|

市場調查報告書

商品編碼

1801890

冷藏箱市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Cooler Box Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

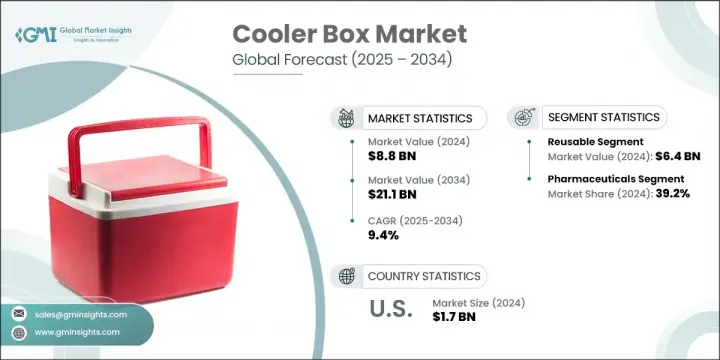

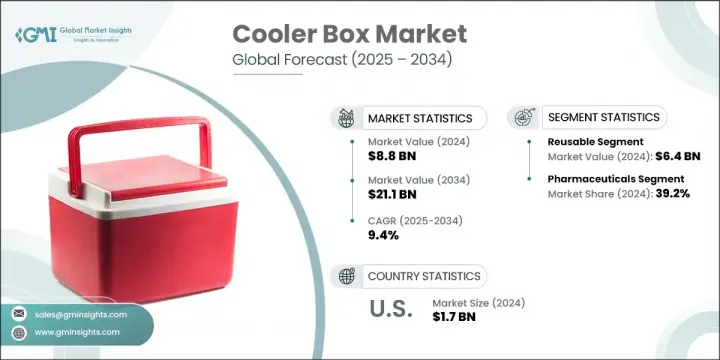

2024 年全球冷藏箱市場價值為 88 億美元,預計到 2034 年將以 9.4% 的複合年成長率成長至 211 億美元。市場發展勢頭強勁,得益於對溫度敏感型商品的需求不斷成長,以及市場普遍轉向永續冷藏解決方案。從低瓦數設備到超過 1.5 兆瓦的系統,冷藏箱的冷卻能力範圍廣泛,顯示其在住宅、商業和工業領域的適應性。隨著消費者對環境責任的日益關注,可重複使用的冷藏箱成為一次性容器的經濟高效、耐用的替代品。隨著越來越多的環保意識影響購買行為,可重複使用的冷藏箱正成為消費者和企業減少浪費策略中不可或缺的一部分。隨著公司和產業與全球永續發展目標保持一致,未來幾年,耐用、環保的冷藏產品市場將穩步發展。

對溫控物流的依賴已成為保障產品品質和公共衛生的關鍵。冷鏈解決方案的缺乏持續影響著關鍵產業,尤其是在醫療保健領域,數百萬名可預防的兒童死亡與疫苗儲存和運輸故障有關。隨著對可靠、節能冷卻系統的需求不斷成長,冷藏箱在各種溫度範圍內(包括超低儲存條件下)提供可靠性能方面發揮著至關重要的作用。這些冷鏈物流需求預計將維持全球市場的擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 88億美元 |

| 預測值 | 211億美元 |

| 複合年成長率 | 9.4% |

可重複使用冷藏箱市場在2024年引領市場,達到64億美元,預計2025年至2034年期間的複合年成長率將達到9.8%。隨著一次性包裝的逐漸減少,人們對可重複使用、使用壽命更長的冷藏箱產品產生了濃厚的興趣。這些冷藏箱採用彈性材料製成,可重複使用,且不會影響隔熱性能或結構耐久性。這一發展趨勢不僅支持全球永續發展目標,還能滿足現代供應鏈的成本效益需求。

2024年,製藥業創造了34億美元的市場規模,佔39.2%。冷鏈完整性仍然是製藥業的重中之重,嚴格的合規標準要求運輸和儲存過程中必須保持穩定的熱環境。全球對疫苗分發和溫敏藥物規範儲存的需求,進一步加劇了對溫控解決方案的需求。為確保產品功效的一致性和合規性,符合嚴格製藥標準的冷藏箱正廣泛應用。

2024年,美國冷藏箱市場規模達17億美元,預計2025年至2034年的複合年成長率將達到10.3%。美國市場的成長主要得益於依賴冷藏基礎設施的產業規模的不斷擴大。從送餐服務到醫藥物流和食品雜貨配送,隨著基礎設施的改善,需求也不斷攀升。住宅和商業用電量的激增也推動了高效冷卻技術的普及。這些因素預示著冷鏈投資將持續成長,為在全國部署冷藏箱創造了有利條件。

活躍於全球冷藏箱市場的知名公司包括 Cold Chain Technologies Inc.、va-Q-tec Thermal Solutions GmbH、WILD Coolers、FEURER Group GmbH、Pelican Products Inc.、Igloo Products Corp.、YETI COOLERS, LLC.、K2Coolers、Sourogam Group、Sonoco Theonomot、Conoco Themotive、Coolers、Souroel、Tonoco Themoce、Conoco Themoce。冷藏箱產業的公司正在投資材料創新、模組化產品設計和技術整合,以打造長期競爭力。許多參與者專注於生產可重複使用、耐用且熱效率高的冷藏箱,以應對日益嚴重的環境問題。包括醫療保健和食品物流在內的不同行業的客製化選項正在擴大,以擴大市場範圍。與物流供應商和冷鏈基礎設施開發商的策略合作夥伴關係也在加強供應鏈連通性。領先的製造商正在積極加強研發力度,設計與智慧溫度監控系統相容的輕型高效能設備。一些公司正在透過建立區域製造中心來提升其地理影響力,幫助降低運輸成本並更有效地回應已開發市場和新興市場的在地化需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業影響力量

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區和類型

- 監理框架

- 標準和認證

- 環境法規

- 進出口法規

- 波特的分析

- PESTEL分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 可重複使用的

- 一次性的

第6章:市場估計與預測:依原料,2021 - 2034 年

- 主要趨勢

- 擠塑聚苯乙烯

- 發泡聚苯乙烯

- 發泡聚丙烯

第7章:市場估計與預測:依價格區間,2021 年至 2034 年

- 主要趨勢

- 低(最高 30 美元)

- 中(30 - 50 美元)

- 高(50 美元以上)

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 製藥

- 食品和飲料

- 其他

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 線上

- 公司網站

- 電子商務網站

- 離線

- 超市和大賣場

- 專業戶外用品商店

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- B Medical System

- Bison Coolers

- Blowkings

- Cold Chain Technologies Inc.

- Cool Ice Box Company

- Eurobox Logistics

- FEURER Group GmbH

- Igloo Products Corp.

- K2Coolers

- Pelican Products Inc.

- Sofrigam Group

- Sonoco ThermoSafe

- va-Q-tec Thermal Solutions GmbH

- WILD Coolers

- YETI COOLERS, LLC.

The Global Cooler Box Market was valued at USD 8.8 billion in 2024 and is estimated to grow at a CAGR of 9.4% to reach USD 21.1 billion by 2034. Market momentum is being driven by a combination of rising demand for temperature-sensitive goods and a broader shift toward sustainable cold storage solutions. The diverse range of cooling capacities, from low-wattage units to systems exceeding 1.5 MW, illustrates the adaptability of cooler boxes across residential, commercial, and industrial sectors. Increasing attention on environmental responsibility is also steering buyers toward reusable cooler boxes, which emerge as cost-effective, durable alternatives to disposable containers. With growing environmental awareness influencing buying behavior, reusable cooler boxes are becoming integral to waste-reduction strategies for both consumers and businesses. As companies and industries align with global sustainability goals, the market for long-lasting, eco-conscious cold storage products is set to advance steadily in the years ahead.

The dependence on temperature-controlled logistics has become essential for protecting product quality and ensuring public health. A lack of cold chain solutions continues to impact critical sectors, particularly in healthcare, where millions of preventable child deaths are linked to failures in vaccine storage and transport. As the need for dependable, energy-efficient cooling systems expands, cooler boxes are proving vital in delivering reliable performance across variable temperature ranges, including ultra-low storage conditions. These cold chain logistics requirements are expected to sustain market expansion globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.8 Billion |

| Forecast Value | $21.1 Billion |

| CAGR | 9.4% |

The reusable cooler box segment led the market in 2024, reaching USD 6.4 billion and is anticipated to grow at a CAGR of 9.8% between 2025 and 2034. The rising shift away from single-use packaging is fueling interest in reusable models engineered for extended service life. Built from resilient materials, these cooler boxes are designed for repeated use without compromising insulation performance or structural durability. This evolution supports global sustainability targets while meeting the cost-efficiency needs of modern supply chains.

The pharmaceuticals segment generated USD 3.4 billion in 2024 holding a 39.2% share. Cold chain integrity remains a top priority in the pharmaceutical industry, where strict compliance standards require stable thermal environments for transportation and storage. The need for temperature-controlled solutions is amplified by the global demand for vaccine distribution and regulated storage of temperature-sensitive medications. Cooler boxes built to meet exacting pharmaceutical standards are seeing strong adoption to support consistent product efficacy and regulatory adherence.

United States Cooler Box Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 10.3% from 2025 to 2034. Market growth in the US is driven by the expanding footprint of industries that depend on cold storage infrastructure. From meal delivery services to pharmaceutical logistics and grocery distribution, demand is climbing alongside infrastructure improvements. A surge in electricity usage across residential and commercial spaces is also supporting the adoption of high-efficiency cooling technologies. These factors point to a sustained rise in cold chain investments, creating favorable conditions for cooler box deployment across the country.

Notable companies active in the Global Cooler Box Market include Cold Chain Technologies Inc., va-Q-tec Thermal Solutions GmbH, WILD Coolers, FEURER Group GmbH, Pelican Products Inc., Igloo Products Corp., YETI COOLERS, LLC., K2Coolers, Sofrigam Group, Sonoco ThermoSafe, Cool Ice Box Company, Bison Coolers, Eurobox Logistics, Blowkings, and B Medical System. Companies operating in the cooler box industry are investing in material innovation, modular product design, and technological integration to build long-term competitiveness. Many players are focusing on producing reusable, durable, and thermally efficient cooler boxes to address rising environmental concerns. Customization options for diverse industries, including healthcare and food logistics, are being expanded to enhance market reach. Strategic partnerships with logistics providers and cold chain infrastructure developers are also strengthening supply chain connectivity. Leading manufacturers are actively enhancing R&D efforts to design lightweight, high-performance units compatible with smart temperature monitoring systems. Several firms are boosting their geographic presence by establishing regional manufacturing hubs, helping reduce shipping costs and respond more efficiently to localized demand across both developed and emerging markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Type

- 2.2.2 Raw Material

- 2.2.3 Price Range

- 2.2.4 End Use

- 2.2.5 Distribution Channel

- 2.2.6 Regional

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region and type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Reusable

- 5.3 Disposable

Chapter 6 Market Estimates & Forecast, By Raw Material, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Extruded polystyrene

- 6.3 Expanded polystyrene

- 6.4 Expanded polypropylene

Chapter 7 Market Estimates & Forecast, By Price Range, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low (Upto USD 30)

- 7.3 Medium (USD 30 - USD 50)

- 7.4 High (Above USD 50)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Pharmaceuticals

- 8.3 Food & beverages

- 8.4 Other

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 Company Website

- 9.2.2 E-commerce website

- 9.3 Offline

- 9.3.1.1 Supermarkets and hypermarkets

- 9.3.1.2 Specialty outdoor stores

- 9.3.1.3 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 U.K.

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 B Medical System

- 11.2 Bison Coolers

- 11.3 Blowkings

- 11.4 Cold Chain Technologies Inc.

- 11.5 Cool Ice Box Company

- 11.6 Eurobox Logistics

- 11.7 FEURER Group GmbH

- 11.8 Igloo Products Corp.

- 11.9 K2Coolers

- 11.10 Pelican Products Inc.

- 11.11 Sofrigam Group

- 11.12 Sonoco ThermoSafe

- 11.13 va-Q-tec Thermal Solutions GmbH

- 11.14 WILD Coolers

- 11.15 YETI COOLERS, LLC.