|

市場調查報告書

商品編碼

1801855

珠寶製造及貴金屬加工設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Jewelry Making and Precious Metals Processing Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

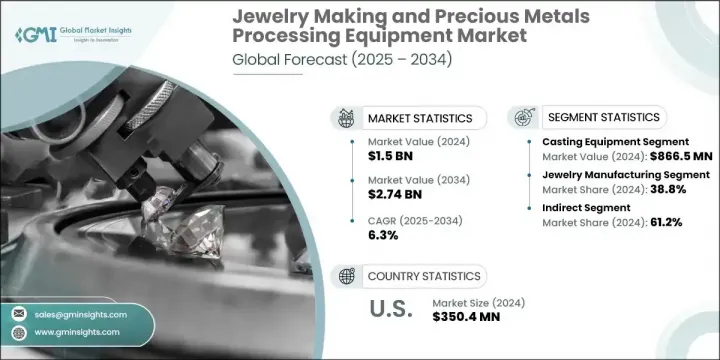

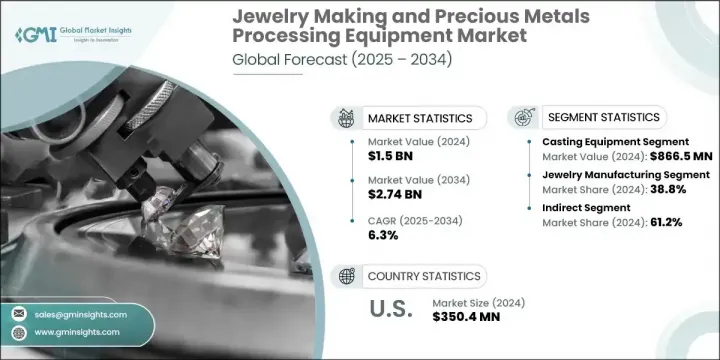

2024年,全球珠寶製造和貴金屬加工設備市場規模達15億美元,預計到2034年將以6.3%的複合年成長率成長,達到27.4億美元。該市場正經歷強勁且持續的成長,主要得益於消費者對高品質訂製珠寶日益成長的興趣。無論是在成熟經濟體或新興經濟體,年輕一代和富裕消費者對能夠展現自身生活方式和個性的珠寶的需求尤其強烈。隨著精密製造需求的不斷成長,產業參與者正在積極擁抱能夠確保精準度和可擴展性的先進生產技術。

電腦輔助設計軟體、3D列印工具和自動化系統正在幫助製造商提供詳細、一致且可擴展的設計,同時最大限度地減少材料浪費和生產時間。這些進步也有助於顯著降低勞動成本。由於完善的基礎設施、熟練的勞動力以及不斷成長的國內外需求,亞太地區仍然是該行業的主導中心。該地區各國受益於低成本勞動力、優惠的監管框架以及促進珠寶購買的文化偏好,這些因素共同增強了亞太地區對全球市場格局的影響力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 15億美元 |

| 預測值 | 27.4億美元 |

| 複合年成長率 | 6.3% |

鑄造設備領域在2024年創造了8.665億美元的產值,預計2025年至2034年間的複合年成長率將達到6.7%。該設備因其適合大規模生產、客製化靈活性和成本效益,在珠寶和貴金屬應用領域備受青睞。雖然基於雷射的系統(例如雕刻和焊接工具)擴大用於精密精加工,但鑄造技術仍然是實現可擴展生產的首選,尤其是在新興市場和中小型製造商中。其適應性強和經濟價值將繼續推動其在整個產業的廣泛應用。

珠寶製造業在2024年佔據38.8%的市場佔有率,預計到2034年複合年成長率將達到6.8%。作為貴金屬加工和珠寶設備行業的領先應用,該領域正因消費者需求的不斷成長、數位化製造程序的進步以及珠寶生產網路的國際化而不斷擴張。與工業精煉或回收等其他應用相比,珠寶生產需要更多種類的工具和設備,這使得其在產業的持續發展和創新中發揮核心作用。

美國珠寶製造和貴金屬加工設備市場佔76.5%的市場佔有率,2024年產值達3.504億美元。這一強勁地位得益於美國先進的製造能力和穩固的奢侈珠寶品牌。美國製造商廣泛利用CAD軟體、3D列印系統和雷射工具等數位技術來簡化工作流程並提高產品產量。這項技術優勢支撐了美國在高階珠寶製造領域的持續主導地位,使其成為整個市場中至關重要的參與者。

塑造全球珠寶製造和貴金屬加工設備市場的關鍵公司包括 Durston Tools、UIHM、Orotig、Supermelt、Indutherm、LaserStar Technologies、CDOCAST Machinery、Gesswein、Rio Grande、EnvisionTEC、Gravotech、Schultheiss、Contenti 和 Pepetools。為了鞏固市場地位,該領域的公司專注於產品創新、擴展數位化設計能力並升級製造技術。許多公司正在整合自動化和人工智慧驅動的工具,以提高設計準確性並簡化生產流程。投資使用者友善的介面和模組化機器,使企業能夠滿足從小型手工作坊到大型製造商的廣泛客戶需求。企業還透過與區域分銷商建立合作夥伴關係並提供響應迅速的售後支援來提升其全球影響力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 訂製和奢侈珠寶的需求不斷成長

- 加工設備的技術進步

- 自動化和數位設計工具的使用日益增多

- 產業陷阱與挑戰

- 先進設備成本高

- 貴金屬價格波動

- 機會

- 3D列印在珠寶製造領域的興起

- 對永續和道德珠寶的需求不斷增加

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 監管環境

- 價值鏈分析

- 原料供應商和零件製造商

- 設備製造商和原始設備製造商

- 分銷通路和銷售網路

- 最終用途領域和應用

- 售後服務供應商

- 價格趨勢

- 按地區

- 依設備類型

- 監管格局

- 標準和合規要求

- 區域監理框架

- 認證標準 貿易統計

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依設備類型,2021 - 2034 年

- 主要趨勢

- 鑄造設備

- 熔煉和精煉設備

- 沖壓成型設備

- 雷射設備

- 拋光和精加工設備

- 電鍍設備

- 其他設備

第6章:市場估計與預測:依金屬類型,2021 - 2034 年

- 主要趨勢

- 黃金加工設備

- 銀加工設備

- 鉑族金屬設備

- 其他貴金屬設備

第7章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 珠寶製造

- 貴金屬精煉

- 鐘錶製造

- 其他行業

第8章:市場估計與預測:按配銷通路2021 - 2034

- 主要趨勢

- 直銷

- 間接銷售

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- CDOCAST Machinery

- Contenti

- Durston Tools

- EnvisionTEC

- Gesswein

- Gravotech

- Indutherm

- LaserStar Technologies

- Orotig

- Pepetools

- Rio Grande

- Schultheiss

- Superbmelt

- UIHM

The Global Jewelry Making and Precious Metals Processing Equipment Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 2.74 billion by 2034. This market is witnessing strong and sustained growth, primarily driven by increasing consumer interest in high-quality, custom-designed jewelry. The demand is especially strong among younger demographics and affluent consumers in both established and emerging economies who seek pieces that express their lifestyle and individuality. As the need for precision manufacturing rises, industry players are embracing advanced production technologies that ensure accuracy and scalability.

Computer-aided design software, 3D printing tools, and automated systems are helping manufacturers deliver detailed, consistent, and scalable designs while minimizing material waste and production time. These advancements are also contributing to significant reductions in labor costs. The Asia-Pacific region remains the dominant hub for this industry, thanks to its established infrastructure, skilled labor force, and growing domestic and global demand. Countries across the region benefit from low-cost labor, favorable regulatory frameworks, and cultural preferences that promote jewelry purchases, which collectively strengthen APAC's influence on the global market landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $2.74 Billion |

| CAGR | 6.3% |

The casting equipment segment generated USD 866.5 million in 2024 and is forecasted to grow at a CAGR of 6.7% between 2025 and 2034. This equipment is highly favored in jewelry and precious metal applications due to its suitability for mass production, flexibility in customization, and cost efficiency. While laser-based systems like engraving and welding tools are increasingly used for precision finishing, casting technology remains the go-to for scalable production, particularly in emerging markets and among small to mid-sized manufacturers. Its adaptability and economic value continue to drive its widespread adoption across the sector.

The jewelry manufacturing segment accounted for a 38.8% share in 2024 and is expected to register a CAGR of 6.8% through 2034. As the leading application within the precious metals processing and jewelry equipment industry, this segment is expanding due to rising consumer demand, advancements in digital manufacturing processes, and the internationalization of jewelry production networks. Compared to other applications like industrial refining or recycling, jewelry production requires a greater variety of tools and equipment, giving it a central role in the industry's continued development and innovation.

U.S. Jewelry Making and Precious Metals Processing Equipment Market held a 76.5% share and generated USD 350.4 million in 2024. This strong position can be attributed to the country's advanced manufacturing capabilities and well-established presence of luxury jewelry brands. American manufacturers widely utilize digital technologies such as CAD software, 3D printing systems, and laser-based tools to streamline workflows and enhance product output. This technological edge supports the country's continued dominance in the high-end jewelry manufacturing space, making it a critical player in the overall market.

Key companies shaping the Global Jewelry Making and Precious Metals Processing Equipment Market include Durston Tools, UIHM, Orotig, Supermelt, Indutherm, LaserStar Technologies, CDOCAST Machinery, Gesswein, Rio Grande, EnvisionTEC, Gravotech, Schultheiss, Contenti, and Pepetools. To reinforce their market position, companies in this sector are focusing on product innovation, expanding digital design capabilities, and upgrading manufacturing technologies. Many are integrating automation and AI-driven tools to enhance design accuracy and streamline production timelines. Investing in user-friendly interfaces and modular machines allows businesses to serve a wide range of customer needs-from small artisan workshops to large-scale manufacturers. Firms are also increasing their global presence by establishing partnerships with regional distributors and offering responsive after-sales support.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.3 Data collection methods

- 1.4 Data mining sources

- 1.4.1 Global

- 1.4.2 Regional/Country

- 1.5 Base estimates and calculations

- 1.5.1 Base year calculation

- 1.5.2 Key trends for market estimation

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Metal type

- 2.2.4 End use Industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for custom and luxury jewelry

- 3.2.1.2 Technological advancements in processing equipment

- 3.2.1.3 Growing use of automation and digital design tools

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of advanced equipment

- 3.2.2.2 Volatility in precious metal prices

- 3.2.3 Opportunities

- 3.2.3.1 Emergence of 3d printing in jewelry manufacturing

- 3.2.3.2 Increasing demand for sustainable and ethical jewelry

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.6 Regulatory environment

- 3.7 Value Chain Analysis

- 3.7.1 Raw material suppliers and component manufacturers

- 3.7.2 Equipment manufacturers and OEMs

- 3.7.3 Distribution channels and sales networks

- 3.7.4 End use segments and applications

- 3.7.5 After-sales service providers

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By equipment type

- 3.9 Regulatory landscape

- 3.9.1 standards and compliance requirements

- 3.9.2 Regional regulatory frameworks

- 3.10 Certification standards Trade statistics

- 3.10.1 Major importing countries

- 3.10.2 Major exporting countries

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Equipment Type, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Casting equipment

- 5.2.1 Melting and refining equipment

- 5.2.2 Stamping and forming equipment

- 5.3 Laser equipment

- 5.3.1 Polishing and finishing equipment

- 5.3.2 Electroplating equipment

- 5.3.3 Other equipment

Chapter 6 Market Estimates & Forecast, By Metal Type, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Gold processing equipment

- 6.3 Silver processing equipment

- 6.4 Platinum group metals equipment

- 6.5 Other precious metals equipment

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Jewelry manufacturing

- 7.3 Precious metals refining

- 7.4 Watch manufacturing

- 7.5 Other industries

Chapter 8 Market Estimates & Forecast, By Distribution Channel 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 CDOCAST Machinery

- 10.2 Contenti

- 10.3 Durston Tools

- 10.4 EnvisionTEC

- 10.5 Gesswein

- 10.6 Gravotech

- 10.7 Indutherm

- 10.8 LaserStar Technologies

- 10.9 Orotig

- 10.10 Pepetools

- 10.11 Rio Grande

- 10.12 Schultheiss

- 10.13 Superbmelt

- 10.14 UIHM