|

市場調查報告書

商品編碼

1801943

硬式內視鏡市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Rigid Endoscopes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

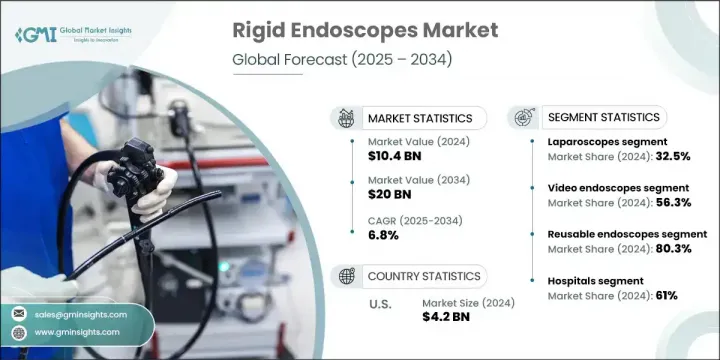

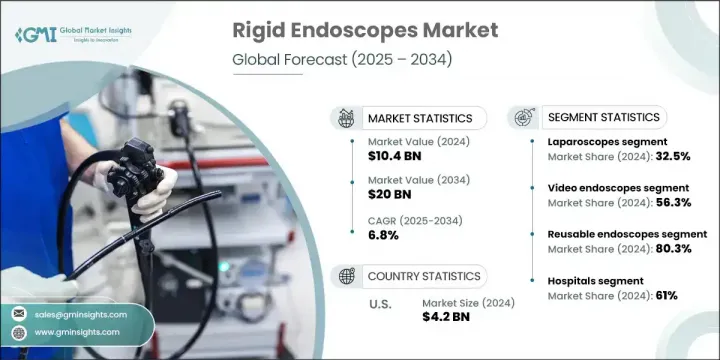

2024 年全球硬性內視鏡市場規模達 104 億美元,預計到 2034 年將以 6.8% 的複合年成長率成長至 200 億美元。市場擴張的主要驅動力是慢性病發病率上升和全球人口老化。硬式內視鏡對於執行微創手術至關重要,有助於診斷和治療各種疾病,包括呼吸系統併發症、消化系統疾病和耳鼻喉疾病。這些設備可提供清晰的影像,廣泛應用於涉及腹腔、關節、生殖系統和膀胱的手術。由於恢復速度更快、併發症更少、住院時間更短,患者對微創技術的偏好日益增加,這對刺激需求發揮至關重要的作用。此外,高清影像和手術導航工具的不斷進步進一步鞏固了其在門診和住院護理中的應用。

2024 年,腹腔鏡類別的佔有率將達到 32.5%,這得益於膽囊切除術、疝氣修補術和婦科手術等可最大程度減輕術後疼痛并縮短住院時間的手術的日益普及。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 104億美元 |

| 預測值 | 200億美元 |

| 複合年成長率 | 6.8% |

2024年,視訊內視鏡市場佔據56.3%的市場佔有率,這得益於其提供即時高清可視化的能力,從而提高了手術精度和臨床記錄能力。這些工具還能促進手術過程中的團隊合作,因此在外科部門備受青睞。

2024年,美國硬式內視鏡市場規模達42億美元,這得益於強大的醫療基礎設施和微創手術技術的廣泛應用。完善的報銷框架、日益成長的老齡人口以及早期診斷篩檢的普及,持續支撐著該地區硬性內視鏡市場的需求。不斷成長的手術量、先進的影像創新以及全國對門診手術的重視,共同支撐著這一成長勢頭。美國領先的製造商和醫療技術創新者也正在向內視鏡研發和自動化領域投入大量資金。

影響硬式內視鏡市場格局的頂級參與者包括 Stryker、Olympus Corporation、Richard Wolf、Karl Storz、Smith & Nephew、Fujifilm、Scholly Fiberoptic、Arthrex、PENTAX Medical、ConMed、B. Braun、Henke-Sass、Wolf、Cook Medical、XION GmbH、Boston Scient 和 Am硬性內視鏡市場公司採用的關鍵策略包括透過人工智慧輔助成像、人體工學儀器設計和整合視訊系統來推進產品創新,以提高手術精度。合併、策略合作和收購是擴大產品組合和進入尚未開發的地理區域的常見方式。參與者正在大力投資研發,以增強微創平台並探索機器人內視鏡技術。許多公司也正在加強售後服務網路並參與醫生培訓計劃以推動採用。與外科中心和機構的合作支持早期臨床採用並提高全球市場滲透率。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 慢性病盛行率不斷上升

- 技術進步

- 微創手術的採用率不斷上升

- 不斷增強的健康意識和對早期診斷的需求

- 產業陷阱與挑戰

- 設備成本高

- 患者不適和手術限制的風險

- 市場機會

- 門診及流動手術中心(ASC)的擴建

- 醫療基礎設施不斷改善的新興市場

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 技術格局

- 當前的技術趨勢

- 新興技術

- 報銷場景

- 2024年定價分析

- 未來市場趨勢

- 市場進入策略

- 管道分析

- 差距分析

- 波特的分析

- PESTEL分析

- 價值鏈分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 腹腔鏡

- 關節鏡

- 膀胱鏡

- 耳鼻喉內視鏡

- 支氣管鏡

- 輸尿管鏡

- 子宮腔鏡

- 其他產品類型

第6章:市場估計與預測:按技術,2021 - 2034 年

- 主要趨勢

- 傳統內視鏡

- 視訊內視鏡

- 光纖內視鏡

第7章:市場估計與預測:按可用性,2021 - 2034 年

- 主要趨勢

- 可重複使用的內視鏡

- 免洗內視鏡

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 其他最終用途

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Ambu

- Arthrex

- B. Braun

- Boston Scientific

- ConMed

- Cook

- Fujifilm

- Henke-Sass Wolf

- Olympus

- PENTAX Medical

- Richard Wolf

- Scholly Fiberoptic

- Smith & Nephew

- Storz

- Stryker

- XION medical

The Global Rigid Endoscopes Market was valued at USD 10.4 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 20 billion by 2034. Market expansion is largely driven by the rising incidence of chronic health issues and an aging global population. Rigid endoscopes are essential for performing minimally invasive procedures that aid in diagnosing and treating a wide range of conditions, including respiratory complications, digestive system ailments, and ENT disorders. These devices deliver crystal-clear imaging and are widely applied in surgeries involving the abdominal cavity, joints, reproductive system, and urinary bladder. Increasing patient preference for minimally invasive techniques-because of faster recovery, fewer complications, and lower hospitalization times-is playing a vital role in boosting demand. Additionally, ongoing advancements in high-definition imaging and surgical navigation tools further reinforce their adoption in both outpatient and inpatient care.

The laparoscopes category held 32.5% share in 2024, fueled by the expanding popularity of procedures like gallbladder removal, hernia repair, and gynecological surgeries that minimize post-operative pain and shorten hospital stays.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.4 Billion |

| Forecast Value | $20 Billion |

| CAGR | 6.8% |

The video endoscopes segment held 56.3% share in 2024, driven by their ability to deliver real-time, high-definition visualization, which enhances surgical precision and clinical documentation. These tools also facilitate team collaboration during operations, making them highly preferred across surgical departments.

U.S. Rigid Endoscopes Market generated USD 4.2 billion in 2024, supported by robust healthcare infrastructure and wide-scale adoption of minimally invasive surgical techniques. Strong reimbursement frameworks, a growing elderly population, and an uptick in early diagnostic screenings continue to bolster regional demand. Rising surgical volumes, advanced imaging innovations, and a focus on outpatient procedures across the country are sustaining this momentum. Leading manufacturers and medtech innovators in the U.S. are also channeling substantial investments into endoscopic R&D and automation.

Top players shaping the Rigid Endoscopes Market landscape include Stryker, Olympus Corporation, Richard Wolf, Karl Storz, Smith & Nephew, Fujifilm, Scholly Fiberoptic, Arthrex, PENTAX Medical, ConMed, B. Braun, Henke-Sass, Wolf, Cook Medical, XION GmbH, Boston Scientific, and Ambu A/S. Key strategies adopted by companies in the rigid endoscopes market include advancing product innovation through AI-assisted imaging, ergonomic instrument design, and integrated video systems to improve surgical precision. Mergers, strategic partnerships, and acquisitions are common to expand product portfolios and enter untapped geographic areas. Players are heavily investing in R&D to enhance minimally invasive platforms and explore robotic endoscopic technologies. Many are also strengthening after-sales service networks and engaging in physician training programs to drive adoption. Collaborations with surgical centers and institutions support early clinical adoption and increase market penetration globally.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Technology trends

- 2.2.3 Usability trends

- 2.2.4 End use trends

- 2.2.5 Region trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of chronic conditions

- 3.2.1.2 Technological advancements

- 3.2.1.3 Rising adoption of minimally invasive surgeries

- 3.2.1.4 Increasing health awareness and demand for early-stage diagnosis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High device cost

- 3.2.2.2 Risk of patient discomfort and procedural limitations

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of outpatient and ambulatory surgical centers (ASCs)

- 3.2.3.2 Emerging markets with improving healthcare infrastructure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Reimbursement scenario

- 3.7 Pricing analysis, 2024

- 3.7.1 North America

- 3.7.2 Europe

- 3.7.3 Asia Pacific

- 3.7.4 Latin America

- 3.7.5 Middle East and Africa

- 3.8 Future market trends

- 3.9 Go-to-market strategy

- 3.10 Pipeline analysis

- 3.11 Gap analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

- 3.14 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 Latin America

- 4.3.6 MEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn and Units)

- 5.1 Key trends

- 5.2 Laparoscopes

- 5.3 Arthroscopes

- 5.4 Cystoscopes

- 5.5 ENT endoscopes

- 5.6 Bronchoscopes

- 5.7 Ureteroscopes

- 5.8 Hysteroscopes

- 5.9 Other product types

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Conventional endoscopes

- 6.3 Video endoscopes

- 6.4 Fiber-optic endoscopes

Chapter 7 Market Estimates and Forecast, By Usability, 2021 - 2034 ($ Mn and Units)

- 7.1 Key trends

- 7.2 Reusable endoscopes

- 7.3 Disposable endoscopes

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn and Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Ambu

- 10.2 Arthrex

- 10.3 B. Braun

- 10.4 Boston Scientific

- 10.5 ConMed

- 10.6 Cook

- 10.7 Fujifilm

- 10.8 Henke-Sass Wolf

- 10.9 Olympus

- 10.10 PENTAX Medical

- 10.11 Richard Wolf

- 10.12 Scholly Fiberoptic

- 10.13 Smith & Nephew

- 10.14 Storz

- 10.15 Stryker

- 10.16 XION medical