|

市場調查報告書

商品編碼

1801882

腹膜透析市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Peritoneal Dialysis Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

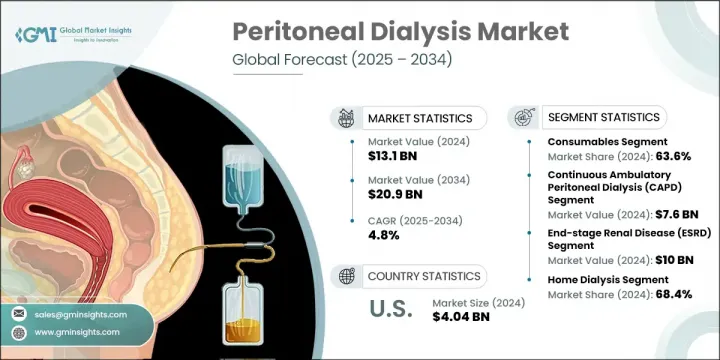

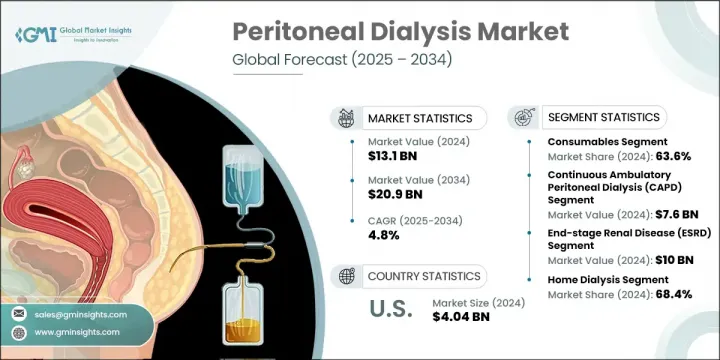

2024 年全球腹膜透析市場規模為 131 億美元,預計到 2034 年將以 4.8% 的複合年成長率成長至 209 億美元。推動這一成長的主要促進因素包括腎臟相關疾病發病率的上升、居家透析解決方案的普及以及支持透析治療的優惠報銷結構。此外,與傳統血液透析相比,腹膜透析的成本效益更高,再加上腎臟捐贈者的持續短缺,進一步刺激了市場需求。腹膜透析是針對末期腎病 (ESRD) 和急性腎損傷患者的一種維持生命的治療方法,可在腎臟喪失功能時有效清除廢物和多餘液體。越來越多的人選擇在家中進行病患管理的護理,這繼續塑造著產業格局。此外,人口老化和受慢性腎臟疾病影響的患者數量不斷增加,大大促進了全球 PD 解決方案的普及。

2024年,耗材市場佔63.6%的市佔率。這一主導地位主要歸因於末期腎病(ESRD)病例數量的增加,以及對透析液、腹膜透析導管和其他相關耗材等腹膜透析必需組件的需求不斷成長。向家庭療法的轉變顯著影響了這一趨勢,因為患者需要穩定的這些產品供應才能獨立定期治療。慢性和急性腎衰竭盛行率的上升,尤其是在老年人群體中,加劇了患者對耗材日益成長的依賴。這些人口結構變化持續推動對可靠、適用於家庭的透析解決方案的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 131億美元 |

| 預測值 | 209億美元 |

| 複合年成長率 | 4.8% |

持續性非臥床腹膜透析 (CAPD) 市場在 2024 年創造了 76 億美元的收入,預計 2025-2034 年的複合年成長率將達到 4.6%。在自動化透析設備使用受限的地區,CAPD 仍然是首選。這種方法使患者能夠每天多次進行手動換液,而無需依賴機器,價格實惠、易於使用,並能靈活地維持正常的日常護理。 CAPD 之所以越來越受歡迎,是因為它能夠讓患者更好地掌控自己的治療,同時減少對透析中心的依賴。

2024年,美國腹膜透析市場規模達40.4億美元,預計2025年至2034年期間的複合年成長率將達到3.5%。腹膜透析在美國日益普及,得益於其以患者為中心的優勢,包括治療靈活性、居家給藥以及生活品質的提升。醫療保健提供者擴大推薦腹膜透析作為中心血液透析的可行替代方案,尤其是在醫療保健系統採用基於價值的醫療模式的背景下。越來越多的患者意識到腹膜透析的重要性,並接受更完善的培訓項目,進一步推動了這一上升趨勢。

積極影響全球腹膜透析市場的頂級公司包括 Terumo Corporation、Vantive(百特)、Diaverum(M42)、BD、B. Braun、Davita Kidney Care、Polymed、Utah Medical Products、Vivance、Fresenius Medical Care、medCOMP 和 Mozarc Medical。為了鞏固市場地位並增強競爭力,腹膜透析領域的公司正積極推行多項策略性措施。

這些措施包括擴大產品組合,推出更先進、更便利的家用透析解決方案,並與醫療保健提供者建立合作關係,以加強服務網路。許多公司正大力投資研發,以開發效率更高、安全性更高的下一代腹膜透析設備。此外,公司還透過策略性併購來拓展地域覆蓋範圍並整合專業能力。此外,公司也進行培訓計畫和宣傳活動,以提高病患(尤其是在發展中地區)的接受度和依從性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 末期腎病(ESRD)患者數量不斷增加

- 腎臟捐贈短缺

- 比血液透析的成本優勢

- 透析治療的優惠報銷方案

- 糖尿病和高血壓盛行率不斷上升

- 產業陷阱與挑戰

- 治療併發症

- 市場機會

- 居家透析採用率的成長

- 新興國家的需求不斷成長

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 技術格局

- 歷史時間表和行業演變

- 報銷場景

- 報銷政策對市場成長的影響

- 2024年各地區價格分析

- 透析機/循環儀

- 腹膜透析液/透析液

- 服務

- 差距分析

- 消費者行為分析

- 流行病學展望

- 波特的分析

- PESTEL分析

- 未來市場趨勢

- 價值鏈分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區 (RoW)

- 按地區

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類別,2021 - 2034 年

- 主要趨勢

- 透析機/循環器

- 耗材

- 腹膜透析液/透析液

- 葡萄糖

- 艾考糊精

- 胺基酸

- 導管

- 訪問產品

- 其他耗材

- 腹膜透析液/透析液

- 服務

- 慢性透析

- 急性透析

- 耗材

第6章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 持續性非臥床腹膜透析(CAPD)

- 自動腹膜透析(APD)

第7章:市場估計與預測:依疾病狀況,2021 - 2034 年

- 主要趨勢

- 末期腎病(ESRD)

- 急性腎損傷(AKI)

- 其他條件

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 居家透析

- 中心透析

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球參與者

- B. Braun

- BD

- Davita Kidney Care

- Diaverum (M42)

- Fresenius Medical Care

- medCOMP

- Mozarc Medical

- Polymed

- Terumo Corporation

- Utah Medical Products

- Vantive (Baxter)

- Vivance

- 區域參與者

- Apollo Dialysis

- Mitra Industries

- Newsol Technologies

- Northwest Kidney Centers

The Global Peritoneal Dialysis Market was valued at USD 13.1 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 20.9 billion by 2034. Key drivers fueling this expansion include the rising incidence of kidney-related conditions, increasing adoption of home-based dialysis solutions, and favorable reimbursement structures supporting dialysis treatment. Additionally, cost efficiency over traditional hemodialysis, combined with a persistent shortfall in kidney donors, further bolsters market demand. Peritoneal dialysis, a life-sustaining therapy for individuals facing end-stage renal disease (ESRD) and acute kidney injury, allows for the effective removal of waste and excess fluid when the kidneys lose function. A growing shift toward patient-managed care at home continues to shape the industry landscape. Moreover, the aging population and a growing number of patients affected by chronic kidney issues are contributing heavily to the uptake of PD solutions globally.

In 2024, the consumables segment held a 63.6% share. This dominance is largely attributed to a higher volume of ESRD cases and increasing demand for essential PD components such as dialysate solutions, PD catheters, and other related consumables. The shift toward home-based therapies has significantly influenced this trend, as patients require a steady supply of these products to conduct regular sessions independently. This growing patient reliance on consumables is magnified by the rising prevalence of both chronic and acute kidney failures, particularly within the elderly population. These demographic changes continue to push demand for dependable, home-compatible dialysis solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.1 Billion |

| Forecast Value | $20.9 Billion |

| CAGR | 4.8% |

The continuous ambulatory peritoneal dialysis (CAPD) segment generated USD 7.6 billion in 2024 and is forecasted to grow at a 4.6% CAGR during 2025-2034. CAPD remains a preferred choice in regions where access to automated dialysis equipment is limited. This approach enables patients to perform manual exchanges multiple times a day without relying on machines, offering affordability, ease of use, and the flexibility to maintain normal routines. Its growing popularity stems from its ability to empower patients with greater control over their treatment while reducing dependence on dialysis centers.

United States Peritoneal Dialysis Market was valued at USD 4.04 billion in 2024 and is expected to grow at a 3.5% CAGR from 2025 through 2034. The rising acceptance of PD in the country is due to its patient-centric benefits, including treatment flexibility, at-home administration, and improved quality of life. Healthcare providers are increasingly recommending PD as a viable alternative to center-based hemodialysis, especially as the healthcare system embraces value-based care models. This upward trend is further fueled by growing awareness and better training programs for patients opting for home dialysis.

The top-tier companies actively shaping the Global Peritoneal Dialysis Market are Terumo Corporation, Vantive (Baxter), Diaverum (M42), BD, B. Braun, Davita Kidney Care, Polymed, Utah Medical Products, Vivance, Fresenius Medical Care, medCOMP, and Mozarc Medical. To secure their market positions and enhance competitiveness, companies operating in the peritoneal dialysis sector are actively pursuing several strategic initiatives.

These include expanding their product portfolios with more advanced and user-friendly dialysis solutions tailored for home use, as well as forming partnerships with healthcare providers to strengthen service delivery networks. Many firms are investing heavily in R&D to develop next-generation PD devices with improved efficiency and safety profiles. Additionally, strategic mergers and acquisitions are being used to widen geographic reach and integrate specialized capabilities. Training programs and awareness campaigns are also being launched to boost patient adoption and adherence, particularly in developing regions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Category trends

- 2.2.3 Type trends

- 2.2.4 Disease condition trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising number of end stage renal diseases (ESRD) patients

- 3.2.1.2 Shortage of donor kidneys

- 3.2.1.3 Cost advantages over hemodialysis

- 3.2.1.4 Favourable reimbursement scenario for dialysis treatment

- 3.2.1.5 Growing prevalence of diabetes and hypertension

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complications in the treatment

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in home dialysis adoption

- 3.2.3.2 Increasing demand in emerging countries

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.6 Historical timeline and industry evolution

- 3.7 Reimbursement scenario

- 3.7.1 Impact of reimbursement policies on market growth

- 3.8 Pricing analysis by region, 2024

- 3.8.1 Dialysis machines/cyclers

- 3.8.2 Peritoneal dialysis solution/Dialysate

- 3.8.3 Services

- 3.9 Gap analysis

- 3.10 Consumer behaviour analysis

- 3.11 Epidemiology outlook

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

- 3.14 Future market trends

- 3.15 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 By Region

- 4.3.1.1 North America

- 4.3.1.2 Europe

- 4.3.1.3 Asia Pacific

- 4.3.1.4 Rest of the world (RoW)

- 4.3.1 By Region

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Category, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Dialysis machines/Cyclers

- 5.2.1 Consumables

- 5.2.1.1 Peritoneal dialysis solution/Dialysate

- 5.2.1.1.1 Dextrose

- 5.2.1.1.2 Icodextrin

- 5.2.1.1.3 Amino Acid

- 5.2.1.2 Catheters

- 5.2.1.3 Access products

- 5.2.1.4 Other consumables

- 5.2.1.1 Peritoneal dialysis solution/Dialysate

- 5.2.2 Services

- 5.2.2.1 Chronic dialysis

- 5.2.2.2 Acute dialysis

- 5.2.1 Consumables

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Continuous ambulatory peritoneal dialysis (CAPD)

- 6.3 Automated peritoneal dialysis (APD)

Chapter 7 Market Estimates and Forecast, By Disease Condition, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 End-stage renal disease (ESRD)

- 7.3 Acute kidney injury (AKI)

- 7.4 Other conditions

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Home dialysis

- 8.3 In-center dialysis

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global players

- 10.1.1 B. Braun

- 10.1.2 BD

- 10.1.3 Davita Kidney Care

- 10.1.4 Diaverum (M42)

- 10.1.5 Fresenius Medical Care

- 10.1.6 medCOMP

- 10.1.7 Mozarc Medical

- 10.1.8 Polymed

- 10.1.9 Terumo Corporation

- 10.1.10 Utah Medical Products

- 10.1.11 Vantive (Baxter)

- 10.1.12 Vivance

- 10.2 Regional players

- 10.2.1 Apollo Dialysis

- 10.2.2 Mitra Industries

- 10.2.3 Newsol Technologies

- 10.2.4 Northwest Kidney Centers