|

市場調查報告書

商品編碼

1801893

智慧電錶市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Smart Meter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

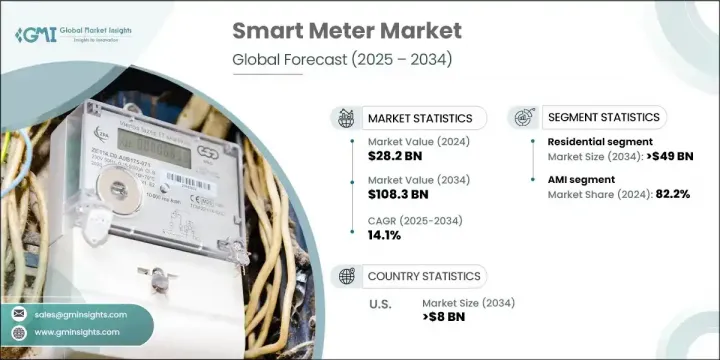

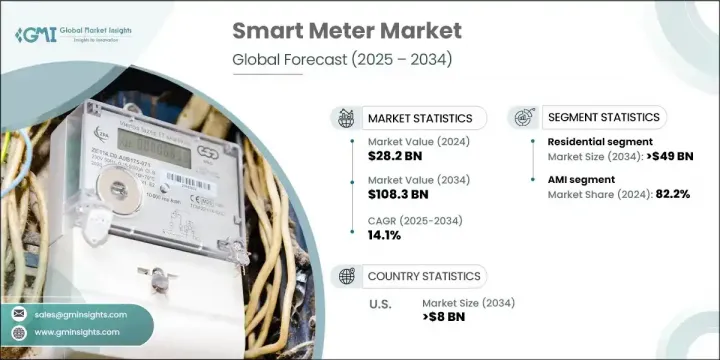

2024年,全球智慧電錶市場規模達282億美元,預計年複合成長率將達14.1%,到2034年將達到1,083億美元。這一顯著成長得益於監管支持力度的加大、計量技術的持續創新以及消費者對永續能源利用日益成長的關注。隨著數位化不斷重塑能源格局,智慧電錶正成為能源管理系統的核心組成部分。這些設備能夠即時採集電力、天然氣或水的消耗資料,並將資訊直接傳輸給公用事業公司,從而提高營運效率和計費準確性。

在許多經濟體中,政府支持的旨在升級國家電網的項目將智慧電錶置於其現代化戰略的核心位置。向智慧電網的轉型不僅在於提高可靠性,還在於整合清潔能源並最大限度地減少傳輸損耗。隨著對減少碳足跡和提高能源透明度的重視,公用事業供應商正在迅速用能夠提供雙向通訊和即時分析的智慧系統取代傳統電錶。隨著電網最佳化、節能減排和消費者賦能日益成為優先事項,智慧電錶市場在住宅、商業和工業領域持續蓬勃發展。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 282億美元 |

| 預測值 | 1083億美元 |

| 複合年成長率 | 14.1% |

預計到2034年,住宅能源市場規模將達到490億美元,這得益於政府大力推動家庭能源基礎建設現代化。大眾對能源效率和環境責任的意識不斷增強,也促使消費者採用智慧計量解決方案。這些數位計量表允許使用者存取即時資料,從而更好地控制能源消耗,幫助降低水電費,同時支持永續生活。隨著需求面管理和節能專案的推進,住宅應用領域仍將維持成長的領先地位。

2024年,先進計量基礎設施 (AMI) 佔據了82.2%的市場佔有率,這得益於其廣泛的功能。 AMI 支援公用事業公司和終端用戶之間的即時雙向資料通訊,這對於能源最佳化和電網可靠性至關重要。透過遠端抄表、動態定價、負載平衡和快速故障檢測等功能,AMI 使能源供應商能夠主動回應需求變化。這些系統還可以輕鬆與智慧家庭和消費者級能源儀錶板整合,從而提高透明度並鼓勵高效的能源行為。

到2034年,美國智慧電錶市場規模將達到80億美元,其中工業和住宅升級將貢獻這一成長動力。美國正在加強電網基礎設施建設,以應對日益成長的能源需求和更高比例的再生能源。監管措施正在推動先進的監控和管理工具的發展,將智慧電錶定位為關鍵基礎設施。此外,智慧電錶正在能源密集產業廣泛應用,進一步提升營運效率、合規性和供電可靠性。

引領全球智慧電錶市場的知名企業包括西門子、施耐德電機、Itron、霍尼韋爾國際和 Landis + Gyr。智慧電錶產業的主要公司正在透過創新、策略聯盟和區域擴張等多種方式來提升其市場地位。研發投入持續發揮關鍵作用,各公司專注於開發整合人工智慧、物聯網和雲端分析技術的下一代電錶。領先的公司也正在與公用事業供應商和政府建立合作夥伴關係,以贏得長期部署合約。為了滿足不斷成長的需求,企業正在擴大生產能力並在戰略區域實現本地化製造。此外,他們還透過包括提供能源洞察、遠端診斷和預測性維護的軟體平台來增強其服務產品,以提高客戶價值和營運可靠性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 進出口貿易分析

- 各地區價格趨勢分析(美元/單位)

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL分析

- 新興機會和趨勢

- 數位化和物聯網整合

- 新興市場滲透

- 投資分析及未來展望

第4章:競爭格局

- 介紹

- 按地區分析公司市場佔有率

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 策略舉措

- 競爭性基準描述

- 策略儀表板

- 創新與技術格局

第5章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 住宅

- 商業的

- 公用事業

第6章:市場規模及預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 急性心肌梗塞

- 抗腫瘤藥物

第7章:市場規模及預測:依產品,2021 - 2034

- 主要趨勢

- 智慧瓦斯

- 智慧水務

- 智慧電動

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 瑞典

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

第9章:公司簡介

- Apator SA

- ABB

- AEM

- Aclara Technologies LLC

- ARAD Group

- B Meters Metering Solutions

- Badger Meter, Inc.

- Chint Group

- General Electric

- Honeywell International, Inc.

- Itron, Inc.

- Iskraemeco Group

- Kamstrup

- Larsen & Toubro Limited

- Landis + Gyr

- Ningbo Water Meter Co., Ltd.

- Osaki Electric Co., Ltd.

- Raychem RPG Private Limited

- Schneider Electric SE

- Siemens

- Sensus

- Sontex SA

- Wasion Group

The Global Smart Meter Market was valued at USD 28.2 billion in 2024 and is estimated to grow at a CAGR of 14.1% to reach USD 108.3 billion by 2034. This remarkable growth is being fueled by rising regulatory support, continued innovation in metering technologies, and growing consumer focus on sustainable energy usage. As digitalization continues to reshape the energy landscape, smart meters are becoming a central component of energy management systems. These devices capture real-time consumption data for electricity, gas, or water, transmitting the information directly to utilities for improved operational efficiency and billing accuracy.

Across many economies, government-backed programs aimed at upgrading national grids are placing smart meters at the core of their modernization strategies. The transition to smart grids is not only about enhancing reliability but also about integrating clean energy and minimizing transmission losses. With greater emphasis on reducing carbon footprints and improving energy transparency, utility providers are rapidly replacing conventional meters with intelligent systems that deliver two-way communication and real-time analytics. As grid optimization, energy conservation, and consumer empowerment rise in priority, the smart meter market continues to gain momentum across residential, commercial, and industrial sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $28.2 Billion |

| Forecast Value | $108.3 Billion |

| CAGR | 14.1% |

The residential sector is projected to reach USD 49 billion by 2034, supported by widespread government efforts to modernize household energy infrastructure. Increasing public awareness of energy efficiency and environmental responsibility is also influencing consumers to adopt smart metering solutions. These digital meters allow users to access real-time data, offering better control over energy consumption and helping reduce utility bills while supporting sustainable living. With demand-side management and energy-saving programs gaining ground, the residential application segment remains at the forefront of growth.

The advanced metering infrastructure (AMI) held an 82.2% share in 2024, driven by its wide functionality. AMI enables real-time, bidirectional data communication between utility companies and end users, making it essential for energy optimization and grid reliability. Through features such as remote meter reading, dynamic pricing, load balancing, and quick fault detection, AMI allows energy providers to respond proactively to changes in demand. These systems also integrate easily with smart homes and consumer-level energy dashboards, boosting transparency and encouraging efficient energy behaviors.

U.S. Smart Meter Market will reach USD 8 billion by 2034, with contributions coming from industrial and residential upgrades. The country is strengthening its grid infrastructure to handle growing energy demands and a higher share of variable renewable sources. Regulatory actions are pushing for advanced monitoring and management tools, positioning smart meters as critical infrastructure. Additionally, smart meters are seeing adoption in energy-intensive sectors, adding further value to operational efficiency, compliance, and supply reliability.

Prominent players leading the Global Smart Meter Market include Siemens, Schneider Electric, Itron, Honeywell International, and Landis + Gyr. Major companies in the smart meter industry are enhancing their market positioning through a mix of innovation, strategic alliances, and regional expansion. Investments in R&D continue to play a key role, with companies focusing on developing next-generation meters that integrate AI, IoT, and cloud-based analytics. Leading firms are also forming partnerships with utility providers and governments to win long-term deployment contracts. To meet growing demand, businesses are expanding production capabilities and localizing manufacturing in strategic regions. Furthermore, they are strengthening their service offerings by including software platforms that provide energy insights, remote diagnostics, and predictive maintenance to enhance customer value and operational reliability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Import/Export trade analysis

- 3.4 Price trend analysis, by region (USD/Unit)

- 3.5 Industry impact forces

- 3.5.1 Growth drivers

- 3.5.2 Industry pitfalls & challenges

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL analysis

- 3.8.1 Political factors

- 3.8.2 Economic factors

- 3.8.3 Social factors

- 3.8.4 Technological factors

- 3.8.5 Legal factors

- 3.8.6 Environmental factors

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization & IoT integration

- 3.9.2 Emerging market penetration

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking depictions

- 4.5 Strategy dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & '000 Units)

- 5.1 Key trends

- 5.2 Residential

- 5.3 Commercial

- 5.4 Utility

Chapter 6 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million & '000 Units)

- 6.1 Key trends

- 6.2 AMI

- 6.3 AMR

Chapter 7 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & '000 Units)

- 7.1 Key trends

- 7.2 Smart gas

- 7.3 Smart water

- 7.4 Smart electric

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & '000 Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Sweden

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 UAE

- 8.5.2 Saudi Arabia

- 8.5.3 South Africa

- 8.5.4 Egypt

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Mexico

- 8.6.3 Argentina

Chapter 9 Company Profiles

- 9.1 Apator SA

- 9.2 ABB

- 9.3 AEM

- 9.4 Aclara Technologies LLC

- 9.5 ARAD Group

- 9.6 B Meters Metering Solutions

- 9.7 Badger Meter, Inc.

- 9.8 Chint Group

- 9.9 General Electric

- 9.10 Honeywell International, Inc.

- 9.11 Itron, Inc.

- 9.12 Iskraemeco Group

- 9.13 Kamstrup

- 9.14 Larsen & Toubro Limited

- 9.15 Landis + Gyr

- 9.16 Ningbo Water Meter Co., Ltd.

- 9.17 Osaki Electric Co., Ltd.

- 9.18 Raychem RPG Private Limited

- 9.19 Schneider Electric SE

- 9.20 Siemens

- 9.21 Sensus

- 9.22 Sontex SA

- 9.23 Wasion Group