|

市場調查報告書

商品編碼

1801914

PEM 電解器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測PEM Electrolyzer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

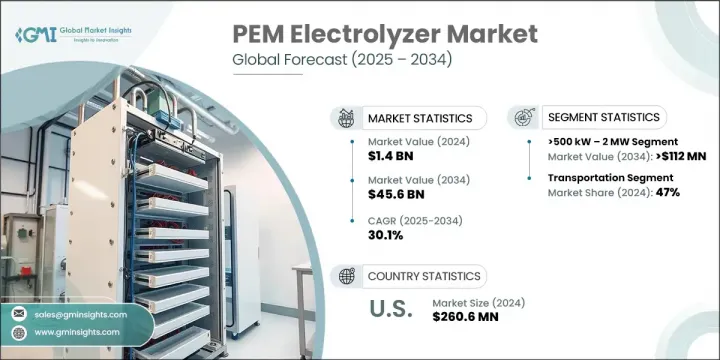

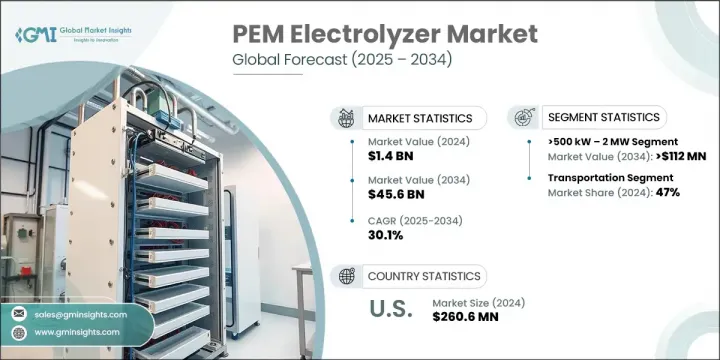

2024年,全球PEM電解器市場規模達14億美元,預計2034年將以30.1%的複合年成長率成長,達到456億美元。這一成長主要得益於工業、運輸和電力產業對清潔氫氣日益成長的需求。隨著全球各行各業尋求降低碳排放,向低碳原料的轉變勢在必行,尤其是在煉油、鋼鐵和合成氨生產等能源密集產業。

質子交換膜 (PEM) 電解器因其高效輸送高純度氫氣的能力以及與波動性能源(尤其是可再生能源)輸入的兼容性,正日益受到廣泛關注。扶持政策、減排指令以及對氫能基礎設施的大規模公私投資,為其廣泛應用創造了有利條件。天然氣管道基礎設施和配送網路的升級預計將降低氫氣輸送成本,從而進一步推動 PEM 系統的普及。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 14億美元 |

| 預測值 | 456億美元 |

| 複合年成長率 | 30.1% |

PEM電解槽的工作原理是透過質子交換膜利用電能將水分解成氫氣和氧氣。其在可變負載下的運作靈活性使其成為與風能和太陽能等可再生能源整合的理想選擇,從而為多個行業提供可靠的綠色氫氣生產。

預計到2034年,500千瓦至2兆瓦容量範圍的市值將超過1.12億美元。這一成長得益於該領域的可擴展性以及在中型工業製氫領域的日益成長的應用。這些系統因其高效的佔地面積和適應性,尤其受到需要備用電源的設施、加氫站和中型工業營運的青睞。其尺寸和輸出功率的平衡使其成為再生能源整合、電力可靠性和現場燃料生產等新興應用的理想解決方案。

交通運輸領域佔了47%的市場佔有率,預計到2034年將以24%的複合年成長率成長。燃料電池電動車的普及以及加氫基礎設施的快速發展,持續增強了移動出行解決方案中對質子交換膜(PEM)電解器的需求。質子交換膜電解器能夠生產高純度氫氣,這對於注重永續性和減排的交通網路至關重要,有助於實現大規模的綠色出行目標。

到2034年,歐洲PEM電解器市場規模將達到175億美元,這得益於對氫能發展的大量投資和強力的監管支持。該地區正在大力推動廣泛的基礎設施建設,以支持氫氣的生產和在多個行業的使用。這些努力與更廣泛的脫碳目標一致,公共和私人資金正在加速氫能相關技術的大規模部署和整合。

塑造全球PEM電解器市場的關鍵公司包括西門子能源、普拉格能源、空氣化學產品公司、康明斯和Nel ASA。為了擴大市場覆蓋範圍並鞏固競爭地位,PEM電解器製造商正在採取多項重點策略。各公司正在擴大產能,以滿足不斷成長的全球需求,並透過製程創新降低生產成本。與公用事業供應商和再生能源開發商建立戰略合作夥伴關係,有助於將電解器的部署與清潔能源發電結合。企業也正在投資研發,以增強薄膜的耐久性、降低能耗並提高系統效率。此外,各公司正在簽訂長期供應協議和建立合資企業,以確保原料供應,並加強其在全球氫能價值鏈的影響力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 2021-2034年價格趨勢分析

- 按生產方式

- 按地區

- 成本結構分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL分析

第4章:競爭格局

- 介紹

- 按地區分析公司市場佔有率

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

- 戰略儀表板

- 策略舉措

- 公司標竿分析

- 創新與技術格局

第5章:市場規模及預測:依產能,2021 - 2034 年

- 主要趨勢

- ≤ 500 千瓦

- > 500千瓦 - 2兆瓦

- > 2 兆瓦 - 5 兆瓦

- 5兆瓦以上

第6章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 發電

- 運輸

- 工業能源

- 工業原料

- 建築暖氣和供電

- 其他

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 荷蘭

- 丹麥

- 西班牙

- 挪威

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 世界其他地區

第8章:公司簡介

- Air Liquide

- Air Products and Chemicals

- Bosch GmbH

- Cummins

- Elogen

- Erre Due

- Giner

- GreenH

- H2B2

- Hygear

- Hystar

- ITM Power

- LARSEN & TOUBRO LIMITED

- Mcphy energy

- Nel ASA

- Next hydrogen

- Ohmium

- Ostermeier H2ydrogen Solutions

- Plug Power

- Siemens Energy

The Global PEM Electrolyzer Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 30.1% to reach USD 45.6 billion by 2034. This growth is largely fueled by the accelerating demand for clean hydrogen across industrial, transport, and power sectors. As global industries seek to lower carbon emissions, the shift toward low-carbon feedstock is becoming imperative, especially in energy-intensive sectors like refining, steel, and ammonia production.

Proton exchange membrane (PEM) electrolyzers are gaining significant traction due to their ability to deliver high-purity hydrogen efficiently and their compatibility with fluctuating energy inputs, particularly from renewable sources. Supportive policies, emission reduction mandates, and large-scale public-private investments in hydrogen infrastructure are creating favorable conditions for widespread adoption. Upgrades in gas pipeline infrastructure and distribution networks are expected to bring down the cost of hydrogen delivery, further promoting the adoption of PEM systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $45.6 Billion |

| CAGR | 30.1% |

PEM electrolyzers function by splitting water into hydrogen and oxygen using electricity via a proton exchange membrane. Their operational flexibility across variable loads makes them ideal for integration with renewable energy sources such as wind and solar, allowing for reliable green hydrogen production across multiple sectors.

The >500 kW - 2 MW capacity range is projected to exceed USD 112 million in value by 2034. This growth is fueled by the segment's scalability and increasing use in mid-scale industrial hydrogen production. These systems are especially favored in facilities requiring backup power, fueling stations, and medium-scale industrial operations due to their efficient footprint and adaptability. Their balance of size and output makes them an ideal solution for emerging applications in renewable energy integration, power reliability, and on-site fuel generation.

The transportation segment held a 47% share and is forecasted to grow at a CAGR of 24% through 2034. Increasing deployment of fuel cell electric vehicles, alongside rapid developments in hydrogen refueling infrastructure, continues to strengthen demand for PEM electrolyzers in mobility solutions. Their ability to produce high-purity hydrogen makes them essential for transportation networks focused on sustainability and emission reduction, supporting large-scale green mobility goals.

Europe PEM Electrolyzer Market will reach USD 17.5 billion by 2034, driven by considerable investments and strong regulatory backing for hydrogen development. The region is pushing forward with widespread infrastructure implementation to support hydrogen production and use across multiple sectors. These efforts align with broader decarbonization targets, with public and private funding accelerating hydrogen-related deployment and integration at scale.

Key companies shaping the Global PEM Electrolyzer Market include Siemens Energy, Plug Power, Air Products & Chemicals, Cummins, and Nel ASA. To expand their market reach and reinforce competitive positioning, PEM electrolyzer manufacturers are adopting several focused strategies. Companies are scaling their manufacturing capacities to meet growing global demand and lowering production costs through process innovation. Strategic partnerships with utility providers and renewable energy developers are helping align electrolyzer deployment with clean power generation. Businesses are also investing in R&D to enhance membrane durability, reduce energy consumption, and boost system efficiency. Additionally, firms are entering long-term supply agreements and joint ventures to secure raw material access and strengthen their hydrogen value chain presence globally.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Capacity trends

- 2.4 Application trends

- 2.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Price trend analysis, 2021-2034

- 3.2.1 By production method

- 3.2.2 By region

- 3.3 Cost structure analysis

- 3.4 Regulatory landscape

- 3.5 Industry impact forces

- 3.5.1 Growth drivers

- 3.5.2 Industry pitfalls & challenges

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL analysis

- 3.8.1 Political factors

- 3.8.2 Economic factors

- 3.8.3 Social factors

- 3.8.4 Technological factors

- 3.8.5 Legal factors

- 3.8.6 Environmental factors

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Rest of World

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 ≤ 500 kW

- 5.3 > 500 kW - 2 MW

- 5.4 > 2 MW - 5 MW

- 5.5 Above 5 MW

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Power generation

- 6.3 Transportation

- 6.4 Industry energy

- 6.5 Industry feedstock

- 6.6 Building heating & power

- 6.7 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Netherlands

- 7.3.6 Denmark

- 7.3.7 Spain

- 7.3.8 Norway

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.5 Rest of World

Chapter 8 Company Profiles

- 8.1 Air Liquide

- 8.2 Air Products and Chemicals

- 8.3 Bosch GmbH

- 8.4 Cummins

- 8.5 Elogen

- 8.6 Erre Due

- 8.7 Giner

- 8.8 GreenH

- 8.9 H2B2

- 8.10 Hygear

- 8.11 Hystar

- 8.12 ITM Power

- 8.13 LARSEN & TOUBRO LIMITED

- 8.14 Mcphy energy

- 8.15 Nel ASA

- 8.16 Next hydrogen

- 8.17 Ohmium

- 8.18 Ostermeier H2ydrogen Solutions

- 8.19 Plug Power

- 8.20 Siemens Energy