|

市場調查報告書

商品編碼

1801868

太陽能一體化建築材料市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Solar-Integrated Construction Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

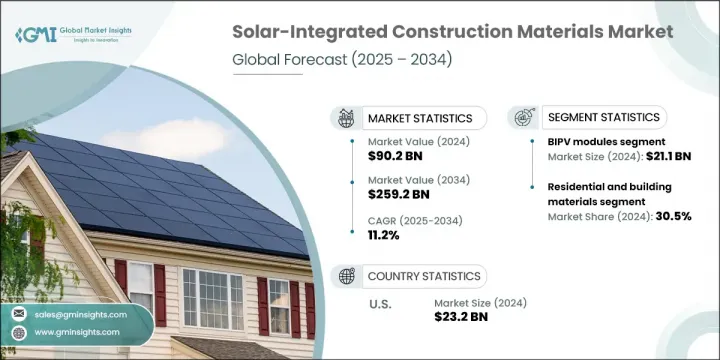

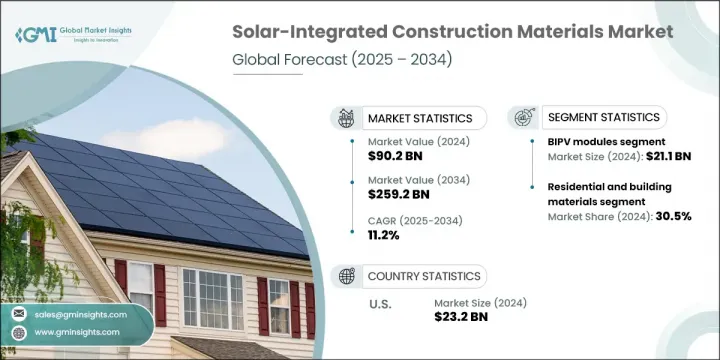

2024年,全球太陽能一體化建築材料市場規模達902億美元,預計到2034年將以11.2%的複合年成長率成長,達到2,592億美元。太陽能一體化建築材料是指嵌入太陽能技術(例如光伏(PV)板)的建築產品。這些材料作為建築物的功能性組件,包括外牆、屋頂和窗戶,從而實現現場再生能源發電。透過使用此類材料,建築物可以顯著減少對傳統能源的依賴,提高能源效率。

太陽能整合材料需求的不斷成長,得益於政府政策、財政激勵措施以及全球向永續發展和減緩氣候變遷的趨勢。此外,智慧城市建設的興起,以及對節能、永續基礎建設的重視,也進一步支持了市場發展。世界各地的城市都在增加對此類技術的投資,以實現其永續發展目標,從而促進了該行業的整體成長。北美憑藉著對技術進步和扶持政策的重視,成為成長最快的市場。政策、創新和城市擴張的共同作用正在重塑全球太陽能整合建築材料市場。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 902億美元 |

| 預測值 | 2592億美元 |

| 複合年成長率 | 11.2% |

2024年,建築一體化光伏 (BIPV) 組件的產值達到211億美元,佔據了市場的關鍵佔有率。 BIPV 組件用途廣泛,不僅可用作發電系統,還可以作為建築圍護結構(例如外牆、屋頂和窗戶)的結構構件。這種多功能性使其受到那些尋求滿足永續性標準並提升建築美感的建築師和開發商的青睞。

2024 年,住宅和建築材料將佔據 30.5% 的市場。消費者對節能住宅的需求不斷成長,加上政府旨在減少碳足跡的激勵措施和建築規範,是住宅建築採用太陽能整合材料的主要驅動力。

2024年,美國太陽能一體化建築材料市場規模達232億美元,這得益於製造和研發領域的進步,以及綠色建築實踐的日益推進。在加拿大,市場成長的驅動力源自於對永續發展的承諾和國家氣候目標,以及消費者對環保建築解決方案日益成長的需求。

全球太陽能一體化建築材料市場的領導者包括天合光能、晶澳太陽能、松下公司、旭硝子公司、特斯拉、晶科能源、First Solar、Mitrex Solar、SunPower Corporation、Saule Technologies、Onyx Solar、Sisecam Group、Guardian Glass 和隆基樂葉。為鞏固其在太陽能一體化建築材料市場的地位,各企業正採取各種策略方針。這些措施包括投資先進研發以提高產品性能並將創新太陽能技術融入建築材料中。企業也與建築公司和開發商建立策略合作夥伴關係,以擴大業務範圍並將太陽能解決方案融入新建築專案。此外,企業也注重永續實踐,確保其材料滿足日益成長的節能環保建築解決方案需求。加強與政府機構的合作並使產品供應與新興的綠色建築標準保持一致也是至關重要的策略。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 專利態勢

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考慮

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021-2034

- 主要趨勢

- BIPV組件

- 晶體矽BIPV組件

- 薄膜BIPV模組

- 鈣鈦礦BIPV組件

- 太陽能玻璃

- 透明太陽能玻璃

- 半透明太陽能玻璃

- 彩色太陽能玻璃

- 太陽能瓦片和木瓦

- 陶瓷太陽能瓦

- 聚合物太陽能瓦

- 整合太陽能瓦片

- 太陽能外牆

- 帷幕牆太陽能系統

- 通風太陽能立面

- 雙層太陽能帷幕牆

- 太陽能天窗和天篷

- 透明太陽能天窗

- 半透明太陽能頂篷

- 太陽能覆層系統

- 其他

- 太陽能隔熱材料

- 太陽能膜系統

- 軟性太陽能薄膜

第6章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 住宅應用

- 獨棟住宅

- 多戶住宅建築

- 住宅改造

- 商業應用

- 辦公大樓

- 零售和購物中心

- 飯店及餐飲業

- 教育機構

- 醫療保健設施

- 工業應用

- 生產設施

- 倉庫和配送中心

- 工業改造

- 機構應用

- 政府大樓

- 宗教建築

- 文化娛樂設施

- 基礎設施應用

- 交通樞紐

- 停車場

- 橋隧一體化

第7章:市場估計與預測:按技術,2021-2034 年

- 主要趨勢

- 晶體矽技術

- 單晶矽

- 多晶矽

- 薄膜技術

- 非晶矽(a-Si)

- 碲化鎘(CdTe)

- 銅銦鎵硒(CIGS)

- 鈣鈦礦技術

- 鉛基鈣鈦礦

- 無鉛鈣鈦礦

- 鈣鈦礦-矽串聯材料

- 有機光伏(OPV)

- 小分子口服小兒麻痺病毒

- 聚合物OPV

- 混合技術

- 鈣鈦礦-有機混合材料

- 矽-鈣鈦礦串聯材料

- 新興技術

- 量子點太陽能電池

- 染料敏化太陽能電池

第8章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- AGC Inc

- Canadian Solar

- First Solar

- Guardian Glass

- JA Solar

- JinkoSolar

- LONGi

- Mitrex Solar

- Onyx Solar

- Panasonic Corporation

- Saule Technologies

- Sisecam Group

- SunPower Corporation

- Tesla

- Trina Solar

The Global Solar-Integrated Construction Materials Market was valued at USD 90.2 billion in 2024 and is estimated to grow at a CAGR of 11.2% to reach USD 259.2 billion by 2034. Solar-integrated construction materials refer to building products that are embedded with solar technologies, such as photovoltaic (PV) panels. These materials serve as functional components of buildings, including facades, roofing, and windows, enabling the on-site generation of renewable energy. By using such materials, buildings can significantly reduce their reliance on conventional energy sources, improving energy efficiency.

The growing demand for solar-integrated materials is driven by government policies, financial incentives, and a global shift towards sustainable development and climate change mitigation. Additionally, the rise of smart city development, with an emphasis on energy-efficient, sustainable infrastructure, is further supporting the market. Cities worldwide are increasingly investing in such technologies to meet their sustainability targets, contributing to the overall growth of the sector. North America, with its focus on technological advancements and supportive policies, is the fastest-growing market. The combined forces of policy, innovation, and urban expansion are reshaping the global market for solar-integrated construction materials.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $90.2 Billion |

| Forecast Value | $259.2 Billion |

| CAGR | 11.2% |

In 2024, building-integrated photovoltaic (BIPV) modules generated USD 21.1 billion, representing a key segment of the market. BIPV modules are versatile, serving not only as energy-generating systems but also as structural elements for building envelopes, such as facades, roofs, and windows. This multi-functionality makes them highly popular with architects and developers seeking to meet sustainability standards while enhancing building aesthetics.

Residential and building materials made up 30.5% of the market in 2024. Increased consumer demand for energy-efficient homes, along with government incentives and building codes aimed at reducing carbon footprints, are key drivers behind the adoption of solar-integrated materials in residential buildings.

In 2024, the U.S. market for solar-integrated construction materials was valued at USD 23.2 billion, fueled by advancements in manufacturing, research and development (R&D), and a growing push towards green building practices. In Canada, the market is driven by a commitment to sustainable development and the country's climate goals, alongside rising consumer demand for eco-friendly building solutions.

Leading players in the Global Solar-Integrated Construction Materials Market include Trina Solar, JA Solar, Panasonic Corporation, AGC Inc., Tesla, JinkoSolar, First Solar, Mitrex Solar, SunPower Corporation, Saule Technologies, Onyx Solar, Sisecam Group, Guardian Glass, and LONGi. To strengthen their position in the solar-integrated construction materials market, companies are adopting various strategic approaches. These include investing in advanced research and development to enhance product performance and integrate innovative solar technologies into construction materials. Companies are also forming strategic partnerships with construction firms and developers to expand their reach and integrate solar solutions into new building projects. Additionally, firms are focusing on sustainable practices, ensuring their materials meet growing demand for energy-efficient and environmentally friendly building solutions. Increasing collaborations with government bodies and aligning product offerings with emerging green building standards have also been essential strategies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 Application trends

- 2.2.3 Technology trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Future market trends

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 BIPV modules

- 5.2.1 Crystalline silicon BIPV modules

- 5.2.2 Thin-film BIPV modules

- 5.2.3 Perovskite BIPV modules

- 5.3 Solar glass

- 5.3.1 Transparent solar glass

- 5.3.2 Semi-transparent solar glass

- 5.3.3 Colored solar glass

- 5.4 Solar tiles and shingles

- 5.4.1 Ceramic solar tiles

- 5.4.2 Polymer solar tiles

- 5.4.3 Integrated solar shingles

- 5.5 Solar facades

- 5.5.1 Curtain wall solar systems

- 5.5.2 Ventilated solar facades

- 5.5.3 Double-skin solar facades

- 5.6 Solar skylights and canopies

- 5.6.1 Transparent solar skylights

- 5.6.2 Semi-transparent solar canopies

- 5.7 Solar cladding systems

- 5.8 Others

- 5.8.1 Solar insulation materials

- 5.8.2 Solar membrane systems

- 5.8.3 Flexible solar films

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Residential applications

- 6.2.1 Single-family homes

- 6.2.2 Multi-family residential buildings

- 6.2.3 Residential retrofits

- 6.3 Commercial applications

- 6.3.1 Office buildings

- 6.3.2 Retail and shopping centers

- 6.3.3 Hotels and hospitality

- 6.3.4 Educational institutions

- 6.4 Healthcare facilities

- 6.5 Industrial applications

- 6.5.1 Manufacturing facilities

- 6.5.2 Warehouses and distribution centers

- 6.5.3 Industrial retrofits

- 6.6 Institutional applications

- 6.6.1 Government buildings

- 6.6.2 Religious buildings

- 6.6.3 Cultural and recreational facilities

- 6.7 Infrastructure applications

- 6.7.1 Transportation hubs

- 6.7.2 Parking structures

- 6.7.3 Bridge and tunnel integration

Chapter 7 Market Estimates and Forecast, By Technology, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Crystalline silicon technology

- 7.2.1 Monocrystalline silicon

- 7.2.2 Polycrystalline silicon

- 7.3 Thin-film technology

- 7.3.1 Amorphous silicon (a-Si)

- 7.3.2 Cadmium telluride (CdTe)

- 7.3.3 Copper indium gallium selenide (CIGS)

- 7.4 Perovskite technology

- 7.4.1 Lead-based perovskites

- 7.4.2 Lead-free perovskites

- 7.4.3 Perovskite-silicon tandems

- 7.5 Organic photovoltaics (OPV)

- 7.5.1 Small molecule OPV

- 7.5.2 Polymer OPV

- 7.6 Hybrid technologies

- 7.6.1 Perovskite-organic hybrids

- 7.6.2 Silicon-perovskite tandems

- 7.7 Emerging technologies

- 7.7.1 Quantum dot solar cells

- 7.7.2 Dye-sensitized solar cells

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 AGC Inc

- 9.2 Canadian Solar

- 9.3 First Solar

- 9.4 Guardian Glass

- 9.5 JA Solar

- 9.6 JinkoSolar

- 9.7 LONGi

- 9.8 Mitrex Solar

- 9.9 Onyx Solar

- 9.10 Panasonic Corporation

- 9.11 Saule Technologies

- 9.12 Sisecam Group

- 9.13 SunPower Corporation

- 9.14 Tesla

- 9.15 Trina Solar