|

市場調查報告書

商品編碼

1822581

擠乳機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Milking Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球擠乳機市場價值為 43.9 億美元,預計到 2034 年將以 6.5% 的複合年成長率成長至 81.8 億美元。

隨著農村勞動力老化和城市人口遷移的持續,農業部門面臨巨大的勞動力挑戰。這些動態正促使全球酪農轉向擠乳自動化,以維持生產力和獲利能力。手工擠奶不僅需要熟練的勞動力,還會增加不一致、衛生條件差和動物壓力的風險。相較之下,自動化和機器人系統可以減少人為錯誤,改善動物福利,並提高牛奶的整體品質。這些機器提供一致的擠奶模式,有助於控制乳房炎,並確保擠奶過程的清潔,使動物健康標準與現代乳牛場的需求一致。自動化不再是奢侈品,而是永續乳牛場運作的必需品。借助人工智慧驅動的追蹤系統和物聯網感測器等先進技術,農民現在可以即時了解牛群的健康狀況和設備性能。這種以數據為中心的方法可以及時介入並更好地控制農場管理。因此,智慧自動化正在全球將乳製品生產轉變為更精準、更有效率、更永續的產業。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 43.9億美元 |

| 預測值 | 81.8億美元 |

| 複合年成長率 | 6.5% |

自動化擠乳系統憑藉其卓越的效率和全天候運行,在2024年創造了可觀的收入。這些系統獨立運行,並提供均勻的吸奶、定時和產量,顯著提高了牛奶的產量和品質。機器人擠乳裝置對於面臨勞動力短缺或希望擴大生產的農場尤其具有吸引力。這些設備減少了人工干預,最大限度地減輕了牲畜的壓力,並配備了人工智慧和物聯網功能,使農民能夠遠端監控乳牛的行為、產奶量和設備效率。這種控制水平可確保更好的牛群健康,有助於預防感染,並支持嚴格遵守食品安全準則,因此自動化系統對於現代乳製品設施至關重要。

攜帶式擠乳機市場在2024年佔了48.38%的市場佔有率,預計2025年至2034年的複合年成長率將達到8%。攜帶式擠乳機功能多樣、價格實惠且易於操作,對中小型乳牛場極具吸引力,尤其是在發展中地區。這些輕便的設備非常適合牲畜分散飼養或在多個牧場放牧的牧場。對於無力負擔昂貴固定系統的農場來說,攜帶式擠乳機提供了一種經濟高效的替代方案,既能減少對勞動力的依賴,又能保持高效的生產。攜帶式擠乳機的移動特性使其能夠應用於各種牲畜和地點,這在混合放牧模式和分散式農場佈局的地區更具吸引力。

美國擠乳機市場佔 73.8% 的市場佔有率,2024 年市場規模達 8.982 億美元。勞動成本上升、熟練農場工人的稀缺性以及農村人口老化,正迫使美國乳牛場採用更多自動化技術。大型商業乳品廠在美國市場佔據主導地位,因此,它們需要高效的解決方案來確保獲利能力。智慧擠奶系統因其能夠在確保牛奶品質的同時提高牛奶產量而日益普及。物聯網技術進一步支持了這些系統,使農民能夠即時追蹤牲畜的健康狀況、牛奶產量和環境狀況。這種技術前沿方法支持了國家對食品安全、可追溯性和動物福利的重視。

影響全球擠奶機市場的知名企業包括 DeLaval、Boumatic、Lely、GEA Group、Fullwood Packo、Afimilk、Lusna、Agrifac Machinery、Prompt Dairy Tech、AMS-Galaxy USA、Melasty、Milkplan Farming Technologies、Kanters Holland、SA Christensen 和 Yuchane Jiang Mechan。為了獲得競爭優勢,擠乳機市場的公司正專注於產品創新、即時監控功能和人工智慧整合系統。市場領導者正在大力投資自動化和機器人技術,以提供適用於小型農場和大型乳牛場的可擴展解決方案。與科技公司的策略合作幫助公司開發出支援物聯網的系統,提供健康追蹤、產量預測和自動清潔功能。許多公司透過與區域分銷商合作並根據當地農業需求客製化產品來全球擴張。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 勞動短缺和成本上升

- 動物福利和衛生重點

- 新興市場中小型乳牛場的成長

- 產業陷阱與挑戰

- 初期投資高

- 農村地區缺乏技術技能

- 機會

- 亞太和非洲地區採用率不斷上升

- 人工智慧與物聯網的融合

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 監管環境

- 價值鏈分析

- 原料供應商和零件製造商

- 設備製造商和原始設備製造商

- 分銷通路和銷售網路

- 最終用途領域和應用

- 售後服務供應商

- 價格趨勢

- 按地區

- 按機器類型

- 監管格局

- 標準和合規要求

- 區域監理框架

- 認證標準 貿易統計(HS編碼-84341000)

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依機器類型,2021 - 2034 年

- 主要趨勢

- 自動的

- 半自動

第6章:市場估計與預測:依車型,2021 - 2034

- 主要趨勢

- 便攜的

- 靜止的

- 其他

第7章:市場估計與預測:按牲畜,2021 - 2034 年

- 主要趨勢

- 乳牛

- 船

- 山羊

- 其他

第8章:市場估計與預測:依最終用途,2021 - 2034

- 主要趨勢

- 微型乳牛場

- 宏乳牛場

- 其他

第9章:市場估計與預測:依配銷通路2021 - 2034

- 主要趨勢

- 直銷

- 間接銷售

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 多邊環境協定

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Afimilk

- Agrifac Machinery

- AMS-Galaxy USA

- Boumatic

- DeLaval

- Fullwood Packo

- GEA Group

- Kanters Holland

- Lely

- Lusna

- Melasty

- Milkplan Farming Technologies

- Prompt Dairy Tech

- SA Christensen

- Yue Jiang Mechanical

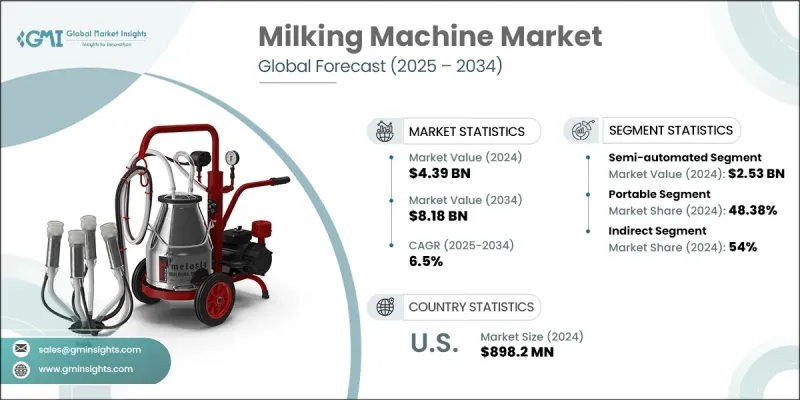

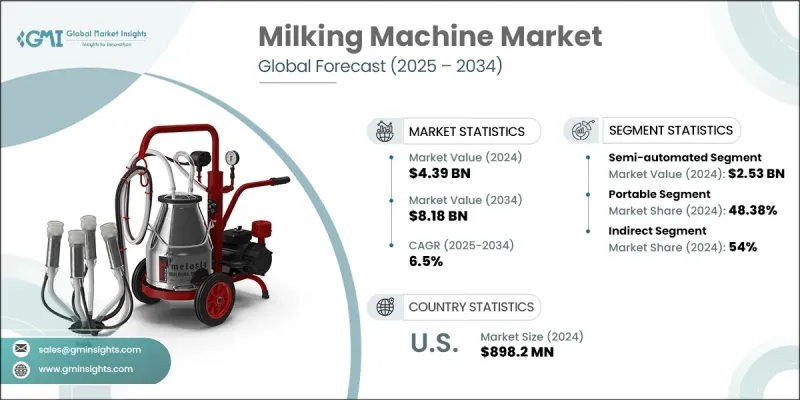

The Global Milking Machine Market was valued at USD 4.39 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 8.18 billion by 2034.

As rural workforces age and urban migration continues, the agricultural sector is facing significant labor challenges. These dynamics are pushing dairy farmers worldwide to turn to milking automation to maintain productivity and profitability. Manual milking not only demands skilled labor but also increases the risk of inconsistencies, poor hygiene, and animal stress. In contrast, automated and robotic systems reduce human error, enhance animal welfare, and improve overall milk quality. These machines offer consistent milking patterns, help control mastitis, and ensure the cleanliness of the milking process, aligning both animal health standards and modern dairy farm needs. Automation is no longer a luxury-it's a necessity for sustainable dairy operations. With advanced technologies such as AI-driven tracking systems and IoT-enabled sensors, farmers now have real-time insights into herd health and equipment performance. This data-centric approach allows for timely interventions and greater control over farm management. As a result, smart automation is transforming dairy production into a more precise, productive, and sustainable industry on a global scale.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.39 Billion |

| Forecast Value | $8.18 Billion |

| CAGR | 6.5% |

The automated milking systems segment generated notable revenues in 2024 owing to their superior efficiency and round-the-clock operation. These systems function independently and deliver uniform suction, timing, and yield, significantly improving both the quantity and quality of milk. Robotic milking units have become particularly attractive to farms dealing with labor shortages or looking to scale up production. These devices reduce manual intervention, minimize stress on livestock, and are equipped with AI and IoT capabilities that allow farmers to monitor cow behavior, milk output, and equipment efficiency remotely. This level of control ensures better herd health, helps prevent infections, and supports strict compliance with food safety guidelines, making automated systems essential for modern dairy facilities.

The portable milking machines segment held 48.38% share in 2024 and is forecasted to grow at a CAGR of 8% from 2025 to 2034. Their versatility, affordability, and ease of operation make them highly attractive to small and mid-sized dairy farms, especially in developing regions. These lightweight units are ideal for operations where livestock is scattered or grazing across multiple pastures. For farms that cannot afford expensive, fixed systems, portable milking machines offer a cost-effective alternative to reduce labor dependence while maintaining efficient production. Their mobile nature also enables their use across various animal types and locations, adding to their appeal in regions with mixed-grazing models and decentralized farm layouts.

U.S. Milking Machine Market held 73.8% share and generated USD 898.2 million in 2024. Rising labor costs, limited access to skilled farmhands, and an aging rural demographic are pushing American dairy farms to adopt more automation. Large-scale commercial dairies dominate the market in the U.S., and as such, they require high-efficiency solutions to ensure profitability. Smart milking systems are becoming widespread due to their ability to increase milk yield while ensuring quality. IoT-enabled technologies further support these systems, allowing farmers to track the health, milk production, and environmental conditions of their animals in real time. This tech-forward approach supports the country's emphasis on food safety, traceability, and animal welfare.

Prominent players shaping the Global Milking Machine Market include DeLaval, Boumatic, Lely, GEA Group, Fullwood Packo, Afimilk, Lusna, Agrifac Machinery, Prompt Dairy Tech, AMS-Galaxy USA, Melasty, Milkplan Farming Technologies, Kanters Holland, S. A. Christensen, and Yue Jiang Mechanical. To gain a competitive edge, companies operating in the milking machine market are focusing on product innovation, real-time monitoring features, and AI-integrated systems. Market leaders are investing heavily in automation and robotics to offer solutions that are scalable for both small farms and large dairy operations. Strategic collaborations with technology firms have helped companies develop IoT-enabled systems that offer health tracking, yield forecasting, and automated cleaning. Many firms are expanding globally by partnering with regional distributors and tailoring products to local farming needs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.3 Data collection methods

- 1.4 Data mining sources

- 1.4.1 Global

- 1.4.2 Regional/Country

- 1.5 Base estimates and calculations

- 1.5.1 Base year calculation

- 1.5.2 Key trends for market estimation

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Machine type

- 2.2.3 Model type

- 2.2.4 Livestock

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Labor shortages & rising costs

- 3.2.1.2 Animal welfare & hygiene focus

- 3.2.1.3 Growth of small & medium dairy farms in emerging markets

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment

- 3.2.2.2 Lack of technical skills in rural areas

- 3.2.3 Opportunities

- 3.2.3.1 Rising adoption in Asia-Pacific & Africa

- 3.2.3.2 Integration of AI & IoT

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.6 Regulatory environment

- 3.7 Value chain analysis

- 3.7.1 Raw material suppliers and component manufacturers

- 3.7.2 Equipment manufacturers and OEMs

- 3.7.3 Distribution channels and sales networks

- 3.7.4 end use segments and applications

- 3.7.5 After-sales service providers

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By machine type

- 3.9 Regulatory landscape

- 3.9.1 standards and compliance requirements

- 3.9.2 Regional regulatory frameworks

- 3.10 Certification standards Trade statistics (HS code -84341000)

- 3.10.1 Major importing countries

- 3.10.2 Major exporting countries

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Automatic

- 5.3 Semi-automatic

Chapter 6 Market Estimates & Forecast, By Model Type, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Portable

- 6.3 Stationery

- 6.4 Others

Chapter 7 Market Estimates & Forecast, By Livestock, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Cow

- 7.3 Ship

- 7.4 Goat

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By end use, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Micro dairy farm

- 8.3 Macro dairy farm

- 8.4 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Afimilk

- 11.2 Agrifac Machinery

- 11.3 AMS-Galaxy USA

- 11.4 Boumatic

- 11.5 DeLaval

- 11.6 Fullwood Packo

- 11.7 GEA Group

- 11.8 Kanters Holland

- 11.9 Lely

- 11.10 Lusna

- 11.11 Melasty

- 11.12 Milkplan Farming Technologies

- 11.13 Prompt Dairy Tech

- 11.14 S. A. Christensen

- 11.15 Yue Jiang Mechanical