|

市場調查報告書

商品編碼

1801877

能源密集材料市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Energy Dense Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

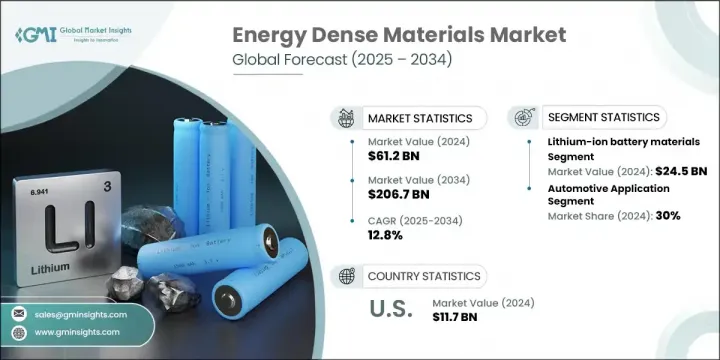

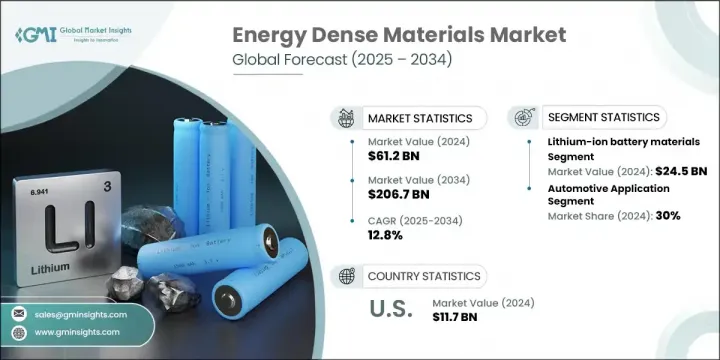

2024年,全球高能源效率材料市場規模達612億美元,預計到2034年將以12.8%的複合年成長率成長,達到2067億美元。由於碳減排的緊迫性日益增強,以及向更永續的電氣化能源系統轉型,該市場正經歷強勁發展勢頭。隨著再生能源在發電領域持續成長,對緊湊高效的儲能解決方案的需求也日益凸顯。高能源效率材料透過確保電網穩定性、在高峰需求期間平衡供電以及提高間歇性電源供電的一致性來支持這一轉變。隨著全球對高效能、輕量化和高容量儲能的需求持續成長,高能源效率材料在各個領域的重要性日益凸顯。

電動車的興起是市場成長的主要動力之一。隨著電動車在全球市場的快速擴張,對續航里程更長、充電速度更快、重量更輕的電池的需求變得至關重要。高能量密度材料在電動飛機和無人機的航太推進系統中也發揮著重要作用,最大限度地提高單位質量的能量可以延長飛行時間並提高有效載荷能力,最終推動航空運輸技術的創新。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 612億美元 |

| 預測值 | 2067億美元 |

| 複合年成長率 | 12.8% |

2024年,鋰離子電池材料市場規模達245億美元。其廣泛應用得益於其相對於燃料電池材料、超級電容器和固態電池等其他材料更高的能量密度。鋰離子電池以緊湊輕巧的形式儲存大量能量,使其成為攜帶式電子設備、電動車和大型儲能系統的首選解決方案。其強大的功率輸出、更長的循環壽命和穩定的性能使其成為現代儲能的基礎技術,並支援從消費性電子產品到公用事業規模電網儲能等行業的快速應用。

汽車應用領域在2024年佔最大佔有率,達30%。這些應用是高能量密度材料創新的核心,其驅動力來自於人們對續航里程、充電速度和性能與傳統引擎相當的汽車日益成長的需求。電池技術能夠提供更高的單位空間和重量能量密度,有助於解決消費者對續航里程的擔憂,並支持電動車的廣泛普及。隨著汽車產業的持續擴張,它仍然是市場成長的關鍵力量。

美國能源密集型材料市場規模在2024年達到117億美元,預計2034年將以13%的複合年成長率成長。隨著經濟穩定擴張、能源需求成長以及工業成長,美國對高效能電池、磁鐵和燃料電池組件的需求不斷成長。能源密集型材料正在幫助各行各業最佳化能源利用、降低成本並提升整體系統性能。它們在各行各業的能源儲存和轉換中發揮著重要作用,這對於建立更具彈性和更有效率的能源基礎設施至關重要。

全球高能源效率材料市場的主要公司包括LG能源解決方案、松下公司、三星SDI有限公司、特斯拉公司和寧德時代新能源科技股份有限公司(CATL)。為了鞏固其在全球高能源效率材料領域的立足點,領先公司正專注於幾個策略重點。這些包括積極投資先進化學技術的研發,以提高能量密度、安全性和生命週期。各公司也在擴大產能,以滿足日益成長的電動車和電網需求,尤其是在關鍵成長地區。與汽車製造商和能源供應商的策略聯盟有助於確保長期合約的簽訂。此外,各公司正在實現產品組合多元化,以涵蓋固態和鋰硫技術等下一代材料,同時最佳化其全球供應鏈,以提高成本效益和穩定性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場規模及預測:依材料類型,2021-2034

- 主要趨勢

- 鋰離子電池材料

- 正極材料(LFP、NMC、NCA、LCO)

- 負極材料(石墨、矽、鋰金屬)

- 電解質材料

- 隔膜材料

- 固態電池材料

- 固態電解質(氧化物、硫化物、聚合物)

- 介面材料

- 先進電極材料

- 超級電容器材料

- 電極材料(碳基、金屬氧化物)

- 電解質溶液

- 隔膜材料

- 先進碳材料

- 石墨烯及其衍生物

- 碳奈米管

- 碳纖維複合材料

- 含能材料

- 高能量密度化合物

- 推進劑材料

- 霹靂

- 燃料電池材料

- 催化劑材料

- 膜材料

- 電極材料

第6章:市場規模及預測:依應用,2021-2034

- 主要趨勢

- 汽車應用

- 電動車(BEV、PHEV、HEV)

- 汽車電子

- 啟動停止系統

- 消費性電子產品

- 智慧型手機和平板電腦

- 筆記型電腦和穿戴式裝置

- 行動電源和可攜式設備

- 儲能系統

- 電網規模存儲

- 住宅儲能

- 商業和工業存儲

- 航太和國防

- 飛機和太空船應用

- 軍事和國防系統

- 無人駕駛汽車和無人機

- 工業應用

- 物料搬運設備

- 備用電源系統

- 電信基礎設施

- 醫療保健

- 植入式裝置

- 攜帶式醫療設備

- 緊急醫療系統

第7章:市場規模及預測:依技術,2021-2034

- 主要趨勢

- 電池技術

- 鋰離子電池

- 固態電池

- 鈉離子電池

- 金屬空氣電池

- 電容器技術

- 超級電容器

- 混合電容器

- 陶瓷電容器

- 燃料電池技術

- 質子交換膜(PEM)

- 固態氧化物燃料電池(SOFC)

- 鹼性燃料電池

- 能量收集技術

- 熱電材料

- 壓電材料

- 光電材料

第 8 章:市場規模與預測:按最終用途產業,2021-2034 年

- 主要趨勢

- 汽車產業

- 電子和半導體

- 能源和公用事業

- 航太和國防

- 醫療保健和醫療器械

- 工業製造

- 電信

- 海洋和運輸

第9章:市場規模及預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Tesla

- Panasonic Corporation

- Samsung SDI

- LG Energy Solution

- Contemporary Amperex Technology

- BYD Company Limited

- QuantumScape Corporation

- Solid Power

- Sila Nanotechnologies

- Group14 Technologies

- Wildcat Discovery Technologies

- Amprius Technologies

- Enovix Corporation

- Ion Storage Systems

- Ampcera

- Sion Power Corporation

- Oxis Energy

The Global Energy Dense Materials Market was valued at USD 61.2 billion in 2024 and is estimated to grow at a CAGR of 12.8% to reach USD 206.7 billion by 2034. This market is experiencing strong momentum due to the increasing urgency around carbon reduction and the shift toward more sustainable, electrified energy systems. As renewable energy continues to gain traction in power generation, the demand for compact and highly efficient energy storage solutions is becoming more critical. Energy dense materials support this transition by ensuring grid stability, balancing supply during peak demand, and improving the consistency of power delivery from intermittent sources. Their importance is rising across various sectors as the global appetite for efficient, lightweight, and high-capacity energy storage continues to grow.

The rise of electric mobility is one of the primary contributors to market growth. As electric vehicles scale quickly across global markets, the need for batteries that deliver longer range, faster charging, and reduced weight becomes vital. Energy dense materials also serve an important role in aerospace propulsion systems for electric aircraft and drones, where maximizing energy per unit of mass results in longer flight duration and greater payload capabilities, ultimately driving innovation across air transport technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $61.2 Billion |

| Forecast Value | $206.7 Billion |

| CAGR | 12.8% |

In 2024, the lithium-ion battery materials segment generated USD 24.5 billion. Their widespread use is driven by their superior energy density relative to other options such as fuel cell materials, supercapacitors, and solid-state batteries. Lithium-ion batteries store significant energy in compact, lightweight formats, making them the go-to solution for portable electronics, electric vehicles, and large-scale energy storage systems. Their strong power output, extended cycle life, and stable performance have made them a foundational technology in modern energy storage and have supported fast adoption across industries ranging from consumer electronics to utility-scale grid storage.

The automotive applications segment held the largest share in 2024, accounting for 30% share. These applications are at the heart of energy dense material innovation, driven by the rising need for vehicles that can travel further, charge quicker, and match traditional engine performance. Battery technologies delivering greater energy density per unit of space and weight help address consumer range concerns and support widespread EV adoption. As the automotive industry continues to expand, it remains a key force behind the market's growth.

U.S. Energy Dense Materials Market reached USD 11.7 billion in 2024 and is forecasted to grow at a CAGR of 13% through 2034. With steady economic expansion, increased energy needs, and industrial growth, the U.S. has seen rising demand for efficient batteries, magnets, and fuel cell components. Energy dense materials are helping industries optimize energy use, reduce costs, and improve overall system performance. Their role in energy storage and conversion across sectors continues to make them essential for building a more resilient and efficient energy infrastructure.

Key companies operating in the Global Energy Dense Materials Market include LG Energy Solution, Panasonic Corporation, Samsung SDI Co., Ltd., Tesla, Inc., and Contemporary Amperex Technology Co. Limited (CATL). To strengthen their foothold in the global energy dense materials landscape, leading companies are focusing on several strategic priorities. These include aggressive investment in R&D for advanced chemistries that improve energy density, safety, and lifecycle. Companies are also scaling up production capacities to meet rising EV and grid demand, particularly in key growth regions. Strategic alliances with automakers and energy providers are helping secure long-term contracts. Additionally, firms are diversifying product portfolios to include next-gen materials like solid-state and lithium-sulfur technologies, while optimizing their global supply chains for cost efficiency and stability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material type

- 2.2.3 Application

- 2.2.4 End Use Industry

- 2.2.5 Technology

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Material Type, 2021-2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Lithium-ion battery materials

- 5.2.1 Cathode materials (LFP, NMC, NCA, LCO)

- 5.2.2 Anode materials (graphite, silicon, lithium metal)

- 5.2.3 Electrolyte materials

- 5.2.4 Separator materials

- 5.3 Solid-state battery materials

- 5.3.1 Solid electrolytes (oxide, sulfide, polymer)

- 5.3.2 Interface materials

- 5.3.3 Advanced electrode materials

- 5.4 Supercapacitor materials

- 5.4.1 Electrode materials (carbon-based, metal oxides)

- 5.4.2 Electrolyte solutions

- 5.4.3 Separator materials

- 5.5 Advanced carbon materials

- 5.5.1 Graphene and derivatives

- 5.5.2 Carbon nanotubes

- 5.5.3 Carbon fiber composites

- 5.6 Energetic materials

- 5.6.1 High energy density compounds

- 5.6.2 Propellant materials

- 5.6.3 Explosive materials

- 5.7 Fuel cell materials

- 5.7.1 Catalyst materials

- 5.7.2 Membrane materials

- 5.7.3 Electrode materials

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Automotive applications

- 6.2.1 Electric vehicles (BEV, PHEV, HEV)

- 6.2.2 Automotive electronics

- 6.2.3 Start-stop systems

- 6.3 Consumer electronics

- 6.3.1 Smartphones and tablets

- 6.3.2 Laptops and wearables

- 6.3.3 Power banks and portable devices

- 6.4 Energy storage systems

- 6.4.1 Grid-scale storage

- 6.4.2 Residential energy storage

- 6.4.3 Commercial and industrial storage

- 6.5 Aerospace and defense

- 6.5.1 Aircraft and spacecraft applications

- 6.5.2 Military and defense systems

- 6.5.3 Unmanned vehicles and drones

- 6.6 Industrial applications

- 6.6.1 Material handling equipment

- 6.6.2 Backup power systems

- 6.6.3 Telecommunications infrastructure

- 6.7 Medical and healthcare

- 6.7.1 Implantable devices

- 6.7.2 Portable medical equipment

- 6.7.3 Emergency medical systems

Chapter 7 Market Size and Forecast, By Technology, 2021-2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 Battery technologies

- 7.2.1 Lithium-ion batteries

- 7.2.2 Solid-state batteries

- 7.2.3 Sodium-ion batteries

- 7.2.4 Metal-air batteries

- 7.3 Capacitor technologies

- 7.3.1 Supercapacitors/ultracapacitors

- 7.3.2 Hybrid capacitors

- 7.3.3 Ceramic capacitors

- 7.4 Fuel cell technologies

- 7.4.1 Proton exchange membrane (PEM)

- 7.4.2 Solid oxide fuel cells (SOFC)

- 7.4.3 Alkaline fuel cells

- 7.5 Energy harvesting technologies

- 7.5.1 Thermoelectric materials

- 7.5.2 Piezoelectric materials

- 7.5.3 Photovoltaic materials

Chapter 8 Market Size and Forecast, By End Use Industry, 2021-2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 Automotive industry

- 8.3 Electronics and semiconductors

- 8.4 Energy and utilities

- 8.5 Aerospace and defense

- 8.6 Healthcare and medical devices

- 8.7 Industrial manufacturing

- 8.8 Telecommunications

- 8.9 Marine and transportation

Chapter 9 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Tesla

- 10.2 Panasonic Corporation

- 10.3 Samsung SDI

- 10.4 LG Energy Solution

- 10.5 Contemporary Amperex Technology

- 10.6 BYD Company Limited

- 10.7 QuantumScape Corporation

- 10.8 Solid Power

- 10.9 Sila Nanotechnologies

- 10.10 Group14 Technologies

- 10.11 Wildcat Discovery Technologies

- 10.12 Amprius Technologies

- 10.13 Enovix Corporation

- 10.14 Ion Storage Systems

- 10.15 Ampcera

- 10.16 Sion Power Corporation

- 10.17 Oxis Energy