- 快速釋放機制效率

- 通用安裝系統相容性

- 耐候性功能增強

- 使用者介面和可訪問性改進

- 未來技術路線圖(2025-2034)

- 專利態勢分析與智慧財產權策略

- 研發投資趨勢及分配

- 技術採用時間表和障礙

- 材料技術演變與路線圖

- 解決方案框架和痛點

- 總擁有成本(TCO)分析

- 按部門分類的初始採購成本明細

- 安裝和設定成本分析

- 維護和更換費用預測

- 保險費影響量化

- 轉售價值考慮和折舊

- 安全和盜竊分析

- 按產品類型和地區分類的竊盜事件率

- 安全功能有效性指標

- 保險理賠分析和趨勢

- 防盜技術投資報酬率評估

- 依安全等級分析回收率

- 安裝複雜性與時間分析

- 按產品分類的安裝複雜度指數 (ICI)

- 按產品類型分類的平均安裝時間

- 專業安裝與DIY安裝的成功率

- 常見安裝挑戰資料庫

- 服務網路可用性映射

- 工具需求分析與成本影響

- 總擁有成本(TCO)分析

- 永續性和環境方面

- 環境影響評估

- 依材料類型分析碳足跡

- 可回收性和報廢管理

- 永續生產實踐評估

- 循環經濟整合策略

- 用水量和廢棄物管理指標

- ESG合規框架

- 企業永續性評級(按公司)

- 供應鏈透明度指標

- 社會影響評估和社區關係

- 治理與道德標準比較

- 利害關係人參與有效性

- 環境影響評估

- 客戶體驗分析

- 客戶滿意度基準測試

- 購買決策歷程圖

- 品牌忠誠度與轉換行為

- 耐候效能資料庫

- 氣動衝擊綜合測量

- 負載能力與利用模式分析

- 品質標準和測試協議

- 數位轉型與電子商務的影響

- 數位行銷成效分析

- 社群媒體影響力指標與投資報酬率

- 線上評論對銷售的影響評估

- 網紅行銷的有效性和影響力

- 內容行銷績效與參與度

- 搜尋引擎最佳化影響分析

- 電商平台績效分析

- 特定平台的銷售分析與趨勢

- 轉換率最佳化策略

- 按平台分析客戶獲取成本

- 數位客戶體驗指標及改進

- 移動商務趨勢和表現

- 數位客戶旅程最佳化

- 全通路體驗整合

- 數位接觸點有效性分析

- 客戶資料分析與個人化

- 數位客戶服務和支援指標

- 數位行銷成效分析

- 季節性需求和庫存分析

- 按地區分析季節性需求模式

- 月度銷售變化分析及趨勢

- 天氣影響相關性和預測

- 旅遊季節調整與最佳化

- 節慶和活動影響分析

- 庫存規劃和最佳化策略

- 需求預測模型與準確性

- 按地區和產品最佳化安全庫存

- 供應鏈同步策略

- 季節性庫存投資分析

- 區域氣候影響評估

- 天氣模式分析與市場影響

- 季節性產品組合最佳化

- 區域存儲和倉儲要求

- 按地區分析季節性需求模式

- 波特的分析

- PESTEL分析

- 戰略展望

- 電動摩托車革命影響分析

- 市場轉型時間表和影響

- 技術適應要求和策略

- 新的市場機會與收入來源

- 傳統市場顛覆評估

- 自動駕駛摩托車技術的影響

- 技術開發時間表和準備情況

- 市場混亂的潛力與影響

- 地緣政治影響評估與緩解

- 貿易政策影響及因應策略

- 市場進入風險評估與緩解

- 供應鏈彈性和適應性

- 策略合作機會和模式

- 技術合作策略與優勢

- 市場拓展合作機會

- 價值鏈整合與最佳化

- 電動摩托車革命影響分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:按摩托車,2021 - 2034 年

- 主要趨勢

- 探險自行車

- 巡洋艦摩托車

- 旅行摩托車

- 運動自行車

- 越野車

- 其他(Enduro、Cafe Racer 等)

第6章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 塑膠

- 鋁

- 玻璃纖維

- 其他(軟尾包等)

第7章:市場估計與預測:按安裝情況,2021 - 2034

- 主要趨勢

- 單鎖

- Monokey

第8章:市場估計與預測:依儲存容量,2021 - 2034

- 主要趨勢

- 小型(10-20公升)

- 中號(21-40L)

- 大號(41-60公升)

- 特大號(60L以上)

第9章:市場估計與預測:按配銷通路,2021 - 2034

- 主要趨勢

- OEM

- 售後市場

- 線上

- 離線

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐人

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 印尼

- 菲律賓

- 泰國

- 韓國

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第 11 章:公司簡介

- 全球參與者

- GIVI

- Hepco & Becker

- SW-MOTECH

- SHAD

- Kappa

- Acerbis

- 區域參與者

- Nelson-Rigg

- Kriega

- Oxford Products

- Touratech

- Giant Loop

- Wolfman Luggage

- Ortlieb Sportartikel

- Bagster

- Ventura Bike-Pack

- Motodry

- 新興參與者/顛覆者

- Mosko Moto

- Enduristan

- ROK Straps

- Tusk

- Twisted Throttle

- Bumot

- Happy Trails Products

- Wolfpack Luggage

- Rigg Gear

The Global Motorcycle Top-box Market was valued at USD 952.2 million in 2024 and is estimated to grow at a CAGR of 11.6% to reach USD 2.87 billion by 2034.

As motorcycles are widely used for leisure and daily commuting, riders are placing greater importance on practical and secure storage solutions. Carrying essentials such as helmets, bags, groceries, laptops, or work-related documents can be challenging without dedicated compartments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $952.2 Million |

| Forecast Value | $2.87 Billion |

| CAGR | 11.6% |

Rising Adoption of Adventure Bikes

The adventure bikes segment held robust growth in 2024 as riders sought versatile motorcycles capable of handling both on-road and off-road conditions. Top-boxes designed for this segment emphasized durability, water resistance, and ample storage capacity to accommodate long-distance touring gear. Riders favor models with reinforced locking systems and rugged construction that withstand harsh environments. The rising popularity of adventure touring, combined with increased disposable income among enthusiasts, is driving demand for premium, multifunctional top-boxes.

Plastic to Gain Traction

The plastic segment in the motorcycle top-box market generated a notable share in 2024 owing to its lightweight, cost-effective, and versatile properties. High-impact plastics such as ABS and polypropylene provide durability while enabling manufacturers to design aerodynamic shapes and vibrant finishes that appeal to style-conscious riders. Plastic top-boxes offer resistance against weather elements and corrosion, making them ideal for daily commuters and casual riders alike. As demand grows for affordable yet reliable storage solutions, companies are innovating by incorporating UV-resistant coatings and reinforced structures to extend product lifespan. The plastic segment's balance of functionality and aesthetics continues to be a significant driver of market expansion.

Regional Insights

Asia Pacific to Emerge as a Propelling Market

Asia Pacific motorcycle top-box market is expected to witness substantial growth through 2034, propelled by the region's expanding urban populations and rising motorcycle ownership. In countries such as India, China, and Southeast Asia, motorcycles serve as essential transportation for millions, fueling demand for practical storage accessories. Local manufacturers and international players are investing in expanding distribution networks, offering competitively priced models tailored to diverse consumer preferences. The growth of e-commerce platforms in the region further enhances accessibility, enabling faster market penetration.

Major players in the motorcycle top-box market are Touratech, SHAD, Kappa, Hepco & Becker, BMW Motorrad, SW-Motech, Acerbis Italia, Piaggio & Co., GIVI, and STUDDS Accessories.

Companies in the motorcycle top-box market are focusing on product innovation, expanding distribution channels, and strengthening brand visibility to solidify their market presence. Many are investing in R&D to develop lightweight, durable, and weather-resistant top-boxes with advanced security features, catering to both premium and budget segments. Strategic collaborations with motorcycle manufacturers allow for OEM partnerships, ensuring compatibility and integrated design. To capture the growing online consumer base, brands are enhancing their e-commerce capabilities, providing detailed product information, and improving after-sales service.

Table of Contents

Chapter 1 Methodology

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.1.6 GMI proprietary AI system

- 1.1.6.1 AI-Powered research enhancement

- 1.1.6.2 Source consistency protocol

- 1.1.6.3 AI accuracy metrics

- 1.2 Forecast model

- 1.3 Primary research and validation

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario Analysis Framework

- 1.4 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Secondary

- 1.5.1.1 Paid Sources

- 1.5.1.2 Public Sources

- 1.5.1.3 Sources, by region

- 1.5.1 Secondary

- 1.6 Research Trail & Confidence Scoring

- 1.6.1 Research Trail Components:

- 1.6.2 Scoring Components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Motorcycle

- 2.2.3 Material

- 2.2.4 Mounting

- 2.2.5 Storage capacity

- 2.2.6 Distribution channel

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising motorcycle ownership in urban areas

- 3.2.1.2 Growth of motorcycle touring and adventure

- 3.2.1.3 E-commerce and logistics sector expansion

- 3.2.1.4 Advancements in material & design

- 3.2.1.5 Integration of smart features

- 3.2.1.6 Growing electric bike market

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Compatibility issues across models

- 3.2.2.2 Theft & vandalism concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Customizable and modular designs

- 3.2.3.2 Eco-friendly and recycled material products

- 3.2.3.3 Integration with rider apps and navigation

- 3.2.3.4 Growth in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.5.1 UN ECE regulations compliance framework

- 3.5.2 EU type-approval systems analysis

- 3.5.3 Regional safety standards comparison

- 3.5.4 Certification requirements by market

- 3.6 Technology and innovation landscape

- 3.6.1 Material technology evolution and roadmap

- 3.6.1.1 Advanced aluminum alloys development

- 3.6.1.2 High-performance plastics innovation (ABS, polycarbonate)

- 3.6.1.3 Carbon fiber composites advancement

- 3.6.1.4 Hybrid material solutions and applications

- 3.6.1.5 Smart materials integration potential

- 3.6.2 Manufacturing process innovations

- 3.6.2.1 Injection molding technology advancements

- 3.6.2.2 3D printing applications and scalability

- 3.6.2.3 Automated assembly systems implementation

- 3.6.2.4 Quality control and testing innovations

- 3.6.3 Smart technology integration framework

- 3.6.3.1 GPS tracking systems and accuracy metrics

- 3.6.3.2 Electronic locking mechanisms security analysis

- 3.6.3.3 Mobile app connectivity and user experience

- 3.6.3.4 Anti-theft alert systems effectiveness

- 3.6.3.5 IoT integration and data analytics

- 3.6.4 Design and ergonomics innovations

- 3.6.4.1 Aerodynamic optimization techniques

- 3.6.4.2 Quick-release mechanisms efficiency

- 3.6.4.3 Universal mounting systems compatibility

- 3.6.4.4 Weather resistance feature enhancement

- 3.6.4.5 User interface and accessibility improvements

- 3.6.5 Future technology roadmap (2025-2034)

- 3.6.5.1 Patent landscape analysis and IP strategy

- 3.6.5.2 R&D investment trends and allocation

- 3.6.5.3 Technology adoption timeline and barriers

- 3.6.1 Material technology evolution and roadmap

- 3.7 Solution framework & pain points

- 3.7.1 Total cost of ownership (TCO) analysis

- 3.7.1.1 Initial purchase cost breakdown by segment

- 3.7.1.2 Installation and setup cost analysis

- 3.7.1.3 Maintenance and replacement expense projections

- 3.7.1.4 Insurance premium impact quantification

- 3.7.1.5 Resale value considerations and depreciation

- 3.7.2 Security and theft analytics

- 3.7.2.1 Theft incident rates by product type and region

- 3.7.2.2 Security feature effectiveness metrics

- 3.7.2.3 Insurance claim analysis and trends

- 3.7.2.4 Anti-theft technology ROI assessment

- 3.7.2.5 Recovery rate analysis by security level

- 3.7.3 Installation complexity and time analysis

- 3.7.3.1 Installation complexity index (ICI) by product

- 3.7.3.2 Average installation time by product type

- 3.7.3.3 Professional vs. DIY installation success rates

- 3.7.3.4 Common installation challenges database

- 3.7.3.5 Service network availability mapping

- 3.7.3.6 Tool requirement analysis and cost impact

- 3.7.1 Total cost of ownership (TCO) analysis

- 3.8 Sustainability and environmental aspects

- 3.8.1 Environmental impact assessment

- 3.8.1.1 Carbon footprint analysis by material type

- 3.8.1.2 Recyclability and end-of-life management

- 3.8.1.3 Sustainable manufacturing practices evaluation

- 3.8.1.4 Circular economy integration strategies

- 3.8.1.5 Water usage and waste management metrics

- 3.8.2 Esg compliance framework

- 3.8.2.1 Corporate sustainability ratings by company

- 3.8.2.2 Supply chain transparency metrics

- 3.8.2.3 Social impact assessment and community relations

- 3.8.2.4 Governance and ethics standards comparison

- 3.8.2.5 Stakeholder engagement effectiveness

- 3.8.1 Environmental impact assessment

- 3.9 Customer experience analytics

- 3.9.1 Customer satisfaction benchmarking

- 3.9.2 Purchase decision journey mapping

- 3.9.3 Brand loyalty and switching behavior

- 3.10 Weather resistance performance database

- 3.10.1 Aerodynamic impact comprehensive measurements

- 3.10.2 Load capacity and utilization pattern analysis

- 3.10.3 Quality standards and testing protocols

- 3.11 Digital transformation and e-commerce impact

- 3.11.1 Digital marketing effectiveness analysis

- 3.11.1.1 Social media influence metrics and ROI

- 3.11.1.2 Online review impact assessment on sales

- 3.11.1.3 Influencer marketing effectiveness and reach

- 3.11.1.4 Content marketing performance and engagement

- 3.11.1.5 Search engine optimization impact analysis

- 3.11.2 E-commerce platform performance analysis

- 3.11.2.1 Platform-specific sales analytics and trends

- 3.11.2.2 Conversion rate optimization strategies

- 3.11.2.3 Customer acquisition cost analysis by platform

- 3.11.2.4 Digital customer experience metrics and improvement

- 3.11.2.5 Mobile commerce trends and performance

- 3.11.3 Digital customer journey optimization

- 3.11.3.1 Omnichannel experience integration

- 3.11.3.2 Digital touchpoint effectiveness analysis

- 3.11.3.3 Customer data analytics and personalization

- 3.11.3.4 Digital customer service and support metrics

- 3.11.1 Digital marketing effectiveness analysis

- 3.12 Seasonal demand and inventory analytics

- 3.12.1 Seasonal demand pattern analysis by region

- 3.12.1.1 Monthly sales variation analysis and trends

- 3.12.1.2 Weather impact correlation and forecasting

- 3.12.1.3 Tourism season alignment and optimization

- 3.12.1.4 Holiday and event impact analysis

- 3.12.2 Inventory planning and optimization strategies

- 3.12.2.1 Demand forecasting models and accuracy

- 3.12.2.2 Safety stock optimization by region and product

- 3.12.2.3 Supply chain synchronization strategies

- 3.12.2.4 Seasonal inventory investment analysis

- 3.12.3 Regional climate impact assessment

- 3.12.3.1 Weather pattern analysis and market impact

- 3.12.3.2 Seasonal product mix optimization

- 3.12.3.3 Regional storage and warehousing requirements

- 3.12.1 Seasonal demand pattern analysis by region

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

- 3.15 Strategic outlook

- 3.15.1 Electric motorcycle revolution impact analysis

- 3.15.1.1 Market transformation timeline and implications

- 3.15.1.2 Technology adaptation requirements and strategies

- 3.15.1.3 New market opportunities and revenue streams

- 3.15.1.4 Traditional market disruption assessment

- 3.15.1.5 Autonomous motorcycle technology impact

- 3.15.1.6 Technology development timeline and readiness

- 3.15.1.7 Market disruption potential and implications

- 3.15.2 Geopolitical impact assessment and mitigation

- 3.15.2.1 Trade policy impact and response strategies

- 3.15.2.2 Market access risk assessment and mitigation

- 3.15.2.3 Supply chain resilience and adaptation

- 3.15.3 Strategic partnership opportunities and models

- 3.15.3.1 Technology partnership strategies and benefits

- 3.15.3.2 Market expansion partnership opportunities

- 3.15.3.3 Value chain integration and optimization

- 3.15.1 Electric motorcycle revolution impact analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Motorcycle, 2021 - 2034 ($Mn, Mn Units)

- 5.1 Key trends

- 5.2 Adventure bikes

- 5.3 Cruiser motorcycles

- 5.4 Touring motorcycles

- 5.5 Sport bikes

- 5.6 Dirt bikes

- 5.7 Others (Enduro, Cafe Racer etc.)

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 ($Mn, Mn Units)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Aluminum

- 6.4 Fiber glass

- 6.5 Others (soft tail bags etc.)

Chapter 7 Market Estimates & Forecast, By Mounting, 2021 - 2034 ($Mn, Mn Units)

- 7.1 Key trends

- 7.2 Monolock

- 7.3 Monokey

Chapter 8 Market Estimates & Forecast, By Storage Capacity, 2021 - 2034 ($Mn, Mn Units)

- 8.1 Key trends

- 8.2 Small (10-20L)

- 8.3 Medium (21-40L)

- 8.4 Large (41-60L)

- 8.5 Extra-large (above 60L)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Mn, Mn Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

- 9.3.1 Online

- 9.3.2 Offline

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Mn Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 Indonesia

- 10.4.6 Philippines

- 10.4.7 Thailand

- 10.4.8 South Korea

- 10.4.9 Singapore

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 GIVI

- 11.1.2 Hepco & Becker

- 11.1.3 SW-MOTECH

- 11.1.4 SHAD

- 11.1.5 Kappa

- 11.1.6 Acerbis

- 11.2 Regional Players

- 11.2.1 Nelson-Rigg

- 11.2.2 Kriega

- 11.2.3 Oxford Products

- 11.2.4 Touratech

- 11.2.5 Giant Loop

- 11.2.6 Wolfman Luggage

- 11.2.7 Ortlieb Sportartikel

- 11.2.8 Bagster

- 11.2.9 Ventura Bike-Pack

- 11.2.10 Motodry

- 11.3 Emerging Players / Disruptors

- 11.3.1 Mosko Moto

- 11.3.2 Enduristan

- 11.3.3 ROK Straps

- 11.3.4 Tusk

- 11.3.5 Twisted Throttle

- 11.3.6 Bumot

- 11.3.7 Happy Trails Products

- 11.3.8 Wolfpack Luggage

- 11.3.9 Rigg Gear