|

市場調查報告書

商品編碼

1801851

電阻點焊機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Resistance Spot Welding Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

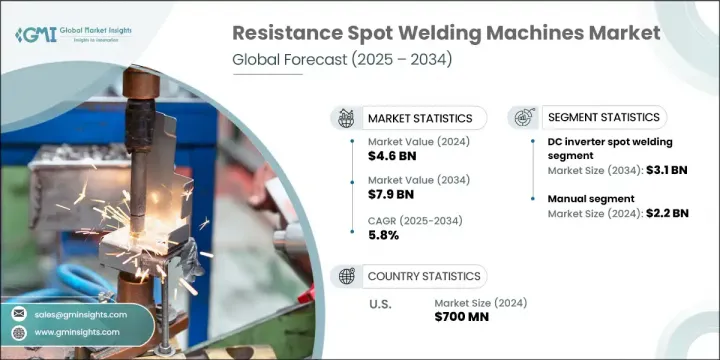

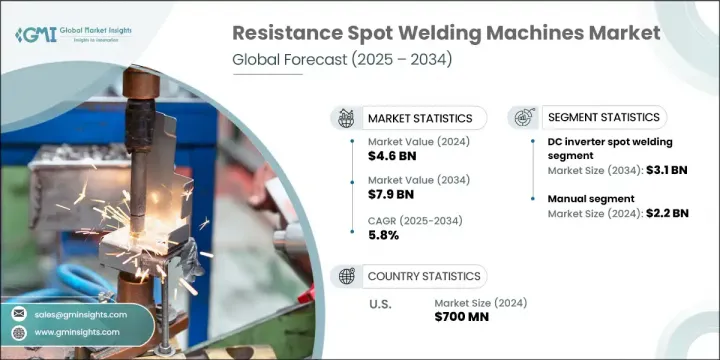

2024年,全球電阻點焊機市場規模達46億美元,預計2034年將以5.8%的複合年成長率成長,達到79億美元。製造業自動化的持續進步,尤其是在汽車、航太和家電生產等高產出產業,推動了這一成長。製造商正在整合數位控制和機器人焊接系統,以最佳化品質、效率和產量。優惠的產業政策和亞太地區製造業的擴張,進一步將電阻點焊定位為大批量生產環境中的關鍵製程。

隨著電動車普及率的上升,電阻點焊因其在輕量化、多金屬結構和電池組件組裝中的應用價值而日益凸顯。此製程的高速運作、可靠性和成本效益使其成為結構連接應用中不可或缺的技術。電阻焊也支持工程領域向高強度鋼和鋁等輕量化材料的轉變,提供低熱變形和高強度的焊點——這些特性對現代設計至關重要。因此,全球的原始設備製造商 (OEM) 和一級供應商持續投資於傳統和先進的電阻點焊 (RSW) 設備,以滿足生產和材料靈活性的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 46億美元 |

| 預測值 | 79億美元 |

| 複合年成長率 | 5.8% |

直流逆變焊機市場在2024年創造了18億美元的市場規模,預計2034年將達到31億美元。與交流電設備相比,這類設備精度更高、電流響應更快、焊接週期更短。逆變技術提高了焊接一致性,降低了營運成本,並將能耗降低高達30%,因此對於追求永續性和效率的製造商來說,逆變焊機的吸引力越來越大。

2024年,手排點焊市場規模達22億美元,佔49.1%。其中很大一部分需求來自拉丁美洲、亞洲和東歐等地區的中小企業。這些企業通常依賴手動機器,因為手動機器價格實惠、操作簡單且維護需求低。手動點焊機廣泛應用於小批量生產、零件尺寸多樣以及需要頻繁更換設定的行業。暖通空調製造、客製化金屬製品和家俱生產等行業仍然青睞手動系統,因為它們在小批量或專業任務中具有良好的適應性且營運成本低。

美國電阻點焊機市場在2024年創收7億美元,預計2034年將以4.9%的複合年成長率成長。美國仍然是汽車和國防應用領域的全球製造中心,而結構焊接在這些領域至關重要。電動車產量的加速成長也增強了國內需求,主要汽車製造商紛紛部署點焊機,用於生產電池模組和白車身結構等關鍵零件。此外,聯邦政府對國防的投資以及產能回流,也支撐了本地原始設備製造商和供應商對電阻點焊系統的需求穩定成長。

電阻點焊機市場的主要參與者包括 Miyachi Unitek (AMADA WELD TECH)、CenterLine (Windsor) Ltd.、Panasonic Welding Systems Co., Ltd.、Nimak GmbH 和 Automation International, Inc.,它們均繼續在該領域保持領先地位。電阻點焊機市場的領先公司正在透過投資自動化、能源效率和先進控制系統來增強其競爭優勢。與汽車 OEM 和工業製造商建立策略合作夥伴關係,可以共同開發滿足不斷變化的材料和設計需求的客製化焊接解決方案。一些製造商正在擴大研發活動,以推出具有智慧監控、預測性維護和人工智慧驅動焊接精度的下一代基於逆變器的系統。此外,擴大服務網路和在高成長地區實現生產在地化可以提供更快的支援並降低分銷成本。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業影響力量

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區和焊接材料

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 交流電阻點焊

- 直流逆變點焊接機

- 電容放電點焊

- 伺服槍點焊

第6章:市場估計與預測:依焊接材料,2021 - 2034 年

- 主要趨勢

- 低碳鋼

- 不銹鋼

- 鋁

- 鍍鋅鋼

- 銅及合金

- 其他(高強度低合金(HSLA)鋼、異種金屬組合等)

第7章:市場估計與預測:依焊接厚度,2021 - 2034 年

- 主要趨勢

- 最多 2 毫米

- 2 - 5 毫米

- 5毫米以上

第8章:市場估計與預測:按電源,2021 - 2034 年

- 主要趨勢

- 單相電源

- 三相電源

- 直流電源

第9章:市場估計與預測:依自動化水平,2021 - 2034 年

- 主要趨勢

- 手動的

- 半自動

- 自動的

第 10 章:市場估計與預測:按最終用途產業,2021 年至 2034 年

- 主要趨勢

- 汽車

- 製造業

- 航太和國防

- 電子和半導體

- 建造

- 農業設備

- 其他

第 11 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直接的

- 間接

第 12 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第13章:公司簡介

- ARO Welding Technologies SAS

- Automation International, Inc.

- CenterLine (Windsor) Ltd.

- Dengensha Manufacturing Co., Ltd.

- Guangzhou CEA Welding Equipment Co., Ltd.

- Heron Intelligent Equipment Co., Ltd.

- Janda Company, Inc.

- Miyachi Unitek (AMADA WELD TECH)

- Nimak GmbH

- Panasonic Welding Systems Co., Ltd.

- TJ Snow Company, Inc.

- TECNA SpA

The Global Resistance Spot Welding Machines Market was valued at USD 4.6 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 7.9 billion by 2034. This growth is being fueled by continued advancements in manufacturing automation, especially in high-output industries such as automotive, aerospace, and appliance production. Manufacturers are integrating digital controls and robotic welding systems to optimize quality, efficiency, and throughput. Favorable industrial policies and the expansion of manufacturing in the Asia-Pacific region have further positioned resistance spot welding as a key process in high-volume production environments.

As electric vehicle adoption rises, demand for resistance spot welding intensifies due to its relevance in assembling lightweight, multi-metal structures and battery components. The method's high-speed operation, reliability, and cost-effectiveness continue to make it indispensable in structural joining applications. Resistance welding also supports engineering shifts toward lightweight materials like high-strength steel and aluminum, offering low thermal distortion and strong weld joints-attributes crucial to modern design requirements. As a result, OEMs and Tier-1 suppliers globally continue to invest in both traditional and advanced RSW machines to meet production and material flexibility demands.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.6 Billion |

| Forecast Value | $7.9 Billion |

| CAGR | 5.8% |

The DC inverter segment generated USD 1.8 billion during 2024 and is projected to reach USD 3.1 billion by 2034. These machines provide enhanced precision, faster current response, and shorter weld cycles compared to AC-based equipment. Inverter technology improves consistency, lowers operational costs, and consumes up to 30% less energy, making it increasingly attractive for manufacturers pursuing sustainability and efficiency.

The manual spot-welding segment accounted for USD 2.2 billion in 2024, securing a 49.1% share. A significant portion of this demand stems from small and medium enterprises in regions such as Latin America, Asia, and Eastern Europe. These operations often rely on manual machines for their affordability, ease of operation, and minimal maintenance needs. Manual spot welders are widely used in small-batch production, varied part sizes, and industries require frequent setup changes. Sectors such as HVAC fabrication, custom metalwork, and furniture production continue to favor manual systems for their adaptability and low operating cost in low-volume or specialized tasks.

United States Resistance Spot Welding Machines Market generated USD 700 million in 2024 and is expected to grow at a CAGR of 4.9% through 2034. The US remains a global manufacturing hub for automotive and defense applications, where structural welding is critical. The accelerated growth of electric vehicle production has also strengthened domestic demand, with major automotive manufacturers deploying spot welding machines for key components like battery modules and BIW structures. Additionally, federal investments in defense and reshoring production capacity have supported a steady increase in demand for RSW systems from local OEMs and suppliers.

Major Resistance Spot Welding Machines Market players include Miyachi Unitek (AMADA WELD TECH), CenterLine (Windsor) Ltd., Panasonic Welding Systems Co., Ltd., Nimak GmbH, and Automation International, Inc., all of which continue to hold leading positions in this space. Leading companies in the resistance spot welding machines market are enhancing their competitive edge through investments in automation, energy efficiency, and advanced control systems. Strategic partnerships with automotive OEMs and industrial manufacturers allow for collaborative development of tailored welding solutions that meet evolving material and design needs. Several manufacturers are scaling up their R&D activities to introduce next-generation inverter-based systems with smart monitoring, predictive maintenance, and AI-driven welding precision. Additionally, expanding service networks and localization of production in high-growth regions enable faster support and lower distribution costs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Material Welded

- 2.2.4 Welding Thickness

- 2.2.5 Power Supply

- 2.2.6 Automation Level

- 2.2.7 End Use Industry

- 2.2.8 Distribution Channel

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region and materials welded

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Middle East and Africa

- 4.2.1.5 Latin America

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Billion) (Units)

- 5.1 Key trends

- 5.2 AC Resistance Spot Welding

- 5.3 DC Inverter Spot Welding

- 5.4 Capacitor Discharge Spot Welding

- 5.5 Servo-Gun Spot Welding

Chapter 6 Market Estimates & Forecast, By Material Welded, 2021 - 2034, (USD Billion) (Units)

- 6.1 Key trends

- 6.2 Mild Steel

- 6.3 Stainless Steel

- 6.4 Aluminum

- 6.5 Galvanized Steel

- 6.6 Copper & Alloys

- 6.7 Others (High Strength Low Alloy (HSLA) Steel, Dissimilar Metal Combination, etc.)

Chapter 7 Market Estimates & Forecast, By Welding Thickness, 2021 - 2034, (USD Billion) (Units)

- 7.1 Key trends

- 7.2 Up to 2 mm

- 7.3 2 - 5 mm

- 7.4 Above 5 mm

Chapter 8 Market Estimates & Forecast, By Power Supply, 2021 - 2034, (USD Billion) (Units)

- 8.1 Key trends

- 8.2 Single-phase Power Supply

- 8.3 Three-phase Power Supply

- 8.4 Direct Current Power Supply

Chapter 9 Market Estimates & Forecast, By Automation Level, 2021 - 2034, (USD Billion) (Units)

- 9.1 Key trends

- 9.2 Manual

- 9.3 Semi-automatic

- 9.4 Automatic

Chapter 10 Market Estimates & Forecast, By End Use Industry, 2021 - 2034, (USD Billion) (Units)

- 10.1 Key trends

- 10.2 Automotive

- 10.3 Manufacturing

- 10.4 Aerospace and Defense

- 10.5 Electronics and Semiconductors

- 10.6 Construction

- 10.7 Agricultural Equipment

- 10.8 Others

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Units)

- 11.1 Key trends

- 11.2 Direct

- 11.3 Indirect

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 U.K.

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 Saudi Arabia

- 12.6.3 South Africa

Chapter 13 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 13.1 ARO Welding Technologies SAS

- 13.2 Automation International, Inc.

- 13.3 CenterLine (Windsor) Ltd.

- 13.4 Dengensha Manufacturing Co., Ltd.

- 13.5 Guangzhou CEA Welding Equipment Co., Ltd.

- 13.6 Heron Intelligent Equipment Co., Ltd.

- 13.7 Janda Company, Inc.

- 13.8 Miyachi Unitek (AMADA WELD TECH)

- 13.9 Nimak GmbH

- 13.10 Panasonic Welding Systems Co., Ltd.

- 13.11 T. J. Snow Company, Inc.

- 13.12 TECNA S.p.A.