|

市場調查報告書

商品編碼

1801854

仿製珠寶市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Imitation Jewelry Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

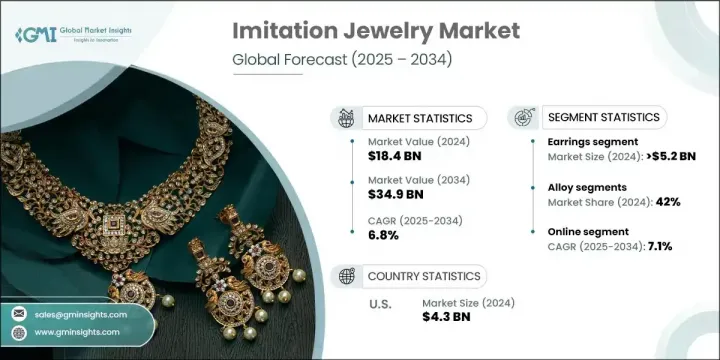

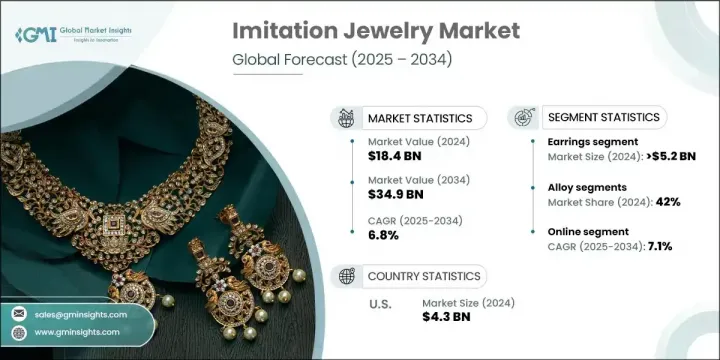

2024年,全球仿製珠寶市場規模達184億美元,預計到2034年將以6.8%的複合年成長率成長,達到349億美元。對輕奢需求的成長、時尚意識的增強以及金銀價格的不斷上漲,共同推動了這一成長。隨著貴金屬珠寶價格的不斷上漲,消費者開始選擇那些無需承擔經濟壓力,即可複製其美感的仿製珠寶。全球中產階級的壯大、可支配收入的增加、城市化進程的加快以及對配件個性化的追求,進一步推動了這一轉變。仿製珠寶靈活便捷,適合各種風格和場合——從休閒裝扮到正式場合。

隨著數位轉型席捲零售業,電商平台正在拓展品牌的覆蓋範圍,讓消費者更容易以極具競爭力的價格購買到潮流設計。隨著生活方式的演變,消費者對珠寶的需求持續轉向適應性強、時尚且永續的款式,而仿製珠寶則成為一種實用的選擇。消費者對價值驅動消費和時尚前衛外觀的強烈興趣,持續推動品牌不斷創新、豐富產品線,並採用環保材料和生產流程。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 184億美元 |

| 預測值 | 349億美元 |

| 複合年成長率 | 6.8% |

耳環品類引領仿製珠寶市場,2024 年銷售額達 52 億美元,預計到 2034 年複合年成長率將達到 7.2%。這種主導地位源自於時尚偏好的轉變,以及模仿奢華風格的平價配件的流行。消費者被那些與高階設計師作品風格相似但價格卻不高昂的耳環所吸引。項鍊也將繼續成為重要的收入驅動力,尤其受到年輕族群的青睞,這得益於層疊佩戴和模組化造型等趨勢的影響。混搭風格首飾日益成長的吸引力反映了消費者行為的轉變,促使品牌推出模組化系列和多樣化的款式選擇。

合金仿製珠寶佔42%的市場佔有率,預計在2025年至2034年期間將維持6.8%的複合年成長率。合金為複製貴金屬外觀提供了一種用途廣泛且經濟實惠的選擇。其適應性和視覺吸引力使其成為日常時尚、婚禮和社交場合的熱門選擇。不銹鋼也因其耐用性和與高級珠寶的相似性而日益受到青睞,為消費者提供了更多款式選擇,價格也更加親民。時尚且價格實惠的時尚單品趨勢繼續將合金產品推向市場需求的前沿。

美國仿製珠寶市場佔80%,預計2024年將達43億美元。這一成長得益於強大的購買力、對時尚且價格實惠的配件的興趣,以及透過社交平台推動潮流的廣泛網路存取。強大的網路影響力擴大了仿製珠寶的影響力,尤其是在那些追求環保材料和新穎設計的潮流消費者中。該地區多元的文化和蓬勃發展的時尚產業極大地影響著消費者的品味,鼓勵他們追求獨特且彰顯個性的珠寶。

影響全球仿製珠寶市場的領導者包括 VM Imitation、RMC Gems、Voylla、Vastradi Jewels、Silvesto、Kanhai Jewels 和 Senco Gold and Diamonds。為了保持競爭力,仿製珠寶行業的主要參與者優先考慮設計創新、價格實惠和數位成長。各大品牌正在投資潮流驅動的系列,這些系列通常受到季節性時裝秀的啟發,以吸引更年輕、更注重風格的買家。許多品牌正在透過電子商務平台和社群媒體行銷來提升其線上形象,以擴大影響力和客戶參與度。隨著永續性成為核心關注點,使用可回收包裝和無毒材料等環保做法也正在成為標準。與有影響力的人和時裝設計師的策略合作正在幫助公司提升品牌知名度和吸引力。為了迎合更廣泛的受眾,企業正在推出提供客製化的模組化系列,同時保持價格實惠,以滿足不同市場對價格敏感的消費者偏好。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監理框架

- 標準和認證

- 環境法規

- 進出口法規

- 貿易統計(HS 編碼 7117)

- 主要進口國

- 主要出口國

- 波特五力分析

- PESTEL分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 耳環

- 項鍊

- 手鐲

- 戒指

- 腳鍊

- 其他(胸針、別針等)

第6章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 不銹鋼

- 合金

- 黃銅

- 鋁

- 其他(塑膠等)

第7章:市場估計與預測:按價格,2021 - 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 男士

- 女性

- 男女通用的

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 線上

- 電子商務

- 公司網站

- 離線

- 超市/大賣場

- 專業零售店

- 其他(獨立零售商等)

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- CZ Jewellery

- Joker & Witch

- Kanhai Jewels

- Kundan Jewellery

- La Trendz

- Manek Ratna

- Mangalmani Jewellers

- Miarah

- RMC Gems

- Senco Gold and Diamonds

- Silvesto

- Vastradi Jewels

- VM Imitation

- Voylla

- Yellow Chimes

The Global Imitation Jewelry Market was valued at USD 18.4 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 34.9 billion by 2034. A rise in demand for affordable luxury, growing fashion consciousness, and escalating gold and silver prices are collectively fueling this growth. As precious metal jewelry becomes increasingly expensive, consumers are opting for imitation alternatives that replicate the aesthetic without financial strain. This shift is further supported by a growing global middle class with more disposable income, increased urbanization, and the desire for personalization in accessories. Imitation jewelry offers flexibility and accessibility, catering to various styles and occasions-from casual looks to formal attire.

With digital transformation sweeping retail, e-commerce platforms are giving brands broader reach, allowing consumers easier access to trendy designs at competitive prices. As lifestyles evolve, demand continues to shift toward adaptable, stylish, and sustainable jewelry options, positioning imitation pieces as a practical choice. Strong consumer interest in value-driven purchases and fashion-forward looks continues to push brands to innovate, diversify offerings, and embrace eco-conscious materials and production techniques.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.4 Billion |

| Forecast Value | $34.9 Billion |

| CAGR | 6.8% |

The earrings category led the imitation jewelry segment generated USD 5.2 billion in 2024 and is forecasted to grow at a CAGR of 7.2% through 2034. This dominance stems from changing fashion preferences and the popularity of affordable accessories that mimic luxury styles. Consumers are drawn to earrings that resemble premium designer pieces but come without the high cost. Necklaces also continue to be a significant revenue driver, benefiting from trends such as layering and modular styling options, particularly among younger audiences. The growing appeal of mix-and-match pieces reflects shifting consumer behaviors, prompting brands to introduce modular collections and variety in style choices.

Alloy-based imitation jewelry held 42% share is expected to maintain a 6.8% CAGR from 2025 to 2034. Alloys offer a versatile and cost-effective option for replicating the look of precious metals. Their adaptability and visual appeal make them a favorite for everyday fashion, weddings, and social occasions. Stainless steel is also gaining traction for its durability and resemblance to fine jewelry, giving consumers more style choices at accessible prices. The trend toward stylish yet budget-friendly pieces continue to push alloy-based products to the forefront of market demand.

United States Imitation Jewelry Market 80% share generating USD 4.3 billion in 2024. This growth is powered by a blend of high purchasing power, interest in fashionable yet affordable accessories, and widespread internet access that promotes trends via social platforms. A strong online presence has amplified the reach of imitation jewelry, especially among trend-conscious consumers seeking eco-friendly materials and fresh designs. The region's diverse culture and thriving fashion sector heavily influence consumer tastes, encouraging the adoption of unique and statement-making pieces.

Leading players shaping the Global Imitation Jewelry Market include VM Imitation, RMC Gems, Voylla, Vastradi Jewels, Silvesto, Kanhai Jewels, and Senco Gold and Diamonds. To stay competitive, major players in the imitation jewelry sector are prioritizing design innovation, affordability, and digital growth. Brands are investing in trend-driven collections, often inspired by seasonal runway fashion, to attract younger and style-conscious buyers. Many are enhancing their online presence through e-commerce platforms and social media marketing to expand reach and customer engagement. Eco-conscious practices, such as using recyclable packaging and non-toxic materials, are also becoming standard as sustainability becomes a core focus. Strategic collaborations with influencers and fashion designers are helping companies boost brand visibility and appeal. To cater to a broader audience, businesses are launching modular collections that offer customization, while maintaining affordability to match price-sensitive consumer preferences in diverse markets.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 By product type

- 2.2.3 By material

- 2.2.4 By price

- 2.2.5 By end use

- 2.2.6 By distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics (HS Code 7117)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Billion, Million Units)

- 5.1 Key trends

- 5.2 Earrings

- 5.3 Necklace

- 5.4 Bracelets

- 5.5 Rings

- 5.6 Anklets

- 5.7 Others (brooches and pins etc.)

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 ($Billion, Million Units)

- 6.1 Key trends

- 6.2 Stainless Steel

- 6.3 Alloy

- 6.4 Brass

- 6.5 Aluminum

- 6.6 Others (plastic etc.)

Chapter 7 Market Estimates & Forecast, By Price, 2021 - 2034 ($Billion, Million Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Billion, Million Units)

- 8.1 Key trends

- 8.2 Men

- 8.3 Women

- 8.4 Unisex

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Million Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce

- 9.2.2 Company websites

- 9.3 Offline

- 9.3.1 Supermarkets/hypermarket

- 9.3.2 Specialty retail stores

- 9.3.3 Others (independent retailer etc.)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 CZ Jewellery

- 11.2 Joker & Witch

- 11.3 Kanhai Jewels

- 11.4 Kundan Jewellery

- 11.5 La Trendz

- 11.6 Manek Ratna

- 11.7 Mangalmani Jewellers

- 11.8 Miarah

- 11.9 RMC Gems

- 11.10 Senco Gold and Diamonds

- 11.11 Silvesto

- 11.12 Vastradi Jewels

- 11.13 VM Imitation

- 11.14 Voylla

- 11.15 Yellow Chimes