|

市場調查報告書

商品編碼

1822574

液體及膏體灌裝機市場機會、成長動力、產業趨勢分析及2025-2034年預測Liquid and Paste Filling Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

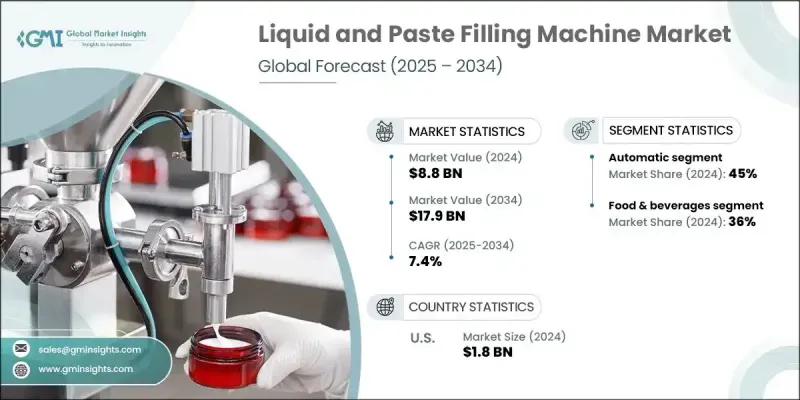

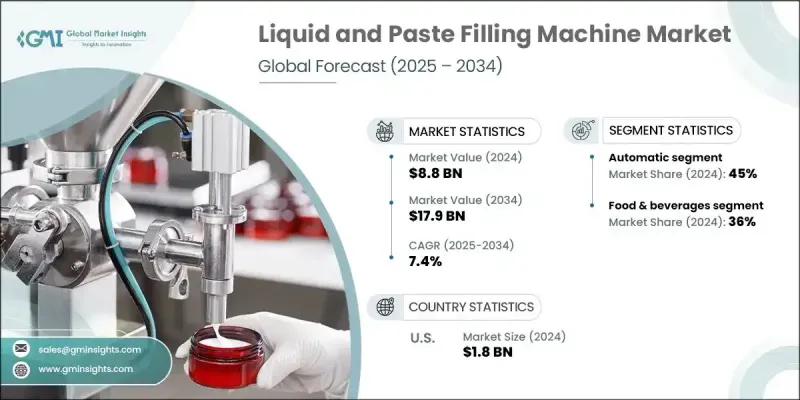

2024 年全球液體和膏體灌裝機市場價值為 88 億美元,預計到 2034 年將以 7.4% 的複合年成長率成長至 179 億美元。

這一成長主要得益於全球對包裝消費品需求的不斷成長,這主要得益於城市化和生活方式的轉變,尤其是在新興經濟體中。製造商正在大力投資開發更有效率的灌裝解決方案,以便在遵守嚴格衛生標準的前提下處理更大的生產量,這顯著推動了市場成長。這一擴張背後的另一個主要推動力是對永續性和環保包裝的日益關注。監管機構和消費者都要求製造商採用可回收、可生物分解或可堆肥的材料。因此,製造商需要能夠適應這些材料的填充機,並創新包裝工藝,以降低能耗並最大限度地減少浪費。在市場中,自動灌裝機因其準確性、成本效益和可擴展性而佔據主導地位。與半自動或手動替代品相比,它們提供更高的吞吐量、更好的填充精度和更低的勞動力成本,使其成為大規模食品加工和其他核心行業不可或缺的設備。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 88億美元 |

| 預測值 | 179億美元 |

| 複合年成長率 | 7.4% |

2024年,自動化領域佔據45%的市場佔有率,預計到2034年將以7.8%的複合年成長率成長。該領域的主導地位歸因於製藥、化妝品、食品飲料等關鍵產業對大批量生產和精準高效灌裝的需求日益成長。自動化機器可提高產量、填充精度並節省勞動力,並且可與更廣泛的自動化系統無縫整合,從而提高生產線效率並實現數據驅動的報告。這些因素使得自動灌裝機在需要嚴格品質控制和高速包裝的生產環境中至關重要。

食品飲料產業在2024年佔了36%的市場佔有率,預計2025年至2034年的複合年成長率將達到8.3%。該行業佔據領先地位,因為液體、糊狀和粘稠產品的種類繁多,產量巨大,需要精確、衛生的包裝。飲料、乳製品、醬料和預製食品等產品需要快速、可靠且通常無菌的填充解決方案,這推動了根據其獨特需求量身定做的先進灌裝機的需求。

2024年,美國液體和膏體灌裝機市場規模達18億美元。美國強大的商業基礎,尤其是在製藥、食品飲料和化學品領域,加上嚴格的監管,推動了對精準無菌包裝解決方案的持續需求。早期採用自動化技術以及對高速高效填充製程的關注,進一步鞏固了北美作為領先區域市場的地位。

全球液體和膏體灌裝機市場的領導企業包括克朗斯股份公司、利樂國際公司、西得樂集團、基伊埃集團和科埃仕有限公司。為了鞏固市場地位,液體和膏體灌裝機產業的企業正專注於多種策略方針。投資研發對於引進速度更快、精度更高、功能更強大且支援永續包裝材料的機器至關重要。企業優先整合智慧自動化和物聯網技術,以提高生產線效率和資料分析能力。與包裝和製造公司建立策略合作夥伴關係有助於擴大客戶群,並根據不斷變化的行業需求量身定做解決方案。

目錄

第1章:方法論與範圍

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 包裝飲料需求不斷成長

- 液體和膏體填充機的技術進步

- 嚴格的品質和安全法規

- 產業陷阱與挑戰

- 初始投資成本高

- 原物料價格波動

- 機會

- 新興市場成長

- 客製化和靈活性

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按操作

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 貿易統計(HS編碼)

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 多邊環境協定

- 拉丁美洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依機器類型,2021 - 2034 年

- 主要趨勢

- 旋轉灌裝機

- 無菌灌裝機

- 體積填充劑

- 淨重填料

- 其他

第6章:市場估計與預測:按營運,2021 - 2034 年

- 主要趨勢

- 自動的

- 半自動

- 手動的

第7章:市場估計與預測:依工藝,2021 - 2034

- 主要趨勢

- 熱灌裝

- 冷灌裝

- 無菌灌裝

- 其他

第 8 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 製藥

- 食品和飲料

- 化學

- 化妝品和個人護理

- 其他

第9章:市場估計與預測:按配銷通路,2021 - 2034

- 主要趨勢

- 直接的

- 間接

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 馬來西亞

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第 11 章:公司簡介

- Krones AG

- Tetra Pak International SA

- Sidel Group

- KHS GmbH

- GEA Group AG

- Serac Group

- ProMach Inc.

- CFT Group

- IMA Group

- SMI SpA

- Ronchi Mario SpA

- Accutek Packaging Equipment Companies, Inc.

- Coesia SpA

- Zhangjiagang King Machine Co., Ltd.

- Romaco

The Global Liquid and Paste Filling Machines Market was valued at USD 8.8 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 17.9 billion by 2034.

This growth is largely fueled by rising demand for packaged consumer goods worldwide, driven by urbanization and shifts in lifestyle, especially within emerging economies. Manufacturers are investing heavily in developing more efficient filling solutions to handle larger production volumes while adhering to stringent hygiene standards, which is significantly boosting market growth. Another major force behind this expansion is the growing focus on sustainability and eco-friendly packaging. Both regulators and consumers are demanding that manufacturers adopt recyclable, biodegradable, or compostable materials. Consequently, manufacturers need filling machines that can accommodate these materials and innovate packaging processes to reduce energy consumption and minimize waste. Within the market, automatic filling machines dominate due to their accuracy, cost-effectiveness, and scalability. They offer higher throughput, better fill precision, and lower labor costs compared to semi-automatic or manual alternatives, making them indispensable for large-scale food processing and other core industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.8 Billion |

| Forecast Value | $17.9 Billion |

| CAGR | 7.4% |

In 2024, the automatic segment held a 45% share and is expected to grow at a CAGR of 7.8% through 2034. This segment's dominance is attributed to the growing need for high-volume production and precise, efficient filling across key sectors such as pharmaceuticals, cosmetics, and food and beverage. Automatic machines provide enhanced output, fill accuracy, and labor savings, and they integrate seamlessly with broader automation systems to improve production line efficiency and enable data-driven reporting. These factors make automatic filling machines vital in production environments that require strict quality control and high-speed packaging.

The food & beverage segment held a 36% share in 2024 and is expected to grow at a CAGR of 8.3% from 2025 to 2034. This sector leads due to the extensive variety and volume of liquid, paste, and viscous products requiring precise, hygienic packaging. Products like beverages, dairy items, sauces, and prepared meals demand fast, reliable, and often aseptic filling solutions, driving demand for advanced filling machines tailored to their unique needs.

United States Liquid and Paste Filling Machines Market generated USD 1.8 billion in 2024. The country's strong commercial base, especially in pharmaceuticals, food and beverage, and chemicals, coupled with stringent regulatory oversight, drives consistent demand for accurate and sterile packaging solutions. Early adoption of automation technologies and a focus on high-speed, efficient filling processes further bolster North America's position as a leading regional market.

The leading players shaping the Global Liquid and Paste Filling Machines Market include Krones AG, Tetra Pak International S.A., Sidel Group, GEA Group AG, and KHS GmbH. To reinforce their market positions, companies in the liquid and paste filling machines sector are focusing on several strategic approaches. Investing in research and development is critical to introducing machines that deliver higher speed, precision, and versatility while supporting sustainable packaging materials. Firms prioritize integrating smart automation and IoT-enabled technologies to enhance production line efficiency and data analytics capabilities. Building strategic partnerships with packaging and manufacturing companies helps expand their customer base and tailor solutions to evolving industry needs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Machine type

- 2.2.3 Operation

- 2.2.4 Process

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing Demand for Packaged Beverages

- 3.2.1.2 Technological Advancements in Liquid and paste filling machines

- 3.2.1.3 Stringent Quality and Safety Regulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High Initial Investment Costs

- 3.2.2.2 Fluctuating Raw Material Prices

- 3.2.3 Opportunities

- 3.2.3.1 Emerging Markets Growth

- 3.2.3.2 Customization and Flexibility

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Operation

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Rotary fillers

- 5.3 Aseptic fillers

- 5.4 Volumetric fillers

- 5.5 Net weight fillers

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Operation, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Automatic

- 6.3 Semi-Automatic

- 6.4 Manual

Chapter 7 Market Estimates & Forecast, By Process, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Hot fill

- 7.3 Cold fill

- 7.4 Aseptic fill

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Pharmaceutical

- 8.3 Food & beverage

- 8.4 Chemical

- 8.5 Cosmetics and personal care

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Malaysia

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Krones AG

- 11.2 Tetra Pak International S.A.

- 11.3 Sidel Group

- 11.4 KHS GmbH

- 11.5 GEA Group AG

- 11.6 Serac Group

- 11.7 ProMach Inc.

- 11.8 CFT Group

- 11.9 IMA Group

- 11.10 SMI S.p.A.

- 11.11 Ronchi Mario S.p.A.

- 11.12 Accutek Packaging Equipment Companies, Inc.

- 11.13 Coesia S.p.A.

- 11.14 Zhangjiagang King Machine Co., Ltd.

- 11.15 Romaco