|

市場調查報告書

商品編碼

1801937

智慧環網櫃市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Smart Ring Main Unit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年,全球智慧環網櫃市場規模達22億美元,預計到2034年將以8.3%的複合年成長率成長,達到49億美元。由於對可靠、自動化中壓配電系統的需求不斷成長,尤其是在城市環境中,市場發展勢頭強勁。電網現代化投資的不斷成長、再生能源的整合度不斷提高以及電網日益複雜化,都在推動需求成長。智慧環網櫃 (RMU) 提供增強的故障偵測、遠端切換和即時資料分析功能,這使其成為現代電網基礎設施的關鍵。提高能源效率和最大限度縮短停電時間的舉措正促使公用事業提供者大規模採用這些智慧系統。環境法規和智慧城市計畫進一步推動了對節省空間、自動化和環保開關設備的需求。

2024年,氣體絕緣領域佔據市場主導地位,市場佔有率超過73%,這主要得益於其緊湊的設計、極低的維護成本以及在有限空間內的可靠性。隨著減少溫室氣體排放的監管壓力日益加大,製造商正在開發不含SF6的替代品,例如氟腈基氣體,這種替代品在維持絕緣品質的同時,也能減少對環境的影響。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 22億美元 |

| 預測值 | 49億美元 |

| 複合年成長率 | 8.3% |

2024年,電動智慧環網櫃(RMU)佔據61%的市場佔有率,預計到2034年將達到32億美元。它們與SCADA系統和物聯網平台整合,使公用事業公司能夠執行即時診斷、遠端故障隔離和自動負載管理,使其成為工業樞紐、智慧電網系統和可再生能源園區的理想選擇。這些先進的環網櫃使電網營運商能夠避免人工干預,顯著縮短停電時間,並增強動態電網環境中的營運控制。

2024年,美國智慧環網櫃市場規模達3.639億美元,佔68.7%。旨在實現電網現代化的聯邦計畫是推動這一成長的主要動力。智慧環網櫃的採用旨在提高氣候適應能力、實現中壓系統自動化以及支援不斷發展的城市基礎設施。對遠端操作、故障管理和即時監控的投資,使這些設備成為各大都市和工業區電網轉型議程的重要組成部分。

塑造全球智慧環網櫃市場的關鍵參與者包括伊頓、Lucy Electric、ABB、西門子和施耐德電機。為了鞏固其在智慧環網櫃市場的地位,領先公司正在推行專注於先進產品開發和永續性的策略。這些策略包括創新無SF6氣體絕緣技術和整合人工智慧預測性維護功能。與公用事業供應商和智慧城市規劃者的合作有助於擴大城市電網的部署。各公司也正在投資數位孿生技術、網路安全增強功能和相容SCADA的平台,以提供完全整合的解決方案。透過在地化製造、強大的售後支援以及收購區域企業進行全球擴張是推動市場滲透的其他策略。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 供應鏈彈性和風險評估

- 原物料採購挑戰

- 製造能力分析

- 物流及配送網路

- 地緣政治風險因素

- 進出口貿易分析

- 主要進口國

- 主要出口國

- 價格趨勢分析,(美元/單位)

- 依技術

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與技術格局

第5章:市場規模及預測:依絕緣材料,2021 - 2034

- 主要趨勢

- 氣體

- 空氣

- 油

- 固體介電體

- 其他

第6章:市場規模及預測:依位置,2021 - 2034

- 主要趨勢

- 2-3-4位置

- 5-6位置

- 7-10位置

- 其他

第7章:市場規模及預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 電動環網櫃

- 非機動環網櫃

第 8 章:市場規模與預測:按安裝量,2021 年至 2034 年

- 主要趨勢

- 室內的

- 戶外的

第9章:市場規模及預測:依組件分類,2021 - 2034 年

- 主要趨勢

- 開關和保險絲

- 自供電電子繼電器

- 傳染性

- 傳統 CT/VT 感測器

- 低功率 CT/VT 感測器

- 非傳染性

- 傳染性

- 自動化 RTU

- UPS

- 故障通道指示器/短路指示器

- 傳染性

- 傳統 CT/VT 感測器

- 傳統 CT/VT 感測器

- 非傳染性

- 傳染性

- 虛擬磁碟

第 10 章:市場規模與預測:按應用,2021 - 2034 年

- 主要趨勢

- 配電設施

- 電動環網櫃

- 非機動環網櫃

- 產業

- 基礎設施

- 電動環網櫃

- 非機動環網櫃

- 運輸

- 其他

第 11 章:市場規模與預測:按地區,2021 年至 2032 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 義大利

- 西班牙

- 法國

- 瑞典

- 希臘

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 科威特

- 南非

- 卡達

- 拉丁美洲

- 巴西

- 阿根廷

第12章:公司簡介

- ABB

- alfanar

- Bonomi Eugenio

- CG Power

- CHINT

- C-Sec

- Eaton

- Electric & Electronic

- Eswari Electricals

- HD HYUNDAI ELECTRIC

- Holley Technology

- LS ELECTRIC

- Lucy Group

- Orecco

- Rockwill

- Schneider Electric

- Siemens

- TIEPCO

- Toshiba Energy

- Zhejiang Volcano

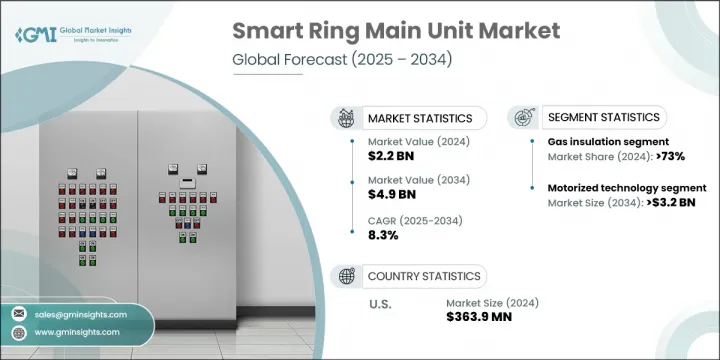

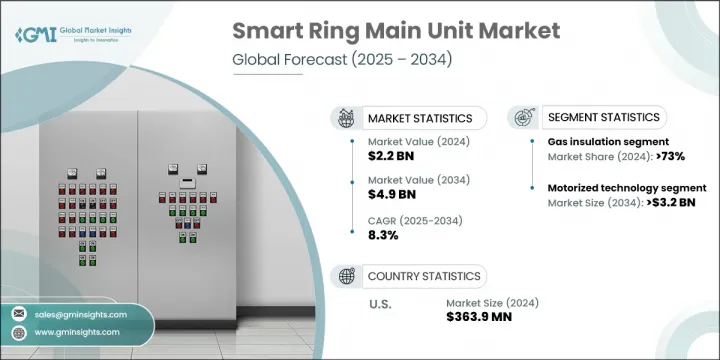

The Global Smart Ring Main Unit Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 4.9 billion by 2034. The market is gaining momentum due to rising demand for reliable and automated medium-voltage distribution systems, especially in urban environments. Growing investments in grid modernization, increased integration of renewables, and the rising complexity of electrical networks are all fueling demand. Smart RMUs offer enhanced fault detection, remote switching, and real-time data analysis, which makes them critical for modern grid infrastructure. Initiatives to enhance energy efficiency and minimize outage durations are prompting utility providers to adopt these intelligent systems at scale. Environmental regulations and smart city initiatives further boost adoption by reinforcing the need for space-saving, automated, and environmentally friendly switchgear.

The gas-insulated segment led the market in 2024 with over 73% share, largely due to its compact design, minimal maintenance, and reliability in constrained spaces. With increasing regulatory pressure to reduce greenhouse gas emissions, manufacturers are developing SF6-free alternatives like fluoronitrile-based gases that preserve insulation quality while reducing environmental impact.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $4.9 Billion |

| CAGR | 8.3% |

The Motorized smart RMUs held a 61% share in 2024 and is projected to reach USD 3.2 billion by 2034. Their integration with SCADA systems and IoT platforms enables utilities to perform real-time diagnostics, remote fault isolation, and automated load management, making them ideal for industrial hubs, smart grid systems, and renewable parks. These advanced RMUs allow grid operators to avoid manual intervention, significantly reducing outage durations and enhancing operational control in dynamic grid environments.

United States Smart Ring Main Unit Market generated USD 363.9 million in 2024, with a 68.7% share. Federal programs aimed at modernizing the electrical grid are the primary drivers of this growth. Smart RMUs are adopted to improve climate resilience, automate medium-voltage systems, and support evolving urban infrastructures. Investments in remote operability, fault management, and real-time monitoring have made these units an essential part of the grid transformation agenda across major metropolitan and industrial regions.

Key players shaping this Global Smart Ring Main Unit Market include Eaton, Lucy Electric, ABB, Siemens, and Schneider Electric. To strengthen their position in the smart ring main unit market, leading companies are pursuing strategies focused on advanced product development and sustainability. These include innovating SF6-free gas insulation technologies and integrating AI-powered predictive maintenance features. Collaborations with utility providers and smart city planners help expand deployment across urban grids. Companies are also investing in digital twin technologies, cybersecurity enhancements, and SCADA-compatible platforms to offer fully integrated solutions. Global expansion through localized manufacturing, robust after-sales support, and acquisitions of regional players are additional tactics driving market penetration.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data Collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculations

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Insulation trends

- 2.1.3 Position trends

- 2.1.4 Technology trends

- 2.1.5 Installation trends

- 2.1.6 Component trends

- 2.1.7 Application trends

- 2.1.8 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Supply chain resilience and risk assessment

- 3.3.1 Raw material sourcing challenges

- 3.3.2 Manufacturing capacity analysis

- 3.3.3 Logistics and distribution networks

- 3.3.4 Geopolitical risk factors

- 3.4 Import export trade analysis

- 3.4.1 Key importing countries

- 3.4.2 Key exporting countries

- 3.5 Price trend analysis, (USD/Unit)

- 3.5.1 By technology

- 3.6 Industry impact forces

- 3.6.1 Growth drivers

- 3.6.2 Industry pitfalls & challenges

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.8.1 Bargaining power of suppliers

- 3.8.2 Bargaining power of buyers

- 3.8.3 Threat of new entrants

- 3.8.4 Threat of substitutes

- 3.9 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Insulation, 2021 - 2034 (‘000 Units & USD Million)

- 5.1 Key trends

- 5.2 Gas

- 5.3 Air

- 5.4 Oil

- 5.5 Solid-Di-Electric

- 5.6 Others

Chapter 6 Market Size and Forecast, By Position, 2021 - 2034 (‘000 Units & USD Million)

- 6.1 Key trends

- 6.2 2-3-4 Position

- 6.3 5-6 Position

- 6.4 7-10 Position

- 6.5 Others

Chapter 7 Market Size and Forecast, By Technology, 2021 - 2034 (‘000 Units & USD Million)

- 7.1 Key trends

- 7.2 Motorized RMU

- 7.3 Non - motorized RMU

Chapter 8 Market Size and Forecast, By Installation, 2021 - 2034 (‘000 Units & USD Million)

- 8.1 Key trends

- 8.2 Indoor

- 8.3 Outdoor

Chapter 9 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 Switch & Fuses

- 9.3 Self-Powered Electronic Relay

- 9.3.1 Communicable

- 9.3.1.1 Conventional CT/VT Sensors

- 9.3.1.2 Low Power CT/VT Sensors

- 9.3.2 Non-Communicable

- 9.3.1 Communicable

- 9.4 Automations RTU’s

- 9.5 UPS

- 9.6 Fault Passage Indicators/Short Circuit Indicators

- 9.6.1 Communicable

- 9.6.1.1 Conventional CT/VT Sensors

- 9.6.1.2 Conventional CT/VT Sensors

- 9.6.2 Non-Communicable

- 9.6.1 Communicable

- 9.7 VDIS

Chapter 10 Market Size and Forecast, By Application, 2021 - 2034 (‘000 Units & USD Million)

- 10.1 Key trends

- 10.2 Distribution Utilities

- 10.2.1 Motorized RMU

- 10.2.2 Non - Motorized RMU

- 10.3 Industries

- 10.4 Infrastructure

- 10.4.1 Motorized RMU

- 10.4.2 Non - Motorized RMU

- 10.5 Transportation

- 10.6 Others

Chapter 11 Market Size and Forecast, By Region, 2021 - 2032 (‘000 Units & USD Million)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.2.3 Mexico

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 Italy

- 11.3.3 Spain

- 11.3.4 France

- 11.3.5 Sweden

- 11.3.6 Greece

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Middle East & Africa

- 11.5.1 Saudi Arabia

- 11.5.2 UAE

- 11.5.3 Kuwait

- 11.5.4 South Africa

- 11.5.5 Qatar

- 11.6 Latin America

- 11.6.1 Brazil

- 11.6.2 Argentina

Chapter 12 Company Profiles

- 12.1 ABB

- 12.2 alfanar

- 12.3 Bonomi Eugenio

- 12.4 CG Power

- 12.5 CHINT

- 12.6 C-Sec

- 12.7 Eaton

- 12.8 Electric & Electronic

- 12.9 Eswari Electricals

- 12.10 HD HYUNDAI ELECTRIC

- 12.11 Holley Technology

- 12.12 LS ELECTRIC

- 12.13 Lucy Group

- 12.14 Orecco

- 12.15 Rockwill

- 12.16 Schneider Electric

- 12.17 Siemens

- 12.18 TIEPCO

- 12.19 Toshiba Energy

- 12.20 Zhejiang Volcano