|

市場調查報告書

商品編碼

1801940

電壓檢測系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Voltage Detection System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

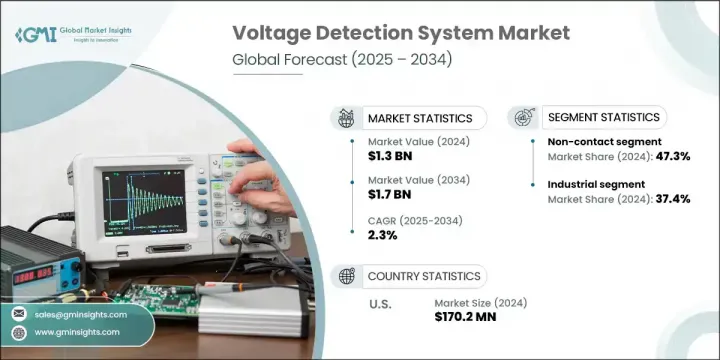

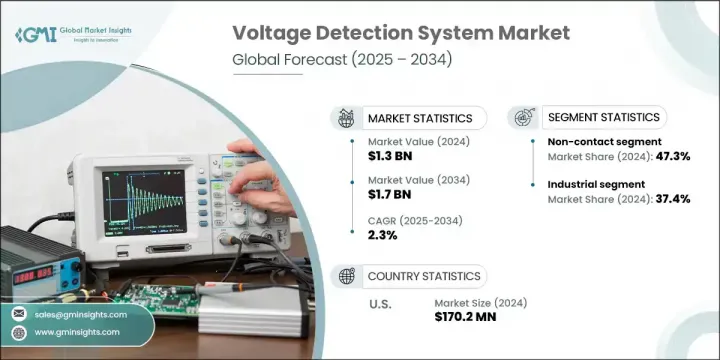

2024年,全球電壓檢測系統市場規模達13億美元,預計2034年將以2.3%的複合年成長率成長,達到17億美元。市場的成長動能源自於對高效能能源利用的日益重視,以及環境法規和永續發展計畫的推動。智慧電網技術、自動化配電網和智慧計量領域的創新正在提升能源可靠性和系統性能。智慧電網框架的採用實現了即時電壓監控,從而實現預測性診斷和遠端維護。電壓檢測系統在安全性和準確性至關重要的工業自動化領域正變得至關重要。

如今,緊湊型高性能感測器已整合到複雜環境中,增強了在狹窄或敏感環境下的監控能力。與物聯網平台的整合以及提供無線即時資料的能力,正在提高營運連續性,同時控制維護成本。基礎設施升級和傳統電網的現代化改造正在增強對先進檢測系統的需求,尤其是那些能夠提供無縫通訊和系統相容性的系統。隨著全球電氣化的持續推進,從公用事業到製造業,電壓檢測的精確度和安全性在各個領域都變得至關重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 13億美元 |

| 預測值 | 17億美元 |

| 複合年成長率 | 2.3% |

非接觸式電壓檢測系統在2024年佔據了47.3%的市場佔有率,預計到2034年複合年成長率將達到3.1%。這些系統的優點在於,它允許技術人員無需實際接觸即可識別帶電電線,從而降低觸電風險,從而增強了安全性。這些工具廣泛用於常規檢查和快速診斷,操作簡便,新手和經驗豐富的操作員都適用。便利性和可靠性的結合使其在維護和安全應用中的應用日益廣泛。

2024年,工業領域佔37.4%的市場佔有率,預計2025年至2034年的複合年成長率為1.7%。工廠和製造設施等高壓環境在啟動上鎖/掛牌(LOTO)等程序之前,需要進行精確驗證。電壓偵測系統對於保障人員安全並防止電弧閃光事故至關重要。將其整合到安全協定中,可確保設備始終符合安全標準,同時最大限度地降低營運風險。

2024年,美國電壓檢測系統市場規模達1.702億美元。美國的成長得益於美國職業安全與健康管理局(OSHA)和美國國家消防協會(NFPA)70E等機構制定的嚴格職業安全法規,這些法規要求必須實施經驗證的保持社交距離協議和安全檢查。美國老化的電力基礎設施也需要定期測試和維護,這促使工業和公用事業部門投資可靠的檢測工具。太陽能和風能等再生能源佔比的不斷成長,正在擴大各種發電系統中電壓監測的範圍。

全球電壓偵測系統市場的知名公司包括 Epoxy House、Chauvin Arnoux、Megger、PENTA、Electrisium International、Fluke Corporation、KK Sales Corporation、DEHN SE、Horstmann、廈門安達興電氣集團、Georg Jordan、C&S Electric Limited、Thorne & Derrick、KPB INTRA sro、Orion 、C&S Electric Limited、Thorne & Derrick、KPB INTRA sro、Orion 、Ci>C.F.Fy時間, G. MD srl、ARCUS ELEKTROTECHNIK ALOIS SCHIFFMANN GMBH、Dipl.-Ing. H. Horstmann GmbH、Arshon Technology、Kyoritsu 和 Cole-Parmer Instrument Company。為了加強在電壓檢測系統市場的地位,各公司正專注於產品創新和擴大全球分銷網路。許多製造商正在整合物聯網相容性和無線功能,以提高系統在工業和公用事業應用中的智慧性和適應性。重點放在微型感測器上,以支援在緊湊或遠端環境中使用。與能源公用事業和基礎設施公司的合作正幫助企業在智慧電網現代化專案中快速擴張。企業也在投資研發,以提高準確性和可靠性,以適應不斷發展的安全標準。為了因應新興經濟體日益成長的需求,一些企業正在建立區域製造中心,以精簡供應鏈並降低成本,從而在全球範圍內提高經濟高效、高效能檢測解決方案的可及性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 原料和零件供應商

- 設計和工程

- 製造和裝配

- 配送和物流

- 行銷和銷售

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL分析

- 2021-2034年價格趨勢分析

- 進出口貿易分析

- 主要進口國

- 主要出口國

- 投資分析及未來展望

第4章:競爭格局

- 介紹

- 按地區分析公司市場佔有率

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 戰略儀表板

- 策略舉措

- 重要夥伴關係與合作

- 重大併購活動

- 產品創新與發布

- 市場擴張策略

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:依產品,2021 - 2034

- 主要趨勢

- 接觸

- 非接觸式

第6章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 住宅

- 商業的

- 工業的

- 實用工具

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 西班牙

- 亞太地區

- 澳洲

- 日本

- 韓國

- 印度

- 中國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- ARCUS ELEKTROTECHNIK ALOIS SCHIFFMANN GMBH

- Arshon Technology

- C&S Electric Limited

- CATU SAS

- Chauvin Arnoux

- Cole-Parmer Instrument Company

- DEHN SE

- Dipl.-Ing. H. Horstmann GmbH

- Electrisium International

- ELECTRONSYSTEM MD srl

- Epoxy House

- Fluke Corporation

- Georg Jordan

- KK Sales Corporation

- Klein Tools

- KPB INTRA sro

- Kries-Energietechnik GmbH & Co. KG

- Kyoritsu

- Megger

- Orion EE

- PENTA

- Thorne & Derrick

- Xiamen Andaxing Electric Group

The Global Voltage Detection System Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 2.3% to reach USD 1.7 billion by 2034. The market's upward trajectory is being driven by increasing emphasis on efficient energy usage, propelled by environmental regulations and sustainability initiatives. Innovations in smart grid technologies, automated distribution networks, and intelligent metering are improving energy reliability and system performance. The adoption of smart grid frameworks is enabling real-time voltage monitoring, allowing for predictive diagnostics and remote maintenance. Voltage detection systems are becoming essential in industrial automation, where safety and accuracy are paramount.

Compact, high-performance sensors are now integrated into complex environments, enhancing monitoring in confined or sensitive settings. Integration with IoT platforms and the ability to deliver wireless, real-time data is improving operational continuity while keeping maintenance costs in check. Infrastructural upgrades and modernization of legacy power networks are reinforcing the demand for advanced detection systems, particularly those offering seamless communication and system compatibility. As global electrification continues, precision and safety in voltage detection are becoming critical across sectors ranging from utilities to manufacturing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $1.7 Billion |

| CAGR | 2.3% |

The non-contact voltage detection systems held 47.3% share in 2024 and is expected to register a CAGR of 3.1% through 2034. These systems offer the benefit of enhanced safety by allowing technicians to identify live wires without making physical contact, reducing exposure to electric shock. Widely favored for routine inspections and rapid diagnostics, these tools are user-friendly and suitable for both novice and experienced operators. The combination of convenience and reliability is expanding their use across maintenance and safety applications.

The industrial sector held 37.4% share in 2024 and is forecasted to grow at a CAGR of 1.7% from 2025 to 2034. High-voltage environments such as factories and manufacturing facilities require precise verification before initiating procedures like lockout/tagout (LOTO). Voltage detection systems are critical in safeguarding personnel and preventing arc flash incidents. Their integration into safety protocols is ensuring equipment remains compliant with safety standards, while minimizing operational risk.

United States Voltage Detection System Market was valued at USD 170.2 million in 2024. Growth in the U.S. is fueled by strict occupational safety regulations under bodies such as OSHA and NFPA 70E, which necessitate verified distancing protocols and safety checks. The country's aging electrical infrastructure also demands regular testing and maintenance, encouraging industrial and utility sectors to invest in reliable detection tools. The increasing share of renewable energy sources, including solar and wind, is expanding the scope of voltage monitoring across diverse power generation systems.

Prominent companies in the Global Voltage Detection System Market include Epoxy House, Chauvin Arnoux, Megger, PENTA, Electrisium International, Fluke Corporation, K.K. Sales Corporation, DEHN SE, Horstmann, Xiamen Andaxing Electric Group, Georg Jordan, C&S Electric Limited, Thorne & Derrick, KPB INTRA s.r.o, Orion EE, Cyclotech, Kries-Energietechnik GmbH & Co. KG, ELECTRONSYSTEM MD srl, ARCUS ELEKTROTECHNIK ALOIS SCHIFFMANN GMBH, Dipl.-Ing. H. Horstmann GmbH, Arshon Technology, Kyoritsu, and Cole-Parmer Instrument Company. To strengthen their presence in the voltage detection system market, companies are focusing on product innovation and expanding global distribution networks. Many manufacturers are integrating IoT compatibility and wireless features to improve system intelligence and adaptability in both industrial and utility applications. Emphasis is placed on miniaturizing sensors to support use in compact or remote environments. Partnerships with energy utilities and infrastructure firms are helping companies scale quickly in smart grid modernization projects. Firms are also investing in R&D to enhance accuracy and reliability, aligning with evolving safety standards. In response to increasing demand across emerging economies, some players are establishing regional manufacturing hubs to streamline supply chains and reduce costs, thereby improving access to cost-effective, high-performance detection solutions worldwide.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1.1 Raw material and component suppliers

- 3.1.1.2 Design and engineering

- 3.1.1.3 Manufacturing and assembly

- 3.1.1.4 Distribution and logistics

- 3.1.1.5 Marketing and sales

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Price trend analysis, 2021-2034

- 3.8 Import/export trade analysis

- 3.8.1 Key importing countries

- 3.8.2 Key exporting countries

- 3.9 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (‘000 Units, USD Million)

- 5.1 Key trends

- 5.2 Contact

- 5.3 Non-contact

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (‘000 Units, USD Million)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial

- 6.4 Industrial

- 6.5 Utilities

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (‘000 Units, USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 Australia

- 7.4.2 Japan

- 7.4.3 South Korea

- 7.4.4 India

- 7.4.5 China

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ARCUS ELEKTROTECHNIK ALOIS SCHIFFMANN GMBH

- 8.2 Arshon Technology

- 8.3 C&S Electric Limited

- 8.4 CATU SAS

- 8.5 Chauvin Arnoux

- 8.6 Cole-Parmer Instrument Company

- 8.7 DEHN SE

- 8.8 Dipl.-Ing. H. Horstmann GmbH

- 8.9 Electrisium International

- 8.10 ELECTRONSYSTEM MD srl

- 8.11 Epoxy House

- 8.12 Fluke Corporation

- 8.13 Georg Jordan

- 8.15 K.K. Sales Corporation

- 8.16 Klein Tools

- 8.17 KPB INTRA s.r.o

- 8.18 Kries-Energietechnik GmbH & Co. KG

- 8.19 Kyoritsu

- 8.20 Megger

- 8.21 Orion EE

- 8.22 PENTA

- 8.23 Thorne & Derrick

- 8.24 Xiamen Andaxing Electric Group