|

市場調查報告書

商品編碼

1801931

滾筒烘乾機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Tumble Dryer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

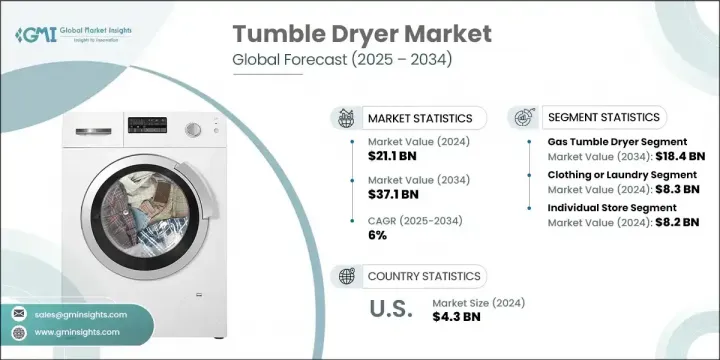

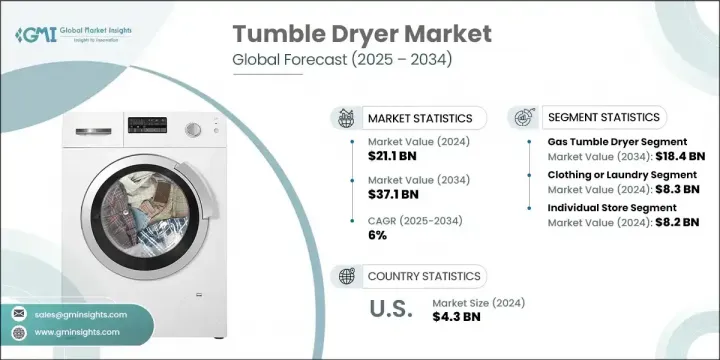

2024年,全球滾筒式乾衣機市場規模達211億美元,預計2034年將以6%的複合年成長率成長,達到371億美元。這一成長動能的驅動力源自於城鎮化進程的加速、消費者生活方式的轉變、新興市場收入的提高以及節能和智慧技術的顯著進步。雙收入家庭和居住在緊湊型城市環境中(戶外烘乾空間有限)的個人擴大選擇滾筒式乾衣機,因為它們方便且省時。不斷提高的能源效率標準和廣泛的激勵措施正在鼓勵消費者升級到現代化的乾衣機。

製造商紛紛推出功能豐富、高效的機型,以滿足住宅和商業場所(例如自助洗衣店和飯店)的需求。智慧互聯功能(例如應用程式控制、濕度感測器和物聯網診斷)正日益成為標配,吸引注重便利性和環保意識的消費者。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 211億美元 |

| 預測值 | 371億美元 |

| 複合年成長率 | 6% |

燃氣滾筒烘乾機在 2024 年佔據該領域的首位,估值達 108 億美元,預計到 2034 年將達到 184 億美元。在北美等地區,燃氣驅動的機型因其乾燥時間更快、每個週期的營運成本更低以及能夠達到更高的溫度而受到青睞——這些優勢對於需要高效乾燥的大容量環境或大家庭至關重要。

服裝或洗衣應用領域在2024年創造了83億美元的市場規模,預計到2034年將以6.2%的複合年成長率成長。由於商業洗衣房和酒店等對高吞吐量和耐用性有較高要求的環境,該領域仍將佔據主導地位。這些環境青睞商用級烘乾機,因為它們性能卓越、可靠性高。

2024年,美國滾筒式乾衣機市場規模達43億美元,預計2025年至2034年的複合年成長率為6%。強勁的成長動能源自於消費者對省時電器的強烈偏好,以及洗衣基礎設施投資的不斷增加。房屋建築商(尤其是在德克薩斯州和佛羅裡達州等地區)正在將專用洗衣空間與標準化的家電介面整合到新建築中,這進一步推動了滾筒式乾衣機的普及。

影響全球滾筒式乾衣機產業的關鍵參與者包括三星、伊萊克斯、Miele、海爾、美泰格、LG、Renzacci、Schulthess、小天鵝、GIRBAU、ASKO Appliances、Pellerin、Milnor、American Dryer、Dexter Laundry 和 Danube。為鞏固市場地位,滾筒式乾衣機製造商正專注於幾個策略方向。他們正在加速熱泵和混合技術的研發,以提供卓越的能源效率並吸引具有環保意識的客戶。產品線現在整合了智慧家庭功能,如 Wi-Fi 控制、應用程式管理和濕度感應技術,以增強用戶便利性並使品牌脫穎而出。該公司正在與房屋建築商和房地產開發商建立合作夥伴關係,以將其設備嵌入新物業,尤其是在城市和郊區住房市場。全球物流和製造網路的擴展有助於有效滿足需求,而對永續包裝、可回收材料和碳減排計畫的投資則增強了品牌信譽。強調耐用性、性能和服務支援的策略品牌建立活動進一步加強了消費者的信任和長期忠誠度。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 監理框架

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特五力分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- MEA

- 拉丁美洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021-2034

- 主要趨勢

- 電動滾筒烘乾機

- 瓦斯滾筒烘乾機

第6章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 家庭

- 紡織業

- 服裝或洗衣業

- 飯店業

- 其他(水療、醫療保健等)

第7章:市場估計與預測:依定價,2021-2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第8章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 線上

- 電子商務

- 公司網站

- 離線

- 大型零售商店

- 專賣店

- 其他(個體店、百貨公司等)

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第10章:公司簡介

- American Dryer

- ASKO Appliances

- Danube

- Dexter Laundry

- Electrolux

- GIRBAU

- Haier

- LG

- Little Swan

- Maytag

- Miele

- Pellerin Milnor

- Renzacci

- Samsung

- Schulthess

The Global Tumble Dryer Market was valued at USD 21.1 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 37.1 billion by 2034. This momentum is driven by escalating urbanization, evolving consumer lifestyles, rising incomes in emerging markets, and significant advances in energy-efficient and smart technologies. Dual-income households and individuals living in compact urban settings-with limited outdoor drying space-are increasingly choosing tumble dryers for their convenience and time-saving capabilities. Enhanced energy efficiency standards and widespread incentives are encouraging consumers to upgrade to modern dryers.

Manufacturers are responding with feature-rich, efficient models that cater to demand in both residential homes and commercial settings such as laundromats and hospitality venues. Smart and connected capabilities-like app control, moisture sensors, and IoT-enabled diagnostics-are increasingly becoming standard, appealing to convenience-oriented and eco-conscious shoppers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.1 Billion |

| Forecast Value | $37.1 Billion |

| CAGR | 6% |

Gas tumble dryers led the segment in 2024 with a valuation of USD 10.8 billion and are forecast to reach USD 18.4 billion by 2034. In regions like North America, gas-powered models are preferred for their faster drying times, lower operational costs per cycle, and ability to reach higher temperatures-advantages that are critical in high-volume environments or large households needing efficient drying.

The clothing or laundry application segment generated USD 8.3 billion in 2024 and is expected to rise at a CAGR of 6.2% through 2034. This segment remains dominant due to its demand in settings that require high throughput and durability, such as commercial laundries and hotels. These environments favor commercial-grade dryers for their performance and reliability.

U.S. Tumble Dryer Market generated USD 4.3 billion in 2024, with anticipated growth at a CAGR of 6% from 2025 to 2034. This robust expansion is backed by a strong consumer preference for time-saving appliances and increased investment in laundry infrastructure. Homebuilders-especially in regions like Texas and Florida-are integrating dedicated laundry spaces with standardized appliance hookups into new constructions, further boosting tumble dryer adoption.

Key players shaping the Global Tumble Dryer Industry include Samsung, Electrolux, Miele, Haier, Maytag, LG, Renzacci, Schulthess, Little Swan, GIRBAU, ASKO Appliances, Pellerin, Milnor, American Dryer, Dexter Laundry, and Danube. To consolidate their market positions, tumble dryer manufacturers are focusing on several strategic directions. They are accelerating R&D in heat-pump and hybrid technologies to deliver superior energy efficiency and appeal to eco-conscious customers. Product lines now integrate smart-home features like Wi-Fi control, app management, and moisture-sensing technology to enhance user convenience and set brands apart. Companies are forging partnerships with homebuilders and real estate developers to embed their appliances in new properties, particularly in urban and suburban housing markets. Expansion of global logistics and manufacturing networks helps meet demand efficiently, while investments in sustainable packaging, recyclable materials, and carbon reduction initiatives bolster brand credibility. Strategic brand-building campaigns highlighting durability, performance, and service support further reinforce consumer trust and long-term loyalty.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.2.4 Pricing

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 ($Bn, Thousand Units)

- 5.1 Key trends

- 5.2 Electric tumble dryer

- 5.3 Gas tumble dryer

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 ($Bn, Thousand Units)

- 6.1 Key trends

- 6.2 Household

- 6.3 Textile industry

- 6.4 Clothing or laundry industry

- 6.5 Hospitality industry

- 6.6 Others (spa, Healthcare, etc.)

Chapter 7 Market Estimates & Forecast, By Pricing, 2021-2034 ($Bn, Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($Bn, Thousand Units)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-commerce

- 8.2.2 Company website

- 8.3 Offline

- 8.3.1 Mega retail stores

- 8.3.2 Specialty stores

- 8.3.3 Others (individual stores, departmental stores, etc.)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034, ($Bn, Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 American Dryer

- 10.2 ASKO Appliances

- 10.3 Danube

- 10.4 Dexter Laundry

- 10.5 Electrolux

- 10.6 GIRBAU

- 10.7 Haier

- 10.8 LG

- 10.9 Little Swan

- 10.10 Maytag

- 10.11 Miele

- 10.12 Pellerin Milnor

- 10.13 Renzacci

- 10.14 Samsung

- 10.15 Schulthess