|

市場調查報告書

商品編碼

1822536

區塊鏈供應鏈金融市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Blockchain In Supply Chain Finance Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

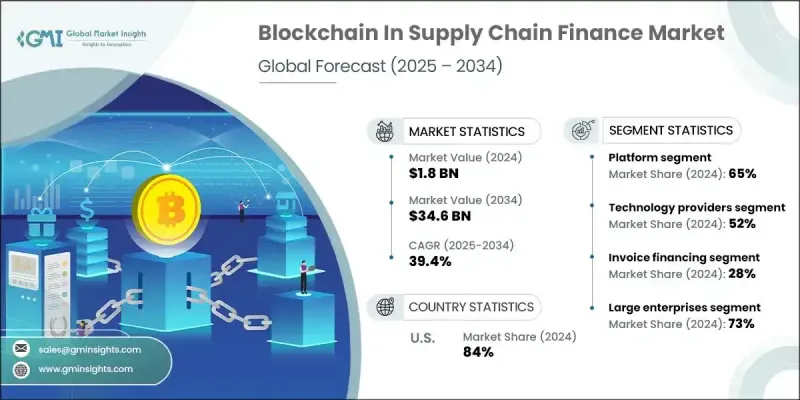

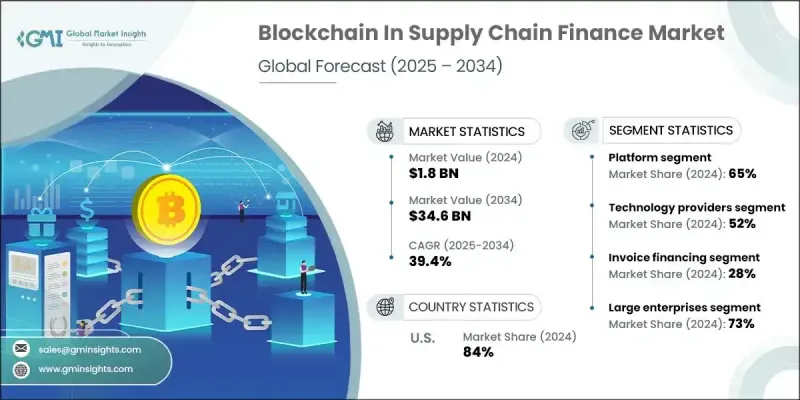

2024 年全球供應鏈金融區塊鏈市場價值為 18 億美元,預計到 2034 年將以 39.4% 的複合年成長率成長至 346 億美元。

專家們一致認為,區塊鏈正在透過簡化供應商付款、加速財務工作流程以及改變企業在供應鏈中管理營運資金的方式,迅速重塑貿易和物流的基礎。透過以自動化、可信賴的框架取代緩慢的紙本系統,區塊鏈可以提高可見性,最大限度地降低詐欺風險,並提升營運效率。市場領導者強調,透明度、安全性和即時功能不再是可有可無的——企業、物流公司、金融機構和最終客戶都期待它們。企業正在實施基於區塊鏈的金融解決方案,以降低成本、最佳化結算週期並消除不必要的風險。向即時數位交易的持續轉變,加上對安全、合規和可驗證流程的需求,正在推動市場的快速擴張。業內專業人士也表示,人工智慧增強分析、安全的帳本基礎設施和智慧合約自動化在推動全球供應鏈的這項變革中發揮著至關重要的作用,這使得區塊鏈成為貿易融資業務數位轉型的關鍵推動者。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 18億美元 |

| 預測值 | 346億美元 |

| 複合年成長率 | 39.4% |

2024年,平台細分市場佔據65%的市場佔有率,預計2025年至2034年的複合年成長率將達到40%。據行業領袖稱,該細分市場憑藉其在供應鏈金融領域提供透明、安全和自動化交易的能力,將繼續保持領先地位。區塊鏈平台支援智慧合約,實現即時資料訪問,並消除了手動文件檢查的需要,最終提高了準確性並消除了錯誤。高層強調,這些平台的去中心化特性可以減少延遲、限制資料篡改並確保交易驗證的一致性,所有這些對於維護複雜的全球供應鏈的完整性都至關重要。這些系統提供的可靠性和自動化使其成為尋求財務職能現代化並改善供應鏈網路內多利益相關方之間協作的企業的首選。

技術供應商細分市場佔了52%的佔有率,預計到2034年將以40%的複合年成長率成長。業內人士認為,這種主導地位得益於先進的區塊鏈基礎設施、人工智慧分析技術以及日益複雜的智慧合約系統的興起。科技公司正在加速開發端到端數位金融平台,以支援日益互聯的供應鏈中即時、安全且合規的交易。企業正在採用這些系統來確保可追溯性、提高合規性,並滿足監管機構和貿易夥伴對透明度的要求。這些解決方案正在北美、印度、中國和歐洲等地區廣泛部署,這些地區的企業都高度重視財務透明度和營運效率。

2024 年,美國供應鏈金融市場區塊鏈的產值達 6.063 億美元,佔有 84% 的市佔率。市場分析師指出,美國憑藉其完善的金融基礎設施、較高的數位化採用率以及擁有複雜供應鏈的跨國企業,成為該領域的領跑者。美國重視尖端研發、即時支付網路以及將人工智慧和智慧合約融入金融系統,從而鞏固了其在該領域的領導地位。專家表示,美國充滿活力的科技生態系統和成熟的金融機構為擴展基於區塊鏈的供應鏈金融解決方案創造了理想的環境。此外,美國企業正在利用區塊鏈技術來支援文件可追溯性、即時驗證和更快的對帳流程,同時以安全且有效率的方式滿足合規性要求。

塑造全球供應鏈金融區塊鏈市場的領先公司包括 ConsenSys、SAP SE、TradeIX、R3、Microsoft、Amazon Web Services 和 IBM。這些公司繼續利用創新技術推動該領域發展,這些技術可增強全球供應鏈的信任、可追溯性和自動化程度。為了鞏固其在供應鏈金融區塊鏈市場中的立足點,各公司正在部署多管齊下的策略。首先,他們正在大力投資建立專為全球貿易和金融量身定做的可擴展和可自訂的區塊鏈平台。其次,透過專注於將人工智慧和即時分析整合到這些平台中,公司正在提高自動化程度並降低營運複雜性。與物流公司、銀行和政府機構建立策略夥伴關係也是一個重點,以實現跨地區更廣泛的應用。此外,領先的參與者正在推動監管協調並開發符合行業標準的解決方案。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 對透明度和預防詐欺的需求日益成長

- 跨境貿易和全球化日益成長

- 採用智慧合約和自動化

- 與 AI、IoT 和 ERP 系統整合

- 政府和監管機構對數位金融的支持

- 產業陷阱與挑戰

- 實施和整合成本高

- 可擴展性和互通性問題

- 市場機會

- 區塊鏈平台中人工智慧和高級分析的整合

- 向貿易量不斷成長的新興市場擴張

- 金融機構與技術提供者之間的合作

- 永續性和 ESG 驅動的供應鏈融資

- 成長潛力分析

- 監管環境和合規框架

- 金融服務法規和區塊鏈

- 貿易融資法規和標準

- 跨境監管協調

- 合規技術與監理科技整合

- 供應鏈金融市場背景及演變

- 全球供應鏈金融市場動態

- 市場規模及成長趨勢分析

- 貿易融資缺口與營運資金挑戰

- 中小企業融資需求及進入障礙

- 跨境貿易的複雜性與文件

- 傳統供應鏈金融挑戰

- 手動流程和紙本文檔

- 缺乏透明度和可見性

- 交易對手風險與信用評估挑戰

- 結算延遲和營運效率低下

- 金融服務數位轉型

- 金融科技創新與顛覆

- 開放銀行和 API 整合

- 監管技術(Regtech)的採用

- 客戶體驗提升與數位化

- 供應鏈金融產品演進

- 發票融資和保理解決方案

- 採購訂單融資和出貨前融資

- 庫存融資和資產抵押貸款

- 貿易信用保險和風險緩解

- 全球供應鏈金融市場動態

- 區塊鏈技術基礎與架構

- 區塊鏈技術基礎與原理

- 分散式帳本技術(DLT)架構

- 共識機制與網路治理

- 加密安全性和哈希函數

- 智慧合約和自動執行

- 區塊鏈網路類型和部署模型

- 公共區塊鏈網路和特徵

- 私有區塊鏈網路與企業重點

- 聯盟區塊鏈網路與產業協作

- 混合區塊鏈解決方案和整合

- 企業區塊鏈平台架構

- Hyperledger 結構與企業功能

- R3 corda 與金融服務重點

- 以太坊企業與智慧合約功能

- 客製化區塊鏈開發和整合

- 區塊鏈整合和互通性

- 遺留系統整合和 API 連接

- 跨鏈互通性和協定標準

- Oracle 整合與外部資料來源

- 雲端基礎架構和可擴充性解決方案

- 區塊鏈技術基礎與原理

- 波特的分析

- PESTEL分析

- 技術平台架構和基礎設施

- 區塊鏈平台的選擇與設計

- 智慧合約開發與部署

- 整合架構和連接性

- 數據管理與分析

- 競爭情報和專利分析

- 專利格局與智慧財產權策略

- 區塊鏈金融專利申請趨勢

- 主要專利持有者和技術領導者

- 專利聚類和技術領域分析

- 專利許可和交叉許可協議

- 技術創新與研發投入

- 企業研發支出與創新重點

- 學術研究與大學合作

- 開源開發和社群貢獻

- 標準制定和行業參與

- 競爭技術定位與差異化

- 平台能力評估和基準測試

- 技術成熟度和準備度評估

- 競爭優勢與市場定位

- 合作夥伴策略和生態系統發展

- 創新生態系與協作網路

- 產業聯盟和工作小組

- 標準組織和協議開發

- 監理沙盒和創新計劃

- 跨產業合作與知識共享

- 專利格局與智慧財產權策略

- 供應鏈金融中的區塊鏈用例

- 貿易融資及跟單信用證

- 發票融資和保理

- 採購訂單和庫存融資

- 風險管理與合規

- 未來技術路線圖與創新時間表

- 區塊鏈技術演進(2024-2034)

- 下一代共識機制

- 抗量子密碼學整合

- 分片和第 2 層擴展解決方案

- 跨鏈互通性提升

- 供應鏈金融創新時間表

- 嵌入式金融與銀行即服務

- 人工智慧驅動的風險評估和核保

- 即時結算,即時支付

- 去中心化金融(DeFi)整合

- 技術融合與整合

- 人工智慧和機器學習增強

- 物聯網和供應鏈可視性整合

- 5G和邊緣運算最佳化

- 量子計算和高級密碼學

- 市場演變與顛覆情景

- 平台整合與生態系發展

- 監管協調和全球標準

- 新的商業模式和收入來源

- 產業轉型與競爭動態

- 區塊鏈技術演進(2024-2034)

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考慮

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 多邊環境協定

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依組成部分,2021 - 2034 年

- 主要趨勢

- 平台

- 服務

- 諮詢與顧問服務

- 整合和部署服務

- 支援和維護服務

第6章:市場估計與預測:依供應商分類,2021 年至 2034 年

- 主要趨勢

- 技術提供者

- 金融機構

- 供應鏈解決方案供應商

第7章:市場估計與預測:按應用,2021 - 2034

- 主要趨勢

- 發票融資

- 庫存融資

- 貿易和出口融資

- 動態折扣

- 保理與逆保理

第8章:市場估計與預測:依企業規模,2021 - 2034 年

- 主要趨勢

- 大型企業

- 中小型企業(SME)

第9章:市場估計與預測:依產業垂直,2021 - 2034

- 主要趨勢

- 製造業

- 零售與電子商務

- 食品和飲料

- 製藥和醫療保健

- 汽車

- 電子與技術

- 石油和天然氣

- 物流與運輸

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐人

- 俄羅斯

- 葡萄牙

- 克羅埃西亞

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 新加坡

- 泰國

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Blockchain platform leaders

- Amazon Web Services

- ConsenSys

- Hyperledger Foundation

- IBM

- Microsoft Corporation

- Oracle Corporation

- R3

- SAP SE

- Supply chain finance specialists

- Batavia

- Contour

- Finastra

- Komgo

- Taulia

- TradeIX

- TradeLens

- Voltron

- we.trade

- Financial services and banking leaders

- Bank of America

- BNP Paribas

- Deutsche Bank

- HSBC Holdings plc

- JPMorgan Chase & Co.

- Santander Group

- Standard Chartered Bank

- Wells Fargo

The Global Blockchain In Supply Chain Finance Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 39.4% to reach USD 34.6 billion by 2034.

Experts agreed that blockchain is rapidly reshaping the foundation of trade and logistics by streamlining supplier payments, accelerating financial workflows, and transforming how companies manage working capital across supply chains. By replacing slow, paper-based systems with automated, trust-enabled frameworks, blockchain delivers increased visibility, minimizes fraud risks, and enhances operational efficiency. Market leaders emphasized that transparency, security, and real-time functionality are no longer optional-they are expected by enterprises, logistics firms, financial institutions, and end customers alike. Businesses are implementing blockchain-based finance solutions to reduce costs, optimize settlement cycles, and eliminate unnecessary risks. The ongoing shift toward real-time digital transactions, paired with the need for secure, compliant, and verifiable processes, is driving rapid market expansion. Industry professionals also stated that AI-enhanced analytics, secure ledger infrastructures, and smart contract automation are playing a vital role in enabling this evolution across global supply chains, positioning blockchain as a critical enabler in the digital transformation of trade finance operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $34.6 Billion |

| CAGR | 39.4% |

In 2024, the platform segment accounted for a 65% share and is projected to register a CAGR of 40% from 2025 through 2034. According to industry leaders, this segment continues to lead due to its ability to offer transparent, secure, and automated transactions in supply chain finance. Blockchain platforms support smart contracts, enable real-time data access, and remove the need for manual document checks, ultimately improving accuracy and eliminating errors. Executives highlighted that the decentralized nature of these platforms reduces delays, limits data tampering, and ensures consistent transaction verification, all of which are crucial in maintaining the integrity of complex global supply chains. The reliability and automation provided by these systems make them a preferred choice for enterprises looking to modernize finance functions and improve collaboration across multiple stakeholders within the supply chain network.

The technology providers segment held a 52% share and is expected to grow at a CAGR of 40% through 2034. Industry stakeholders shared that this dominance is driven by the emergence of advanced blockchain infrastructure, AI-powered analytics, and increasingly sophisticated smart contract systems. Technology firms are accelerating the development of end-to-end digital finance platforms that support real-time, secure, and regulation-compliant transactions across increasingly interconnected supply chains. Businesses are adopting these systems to ensure traceability, improve compliance, and meet the transparency demands of regulators and trading partners alike. These solutions are being widely deployed across regions such as North America, India, China, and Europe, where companies are prioritizing financial transparency and operational efficiency.

United States Blockchain In Supply Chain Finance Market generated USD 606.3 million and held an 84% share in 2024. Market analysts noted that the U.S. has emerged as a frontrunner due to its sophisticated financial infrastructure, high digital adoption rates, and the presence of multinational enterprises with intricate supply chains. The nation's emphasis on cutting-edge R&D, real-time payment networks, and integration of AI and smart contracts into financial systems has propelled its leadership in this space. Experts explained that the country's dynamic tech ecosystem and established financial institutions are creating the perfect environment for scaling blockchain-based SCF solutions. Furthermore, businesses in the U.S. are leveraging blockchain technology to support document traceability, instant verification, and faster reconciliation processes while meeting compliance requirements in a secure and efficient manner.

The leading companies shaping the Global Blockchain In Supply Chain Finance Market include ConsenSys, SAP SE, TradeIX, R3, Microsoft, Amazon Web Services, and IBM. These companies continue to advance the field with innovative technologies that enhance trust, traceability, and automation across global supply chains. To strengthen their foothold in the Blockchain In Supply Chain Finance Market, companies are deploying multi-pronged strategies. First, they are investing heavily in building scalable and customizable blockchain platforms tailored for global trade and finance. Second, by focusing on the integration of AI and real-time analytics into these platforms, firms are enhancing automation and reducing operational complexity. Strategic partnerships with logistics firms, banks, and government bodies are also a key focus, enabling broader adoption across regions. Moreover, leading players are pushing for regulatory alignment and developing solutions that comply with industry standards.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Components

- 2.2.3 Providers

- 2.2.4 Application

- 2.2.5 Enterprise Size

- 2.2.6 Industry Vertical

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Rising need for transparency and fraud prevention

- 3.2.1.3 Increasing cross-border trade and globalization

- 3.2.1.4 Adoption of smart contracts and automation

- 3.2.1.5 Integration with AI, IoT, and ERP systems

- 3.2.1.6 Government and regulatory support for digital finance

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation and integration costs

- 3.2.2.2 Scalability and interoperability issues

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI and advanced analytics in blockchain platforms

- 3.2.3.2 Expansion into emerging markets with growing trade volumes

- 3.2.3.3 Partnerships between financial institutions and technology providers

- 3.2.3.4 Sustainability and ESG-driven supply chain financing

- 3.3 Growth potential analysis

- 3.4 Regulatory environment and compliance framework

- 3.4.1 Financial services regulations and blockchain

- 3.4.2 Trade finance regulations and standards

- 3.4.3 Cross-border regulatory harmonization

- 3.4.4 Compliance technology and regtech integration

- 3.5 Supply chain finance market context and evolution

- 3.5.1 Global supply chain finance market dynamics

- 3.5.1.1 Market size and growth trends analysis

- 3.5.1.2 Trade finance gap and working capital challenges

- 3.5.1.3 Sme financing needs and access barriers

- 3.5.1.4 Cross-border trade complexity and documentation

- 3.5.2 Traditional supply chain finance challenges

- 3.5.2.1 Manual processes and paper-based documentation

- 3.5.2.2 Lack of transparency and visibility

- 3.5.2.3 Counterparty risk and credit assessment challenges

- 3.5.2.4 Settlement delays and operational inefficiencies

- 3.5.3 Digital transformation in financial services

- 3.5.3.1 Fintech innovation and disruption

- 3.5.3.2 Open banking and API integration

- 3.5.3.3 Regulatory technology (Regtech) adoption

- 3.5.3.4 Customer experience enhancement and digitalization

- 3.5.4 Supply chain finance product evolution

- 3.5.4.1 Invoice financing and factoring solutions

- 3.5.4.2 Purchase order financing and pre-shipment finance

- 3.5.4.3 Inventory financing and asset-based lending

- 3.5.4.4 Trade credit insurance and risk mitigation

- 3.5.1 Global supply chain finance market dynamics

- 3.6 Blockchain technology foundation and architecture

- 3.6.1 Blockchain technology fundamentals and principles

- 3.6.1.1 Distributed ledger technology (DLT) architecture

- 3.6.1.2 Consensus mechanisms and network governance

- 3.6.1.3 Cryptographic security and hash functions

- 3.6.1.4 Smart contracts and automated execution

- 3.6.2 Blockchain network types and deployment models

- 3.6.2.1 Public blockchain networks and characteristics

- 3.6.2.2 Private blockchain networks and enterprise focus

- 3.6.2.3 Consortium blockchain networks and industry collaboration

- 3.6.2.4 Hybrid blockchain solutions and integration

- 3.6.3 Enterprise blockchain platform architecture

- 3.6.4 Hyperledger fabric and enterprise features

- 3.6.5 R3 corda and financial services focus

- 3.6.6 Ethereum enterprise and smart contract capabilities

- 3.6.7 Custom blockchain development and integration

- 3.6.8 Blockchain integration and interoperability

- 3.6.8.1 Legacy system integration and API connectivity

- 3.6.8.2 Cross-chain interoperability and protocol standards

- 3.6.8.3 Oracle integration and external data sources

- 3.6.8.4 Cloud infrastructure and scalability solutions

- 3.6.1 Blockchain technology fundamentals and principles

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Technology platform architecture and infrastructure

- 3.9.1 Blockchain platform selection and design

- 3.9.2 Smart contract development and deployment

- 3.9.3 Integration architecture and connectivity

- 3.9.4 Data management and analytics

- 3.10 Competitive intelligence and patent analysis

- 3.10.1 Patent landscape and intellectual property strategy

- 3.10.1.1 Blockchain in finance patent filing trends

- 3.10.1.2 Key patent holders and technology leaders

- 3.10.1.3 Patent clustering and technology domain analysis

- 3.10.1.4 Patent licensing and cross-licensing agreements

- 3.10.2 Technology innovation and R&D investment

- 3.10.2.1 Corporate R&D spending and innovation focus

- 3.10.2.2 Academic research and university collaboration

- 3.10.2.3 Open-source development and community contribution

- 3.10.2.4 Standards development and industry participation

- 3.10.3 Competitive technology positioning and differentiation

- 3.10.3.1 Platform capability assessment and benchmarking

- 3.10.3.2 Technology maturity and readiness evaluation

- 3.10.3.3 Competitive advantage and market positioning

- 3.10.3.4 Partnership strategy and ecosystem development

- 3.10.4 Innovation ecosystem and collaboration networks

- 3.10.4.1 Industry consortium and working groups

- 3.10.4.2 Standards organizations and protocol development

- 3.10.4.3 Regulatory sandbox and innovation programs

- 3.10.4.4 Cross-industry collaboration and knowledge sharing

- 3.10.1 Patent landscape and intellectual property strategy

- 3.11 Blockchain use cases in supply chain finance

- 3.11.1 Trade finance and documentary credit

- 3.11.2 Invoice financing and factoring

- 3.11.3 Purchase order and inventory financing

- 3.11.4 Risk management and compliance

- 3.12 Future technology roadmap and innovation timeline

- 3.12.1 Blockchain technology evolution (2024-2034)

- 3.12.1.1 Next-generation consensus mechanisms

- 3.12.1.2 Quantum-resistant cryptography integration

- 3.12.1.3 Sharding and layer 2 scaling solutions

- 3.12.1.4 Cross-chain interoperability advancement

- 3.12.2 Supply chain finance innovation timeline

- 3.12.2.1 Embedded finance and banking-as-a-service

- 3.12.2.2 AI-Powered risk assessment and underwriting

- 3.12.2.3 Real-time settlement and instant payments

- 3.12.2.4 Decentralized finance (DeFi) integration

- 3.12.3 Technology convergence and integration

- 3.12.3.1 AI and machine learning enhancement

- 3.12.3.2 IoT and supply chain visibility integration

- 3.12.3.3 5G and edge computing optimization

- 3.12.3.4 Quantum computing and advanced cryptography

- 3.12.4 Market evolution and disruption scenarios

- 3.12.4.1 Platform consolidation and ecosystem development

- 3.12.4.2 Regulatory harmonization and global standards

- 3.12.4.3 New business models and revenue streams

- 3.12.4.4 Industry transformation and competitive dynamics

- 3.12.1 Blockchain technology evolution (2024-2034)

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.13.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Components, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Platform

- 5.3 Services

- 5.3.1 Consulting & advisory services

- 5.3.2 Integration & deployment services

- 5.3.3 Support & maintenance services

Chapter 6 Market Estimates & Forecast, By Providers, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Technology providers

- 6.3 Financial institutions

- 6.4 Supply chain solution providers

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Invoice financing

- 7.3 Inventory financing

- 7.4 Trade & export finance

- 7.5 Dynamic discounting

- 7.6 Factoring & reverse factoring

Chapter 8 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Large enterprises

- 8.3 Small & medium enterprises (SMEs)

Chapter 9 Market Estimates & Forecast, By Industry Vertical, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 Manufacturing

- 9.3 Retail & e-commerce

- 9.4 Food & beverages

- 9.5 Pharmaceuticals & healthcare

- 9.6 Automotive

- 9.7 Electronics & technology

- 9.8 Oil & gas

- 9.9 Logistics & transportation

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.3.8 Portugal

- 10.3.9 Croatia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Blockchain platform leaders

- 11.1.1 Amazon Web Services

- 11.1.2 ConsenSys

- 11.1.3 Hyperledger Foundation

- 11.1.4 IBM

- 11.1.5 Microsoft Corporation

- 11.1.6 Oracle Corporation

- 11.1.7 R3

- 11.1.8 SAP SE

- 11.2 Supply chain finance specialists

- 11.2.1 Batavia

- 11.2.2 Contour

- 11.2.3 Finastra

- 11.2.4 Komgo

- 11.2.5 Taulia

- 11.2.6 TradeIX

- 11.2.7 TradeLens

- 11.2.8 Voltron

- 11.2.9 we.trade

- 11.3 Financial services and banking leaders

- 11.3.1 Bank of America

- 11.3.2 BNP Paribas

- 11.3.3 Deutsche Bank

- 11.3.4 HSBC Holdings plc

- 11.3.5 JPMorgan Chase & Co.

- 11.3.6 Santander Group

- 11.3.7 Standard Chartered Bank

- 11.3.8 Wells Fargo