|

市場調查報告書

商品編碼

1801942

同步發電機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Synchronous Generator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

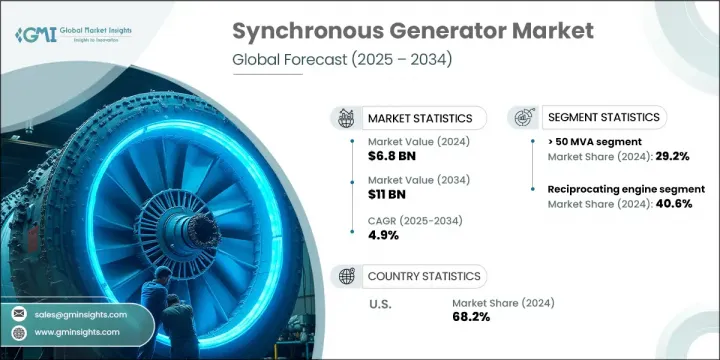

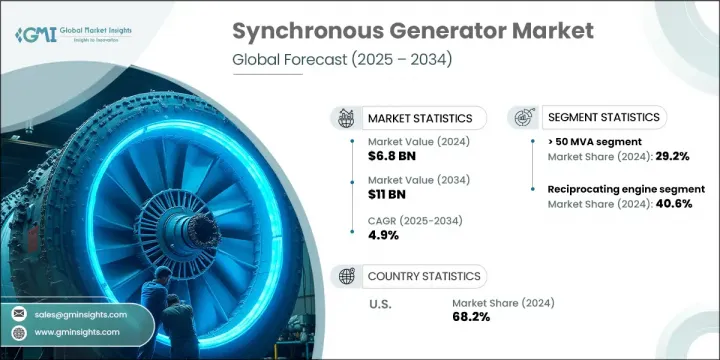

2024年,全球同步發電機市場規模達68億美元,預計2034年將以4.9%的複合年成長率成長,達到110億美元。對節能技術的日益重視以及對高性能、可靠電力基礎設施日益成長的需求是推動市場擴張的關鍵因素。再生能源專案的成長,加上絕緣和材料科學的進步,持續塑造該產業的發展。同步發電機是現代電力系統不可或缺的一部分,提供穩定的電壓和頻率,以支援電網的穩定性。它們的應用正變得越來越多樣化,從傳統的備用電源擴展到分散式和尖峰負載能源系統中的主動元件。

隨著全球電力需求激增,配備物聯網功能的智慧發電機系統的整合正在改變營運模式。這些新一代發電機支援遠端診斷、預測性維護和能源最佳化——所有這些在現代能源框架中都至關重要。人們對能源可靠性日益成長的擔憂,加上老化基礎設施的升級和電網中斷頻率的上升,也加速了這些系統的採用。對永續性和法規遵循的日益重視,推動了設計、控制功能和智慧連接方面的創新,使這些機器在更廣泛的行業和應用中成為不可或缺的一部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 68億美元 |

| 預測值 | 110億美元 |

| 複合年成長率 | 4.9% |

發電機細分市場在2024年佔據40.6%的市場佔有率,預計到2034年將以超過4.5%的複合年成長率成長。發電機性能強勁、維護簡便、輸出可靠,使其成為各種營運場景的理想選擇。此細分市場的持續相關性在於其適應性強,並具有成本效益,可滿足各種最終用戶的需求。

預計到2034年,額定功率小於等於5 MVA的機組將以5%的複合年成長率成長,這得益於其在分散式電力系統、備用系統以及中小型工業應用中日益成長的使用。智慧控制系統、升級的冷卻功能和遠端監控介面等增強功能正在幫助其在現代電力生態系統中發揮更大的作用。

2024年,亞太同步發電機市場佔37.5%的市佔率。工業活動的加速發展,加上對能源發電基礎設施的大規模投資,正在推動該地區的成長。向分散式發電和智慧微電網的轉變正在進一步增強成長動力,尤其是在地方政府推出需量反應計畫並投資於電網彈性建設的情況下。

全球同步發電機市場的主要參與者包括 TMEIC、POWERTEC GENERATOR SYSTEM、西門子能源、明電舍、臥龍電氣集團、ABB、Alconz、PARTZSCH 集團、施耐德電機、WEG、TD Power Systems、EvoTec Power Generation、Ingeteam、Marelli Motori、Elin Motoren、GEN、EvoTec Power Gene、Ingeteam、Marelli Motori、Eliner Motor ELEKTROMOTOREN、Ansaldo Energia、Koncar、CG Power & Industrial Solutions 和 Mecc Alte。同步發電機市場的領先公司正在大力投資先進產品開發,旨在透過智慧連接和物聯網系統實現數位轉型。許多公司正在透過加強本地生產能力和服務網路來擴大其地理覆蓋範圍,尤其是在高成長市場。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 原料可用性和採購分析

- 製造能力評估

- 供應鏈彈性和風險因素

- 配電網路分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL分析

- 同步發電機成本結構分析

- 新興機會和趨勢

- 利用物聯網技術進行數位轉型

- 投資分析及未來展望

第4章:競爭格局

- 介紹

- 按地區分析公司市場佔有率

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 戰略儀表板

- 策略舉措

- 重要夥伴關係與合作

- 重大併購活動

- 產品創新與發布

- 市場擴張策略

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:依主要推動因素,2021 - 2034 年

- 主要趨勢

- 瓦斯渦輪機

- 蒸汽渦輪機

- 往復式引擎

- 其他

第6章:市場規模及預測:依階段,2021 - 2034

- 主要趨勢

- 單相

- 三相

第7章:市場規模及預測:依功率等級,2021 - 2034

- 主要趨勢

- ≤5兆伏安

- > 5 兆伏安 - 15 兆伏安

- > 15 兆伏安 - 30 兆伏安

- > 30 兆伏安 - 50 兆伏安

- > 50 兆伏安

第 8 章:市場規模與預測:按應用,2021 - 2034 年

- 主要趨勢

- 工業的

- 公用事業

第9章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 俄羅斯

- 英國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 紐西蘭

- 馬來西亞

- 印尼

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 埃及

- 南非

- 奈及利亞

- 土耳其

- 約旦

- 拉丁美洲

- 巴西

- 秘魯

- 智利

- 阿根廷

第10章:公司簡介

- ABB

- Alconza

- ANDRITZ

- Ansaldo Energia

- CG Power & Industrial Solutions

- Elin Motoren

- EvoTec Power Generation

- GE Vernova

- Ingeteam

- Jeumont Electric

- Koncar

- Marelli Motori

- Mecc Alte

- Meidensha Corporation

- MENZEL ELEKTROMOTOREN

- Nidec

- PARTZSCH Group

- POWERTEC GENERATOR SYSTEM

- Schneider Electric

- Siemens Energy

- TD Power Systems

- TMEIC

- WEG

- Wolong Electric Group

The Global Synchronous Generator Market was valued at USD 6.8 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 11 billion by 2034. Increasing emphasis on energy-efficient technologies and the rising need for high-performance, reliable power infrastructure are key factors fueling market expansion. Growth in renewable energy projects, combined with advancements in insulation and material science, continues to shape the evolution of this sector. Synchronous generators are integral to modern power systems, offering consistent voltage and frequency that support the stability of electrical grids. Their use is becoming more dynamic, extending from conventional backup roles to active components in distributed and peak-load energy systems.

As global power demands surge, the integration of intelligent generator systems equipped with IoT features is transforming operational models. These next-generation generators support remote diagnostics, predictive maintenance, and energy optimization-all crucial in modern energy frameworks. Escalating concerns over energy reliability, coupled with upgrades to aging infrastructure and greater frequency of grid disruptions, are also accelerating the adoption of these systems. Growing emphasis on sustainability and regulatory compliance is pushing innovation in design, control features, and smart connectivity, making these machines indispensable across a wider range of industries and applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.8 Billion |

| Forecast Value | $11 Billion |

| CAGR | 4.9% |

The generators segment accounted for a 40.6% share in 2024 and is projected to grow at over 4.5% CAGR by 2034. Their strong performance, ease of maintenance, and dependable output make them ideal for a range of operational scenarios. The segment's continued relevance lies in its adaptability and cost-effectiveness for diverse end-user requirements.

The Units with a power rating of <= 5 MVA are expected to grow at a CAGR of 5% through 2034, driven by their increasing use in decentralized power setups, backup systems, and small to mid-sized industrial applications. Enhancements such as intelligent control systems, upgraded cooling features, and remote monitoring interfaces are helping to expand their role in modern power ecosystems.

Asia Pacific Synchronous Generator Market held a 37.5% share in 2024. Accelerating industrial activity, together with large-scale investment in energy generation infrastructure, is fostering growth in the region. The shift toward distributed generation and smart microgrids is adding further momentum, especially as local governments roll out demand-response programs and invest in power grid resilience.

Key players in the Global Synchronous Generator Market include TMEIC, POWERTEC GENERATOR SYSTEM, Siemens Energy, Meidensha Corporation, Wolong Electric Group, ABB, Alconz, PARTZSCH Group, Schneider Electric, WEG, TD Power Systems, EvoTec Power Generation, Ingeteam, Marelli Motori, Elin Motoren, GE Vernova, Nidec, Jeumont Electric, ANDRITZ, MENZEL ELEKTROMOTOREN, Ansaldo Energia, Koncar, CG Power & Industrial Solutions, and Mecc Alte. Leading companies in the synchronous generator market are investing heavily in advanced product development, targeting digital transformation with smart connectivity and IoT-enabled systems. Many firms are expanding their geographic footprint by strengthening local production capabilities and service networks, especially in high-growth markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1.1 Raw material availability & sourcing analysis

- 3.1.1.2 Manufacturing capacity assessment

- 3.1.1.3 Supply chain resilience & risk factors

- 3.1.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of synchronous generator

- 3.8 Emerging opportunities & trends

- 3.9 Digital transformation with IoT technologies

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Prime Mover, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Gas turbine

- 5.3 Steam turbine

- 5.4 Reciprocating engine

- 5.5 Others

Chapter 6 Market Size and Forecast, By Phase, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Single phase

- 6.3 Three phase

Chapter 7 Market Size and Forecast, By Power Rating, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 ≤ 5 MVA

- 7.3 > 5 MVA - 15 MVA

- 7.4 > 15 MVA - 30 MVA

- 7.5 > 30 MVA - 50 MVA

- 7.6 > 50 MVA

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Industrial

- 8.3 Utility

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 Russia

- 9.3.4 UK

- 9.3.5 Italy

- 9.3.6 Spain

- 9.3.7 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 South Korea

- 9.4.4 India

- 9.4.5 Australia

- 9.4.6 New Zealand

- 9.4.7 Malaysia

- 9.4.8 Indonesia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Qatar

- 9.5.4 Egypt

- 9.5.5 South Africa

- 9.5.6 Nigeria

- 9.5.7 Turkey

- 9.5.8 Jordan

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Peru

- 9.6.3 Chile

- 9.6.4 Argentina

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Alconza

- 10.3 ANDRITZ

- 10.4 Ansaldo Energia

- 10.5 CG Power & Industrial Solutions

- 10.6 Elin Motoren

- 10.7 EvoTec Power Generation

- 10.8 GE Vernova

- 10.9 Ingeteam

- 10.10 Jeumont Electric

- 10.11 Koncar

- 10.12 Marelli Motori

- 10.13 Mecc Alte

- 10.14 Meidensha Corporation

- 10.15 MENZEL ELEKTROMOTOREN

- 10.16 Nidec

- 10.17 PARTZSCH Group

- 10.18 POWERTEC GENERATOR SYSTEM

- 10.19 Schneider Electric

- 10.20 Siemens Energy

- 10.21 TD Power Systems

- 10.22 TMEIC

- 10.23 WEG

- 10.24 Wolong Electric Group