|

市場調查報告書

商品編碼

1801903

攜帶式 X 光設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Portable X-ray Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

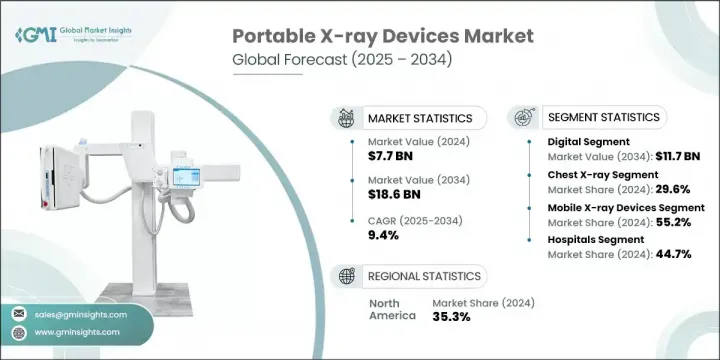

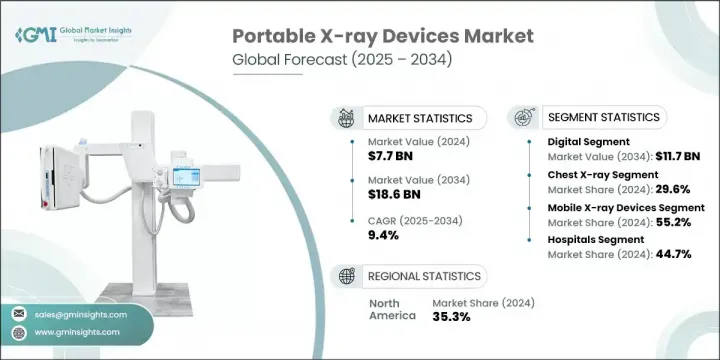

2024年,全球攜帶式X光設備市場規模達77億美元,預計到2034年將以9.4%的複合年成長率成長,達到186億美元。市場持續成長的動力源自於慢性病負擔的加重以及人們對即時診斷的日益青睞。隨著早期便捷的影像學檢查對健康狀況管理至關重要,攜帶式X光設備的需求持續成長。另一個關鍵促進因素是老年人口的成長,他們更容易需要定期進行影像學檢查。人工智慧增強成像、雲端整合和無線資料傳輸等技術進步也有助於簡化診斷流程,同時提高準確性和效率,使攜帶式X光設備成為多種醫療環境中的首選解決方案。

攜帶式X光設備專為移動性和高效性而設計,如今已成為常規診斷中的重要工具,尤其是在無法進行院內成像的情況下。這些系統因其易於使用、快速設置以及與現有數位基礎設施的兼容性,在急診室、家庭護理環境和現場應用中的應用日益廣泛。這些設備透過無線功能提供即時成像,不僅提高了速度,還減少了不必要的患者移動,從而提高了護理和工作流程的效率。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 77億美元 |

| 預測值 | 186億美元 |

| 複合年成長率 | 9.4% |

數位系統領域在2024年創造了48億美元的市場規模,預計到2034年將達到117億美元,複合年成長率為9.6%。數位攜帶式X光設備憑藉其快速的成像速度、高解析度輸出以及與醫院內IT生態系統互聯互通的能力佔據主導地位。這些系統支援人工智慧整合、即時檢視和精簡的雲端共享功能,這些功能對於重症監護、遠距放射學和遠端診斷尤其重要。其更低的輻射輸出和更高的清晰度是其在各個臨床領域日益受到青睞的主要原因。

2024年,行動X光系統的市佔率達到55.2%。這一高佔有率源於其在住院病房、重症監護病房以及需要床邊成像的醫療機構中的廣泛應用。行動系統減少了轉運患者的需要,並配備了增強型數位成像技術和無線連接,使其成為創傷護理、感染控制區和慢性病管理中不可或缺的一部分。移動系統能夠適應各種臨床需求,並能夠在床邊進行成像,這將繼續推動該領域的成長。

2024年,北美攜帶式X光設備市場佔據35.3%的市場。這一優勢得益於該地區先進的醫療基礎設施、早期的技術應用以及對遠端診斷和自動化工作流程解決方案日益成長的需求。高發病率以及專業人士對數位醫學影像日益成長的需求,持續推動攜帶式解決方案的普及。強而有力的公共衛生舉措,加上私部門的快速創新,共同支撐著這一強勁的成長前景。

全球攜帶式X光設備市場的主要參與者包括佳能醫療系統、通用電氣醫療、飛利浦、西門子醫療和富士膠片。攜帶式X光設備市場的公司正大力投入研發,將人工智慧、邊緣運算和雲端連接等先進技術融入其系統。他們正在擴展產品組合,包括專為緊急情況和遠端使用而設計的輕型電池供電型號。與醫療機構和IT提供者的策略聯盟使成像解決方案能夠更順暢地整合到醫院基礎設施中。此外,該公司正在利用數位平台進行即時診斷和遠端諮詢,從而提升服務價值。對培訓項目和服務網路的投資有助於增強客戶保留率。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- X光設備的技術進步

- 全球慢性病盛行率不斷上升

- 診斷成像程序的數量不斷增加

- 老年人口不斷增加

- 產業陷阱與挑戰

- 嚴格的監管情景

- 輻射暴露風險高

- 市場機會

- 人工智慧成像和智慧整合

- 政府篩選和健康計劃

- 成長動力

- 成長潛力分析

- 監管格局

- 技術進步

- 當前的技術趨勢

- 新興技術

- 供應鏈分析

- 報銷場景

- 2024年定價分析

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按技術,2021 - 2034 年

- 主要趨勢

- 數位X光

- 模擬X光

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 牙科X光

- 乳房X光檢查

- 胸部X光檢查

- 心血管

- 骨科

- 其他應用

第7章:市場估計與預測:按方式,2021 - 2034 年

- 主要趨勢

- 行動X光設備

- 手持式X光設備

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 診斷中心

- 其他最終用途

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- GE Healthcare

- Siemens Healthineers

- Canon Medical Systems

- Philips

- Shimadzu

- MinXray

- Hitachi Medical

- Hologic

- Carestream Health

- Samsung Electronics

- Ziehm Imaging

- Fujifilm

- Agfa HealthCare

- DRGEM

- OR Technology

The Global Portable X-ray Devices Market was valued at USD 7.7 billion in 2024 and is estimated to grow at a CAGR of 9.4% to reach USD 18.6 billion by 2034. The market's consistent growth is attributed to the rising burden of chronic illnesses and the increasing preference for point-of-care diagnostics. As early and accessible imaging becomes essential for managing health conditions, demand continues to grow. Another key driver is the expanding elderly population, which is more prone to requiring regular imaging procedures. Technological advancements such as AI-enhanced imaging, cloud integration, and wireless data transfer are also helping streamline diagnostics while improving accuracy and efficiency, making portable X-ray devices a go-to solution across multiple healthcare settings.

Portable X-ray units, designed for mobility and efficiency, are now vital tools in diagnostic routines, especially where in-hospital imaging is impractical. These systems are increasingly used in emergency departments, home-care environments, and field applications due to their ease of use, quick setup, and compatibility with existing digital infrastructure. By offering real-time imaging with wireless capabilities, these devices not only enhance speed but also reduce unnecessary patient movement, improving both care and workflow efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.7 Billion |

| Forecast Value | $18.6 Billion |

| CAGR | 9.4% |

The digital systems segment generated USD 4.8 billion in 2024 and is projected to reach USD 11.7 billion by 2034 at a CAGR of 9.6%. Digital portable X-ray units dominate due to their rapid imaging speed, high-resolution outputs, and ability to link with IT ecosystems within hospitals. These systems support AI integration, real-time viewing, and streamlined cloud-based sharing-features that are particularly important for critical care, tele-radiology, and remote diagnostics. Their reduced radiation output and improved clarity are major contributors to their growing preference across various clinical domains.

The mobile X-ray systems held a 55.2% share in 2024. This high share results from their widespread use in inpatient wards, intensive care units, and healthcare facilities requiring bedside imaging. Mobile systems reduce the need to transport patients and come equipped with enhanced digital imaging technology and wireless connectivity, making them essential for trauma care, infection control zones, and chronic disease management. Their adaptability to varied clinical needs and ability to perform imaging at the point of care continue to drive growth in this segment.

North America Portable X-ray Devices Market held a 35.3% share in 2024. This dominance can be credited to the region's advanced healthcare infrastructure, early technology adoption, and growing demand for remote diagnostics and automated workflow solutions. High disease prevalence, along with the increasing demand for digital medical imaging among professionals, continues to fuel the uptake of portable solutions. Strong public health initiatives, combined with rapid private sector innovation, are supporting this robust growth outlook.

Key players involved in the Global Portable X-ray Devices Market include Canon Medical Systems, GE Healthcare, Philips, Siemens Healthineers, and Fujifilm. Companies in the portable X-ray devices market are focusing heavily on R&D to incorporate advanced technologies like AI, edge computing, and cloud connectivity into their systems. They are expanding their portfolios to include lightweight, battery-operated models tailored for emergency and remote use. Strategic alliances with healthcare institutions and IT providers are enabling smoother integration of imaging solutions into hospital infrastructures. Additionally, firms are leveraging digital platforms for real-time diagnostics and remote consultations, enhancing service value. Investments in training programs and service networks are helping strengthen customer retention.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Technology trends

- 2.2.3 Modality trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancement in x-ray devices

- 3.2.1.2 Rising prevalence of chronic diseases worldwide

- 3.2.1.3 Growing number of diagnostic imaging procedures

- 3.2.1.4 Rising geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory scenario

- 3.2.2.2 High risk of radiation exposure

- 3.2.3 Market opportunities

- 3.2.3.1 AI-powered imaging and smart integration

- 3.2.3.2 Government screening and health programs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Digital X-ray

- 5.3 Analog X-ray

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dental X-ray

- 6.3 Mammography

- 6.4 Chest X-ray

- 6.5 Cardiovascular

- 6.6 Orthopedics

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By Modality, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Mobile X-ray devices

- 7.3 Handheld X-ray devices

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Diagnostic centers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 GE Healthcare

- 10.2 Siemens Healthineers

- 10.3 Canon Medical Systems

- 10.4 Philips

- 10.5 Shimadzu

- 10.6 MinXray

- 10.7 Hitachi Medical

- 10.8 Hologic

- 10.9 Carestream Health

- 10.10 Samsung Electronics

- 10.11 Ziehm Imaging

- 10.12 Fujifilm

- 10.13 Agfa HealthCare

- 10.14 DRGEM

- 10.15 OR Technology