|

市場調查報告書

商品編碼

1801844

製藥機器人市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Pharmaceutical Robots Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

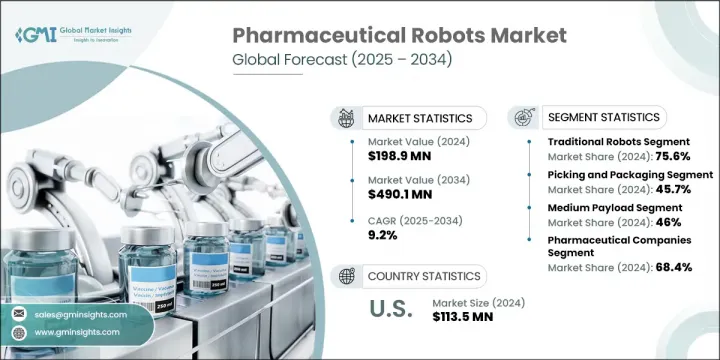

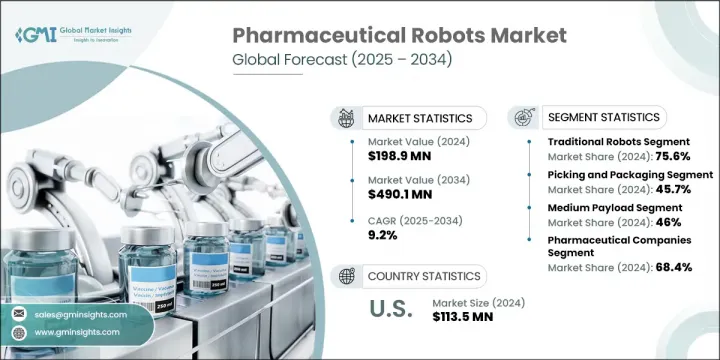

2024年,全球製藥機器人市場規模達1.989億美元,預計年複合成長率將達9.2%,到2034年將達到4.901億美元。強勁成長的動力源自於製藥生產流程自動化程度的提高、研發投入的增加以及協作機器人在藥品生產設施中應用的不斷擴展。製藥機器人的應用範圍十分廣泛,包括藥物檢測、無塵室應用和生產工作流程。

協作機器人系統日益普及,主要原因在於增強工作場所安全性、解決勞動力短缺問題以及提高無菌配製和其他複雜製藥流程效率的需求。同時,新一代療法的顯著進步和不斷增加的研發投入,促使製藥公司加速其營運自動化。這促進了對可擴展性、安全性和始終如一的精度的機器人系統的需求。行業創新與政府支持相結合,為製藥機器人的廣泛應用奠定了基礎,進一步推動了該行業的自動化趨勢。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.989億美元 |

| 預測值 | 4.901億美元 |

| 複合年成長率 | 9.2% |

2024年,傳統機器人市場佔據75.6%的佔有率,這得益於其在高階製造環境中無與倫比的精度、速度和效率。其中,關節型機器人系統因其在物料搬運和包裝等操作中的多功能性而廣泛應用。其靈活的有效載荷能力和高效率使其適用於各種製藥應用。產業領導者正積極拓展這些機器人的應用範圍,以滿足製藥製造的需求。

2024年,揀選和包裝應用領域佔了45.7%的佔有率。隨著製藥製造商尋求緊湊、節省空間、能夠簡化操作的解決方案,包裝功能對機器人系統的需求持續成長。這些系統還能透過最佳化工作空間利用率來提高效率。各公司正在與自動化解決方案提供者合作,開發客製化系統,以滿足不斷變化的藥品生產需求。重點仍然是加快包裝工作流程並提高整個生產設施的營運產出。

2024年,美國製藥機器人市場規模達1.135億美元。輝瑞、艾伯維、強生和百時美施貴寶等大型製藥公司的參與對推動這一成長發揮著至關重要的作用。美國企業也在投資,透過機器人技術和數位轉型實現供應鏈現代化,以提高透明度和營運效率,同時最大限度地降低成本。這種對效率的關注正在推動全國製藥生產線對機器人系統的需求。

製藥機器人市場的主要參與者包括 FANUC、OMRON AUTOMATION、EPSON、UNIVERSAL ROBOTS、STAUBLI、ABB、MITSUBISHI ELECTRIC、DENSO WAVE、YASKAWA、KAWASAKI Robotics 和 KUKA。製藥機器人市場的頂尖公司正在優先考慮自動化進步和智慧製造整合,以鞏固其市場地位。他們正在投資研發具有增強安全性和精度的協作機器人,以滿足製藥業的特定要求。公司正在擴大其產品組合,以支持無塵室標準和無菌環境。與製藥商建立策略合作夥伴關係可以共同開發用於包裝、物料處理和藥物配方的客製化解決方案。供應商還利用人工智慧和機器學習來創建能夠適應複雜流程的智慧機器人系統。此外,正在加強全球擴張和售後服務網路,以確保客戶支援和長期可靠性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 製藥製造業對自動化的需求不斷成長

- 增加醫藥研發投資和生產量

- 機器人系統的技術進步

- 製藥生產設施中協作機器人的採用激增

- 產業陷阱與挑戰

- 初期投資及維護成本高

- 缺乏在自動化部門工作的技術人員

- 市場機會

- 機器人技術中的人工智慧和機器學習的融合

- 新興市場的擴張

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 技術進步

- 當前的技術趨勢

- 新興技術

- 價值鏈分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 2024年定價分析

- 市場演變與歷史背景

- 波特的分析

- PESTEL分析

- 未來市場趨勢

- 差距分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 傳統機器人

- 關節型機器人

- SCARA機器人

- Delta/並聯機器人

- 笛卡兒機器人

- 雙臂機器人

- 協作機器人

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 挑選和包裝

- 藥品檢驗

- 實驗室應用

- 其他應用

第7章:市場估計與預測:按有效載荷,2021 - 2034 年

- 主要趨勢

- 低(最多 5 公斤)

- 中型(6-15公斤)

- 高(超過15公斤)

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 製藥公司

- 研究實驗室

- 其他最終用途

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- ABB

- DENSO WAVE

- EPSON

- FANUC

- KAWASAKI Robotics

- KUKA

- MITSUBISHI ELECTRIC

- OMRON AUTOMATION

- STAUBLI

- UNIVERSAL ROBOTS

- YASKAWA

The Global Pharmaceutical Robots Market was valued at USD 198.9 million in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 490.1 million by 2034. This robust growth is being fueled by increasing automation across pharmaceutical manufacturing processes, heightened investments in R&D, and the expanding use of collaborative robotics within drug production facilities. Pharmaceutical robots are being utilized across a broad range of functions, including drug testing, cleanroom applications, and production workflows.

The rising adoption of collaborative robotic systems is primarily driven by the need for enhanced workplace safety, solutions to address labor shortages, and efficiency in sterile compounding and other complex pharmaceutical processes. At the same time, significant advancements in next-generation therapies and increasing R&D investments are prompting pharmaceutical companies to accelerate the automation of their operations. This is fostering demand for robotics systems that offer scalability, safety, and consistent precision. Industry innovation combined with government support is laying the foundation for widespread adoption of pharmaceutical robots, further advancing the automation trend within the sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $198.9 Million |

| Forecast Value | $490.1 Million |

| CAGR | 9.2% |

In 2024, the traditional robots segment held a 75.6% share, driven by their unmatched accuracy, speed, and effectiveness in high-end manufacturing environments. Among these, articulated robotic systems are widely deployed due to their versatility in operations such as material handling and packaging. Their flexible payload capacities and efficiency make them suitable for diverse pharmaceutical applications. Leading industry players are actively working to expand the application scope of these robots to serve pharmaceutical manufacturing needs.

The picking and packaging application segment held a 45.7% share in 2024. The demand for robotic systems in packaging functions continues to grow as pharma manufacturers seek compact, space-saving solutions that can streamline operations. These systems also improve efficiency by optimizing workspace utilization. Companies are partnering with automation solution providers to develop customized systems that align with evolving pharmaceutical production demands. The focus remains on speeding up packaging workflows and enhancing operational output across production facilities.

United States Pharmaceutical Robots Market was valued at USD 113.5 million in 2024. The presence of major pharmaceutical players such as Pfizer, AbbVie, Johnson & Johnson, and Bristol Myers Squibb plays a crucial role in fueling this growth. U.S.-based firms are also investing in modernizing their supply chains through robotics and digital transformation to improve transparency and operational efficiency while minimizing costs. This focus on efficiency is boosting the demand for robotic systems across pharmaceutical production lines nationwide.

Key market participants in the Pharmaceutical Robots Market include FANUC, OMRON AUTOMATION, EPSON, UNIVERSAL ROBOTS, STAUBLI, ABB, MITSUBISHI ELECTRIC, DENSO WAVE, YASKAWA, KAWASAKI Robotics, and KUKA. Top companies in the pharmaceutical robots market are prioritizing automation advancements and smart manufacturing integration to solidify their market foothold. They are investing in R&D to develop collaborative robots with enhanced safety features and precision, tailored to pharmaceutical-specific requirements. Companies are expanding their product portfolios to support cleanroom standards and sterile environments. Strategic partnerships with pharma manufacturers enable co-development of customized solutions for packaging, material handling, and drug formulation. Vendors are also leveraging AI and machine learning to create intelligent robotic systems capable of adapting to complex processes. In addition, global expansion and after-sales service networks are being strengthened to ensure customer support and long-term reliability.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Application trends

- 2.2.4 Payload trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for automation in pharmaceutical manufacturing

- 3.2.1.2 Increasing pharmaceutical research and development investments and production volumes

- 3.2.1.3 Technological advancements in robotic systems

- 3.2.1.4 Surging adoption of collaborative robots in pharma manufacturing facilities

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment and maintenance

- 3.2.2.2 Lack of skilled personnel to work in automated units

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI and machine learning in robotics

- 3.2.3.2 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Value chain analysis

- 3.7 Pharmaceutical robots market in terms of Volume (Units), 2021 -2034

- 3.7.1 Global

- 3.7.2 North America

- 3.7.3 Europe

- 3.7.4 Asia Pacific

- 3.7.5 Latin America

- 3.7.6 MEA

- 3.8 Pricing analysis, 2024

- 3.9 Market evolution and historical context

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Future market trends

- 3.13 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 MEA

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Traditional robots

- 5.2.1 Articulated robots

- 5.2.2 SCARA robots

- 5.2.3 Delta/Parallel robots

- 5.2.4 Cartesian robots

- 5.2.5 Dual-arm robots

- 5.3 Collaborative robots

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Picking and packaging

- 6.3 Pharmaceutical drugs inspection

- 6.4 Laboratory applications

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By Payload, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Low (Upto 5 kg)

- 7.3 Medium (6-15 kg)

- 7.4 High (more than 15 kg)

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical companies

- 8.3 Research laboratories

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 DENSO WAVE

- 10.3 EPSON

- 10.4 FANUC

- 10.5 KAWASAKI Robotics

- 10.6 KUKA

- 10.7 MITSUBISHI ELECTRIC

- 10.8 OMRON AUTOMATION

- 10.9 STAUBLI

- 10.10 UNIVERSAL ROBOTS

- 10.11 YASKAWA