|

市場調查報告書

商品編碼

1801862

鋼筋腐蝕抑制劑市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Corrosion Inhibitors for Reinforcement Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

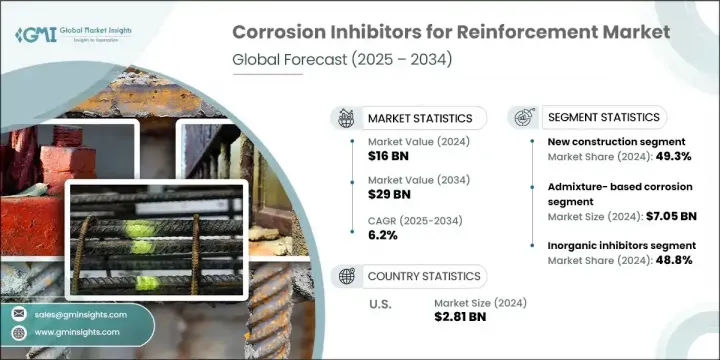

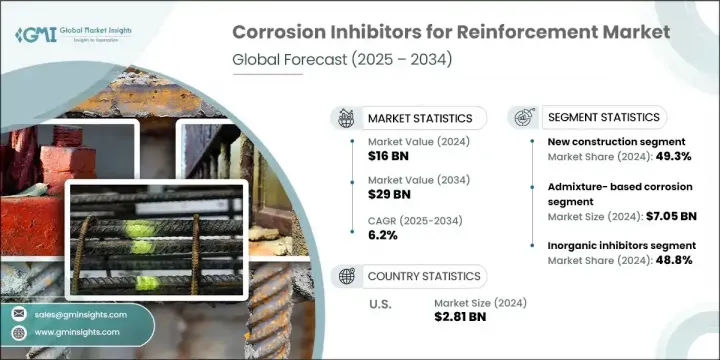

2024年,全球鋼筋腐蝕抑制劑市場規模達160億美元,預計2034年將以6.2%的複合年成長率成長,達到290億美元。該市場涵蓋各種類型的解決方案,例如表面應用型抑制劑、外加劑配方以及專為防止鋼筋混凝土結構腐蝕而設計的遷移系統。基礎設施建設、城市化進程的加快以及旨在提高耐久性和減少維修頻率的監管要求的加強,推動了市場的成長。

隨著越來越多的國家實施更嚴格的建築規範和永續發展目標,使用先進的緩蝕劑延長鋼筋混凝土結構的使用壽命已成為建築和土木工程領域的關鍵。在北美、歐洲和亞太等地區,對耐用且持久的建築材料的需求日益成長,為防腐技術的發展創造了強勁動力。向環保、永續的緩蝕劑解決方案的轉變正在加速創新。製造商正在開發符合全球生態合規目標的新型輸送機制和綠色化學品。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 160億美元 |

| 預測值 | 290億美元 |

| 複合年成長率 | 6.2% |

在不同類型的產品中,外加劑型緩蝕劑在2024年的市佔率為44%。這類產品因其易於融入混凝土混合物中,並能提供長期內部保護(尤其適用於新建結構)而備受青睞。它們在維護應用中也非常有效。相較之下,表面應用型解決方案則廣泛用於修復和維護老舊混凝土資產。

在應用方面,2024年新建築領域佔了49.3%的佔有率。在混凝土攪拌過程中使用抑制劑可顯著提高結構彈性,延緩腐蝕的發生,從而最大限度地降低生命週期成本,並符合在更長時間內提高基礎設施品質標準的更廣泛努力。這種預防性方法正成為現代建築實踐的重要組成部分。

2024年,美國鋼筋腐蝕抑制劑市場產值達28.1億美元。美國擁有眾多領先製造商,並致力於提升產品性能、永續性和合規性,為此投入了強大的研發力量。隨著基礎設施現代化成為國家優先事項,對耐用、低維護混凝土結構的需求持續成長。先進的抑制劑技術正擴大應用於交通系統、商業建築、民用基礎設施和住宅開發項目,以滿足性能要求並降低維修成本。

鋼筋腐蝕抑制劑市場的主要公司包括 GCP Applied Technologies Inc.、BASF SE、Halliburton(生產化學品部門)、Sika AG、Penetron International Ltd.、Pidilite Industries Limited、Clariant AG、MAPEI SpA、ChemTreat Inc.、Arkema、 CV、Ecolab Inc.(Nalco Water)、Dow Inc.、CEMC)。

為了提升市場佔有率,鋼筋緩蝕劑領域的企業正在實施以創新、永續性和客製化產品解決方案為中心的策略性舉措。重點關注開發符合綠色建築法規並減少環境影響的環保無毒配方。企業正在透過進軍基礎設施需求旺盛的新興市場來擴大其全球影響力。與建築公司和研發機構的策略合作有助於提升產品性能和應用技術。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 對耐用基礎設施材料的需求不斷成長

- 抑制劑配方的技術進步

- 監理推動永續建築化學品

- 產業陷阱與挑戰

- 混凝土混合料設計的兼容性問題

- 價格競爭市場中的成本敏感性

- 市場機會

- 與智慧建築和監控系統整合

- 對環保和永續解決方案的需求不斷成長

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考慮

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 外加劑型腐蝕抑制劑

- 亞硝酸鈣類抑制劑

- 有機摻合料抑制劑

- 磷酸鹽基外加劑

- 其他化學外加劑

- 表面應用的腐蝕抑制劑

- 滲透抑制劑

- 屏障形成抑制劑

- 雙相抑制劑

- 遷移腐蝕抑制劑

- 有機遷移抑制劑

- 無機遷移系統

- 新興技術

- 智慧/響應抑制劑

- 奈米增強系統

- 生物基抑制劑

第6章:市場估計與預測:按應用方法,2021 年至 2034 年

- 主要趨勢

- 新建築應用

- 混凝土攪拌階段整合

- 施工前表面處理

- 修復和維修

- 表面應用方法

- 注射及浸漬技術

- 維護和保護

- 預防性維護計劃

- 緊急搶修申請

第7章:市場估計與預測:依化學類型,2021-2034

- 主要趨勢

- 無機抑制劑

- 基於亞硝酸鹽的系統

- 磷酸鹽基化合物

- 矽酸鹽類抑制劑

- 有機抑制劑

- 氨基醇基體系

- 胺羧酸鹽抑制劑

- 有機酸衍生物

- 混合和先進系統

- 有機-無機組合

- 奈米增強配方

- 智慧釋放系統

第8章:市場估計與預測:按最終用途產業,2021-2034 年

- 主要趨勢

- 基礎設施和交通

- 橋樑和公路結構

- 隧道和地下建築

- 海洋和港口設施

- 機場基礎設施

- 住宅建築

- 高層建築

- 住房開發

- 改造專案

- 商業和工業

- 辦公大樓及綜合大樓

- 工業設施

- 倉庫和配送中心

- 專業應用

- 石油和天然氣設施

- 發電廠

- 水處理基礎設施

- 化學加工廠

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Arkema Group

- BASF SE

- ChemTreat Inc.

- CEMEX SAB de CV

- Clariant AG

- Dow Inc.

- Ecolab Inc. (Nalco Water)

- Evonik Industries AG

- GCP Applied Technologies Inc

- Halliburton (Production Chemicals Division)

- MAPEI SpA

- Penetron International Ltd.

- Pidilite Industries Limited

- Sika AG

The Global Corrosion Inhibitors for Reinforcement Market was valued at USD 16 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 29 billion by 2034. This market includes various types of solutions such as surface-applied inhibitors, admixture-based formulations, and migrating systems specifically designed to prevent corrosion in reinforced concrete structures. Market growth is fueled by increasing infrastructure development, urbanization, and heightened regulatory demands aimed at boosting durability and reducing repair frequency.

As more countries implement stricter building codes and sustainability goals, the need to extend the life of reinforced concrete structures using advanced inhibitors has become essential across the construction and civil engineering sectors. In regions like North America, Europe, and Asia-Pacific, there's a rising demand for durable and long-lasting building materials, creating strong momentum for corrosion prevention technologies. The shift toward environmentally safe, sustainable corrosion inhibitor solutions is accelerating innovation. Manufacturers are developing newer delivery mechanisms and green chemistries that align with global eco-compliance goals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16 Billion |

| Forecast Value | $29 Billion |

| CAGR | 6.2% |

Among the different product types, the admixture-based corrosion inhibitors segment held a 44% share in 2024. These are favored for their ease of integration into concrete mixes and their ability to provide long-term internal protection, particularly for newly built structures. They are also used effectively in maintenance applications. In contrast, surface-applied solutions are widely used for rehabilitating and preserving older concrete assets.

In terms of application, the new construction segment held a 49.3% share in 2024. The use of inhibitors during concrete mixing significantly improves structural resilience and delays the onset of corrosion, minimizing lifecycle costs and aligning with broader efforts to raise infrastructure quality standards over extended timelines. This preventative approach is becoming a critical part of modern construction practices.

U.S. Corrosion Inhibitors for Reinforcement Market generated USD 2.81 billion in 2024. The country benefits from a strong presence of leading manufacturers and robust research efforts focused on improving product performance, sustainability, and regulatory alignment. As infrastructure modernization gains national priority, the demand for durable, low-maintenance concrete structures continues to rise. Advanced inhibitor technologies are being increasingly adopted across transportation systems, commercial buildings, civil infrastructure, and residential developments to comply with performance mandates and lower repair expenditures.

Key companies operating in the Corrosion Inhibitors for Reinforcement Market include GCP Applied Technologies Inc., BASF SE, Halliburton (Production Chemicals Division), Sika AG, Penetron International Ltd., Pidilite Industries Limited, Clariant AG, MAPEI S.p.A., ChemTreat Inc., Arkema Group, Ecolab Inc. (Nalco Water), Dow Inc., CEMEX S.A.B. de C.V., and Evonik Industries AG.

To enhance market presence, companies in the corrosion inhibitors for reinforcement segment are implementing strategic initiatives centered around innovation, sustainability, and tailored product solutions. A significant focus is placed on developing eco-friendly, non-toxic formulations that comply with green building regulations and reduce environmental impact. Businesses are expanding their global footprint by entering emerging markets with high infrastructure demand. Strategic collaborations with construction firms and R&D institutes help improve product performance and application techniques.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Application method

- 2.2.3 Chemistry type

- 2.2.4 End use industry

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for long-lasting infrastructure materials

- 3.2.1.2 Technological advancements in inhibitor formulations

- 3.2.1.3 Regulatory push for sustainable construction chemicals

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Compatibility issues with concrete mix designs

- 3.2.2.2 Cost sensitivity in price-competitive markets

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with smart construction and monitoring systems

- 3.2.3.2 Rising demand for eco-friendly and sustainable solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product type

- 3.9 Future market trends

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent landscape

- 3.12 Trade statistics (HS code)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Admixture-based corrosion inhibitors

- 5.2.1 Calcium nitrite-based inhibitors

- 5.2.2 Organic admixture inhibitors

- 5.2.3 Phosphate-based admixtures

- 5.2.4 Other chemical admixtures

- 5.3 Surface-applied corrosion inhibitors

- 5.3.1 Penetrating inhibitors

- 5.3.2 Barrier-forming inhibitors

- 5.3.3 Dual-phase inhibitors

- 5.4 Migrating corrosion inhibitors

- 5.4.1 Organic migrating inhibitors

- 5.4.2 Inorganic migrating systems

- 5.5 Emerging technologies

- 5.5.1 Smart/responsive inhibitors

- 5.5.2 Nano-enhanced systems

- 5.5.3 Bio-based inhibitors

Chapter 6 Market Estimates and Forecast, By Application Method, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 New construction applications

- 6.2.1 Concrete mixing stage integration

- 6.2.2 Pre-construction surface treatment

- 6.3 Rehabilitation and repair

- 6.3.1 Surface application methods

- 6.3.2 Injection and impregnation techniques

- 6.4 Maintenance and protection

- 6.4.1 Preventive maintenance programs

- 6.4.2 Emergency repair applications

Chapter 7 Market Estimates and Forecast, By Chemistry Type, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Inorganic inhibitors

- 7.2.1 Nitrite-based systems

- 7.2.2 Phosphate-based compounds

- 7.2.3 Silicate-based inhibitors

- 7.3 Organic inhibitors

- 7.3.1 Aminoalcohol-based systems

- 7.3.2 Amine carboxylate inhibitors

- 7.3.3 Organic acid derivatives

- 7.4 Hybrid and advanced systems

- 7.4.1 Organic-inorganic combinations

- 7.4.2 Nano-enhanced formulations

- 7.4.3 Smart release systems

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Infrastructure and transportation

- 8.2.1 Bridge and highway structures

- 8.2.2 Tunnels and underground construction

- 8.2.3 Marine and port facilities

- 8.2.4 Airport infrastructure

- 8.3 Residential construction

- 8.3.1 High-rise buildings

- 8.3.2 Housing developments

- 8.3.3 Renovation projects

- 8.4 Commercial and industrial

- 8.4.1 Office buildings and complexes

- 8.4.2 Industrial facilities

- 8.4.3 Warehouses and distribution centers

- 8.5 Specialty applications

- 8.5.1 Oil and gas facilities

- 8.5.2 Power generation plants

- 8.5.3 Water treatment infrastructure

- 8.5.4 Chemical processing plants

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Arkema Group

- 10.2 BASF SE

- 10.3 ChemTreat Inc.

- 10.4 CEMEX S.A.B. de C.V.

- 10.5 Clariant AG

- 10.6 Dow Inc.

- 10.7 Ecolab Inc. (Nalco Water)

- 10.8 Evonik Industries AG

- 10.9 GCP Applied Technologies Inc

- 10.10 Halliburton (Production Chemicals Division)

- 10.11 MAPEI S.p.A

- 10.12 Penetron International Ltd.

- 10.13 Pidilite Industries Limited

- 10.14 Sika AG