|

市場調查報告書

商品編碼

1801928

資料中心外包市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Data Center Outsourcing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

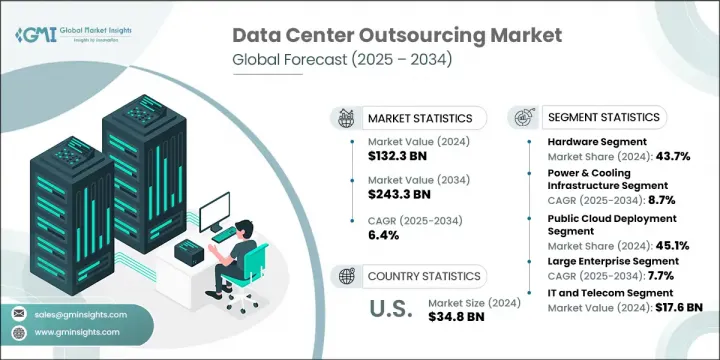

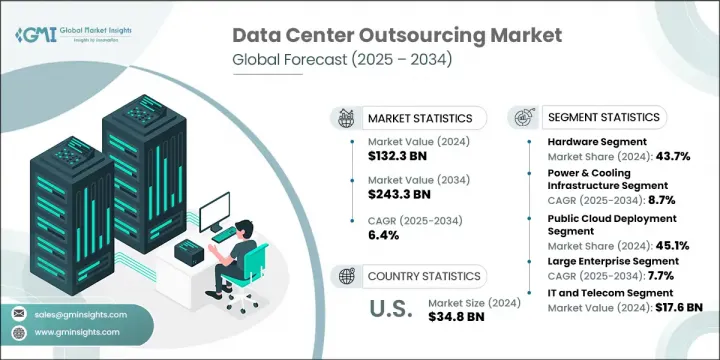

2024年,全球資料中心外包市場規模達1,323億美元,預計到2034年將以6.4%的複合年成長率成長,達到2,433億美元。隨著企業日益追求靈活安全的基礎設施解決方案,對資料中心外包的需求也持續成長。企業正在採用混合雲端策略,將私有雲的控制力與公有雲端服務的靈活性結合。這種方法使企業能夠擴展營運規模,同時對關鍵資料進行更嚴格的監管。外包服務供應商現在提供涵蓋私有環境和公有環境的整合解決方案,同時最佳化效能和成本管理。

隨著 5G、物聯網和即時應用等新興技術的蓬勃發展,企業紛紛轉向邊緣運算,以便在資料生成源頭實現更快的處理速度。這導致了向更分散式的外包模式的轉變,即將規模較小、分散的設施部署在更靠近最終用戶的位置。在美國,包括 Microsoft Azure、Google Cloud、AWS 和 IBM 在內的超大規模營運商憑藉其龐大的基礎設施和容量引領外包潮流,無需巨額前期投資即可為大規模企業提供支援。同時,HIPAA、FINRA 和 CCPA 等資料隱私框架正在塑造外包需求,促使企業與能夠提供認證設施、強大合規支援和區域監管協調的供應商合作。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1323億美元 |

| 預測值 | 2433億美元 |

| 複合年成長率 | 6.4% |

硬體領域在2024年佔據了43.7%的市場佔有率,預計到2034年將以6.4%的複合年成長率成長。隨著資料量的不斷成長和技術的不斷發展,企業選擇將硬體管理外包,以削減資本支出並採用營運成本模型。事實證明,內部基礎設施升級管理成本高昂且耗時,因此,外包硬體服務已成為實現可擴展性和敏捷性的首選途徑。

預計2025年至2034年期間,電力和冷卻基礎設施領域的複合年成長率將達到8.7%。外包供應商正在引入先進的能源管理解決方案,以支援高效能運算環境。基於人工智慧的溫度控制、液體冷卻和自然冷卻等技術正在被採用,以處理密集工作負載產生的熱量,同時降低能耗並提高系統可靠性。

2024年,美國資料中心外包市場佔據76.1%的市場佔有率,產值達348億美元。由於Equinix、亞馬遜網路服務 (AWS)、Verizon Communications和谷歌雲端等主要供應商的鼎力支持,美國仍然是全球資料中心樞紐。隨著監管框架日益複雜,企業擴大尋求擁有合規資格和基礎設施的第三方合作夥伴,以應對不斷變化的資料隱私法。加拿大的企業市場也正在向雲端驅動的外包模式轉型,優先考慮速度、創新和跨平台編排。擁有強大混合雲和多雲能力的供應商在該地區正受到越來越多的關注。

全球資料中心外包市場的主要公司包括 Cognizant、塔塔諮詢服務公司 (TCS)、富士通、埃森哲、亞馬遜網路服務 (AWS)、Google雲端、微軟 Azure、Equinix、威瑞森通訊和 Digital Realty。為了鞏固其在競爭激烈的資料中心外包領域的地位,該公司正專注於擴展全球基礎設施、整合邊緣運算解決方案以及提供混合雲和多雲管理平台。公司正在對基於人工智慧的資料管理、能源最佳化和即時監控自動化進行策略性投資。供應商也與超大規模雲端供應商結盟,共同提供可擴展的服務,同時確保遵守不斷變化的區域法規。供應商的重點是提供靈活的服務模式、經濟高效的基礎設施即服務 (IaaS) 以及針對醫療保健或金融等特定行業合規性的專門支援。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 價值鏈分析

- 資料中心基礎設施供應商

- 託管服務提供者

- 雲端服務供應商

- 系統整合商和顧問

- 最終使用組織

- 產業衝擊力

- 成長動力

- 雲端運算採用率不斷成長

- 成本效益

- 專注於核心業務

- 進階安全要求

- 產業陷阱與挑戰

- 資料隱私問題

- 對服務提供者的依賴

- 初始轉型成本高

- 整合的複雜性

- 市場機會

- 邊緣運算的擴展

- 綠色資料中心計劃

- 物聯網和5G技術的發展

- 日益成長的監理合規需求

- 成長動力

- 成長潛力分析

- 定價模型與成本結構分析

- 主機託管定價框架

- 託管服務定價模型

- 雲端服務成本結構

- 總擁有成本(TCO)分析

- CapEx 與 OpEx 決策框架

- 服務等級協定 (SLA) 和效能指標

- 正常運作時間和可用性標準

- 性能基準測試

- 安全和合規性要求

- 災難復原和業務連續性

- 支援和維護標準

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 波特的分析

- PESTEL分析

- 資料中心容量分析與供需動態

- 全球產能概覽

- 供給側分析

- 需求面分析

- 產能規劃與預測

- 產能投融資

- 電源使用效率 (PUE) 分析和基準測試

- PUE基礎知識與業界標準

- 全球PUE效能分析

- PUE最佳化策略與技術

- 配電效率

- IT設備效率

- AI驅動的PUE最佳化

- PUE對業務決策的影響

- 能源效率技術與最佳化策略

- 先進的冷卻技術

- 電源管理和分配效率

- IT基礎架構效率

- 監控和管理系統

- 能源效率的投資報酬率和商業案例

- 策略情境和最佳案例分析

- 全面的案例研究和成功案例

- 技術和創新格局

- 目前技術分析

- 新興科技趨勢

- 專利分析

- 永續性和環境策略

- 環境影響評估

- 綠色資料中心技術與解決方案

- 永續基礎設施設計

- 環境法規與合規性

- 企業永續發展策略

- 永續發展的經濟效益

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 硬體

- 軟體

- 服務

第6章:市場估計與預測:依實體基礎設施,2021 - 2034 年

- 主要趨勢

- 資料中心設施

- 電力和冷卻基礎設施

- 架子和櫥櫃

- 電纜和接線

- 其他

第7章:市場估計與預測:依部署模型,2021 - 2034 年

- 主要趨勢

- 公共雲端部署

- 私有雲端部署

- 混合雲端部署

- 社群雲部署

- 多雲部署

第8章:市場估計與預測:依組織規模,2021 - 2034 年

- 主要趨勢

- 中小型企業

- 大型企業

- 政府和公共部門

第9章:市場估計與預測:依產業垂直,2021 - 2034 年

- 主要趨勢

- 金融服務業

- IT和電信

- 醫療保健和生命科學

- 政府和公共部門

- 製造業和工業

- 零售與電子商務

- 其他行業

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 波蘭

- 北歐人

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 新加坡

- 印尼

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 智利

- 哥倫比亞

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Global Leaders

- Accenture

- AWS

- Cognizant

- Digital Realty

- Equinix

- Google Cloud

- Hewlett Packard Enterprise (HPE)

- IBM

- Microsoft Azure

- NTT

- Tata Consultancy Services (TCS)

- 區域參與者

- CyrusOne

- Fujitsu

- Interxion

- Iron Mountain

- Kyndryl

- Lumen Technologies

- Rackspace Technology

- Schneider Electric

- 新興玩家

- AT&T

- Verizon Communications

The Global Data Center Outsourcing Market was valued at USD 132.3 billion in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 243.3 billion by 2034. The demand for data center outsourcing continues to rise as businesses increasingly pursue flexible and secure infrastructure solutions. Organizations are embracing hybrid cloud strategies that combine the control of private clouds with the agility of public cloud services. This approach enables companies to scale operations while maintaining tighter oversight of critical data. Outsourcing providers are now offering integrated solutions that span both private and public environments, optimizing performance and cost management simultaneously.

As emerging technologies such as 5G, IoT, and real-time applications gain momentum, enterprises are turning to edge computing for faster processing at the source of data generation. This has led to a shift toward more distributed outsourcing models, where smaller, decentralized facilities are placed closer to end users. In the US, hyperscale operators, including Microsoft Azure, Google Cloud, AWS, and IBM, are leading the outsourcing movement with their massive infrastructure and capacity to support enterprises at scale without hefty upfront investments. Meanwhile, data privacy frameworks such as HIPAA, FINRA, and CCPA are shaping outsourcing demand, driving businesses to work with providers who offer certified facilities, robust compliance support, and regional regulatory alignment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $132.3 Billion |

| Forecast Value | $243.3 Billion |

| CAGR | 6.4% |

The hardware segment captured 43.7% share in 2024 and is projected to grow at a CAGR of 6.4% through 2034. With rising data volumes and evolving technologies, organizations are opting to outsource hardware management to cut capital expenses and adopt an operating cost model. Managing in-house infrastructure upgrades proves cost-intensive and time-consuming, which is why outsourcing hardware services has become a preferred path for scalability and agility.

The power and cooling infrastructure segment is expected to register a CAGR of 8.7% from 2025 to 2034. Outsourcing providers are introducing advanced energy management solutions to support high-performance computing environments. Technologies such as AI-based temperature control, liquid cooling, and free cooling are being adopted to handle heat generated by dense workloads while also reducing energy consumption and enhancing system reliability.

United States Data Center Outsourcing Market held a 76.1% share in 2024, generating USD 34.8 billion. The US remains a global hub for data centers, driven by the presence of major providers such as Equinix, Amazon Web Services (AWS), Verizon Communications, and Google Cloud. As regulatory frameworks become more complex, companies increasingly seek third-party partners with the compliance credentials and infrastructure to navigate evolving data privacy laws. Canada's enterprise market is also transitioning toward cloud-driven outsourcing models, prioritizing speed, innovation, and cross-platform orchestration. Providers with strong hybrid and multi-cloud capabilities are seeing increased traction across the region.

Key companies operating in the Global Data Center Outsourcing Market include Cognizant, Tata Consultancy Services (TCS), Fujitsu, Accenture, Amazon Web Services (AWS), Google Cloud, Microsoft Azure, Equinix, Verizon Communications, and Digital Realty. To strengthen their position in the competitive data center outsourcing space, companies are focusing on expanding global infrastructure, integrating edge computing solutions, and offering hybrid and multi-cloud management platforms. Strategic investments are being made in AI-based automation for data management, energy optimization, and real-time monitoring. Providers are also forming alliances with hyperscale cloud vendors to co-deliver scalable services while ensuring compliance with evolving regional regulations. Emphasis is being placed on offering flexible service models, cost-effective infrastructure-as-a-service (IaaS), and dedicated support for industry-specific compliance, like healthcare or finance.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Physical infrastructure

- 2.2.4 Deployment model

- 2.2.5 Organization Size

- 2.2.6 Industry vertical

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Profit margin analysis

- 3.1.2 Cost structure

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Value chain analysis

- 3.2.1 Data center infrastructure providers

- 3.2.2 Managed service providers

- 3.2.3 Cloud service providers

- 3.2.4 System integrators and consultants

- 3.2.5 End use organizations

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growing cloud adoption

- 3.3.1.2 Cost efficiency

- 3.3.1.3 Focus on core business

- 3.3.1.4 Advanced security requirements

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Data privacy concerns

- 3.3.2.2 Dependence on service providers

- 3.3.2.3 High initial transition costs

- 3.3.2.4 Complexity of integration

- 3.3.3 Market opportunities

- 3.3.3.1 Expansion of edge computing

- 3.3.3.2 Green data center initiatives

- 3.3.3.3 Growth in IoT and 5G technologies

- 3.3.3.4 Increasing regulatory compliance needs

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Pricing models and cost structure analysis

- 3.5.1 Colocation pricing framework

- 3.5.2 Managed services pricing models

- 3.5.3 Cloud services cost structures

- 3.5.4 Total cost of ownership (TCO) analysis

- 3.5.5 CapEx vs OpEx decision framework

- 3.6 Service level agreements (SLA) and performance metrics

- 3.6.1 Uptime and availability standards

- 3.6.2 Performance benchmarking

- 3.6.3 Security and compliance requirements

- 3.6.4 Disaster recovery and business continuity

- 3.6.5 Support and maintenance standards

- 3.7 Regulatory landscape

- 3.7.1 North America

- 3.7.2 Europe

- 3.7.3 Asia Pacific

- 3.7.4 LATAM

- 3.7.5 MEA

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

- 3.10 Data center capacity analysis and supply-demand dynamics

- 3.10.1 Global capacity overview

- 3.10.2 Supply-side analysis

- 3.10.3 Demand-side analysis

- 3.10.4 Capacity planning and forecasting

- 3.10.5 Capacity investment and financing

- 3.11 Power usage effectiveness (PUE) analysis and benchmarking

- 3.11.1 PUE fundamentals and industry standards

- 3.11.2 Global PUE performance analysis

- 3.11.3 PUE optimization strategies and technologies

- 3.11.4 Power distribution efficiency

- 3.11.5 IT equipment efficiency

- 3.11.6 AI-Driven PUE optimization

- 3.11.7 PUE impact on business decisions

- 3.12 Energy efficiency technologies and optimization strategies

- 3.12.1 Advanced cooling technologies

- 3.12.2 Power management and distribution efficiency

- 3.12.3 IT infrastructure efficiency

- 3.12.4 Monitoring and management systems

- 3.12.5 ROI and business case for energy efficiency

- 3.13 Strategic scenarios and best case analysis

- 3.14 Comprehensive case studies and success stories

- 3.15 Technology and innovation landscape

- 3.15.1 Current technology analysis

- 3.15.2 Emerging technology trends

- 3.16 Patent analysis

- 3.17 Sustainability and environmental strategies

- 3.17.1 Environmental impact assessment

- 3.17.2 Green data center technologies and solutions

- 3.17.3 Sustainable infrastructure design

- 3.17.4 Environmental regulations and compliance

- 3.17.5 Corporate sustainability strategies

- 3.17.6 Economic benefits of sustainability

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Mn)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Service

Chapter 6 Market Estimates & Forecast, By Physical Infrastructure, 2021 - 2034 (USD Mn)

- 6.1 Key trends

- 6.2 Data center facilities

- 6.3 Power & cooling infrastructure

- 6.4 Racks & cabinets

- 6.5 Cabling & wiring

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 (USD Mn)

- 7.1 Key trends

- 7.2 Public cloud deployment

- 7.3 Private cloud deployment

- 7.4 Hybrid cloud deployment

- 7.5 Community cloud deployment

- 7.6 Multi-cloud deployment

Chapter 8 Market Estimates & Forecast, By Organization Size, 2021 - 2034 (USD Mn)

- 8.1 Key trends

- 8.2 Small/medium enterprises

- 8.3 Large enterprises

- 8.4 Government and public sector

Chapter 9 Market Estimates & Forecast, By Industry Vertical, 2021 - 2034 (USD Mn)

- 9.1 Key trends

- 9.2 BFSI

- 9.3 IT and telecom

- 9.4 Healthcare and life sciences

- 9.5 Government and public sector

- 9.6 Manufacturing and industrial

- 9.7 Retail and e-commerce

- 9.8 Other industries

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Poland

- 10.3.7 Nordics

- 10.3.8 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Singapore

- 10.4.5 Indonesia

- 10.4.6 Australia

- 10.4.7 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Argentina

- 10.5.3 Mexico

- 10.5.4 Chile

- 10.5.5 Colombia

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Global Leaders

- 11.1.1 Accenture

- 11.1.2 AWS

- 11.1.3 Cognizant

- 11.1.4 Digital Realty

- 11.1.5 Equinix

- 11.1.6 Google Cloud

- 11.1.7 Hewlett Packard Enterprise (HPE)

- 11.1.8 IBM

- 11.1.9 Microsoft Azure

- 11.1.10 NTT

- 11.1.11 Tata Consultancy Services (TCS)

- 11.2 Regional Players

- 11.2.1 CyrusOne

- 11.2.2 Fujitsu

- 11.2.3 Interxion

- 11.2.4 Iron Mountain

- 11.2.5 Kyndryl

- 11.2.6 Lumen Technologies

- 11.2.7 Rackspace Technology

- 11.2.8 Schneider Electric

- 11.3 Emerging Players

- 11.3.1 AT&T

- 11.3.2 Verizon Communications