|

市場調查報告書

商品編碼

1801899

智慧水龍頭市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Smart Faucet Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

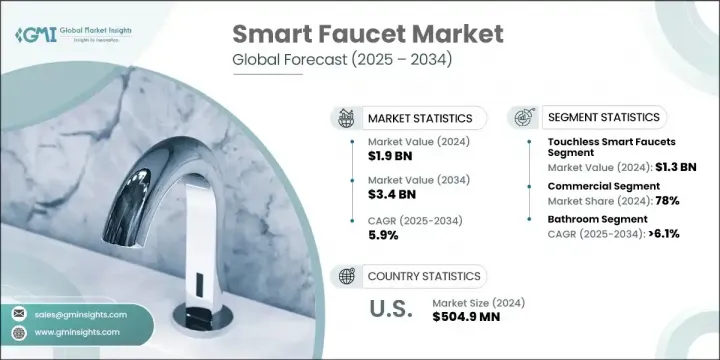

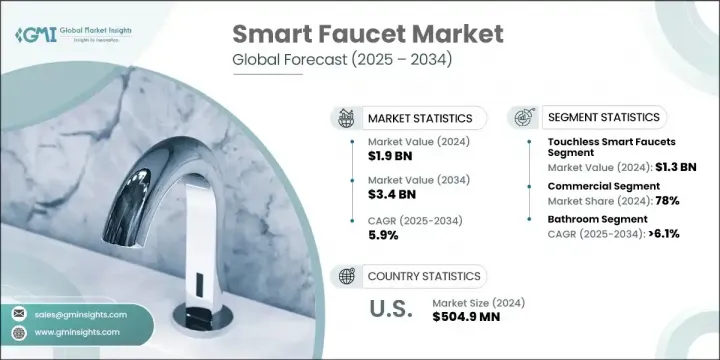

2024年,全球智慧水龍頭市場規模達19億美元,預計2034年將以5.9%的複合年成長率成長,達到34億美元。這一成長主要源於人們對用水效率日益成長的關注,以及對環保解決方案日益成長的需求。消費者和企業都優先考慮能夠減少水資源浪費並支持永續發展目標的技術。智慧水龍頭已成為備受追捧的創新產品,它兼具節水功能、方便用戶使用的操控和智慧自動化功能。感測器系統、語音指令和物聯網功能的整合提升了便利性,並順應了日益成長的智慧家庭趨勢。

需求的成長也與人們衛生意識的增強有關,免接觸操作已成為住宅、商業和醫療保健環境中的關鍵特性。這些水龍頭透過消除身體接觸,提供更乾淨、更安全的使用者體驗。城市化和持續的建築活動持續提升了現代住宅和商業開發項目中對智慧水裝置的需求。越來越多的業主選擇高階的、技術支援的解決方案,這些解決方案有助於節約資源,同時提升建築環境的價值。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 19億美元 |

| 預測值 | 34億美元 |

| 複合年成長率 | 5.9% |

2024年,免接觸式智慧水龍頭市場規模達13億美元,預計2034年的複合年成長率將達到6.1%。該細分市場憑藉其衛生至上的設計引領市場,吸引了注重健康安全的用戶。這些系統使用運動感測器自動控制水流,消除了物理接觸並減少了交叉污染。如今,清潔已成為公共和私人空間的關鍵因素,免接觸式水龍頭系統正被廣泛採用,並鞏固了其在市場上的主導地位。

商業領域在2024年佔據了78%的市場佔有率,預計到2034年將以5.8%的複合年成長率成長。商業應用中的智慧水龍頭透過控制用水量和降低能耗,幫助設施降低營運成本。飯店、公共衛生間、辦公大樓和醫院等人流量大的空間中的企業正在採用這些系統來提高效率並改善使用者體驗。這些水龍頭有助於防止洩漏、最佳化維護並實現長期成本節約,使其成為整個商業營運的實用升級。

美國智慧水龍頭市場佔77%的市場佔有率,2024年市場規模達5.049億美元。美國市場的成長得益於消費者對家庭自動化的濃厚興趣、完善的基礎設施以及有利的監管措施。高水準的智慧家庭整合使美國處於智慧家庭應用的前沿,屋主們紛紛將智慧水龍頭作為互聯生活環境的一部分。語音啟動、遠端應用監控和用水量分析等功能持續激發消費者興趣,並增強市場滲透率。

全球智慧水龍頭市場的主要製造商包括 LIXIL、Delta Faucet、TOTO、Moen、Hansgrohe、Masco、Kohler、Roca Sanitario、ASSA ABLOY、House of Rohl、KWC、Oras、BRIZO Kitchen & Bath、Gessi 和 Villeroy & Boch。智慧水龍頭市場的頂尖公司正專注於創新、設計和智慧技術整合,以擴大市場佔有率。對人工智慧、運動感測器和語音控制功能的投資是產品開發策略的核心。領先的企業也透過與房地產開發商、連鎖飯店和公共基礎設施項目合作來增強品牌影響力。產品線擴大被客製化,以提供節能、節水和易於安裝的產品,以滿足最終消費者和商業買家的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 非接觸式智慧水龍頭

- 觸控式智慧水龍頭

第6章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 金屬

- 塑膠

- 其他

第7章:市場估計與預測:按應用,2021 - 2034 年

- 浴室

- 廚房

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 住宅

- 商業的

- 飯店和餐廳

- 醫院

- 公司辦公室

- 公共衛生間

- 其他

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 線上

- 電子商務

- 公司網站

- 離線

- 超市/大賣場

- 專業零售店

- 其他(獨立零售商等)

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- ASSA ABLOY

- BRIZO Kitchen & Bath

- Delta Faucet

- Gessi

- Hansgrohe

- House of Rohl

- Kohler

- KWC

- LIXIL

- Masco

- Moen

- Oras

- Roca Sanitario

- TOTO

- Villeroy & Boch

The Global Smart Faucet Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 3.4 billion by 2034. This growth is being fueled by rising concerns around water efficiency and the increasing push for eco-conscious solutions. Consumers and businesses alike are prioritizing technologies that help minimize water waste while supporting sustainability goals. Smart faucets have become a sought-after innovation, delivering water-saving features combined with user-friendly control and intelligent automation. The integration of sensor-based systems, voice-enabled commands, and IoT capabilities enhances convenience and aligns with the expanding smart home trend.

The rising demand is also linked to heightened hygiene awareness, with touch-free operation becoming a critical feature across residential, commercial, and healthcare environments. These faucets offer a cleaner, safer user experience by eliminating physical contact. Urbanization and ongoing construction activity continue to elevate demand for smart water fixtures in modern residential and commercial developments. Property owners are increasingly turning to premium, tech-enabled solutions that help conserve resources while also enhancing the value of built environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $3.4 Billion |

| CAGR | 5.9% |

The touchless smart faucets generated USD 1.3 billion in 2024 and is anticipated to grow at a CAGR of 6.1% throughout 2034. This segment leads the market thanks to its hygiene-first design, which appeals to users prioritizing health safety. These systems activate water flow automatically using motion sensors, eliminating physical interaction and reducing cross-contamination. With cleanliness now a critical factor in both public and private spaces, hands-free faucet systems are being adopted widely, supporting their continued dominance in the market.

The commercial sector held 78% share in 2024 and is projected to grow at a CAGR of 5.8% through 2034. Smart faucets in commercial applications help facilities reduce operating costs by controlling water usage and lowering energy consumption. Businesses in high-traffic spaces such as hotels, public restrooms, office buildings, and hospitals are adopting these systems to enhance efficiency while improving user experience. These faucets help prevent leaks, optimize maintenance, and offer long-term cost savings-making them a practical upgrade across commercial operations.

United States Smart Faucet Market accounted for 77% share and generated USD 504.9 million in 2024. Growth in the U.S. is supported by strong consumer interest in home automation, robust infrastructure, and favorable regulatory initiatives. A high level of smart home integration has positioned the country at the forefront of adoption, with homeowners embracing intelligent water fixtures as part of their connected living environments. Features such as voice activation, remote app monitoring, and water usage analytics continue to drive consumer interest and strengthen market penetration.

Key manufacturers in the Global Smart Faucet Market include LIXIL, Delta Faucet, TOTO, Moen, Hansgrohe, Masco, Kohler, Roca Sanitario, ASSA ABLOY, House of Rohl, KWC, Oras, BRIZO Kitchen & Bath, Gessi, and Villeroy & Boch. Top companies in the smart faucet market are focusing on innovation, design, and smart technology integration to expand their market share. Investments in AI, motion sensors, and voice control capabilities are central to product development strategies. Leading players are also strengthening brand presence through partnerships with real estate developers, hospitality chains, and public infrastructure projects. Product lines are increasingly being tailored to offer energy efficiency, water conservation, and ease of installation-catering to both end consumers and commercial buyers.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 By type

- 2.2.3 By material

- 2.2.4 By application

- 2.2.5 By end use

- 2.2.6 By distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Billion, Million Units)

- 5.1 Key trends

- 5.2 Touchless smart faucets

- 5.3 Touch-enabled smart faucets

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 ($Billion, Million Units)

- 6.1 Key trends

- 6.2 Metallic

- 6.3 Plastic

- 6.4 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Billion, Million Units)

- 7.1 Bathroom

- 7.2 Kitchen

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Billion, Million Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.3.1 Hotels & restaurants

- 8.3.2 Hospitals

- 8.3.3 Corporate offices

- 8.3.4 Public washrooms

- 8.3.5 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Million Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce

- 9.2.2 Company websites

- 9.3 Offline

- 9.3.1 Supermarkets/hypermarket

- 9.3.2 Specialty retail stores

- 9.3.3 Others (independent retailer etc.)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 ASSA ABLOY

- 11.2 BRIZO Kitchen & Bath

- 11.3 Delta Faucet

- 11.4 Gessi

- 11.5 Hansgrohe

- 11.6 House of Rohl

- 11.7 Kohler

- 11.8 KWC

- 11.9 LIXIL

- 11.10 Masco

- 11.11 Moen

- 11.12 Oras

- 11.13 Roca Sanitario

- 11.14 TOTO

- 11.15 Villeroy & Boch