|

市場調查報告書

商品編碼

1801892

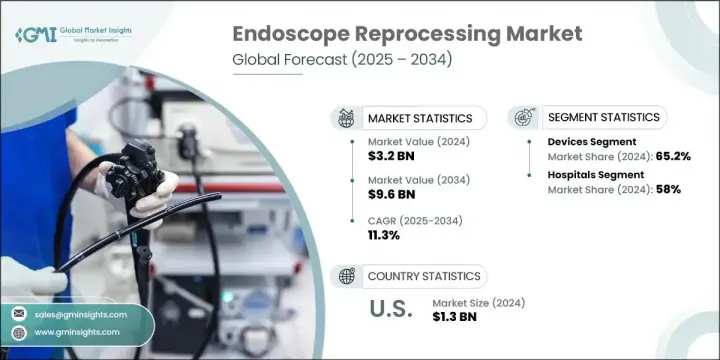

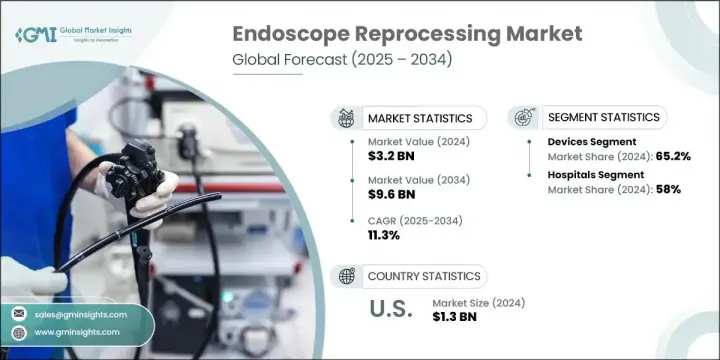

內視鏡再處理市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Endoscope Reprocessing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年,全球內視鏡再處理市場規模達32億美元,預計到2034年將以11.3%的複合年成長率成長,達到96億美元。這一市場的快速擴張得益於微創手術技術的日益普及,以及胃腸道疾病和癌症等需要頻繁進行內視鏡診斷和治療的疾病的盛行率不斷上升。隨著越來越多的手術轉移到門診和流動手術中心,對可靠高效的再處理系統的需求,以確保使用者之間內視鏡的安全,變得愈發重要。

確保可重複使用內視鏡的消毒和安全是臨床環境中感染控制的核心。監管機構持續執行嚴格的內視鏡設備清潔和消毒規程。隨著醫療保健提供者面臨日益成長的減少院內感染的壓力,制定全面、經過驗證的再處理規程的重要性也日益凸顯。此外,對抗菌素抗藥性的日益擔憂以及對更嚴格感染預防的需求,也不斷加劇了對高效能、高品質內視鏡再處理系統的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 32億美元 |

| 預測值 | 96億美元 |

| 複合年成長率 | 11.3% |

預計到2034年,配件市場的複合年成長率將達到10.9%,這得益於設備組件的創新,這些創新旨在提升性能並簡化工作流程。持續的研發投入使企業能夠引入自動化技術,這不僅可以提高再處理的一致性,還可以減少對人工的依賴,而人工往往會導致生產不穩定和潛在的錯誤。自動化內視鏡再處理機的穩定成長,在提高效率的同時,也確保了合規性,並最大限度地降低了不當滅菌的風險。

2024年,醫院細分市場佔據了58%的市場。此細分市場的主導地位主要歸功於其龐大的患者數量,以及日益重視透過嚴格遵守消毒規程來減少感染傳播。醫療機構高度重視技術人員培訓、合規性追蹤以及清潔週期記錄,以確保始終如一地進行正確的消毒。因此,醫院正在整合先進的追蹤系統,以監控每個內視鏡的再處理歷史,並最佳化工作流程的安全性。

2024年,美國內視鏡再處理市場規模達13億美元。美國佔據主導地位,得益於其與慢性病相關的高手術量,以及聯邦政府對改善醫療機構感染控制的重視。醫療基礎設施的升級以及對病人安全計畫的財政投入不斷增加,正在推動北美地區更廣泛地採用自動化和數位化再處理解決方案。

推動全球內視鏡再處理市場創新和競爭的主要參與者包括 Olympus、Wassenburg Medical、Steelco、Getinge、Metrex、Ecolab、Belimed、ASP、Shinva Medical Instrument、Creo Medical、CONMED Corporation、Karl Storz、ARC Group of Companies 和 STERIS。為了鞏固其在內視鏡再處理市場中的地位,領先的公司正在大力投資研發先進的系統,以提供一致的清潔性能並減少人為錯誤。許多公司專注於自動化和數位整合,以增強可追溯性、提高工作流程效率並確保法規遵循。與醫院和外科中心的策略合作有助於擴大客戶群並根據實際需求量身定做解決方案。一些參與者提供增值服務,如員工培訓、維護和合規性追蹤。透過區域製造工廠和本地化服務支援進行全球擴張正在幫助製造商提高市場滲透率。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 內視鏡檢查的需求不斷增加

- 內視鏡再處理的技術進步

- 微創手術的偏好日益增加

- 胃腸道疾病、癌症和其他慢性疾病的盛行率不斷上升

- 產業陷阱與挑戰

- 化學消毒劑的不良反應

- 內視鏡再處理設備成本高

- 市場機會

- 感染控制意識不斷提高

- 醫療基礎設施的成長

- 成長動力

- 成長潛力

- 成長潛力分析

- 報銷場景

- 監管格局

- 北美洲

- 歐洲

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 未來市場趨勢

- 新產品開發格局

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 裝置

- 自動內視鏡再處理器(AER)

- 按類型

- 單門自動排氣扇

- 雙門自動排氣扇

- 按可移植性

- 獨立 AER

- 手提式空氣脫氣機

- 按類型

- 內視鏡乾燥、儲存及運送系統

- 其他設備

- 自動內視鏡再處理器(AER)

- 耗材

- 閥門和適配器

- 高水準消毒劑

- 床頭套件

- 其他耗材

- 配件

第6章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 其他最終用途

第7章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 奧地利

- 瑞士

- 中東歐

- 波蘭

- 匈牙利

- 羅馬尼亞

- 捷克共和國

- 保加利亞

- 中東歐其他地區

- 北歐國家

- 丹麥

- 瑞典

- 挪威

- 其他北歐國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲和紐西蘭

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- ARC Group of Companies

- ASP

- Belimed

- CONMED Corporation

- Creo Medical

- Ecolab

- Getinge

- Metrex

- Olympus

- Shinva Medical Instrument

- Steelco

- STERIS

- Karl Storz

- Wassenburg Medical

The Global Endoscope Reprocessing Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 11.3% to reach USD 9.6 billion by 2034. This rapid market expansion is being fueled by the increasing shift toward minimally invasive surgical techniques, coupled with the rising prevalence of conditions such as gastrointestinal diseases and cancers that require frequent diagnostic and therapeutic endoscopic procedures. As more procedures shift to outpatient and ambulatory surgical centers, the need for reliable and efficient reprocessing systems that ensure endoscope safety between users becomes more critical.

Ensuring the disinfection and safety of reusable endoscopes is central to infection control in clinical environments. Regulatory bodies continue to enforce strict protocols for cleaning and disinfecting endoscopic devices. As healthcare providers face heightened pressure to mitigate healthcare-associated infections, the importance of thorough, validated reprocessing protocols has grown considerably. Additionally, increasing concerns surrounding antimicrobial resistance and the demand for greater infection prevention continue to intensify the need for effective, high-quality endoscope reprocessing systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $9.6 Billion |

| CAGR | 11.3% |

The accessories segment is expected to grow at a CAGR of 10.9% through 2034, driven by innovation in device components that enhance performance and simplify workflows. Continued investments in R&D are allowing companies to introduce automated technologies that not only improve reprocessing consistency but also reduce reliance on manual labor, which often leads to variability and potential error. The steady rise of automated endoscope reprocessors is enhancing efficiency while ensuring regulatory compliance and minimizing the risk of improper sterilization.

In 2024, the hospitals segment held 58% share. The dominance of this segment is primarily attributed to the high volume of patients and the increasing focus on reducing infection transmission through strict adherence to sterilization protocols. Facilities are placing strong emphasis on technician training, compliance tracking, and documentation of cleaning cycles to ensure that proper disinfection is achieved consistently. As a result, hospitals are integrating advanced tracking systems to monitor the reprocessing history of every scope and optimize workflow safety.

U.S. Endoscope Reprocessing Market was valued at USD 1.3 billion in 2024. The country's dominance stems from high procedural volumes tied to chronic diseases, as well as federal focus on improving infection control across healthcare facilities. Upgrades to healthcare infrastructure and growing financial investment in patient safety initiatives are supporting stronger adoption of automated and digitalized reprocessing solutions across North America.

Key players driving innovation and competition in the Global Endoscope Reprocessing Market include Olympus, Wassenburg Medical, Steelco, Getinge, Metrex, Ecolab, Belimed, ASP, Shinva Medical Instrument, Creo Medical, CONMED Corporation, Karl Storz, ARC Group of Companies, and STERIS. To strengthen their position in the endoscope reprocessing market, leading companies are investing heavily in R&D to develop advanced systems that deliver consistent cleaning performance and reduce human error. Many are focusing on automation and digital integration to enhance traceability, improve workflow efficiency, and ensure regulatory compliance. Strategic collaborations with hospitals and surgical centers are helping expand their client base and tailor solutions to real-world needs. Some players are offering value-added services such as staff training, maintenance, and compliance tracking. Global expansion through regional manufacturing facilities and localized service support is helping manufacturers increase market penetration.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for endoscopy procedures

- 3.2.1.2 Technological advancements in endoscope reprocessing

- 3.2.1.3 Rising preferences for minimally invasive procedures

- 3.2.1.4 Increasing prevalence of GI disorders, cancer, and other chronic ailments

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adverse effects of chemical disinfectants

- 3.2.2.2 High cost of endoscope reprocessing devices

- 3.2.3 Market opportunities

- 3.2.3.1 Rising awareness of infection control

- 3.2.3.2 Growth in healthcare infrastructure

- 3.2.1 Growth drivers

- 3.3 Growth potential

- 3.4 Growth potential analysis

- 3.5 Reimbursement scenario

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Future market trends

- 3.9 New product development landscape

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 MEA

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Devices

- 5.2.1 Automated endoscope reprocessors (AERs)

- 5.2.1.1 By Type

- 5.2.1.1.1 Single-door AERs

- 5.2.1.1.2 Double-door AERs

- 5.2.1.2 By Portability

- 5.2.1.2.1 Standalone AERs

- 5.2.1.2.2 Portable AERs

- 5.2.1.1 By Type

- 5.2.2 Endoscope drying, storage, and transport systems

- 5.2.3 Other devices

- 5.2.1 Automated endoscope reprocessors (AERs)

- 5.3 Consumables

- 5.3.1 Valves and adaptors

- 5.3.2 High level disinfectants

- 5.3.3 Bedside kits

- 5.3.4 Other consumables

- 5.4 Accessories

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Ambulatory surgical centers

- 6.4 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.3.7 Austria

- 7.3.8 Switzerland

- 7.3.9 CEE

- 7.3.9.1 Poland

- 7.3.9.2 Hungary

- 7.3.9.3 Romania

- 7.3.9.4 Czech Republic

- 7.3.9.5 Bulgaria

- 7.3.9.6 Rest of CEE

- 7.3.10 Nordic countries

- 7.3.10.1 Denmark

- 7.3.10.2 Sweden

- 7.3.10.3 Norway

- 7.3.10.4 Rest of Nordic countries

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia and New Zealand

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 ARC Group of Companies

- 8.2 ASP

- 8.3 Belimed

- 8.4 CONMED Corporation

- 8.5 Creo Medical

- 8.6 Ecolab

- 8.7 Getinge

- 8.8 Metrex

- 8.9 Olympus

- 8.10 Shinva Medical Instrument

- 8.11 Steelco

- 8.12 STERIS

- 8.13 Karl Storz

- 8.14 Wassenburg Medical