|

市場調查報告書

商品編碼

1801949

自動乳房超音波系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automated Breast Ultrasound Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

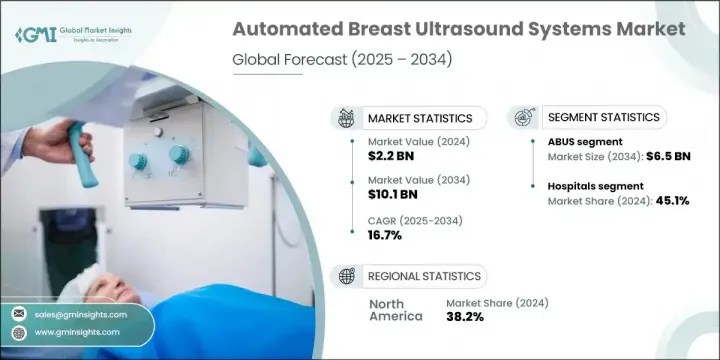

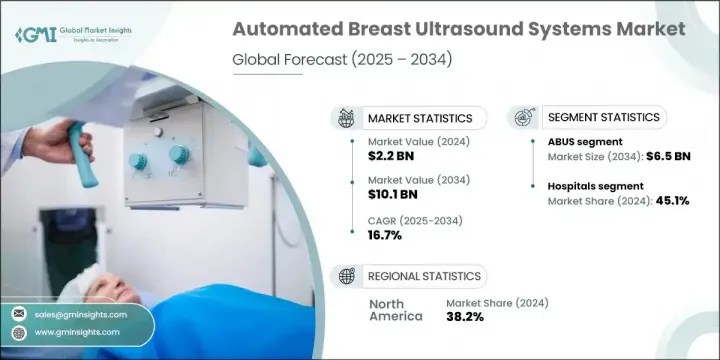

2024年,全球自動乳房超音波系統市場規模達22億美元,預估年複合成長率達16.7%,2034年將達101億美元。全球乳癌發生率的上升、對早期發現的日益重視、公共衛生意識的增強以及政府支持的篩檢計劃是推動該市場發展的核心因素。隨著醫學影像和診斷技術的快速發展,自動乳房超音波系統正逐漸成為乳癌篩檢的重要工具,尤其對於乳房組織緻密的女性而言。

自動乳房超音波系統 (ABUS) 提供先進的全乳房 3D 視覺化技術,無需過度依賴操作人員的技能即可提供一致且標準化的影像。由於其能夠提高檢測準確性,ABUS 在醫院、影像中心和專業乳房護理機構中的應用正在迅速增加。透過擷取跨組織層的高解析度影像,這些系統可支援早期診斷並改善患者預後。隨著醫療機構持續重視早期癌症的識別,ABUS 與其他影像方法的整合變得更加重要。對密集乳房篩檢和 AI 增強診斷的關注預計將推動全球範圍內的需求和應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 22億美元 |

| 預測值 | 101億美元 |

| 複合年成長率 | 16.7% |

2024年,ABUS類別的市場價值最高,達到14億美元,預計到2034年將達到65億美元,複合年成長率為16.9%。其市場領先地位源於對人工智慧診斷日益成長的需求、人們對乳癌風險的認知不斷加深,以及這些系統在醫療保健環境中用於全面篩檢和詳細分析的日益普及。 ABUS提供完整的3D乳房影像,使放射科醫生能夠識別傳統乳房X光檢查可能被忽視的異常。其高清晰度減少了人為錯誤,標準化使其成為乳房結構緻密患者乳癌檢測的關鍵工具。

2024年,醫院領域佔了45.1%的佔有率。這些機構配備了先進的診斷技術,並擁有熟練的專業人員,使其成為ABUS的領先應用者。作為癌症篩檢、診斷和治療的中心樞紐,醫院處理大量患者,並受益於公共衛生篩檢項目,這進一步推動了自動化超音波系統的使用。將ABUS整合到更廣泛的診斷工作流程中,使醫療保健提供者能夠提供更全面、更有效率的乳房護理服務。

2024年,美國自動乳房超音波系統市場規模達7.583億美元。這一成長與美國乳癌發病率的上升密切相關,這導致對精準早期診斷工具的需求激增。此外,美國醫療保健生態系統也受益於良好的監管環境、廣泛的癌症篩檢公眾教育以及對醫療技術創新的大力投入。這些因素為ABUS的普及和持續的市場擴張奠定了堅實的基礎。

活躍於全球自動乳腺超音波系統市場的關鍵公司包括西門子醫療、SonoCine, Inc.、Canon、通用電氣醫療、Real Imaging、Seno Medical Instruments Inc.、Hologic、Supersonic Imagine、汕頭超音波儀器研究所、Theraclion、Metritrack、QView Medical、Delphinus Medical Technologies、汕頭超音波儀器研究所、Theraclion、Metritrack、QView Medical、Delphinus Medical Technologies、Rayape 和在自動乳房超音波系統市場營運的公司正在透過創新、全球擴張和合作夥伴關係的結合來加強其影響力。領先的公司正在大力投資研發,以提高影像品質、縮短掃描時間並整合基於人工智慧的解釋工具。為了滿足已開發市場和新興市場日益成長的需求,製造商正在擴大其分銷網路並與醫院和診斷連鎖店建立策略聯盟。許多公司正在努力獲得更快的監管部門批准,以加快產品推出,尤其是在高負擔地區。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 全球乳癌發生率不斷上升

- 自動乳腺超音波系統的技術進步日新月異

- 乳房 X 光攝影對緻密型乳房組織患者的療效有限

- 乳癌意識的提高和政府的積極舉措

- 全球範圍內增加國家乳癌篩檢項目

- 美國乳房超音波和數位乳房斷層合成檢查的報銷增加

- 產業陷阱與挑戰

- 自動乳房超音波系統成本高

- 發展中國家對ABUS的認知有限

- 新興國家缺乏熟練或訓練有素的人才

- 市場機會

- 人工智慧整合的 ABUS 在乳癌預測篩檢的應用日益增多

- 成長動力

- 成長潛力分析

- 監管格局

- 技術進步

- 當前的技術趨勢

- 新興技術

- 供應鏈分析

- 2024年定價分析

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 自動乳房超音波系統(ABUS)

- 自動乳腺體積掃描儀(ABVS)

- 其他產品

第6章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 診斷影像中心

- 專科診所

第7章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第8章:公司簡介

- Canon

- CapeRay Medical

- Delphinus Medical Technologies

- GE Healthcare

- Hitachi

- Hologic

- Koninklijke Philips

- Metritrack

- QView Medical

- Real Imaging

- SonoCine, Inc.

- Supersonic Imagine

- Siemens Healthineers

- Seno Medical Instruments Inc.

- Shantou Institute of Ultrasonic Instruments

- Theraclion

The Global Automated Breast Ultrasound Systems Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 16.7% to reach USD 10.1 billion by 2034. Rising breast cancer rates across the globe, growing emphasis on early detection, strong public health awareness, and government-backed screening initiatives are among the core factors driving this market forward. With rapid advances in medical imaging and diagnostic technology, automated breast ultrasound systems are gaining ground as essential tools in breast cancer screening, especially among women with dense breast tissue.

Automated breast ultrasound systems, or ABUS, offer advanced 3D visualization of the entire breast, providing consistent and standardized imaging without relying heavily on the skill of the operator. Their implementation is rapidly increasing in hospitals, imaging centers, and specialized breast care facilities due to their ability to enhance detection accuracy. By capturing high-resolution images across tissue layers, these systems support early diagnosis and improve patient outcomes. As health organizations continue prioritizing early-stage cancer identification, the integration of ABUS alongside other imaging methods becomes even more important. The focus on dense breast screening and AI-enhanced diagnostics is expected to drive demand and adoption worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $10.1 Billion |

| CAGR | 16.7% |

In 2024, the ABUS category held the largest market value at USD 1.4 billion and will reach USD 6.5 billion by 2034, growing at a CAGR of 16.9%. Its leadership in the market stems from increasing demand for AI-powered diagnostics, wider awareness of breast cancer risks, and the growing use of these systems across healthcare environments for thorough screening and detailed analysis. ABUS delivers full 3D breast imaging, enabling radiologists to identify abnormalities that may go unnoticed with conventional mammography. Its high clarity reduced human error, and standardization has made it a key asset in breast cancer detection for patients with dense breast composition.

The hospitals segment held a 45.1% share in 2024. These facilities are equipped with advanced diagnostic technology and have access to skilled professionals, making them leading adopters of ABUS. As central hubs for cancer screening, diagnosis, and treatment, hospitals handle high patient volumes and benefit from public health screening programs, further promoting the use of automated ultrasound systems. The integration of ABUS into broader diagnostic workflows allows healthcare providers to offer more complete and efficient breast care services.

United States Automated Breast Ultrasound Systems Market reached USD 758.3 million in 2024. This growth is closely tied to the increasing incidence of breast cancer across the country, which has led to a surge in demand for precise, early-stage diagnostic tools. The U.S. healthcare ecosystem also benefits from a favorable regulatory environment, widespread public education on cancer screening, and strong investments in medical technology innovation. These factors create a solid foundation for ABUS adoption and continued market expansion.

Key companies active in the Global Automated Breast Ultrasound Systems Market include Siemens Healthineers, SonoCine, Inc., Canon, GE Healthcare, Real Imaging, Seno Medical Instruments Inc., Hologic, Supersonic Imagine, Shantou Institute of Ultrasonic Instruments, Theraclion, Metritrack, QView Medical, Delphinus Medical Technologies, Koninklijke Philips, CapeRay Medical, and Hitachi. Companies operating in the automated breast ultrasound systems market are strengthening their presence through a combination of innovation, global expansion, and collaborative partnerships. Leading players are heavily investing in R&D to enhance image quality, reduce scan time, and integrate AI-based interpretation tools. To meet increasing demand in both developed and emerging markets, manufacturers are expanding their distribution networks and entering strategic alliances with hospitals and diagnostic chains. Many firms are working on gaining faster regulatory approvals to accelerate product rollouts, especially in high-burden regions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of breast cancer worldwide

- 3.2.1.2 Rising technological advancements in automated breast ultrasound systems

- 3.2.1.3 Limited capability of mammography in dense breast tissue patients

- 3.2.1.4 Rising awareness and favorable government initiatives regarding breast cancer

- 3.2.1.5 Increasing national breast screening programs across the globe

- 3.2.1.6 Increased reimbursement for breast ultrasound and digital breast tomosynthesis in the U.S.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of the automated breast ultrasound system

- 3.2.2.2 Limited awareness of ABUS in developing countries

- 3.2.2.3 Lack of skilled or trained personnel in emerging nations

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption of AI-integrated ABUS for predictive breast cancer screening

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Automated breast ultrasound system (ABUS)

- 5.3 Automated breast volume scanner (ABVS)

- 5.4 Other products

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Diagnostic imaging centers

- 6.4 Specialty clinics

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Canon

- 8.2 CapeRay Medical

- 8.3 Delphinus Medical Technologies

- 8.4 GE Healthcare

- 8.5 Hitachi

- 8.6 Hologic

- 8.7 Koninklijke Philips

- 8.8 Metritrack

- 8.9 QView Medical

- 8.10 Real Imaging

- 8.11 SonoCine, Inc.

- 8.12 Supersonic Imagine

- 8.13 Siemens Healthineers

- 8.14 Seno Medical Instruments Inc.

- 8.15 Shantou Institute of Ultrasonic Instruments

- 8.16 Theraclion