|

市場調查報告書

商品編碼

1822546

眼科雷射器市場機會、成長動力、產業趨勢分析及2025-2034年預測Ophthalmic Lasers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

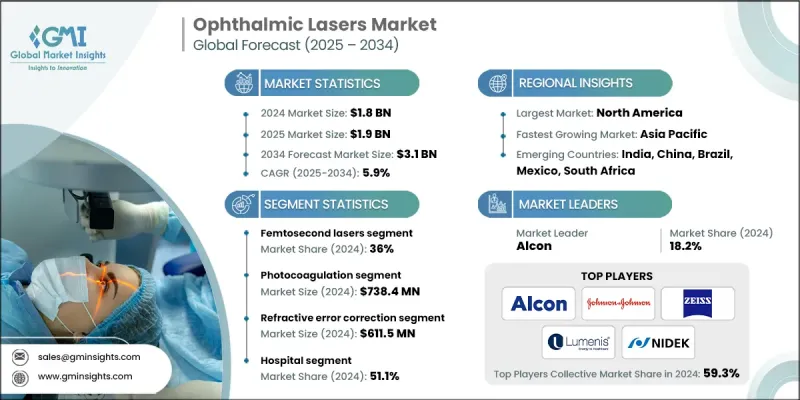

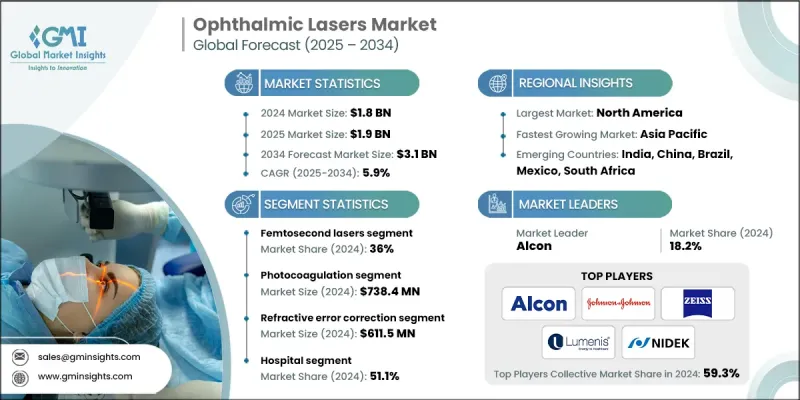

根據 Global Market Insights, Inc. 發布的最新報告,2024 年全球眼科雷射器市場價值為 18 億美元,預計將從 2025 年的 19 億美元成長到 2034 年的 31 億美元,複合年成長率為 5.9%。隨著視力障礙發病率的上升、人口老化以及眼科手術雷射系統的技術進步,該市場正在經歷顯著成長。

眼科雷射已成為治療青光眼、糖尿病視網膜病變、老年性黃斑部病變 (AMD) 和屈光不正等疾病的關鍵。眼科雷射是一種微創器械,能夠提供精準有效的手術治療,因此預計未來幾年其應用將日益廣泛。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 18億美元 |

| 預測值 | 31億美元 |

| 複合年成長率 | 5.9% |

關鍵促進因素:

1.眼部疾病發生率上升:白內障、糖尿病視網膜病變和青光眼的發生率不斷上升,對雷射治療的需求不斷增加。

2.屈光手術的興起:年輕一代對 LASIK 和 SMILE 手術的興趣日益濃厚,推動了飛秒和準分子雷射的使用。

3.提高雷射的精度和安全性:新型眼科雷射具有更強的控制力、更少的熱損傷和更好的術後效果,因此越來越受到眼科醫生的青睞。

4.人口老化:與年齡相關的眼部疾病在世界範圍內呈上升趨勢,尤其是在高收入和中等收入國家。

關鍵參與者:

- 愛爾康、強生、蔡司、LUMENIS 和 NIDEK 是其中的一些主要參與者,共佔了整個市場的 59.3%。

- 2024 年,愛爾康佔據了眼科雷射市場 18.2% 的佔有率。

主要挑戰:

- 設備成本高:眼科雷射價格昂貴,阻礙了其在低收入醫療機構的普及。

- 嚴格的法規核准:各個市場的設備核准延遲可能會限制發佈時間表。

- 熟練專業人員短缺:使用複雜的雷射系統需要專門的培訓,這在農村和低度開發地區仍然是一個問題。

按產品類型 - 飛秒雷射佔據市場主導地位

飛秒雷射器憑藉其精準度、微創性以及在屈光手術和白內障手術中的卓越療效,在2024年引領了產品類別。隨著全球患者對視力矯正的興趣日益濃厚,飛秒雷射在LASIK、SMILE和角膜切開術中的應用也正在迅速成長。

依技術分類-光凝術被廣泛採用

光凝固術領域在2024年保持強勁成長,尤其得益於其在糖尿病視網膜病變和視網膜靜脈阻塞治療的應用日益增多。該技術因其能夠長期穩定危及視力的疾病而受到視網膜專家的青睞。

按應用 - 屈光不正矯正仍是焦點

2024 年,屈光不正矯正佔據了市場主導地位。對眼鏡和隱形眼鏡的永久性視力矯正解決方案的需求不斷成長,推動了對雷射輔助手術的需求,尤其是在城市地區。

按最終用途分類-醫院佔最大佔有率

2024年,醫院在終端使用領域佔據主導地位。醫院設施配備綜合眼科護理單位、合格的外科醫生和高科技雷射設備。它們還提供報銷福利,並有能力進行選擇性和緊急眼科手術。

2024年,北美成為全球眼科雷射市場的最大參與者,這得益於先進眼科手術的廣泛應用、較高的近視和白內障發病率以及知名企業的湧現。美國在技術應用、報銷方案以及擁有先進雷射治療的門診手術設施方面仍處於領先地位。

頂尖企業正在探索並執行新的研發、策略合作夥伴關係和新品發布,以提升競爭優勢。例如,愛爾康近期推出了用於白內障和角膜手術的新一代飛秒雷射產品組合。蔡司和強生則專注於人工智慧導引的雷射平台,以提高手術精準度。另一方面,科醫人(Lumenis)和格勞科斯(Glaukos)則致力於與眼科診所和醫院合作,以更好地支持其分銷管道。博士倫(BAUSCH + LOMB)和尼德克(NIDEK)則透過探索本地生產和培訓眼科醫生,實施專注於新興市場的成長策略。這將進一步拓展全球影響力,同時也將推動技術進步並改善病患照護效果。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 眼部疾病盛行率不斷上升

- 微創眼科手術的需求不斷成長

- 雷射系統的技術進步

- 已開發市場的報銷狀況改善

- 產業陷阱與挑戰

- 眼科雷射系統成本高

- 術後併發症和副作用的風險

- 市場機會

- 亞太、拉丁美洲和中東和非洲地區的新興市場

- 用於外展計劃的攜帶式緊湊型雷射平台

- 成長動力

- 成長潛力分析

- 監管格局

- 報銷場景

- 技術格局

- 當前的技術趨勢

- 新興技術

- 2024 年按產品類型分類的定價分析

- 差距分析

- 波特的分析

- PESTEL分析

- 未來市場趨勢

- 價值鏈分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲和中東和非洲

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品類型發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 飛秒雷射

- 二極體雷射

- 準分子雷射

- Nd:YAG雷射

- 其他產品類型

第6章:市場估計與預測:按技術,2021 - 2034 年

- 主要趨勢

- 光凝固

- 光破壞

- 消融

- 其他技術

第7章:市場估計與預測:按應用,2021 - 2034

- 主要趨勢

- 屈光不正矯正

- 白內障手術

- 糖尿病視網膜病變

- 青光眼

- 其他應用

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 眼科診所

- 門診手術中心

- 其他最終用途

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球參與者

- Alcon

- BAUSCH + LOMB

- Johnson & Johnson

- LUMENIS

- NIDEK

- ZEISS

- 區域參與者

- LIGHTMED

- LUMIBIRD MEDICAL

- Meridian Medical

- TOPCON Healthcare

- 新興玩家

- ARC LASER

- Glaukos

- IRIDEX

- Ziemer Ophthalmology

The global ophthalmic lasers market was valued at USD 1.8 billion in 2024 and is projected to grow from USD 1.9 billion in 2025 to USD 3.1 billion by 2034, at a CAGR of 5.9%, according to the latest report published by Global Market Insights, Inc. The market is experiencing significant growth with the growing incidence of vision disorders, the aging population, and technological advancements in laser systems for eye procedures.

Ophthalmic lasers have emerged as vital for the treatment of diseases like glaucoma, diabetic retinopathy, age-related macular degeneration (AMD), and refractive errors. Ophthalmic lasers are minimally invasive instruments that deliver precise and effective surgical treatments, and therefore are expected to show increased uptake over the next few years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $3.1 Billion |

| CAGR | 5.9% |

Key Drivers:

1. Rising incidences of eye diseases: Increasing numbers of cataracts, diabetic retinopathy, and glaucoma are favoring the demand for laser-based treatments.

2. Rise in refractive surgeries: Increased interest in LASIK and SMILE surgeries among young generations is driving the usage of femtosecond and excimer lasers.

3. Improved precision and safety of lasers: New ophthalmic lasers provide enhanced control, less thermal damage, and better post-op results, thus gaining traction among ophthalmologists.

4. Aging population: Age-related eye conditions are on the rise worldwide, particularly in high-income and middle-income nations.

Key Players:

- Alcon, Johnson & Johnson, ZEISS, LUMENIS, and NIDEK are some of the key players, together commanding 59.3% of the overall market.

- Alcon captured an 18.2% share of the ophthalmic lasers market in 2024.

Key Challenges:

- High cost of equipment: Ophthalmic lasers are expensive, which hinders their penetration in low-income healthcare facilities.

- Strict regulatory approvals: Device approval delays in various markets may limit launch schedules.

- Scarcity of skilled professionals: Specialized training is needed for the use of sophisticated laser systems, which is still an issue in rural and underdeveloped regions.

By Product Type - Femtosecond Lasers Dominate the Market

Femtosecond lasers led the product category in 2024 with their precision, minimal invasiveness, and efficacy in refractive and cataract surgeries. Their use in LASIK, SMILE, and corneal incisions is increasing rapidly due to the increasing patient interest in vision correction continues to rise worldwide.

By Technology - Photocoagulation witnessed widespread Adoption

The photocoagulation segment sustained a strong position in 2024, particularly because of the increasing usage in the treatment of diabetic retinopathy and retinal vein occlusions. The technology is preferred among retinal specialists as it offers long-term stabilization of vision-threatening disease.

By Application - Refractive Error Correction Remains in Focus

Refractive error correction dominated the market in 2024. Growing demand for permanent vision correction solutions to glasses and contact lenses is propelling the demand for laser-assisted procedures, especially in urban areas.

By End Use - Hospitals Captured the Biggest Share

Hospitals dominated the end-use segment in 2024. Hospital facilities have integrated eye care units, qualified surgeons, and high-tech laser equipment. They also offer reimbursement benefits and have the capacity to treat both elective and emergency ophthalmic surgeries.

North America was the biggest player in the global ophthalmic lasers market in 2024, driven by extensive use of advanced ophthalmic surgeries, high myopia and cataract rates, and the presence of prominent players. The U.S. remains at the forefront in terms of technology adoption, reimbursement schemes, and outpatient surgical facilities with sophisticated laser-based treatments.

Top players are exploring and executing new research and development, strategic partnerships, and new launches for competitive advantage. As an example, Alcon has recently built its portfolio with next-generation femtosecond lasers for cataract and corneal surgery. ZEISS and Johnson & Johnson are focused on artificial intelligence-guided laser platforms to improve surgical precision. Conversely, Lumenis and Glaukos aim to partner with eye clinics and hospitals to better support their distribution channels. BAUSCH + LOMB and NIDEK implement growth strategies focused on emerging markets by exploring local production and also training ophthalmologists. This will further global reach but also advance technology and improve patient care outcomes.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Technology trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of eye disorders

- 3.2.1.2 Growing demand for minimally invasive ophthalmic surgeries

- 3.2.1.3 Technological advancements in laser systems

- 3.2.1.4 Improved reimbursement landscape in developed markets

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of ophthalmic laser systems

- 3.2.2.2 Risk of postoperative complications and side effects

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging markets in Asia-Pacific, Latin America, and MEA

- 3.2.3.2 Portable and compact laser platforms for outreach programs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 MEA

- 3.5 Reimbursement scenario

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Pricing analysis, By product type, 2024

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

- 3.12 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LATAM and MEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Femtosecond lasers

- 5.3 Diode lasers

- 5.4 Excimer lasers

- 5.5 Nd:YAG lasers

- 5.6 Other product types

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Photocoagulation

- 6.3 Photodisruption

- 6.4 Ablation

- 6.5 Other technologies

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Refractive error correction

- 7.3 Cataract surgery

- 7.4 Diabetic retinopathy

- 7.5 Glaucoma

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ophthalmic clinics

- 8.4 Ambulatory surgical centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Alcon

- 10.1.2 BAUSCH + LOMB

- 10.1.3 Johnson & Johnson

- 10.1.4 LUMENIS

- 10.1.5 NIDEK

- 10.1.6 ZEISS

- 10.2 Regional Players

- 10.2.1 LIGHTMED

- 10.2.2 LUMIBIRD MEDICAL

- 10.2.3 Meridian Medical

- 10.2.4 TOPCON Healthcare

- 10.3 Emerging Players

- 10.3.1 A.R.C. LASER

- 10.3.2 Glaukos

- 10.3.3 IRIDEX

- 10.3.4 Ziemer Ophthalmology