|

市場調查報告書

商品編碼

1801842

摩托車碳陶瓷煞車轉子市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Motorcycle Carbon Ceramic Brake Rotors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

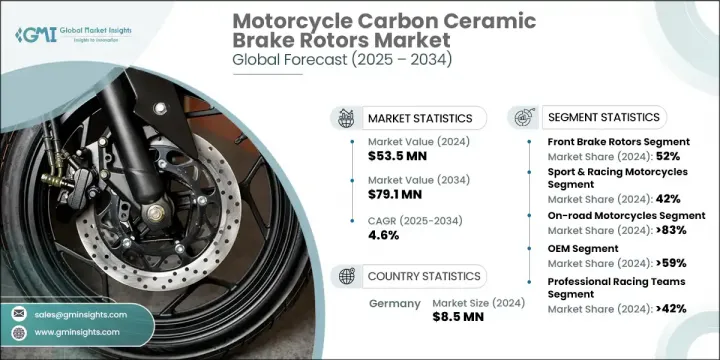

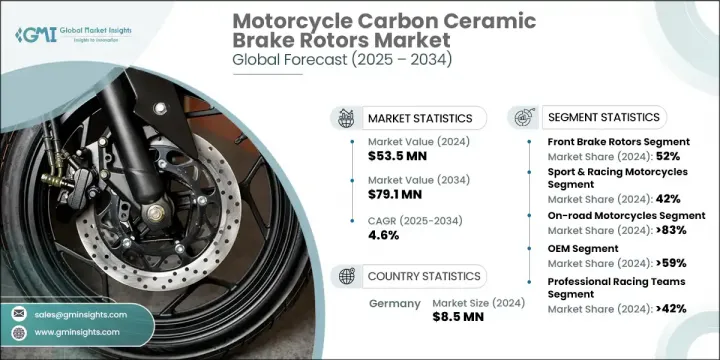

2024年,全球摩托車碳陶瓷煞車碟盤市場規模達5,350萬美元,預計2034年將以4.6%的複合年成長率成長,達到7,910萬美元。高性能和豪華摩托車(尤其是在運動和賽車領域)日益普及,推動了該市場的成長。這些煞車碟盤因其輕量化結構、卓越的耐熱性和更高的煞車精度而備受青睞,使其成為激烈駕駛和高速操控的理想選擇。對於注重安全性、耐用性和減少維護的騎乘者來說,這些系統尤其具有吸引力。複合材料的創新正在提高這些煞車碟盤的使用壽命和熱管理,即使在極端駕駛條件下也是如此。

隨著歐洲和北美等賽車運動重鎮的需求不斷成長,領先的製造商正在利用先進的冷卻技術和模組化轉子架構,為符合道路法規的摩托車帶來賽道級的性能。供應商正在客製化設計,以滿足原始設備製造OEM) 的規格和消費者對安全性、效率和性能的期望。高階市場的蓬勃發展促使 EBC Brakes、Sunstar 和 Braketech 等製造商在售後市場和原廠配件通路拓展產品線。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 5350萬美元 |

| 預測值 | 7910萬美元 |

| 複合年成長率 | 4.6% |

2024年,前煞車碟盤市場佔52%的市場佔有率,預計到2034年將以5%的複合年成長率成長。由於大部分制動力由前煞車碟盤處理,因此性能升級和創新都圍繞著這些部件。隨著運動旅行車和超級摩托車銷售的持續成長,通風式和開槽式轉子設計等技術正日益受到青睞。 Galfer Brakes和Brembo等製造商正在積極推出高效能轉子系統,以滿足這一需求。

2024年,運動和賽車摩托車市場佔據了50%的市場。這些摩托車需要在高速行駛時實現無與倫比的煞車控制和熱平衡。該領域正在持續進行產品開發,其轉子能夠減少熱變形並增強通風性能,以應對長時間的高性能使用。騎士們更青睞碳陶瓷,因為它即使在惡劣條件下也能保持穩定的煞車力,這也促使其在賽道車型中的應用日益廣泛。

德國摩托車碳陶瓷煞車碟盤市場佔50%的市場佔有率,2024年市場規模達850萬美元。該國的領先地位源自於其強大的賽車運動文化和OEM供應商網路。對更輕、更耐熱材料的需求,尤其是電動摩托車的需求,正在加速陶瓷複合材料的創新。先進的研發中心不斷湧現,不斷突破煞車碟盤技術的極限,注重效率和安全性,使德國成為全球產品革新的重要貢獻者。

塑造摩托車碳陶瓷煞車轉子市場的關鍵參與者包括 AP Racing、Braketech、SICOM Brakes、Galfer Brakes、Sunstar、Brembo SpA 和 EBC Brakes。該市場的製造商正在利用先進的轉子技術來擴展其產品組合,這些技術專注於熱穩定性、輕量化結構和改進的氣流。與原始設備製造商 (OEM) 的策略合作幫助品牌商獲得長期供應協議,同時與不斷發展的摩托車設計保持一致。一些參與者正在投資研發,以開發具有更長使用壽命和更高高溫性能的轉子材料。各公司也在加強其全球分銷網路,尤其是在賽車運動占主導地位的地區,以提高售後市場的可及性。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 高性能摩托車需求不斷成長

- 卓越的耐熱性並減少煞車衰退

- 賽車運動和場地賽日益流行

- 轉子製造的技術進步

- 重量輕且操控性更好

- 產業陷阱與挑戰

- 碳陶瓷轉子成本高

- 與標準摩托車的兼容性有限

- 市場機會

- 進軍中檔摩托車

- 電動摩托車(EV)的成長

- 材料科學的技術進步

- 新興市場的成長

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 科技與創新格局

- 統計概覽

- 全球高級摩托車產量統計

- 碳陶瓷採用率(按領域)

- 與傳統轉子的性能比較

- 成本分析和溢價評估

- 全球高級摩托車產量統計

- 技術與材料分析

- 材料成分和結構

- 碳纖維增強系統

- 陶瓷基質組合物

- 黏合劑和添加劑

- 組織與績效關係

- 製造流程

- 預製件準備和鋪層

- 化學氣相滲透(CVI)

- 液態矽滲透(LSI)

- 機械加工和精加工操作

- 性能特徵

- 熱性能和散熱

- 機械強度和耐久性

- 摩擦係數和耐磨性

- 減重和密度分析

- 材料成分和結構

- 價格趨勢

- 按地區

- 按產品

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 品牌分析與市場認知

- 品牌實力與認知度

- 客戶忠誠度和滿意度

- 賽車傳統和性能可信度

- 技術領導認知

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依產品,2021 - 2034 年

- 主要趨勢

- 前煞車轉子

- 後煞車轉子

- 全套(前後)

第6章:市場估計與預測:按摩托車,2021 - 2034 年

- 主要趨勢

- 運動和賽車摩托車

- 巡洋艦和旅行摩托車

- 泥地和越野摩托車

- 其他

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 公路

- 越野

第8章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 專業賽車隊

- 個人摩托車主

- 摩托車製造商

第10章:市場估計與預測:按地區,2021 - 2034 年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Alth Brakes

- AP Racing

- Braketech

- BRAKING

- Brembo

- Carbon Lorraine

- EBC Brakes

- Ferodo

- Galfer Brakes

- Galfer USA

- Moto-Master

- NG Brakes

- Nissin Kogyo

- SBS Friction

- SICOM Brakes

- Sunstar Engineering

- TRW Automotive

- Yutaka Giken

The Global Motorcycle Carbon Ceramic Brake Rotors Market was valued at USD 53.5 million in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 79.1 million by 2034. Growth in this market is driven by the rising popularity of high-performance and luxury motorcycles, particularly in the sport and racing categories. These brake rotors are favored for their lightweight structure, superior heat resistance, and increased braking precision, making them ideal for aggressive riding and high-speed control. The appeal of these systems is especially strong among riders who prioritize safety, durability, and reduced maintenance. Innovations in composite materials are enhancing the lifespan and thermal management of these rotors, even under extreme riding conditions.

With expanding demand across motorsports-heavy regions like Europe and North America, leading manufacturers are leveraging advanced cooling technologies and modular rotor architecture to bring track-level performance to road-legal motorcycles. Suppliers are tailoring designs to match OEM specifications and consumer expectations around safety, efficiency, and performance. Premium segment growth has encouraged manufacturers like EBC Brakes, Sunstar, and Braketech to expand their offerings across both aftermarket and factory-fit channels.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $53.5 Million |

| Forecast Value | $79.1 Million |

| CAGR | 4.6% |

In 2024, the front brake rotor segment held a 52% share and is projected to grow at a CAGR of 5% through 2034. Since most braking power is handled by front rotors, performance upgrades and innovations are centered around these components. Technologies like ventilated and slotted rotor designs are gaining traction as sport touring and superbike sales continue to rise. Manufacturers such as Galfer Brakes and Brembo are actively releasing high-efficiency rotor systems to meet this demand.

The sport and racing motorcycles segment held a 50% share in 2024. These motorcycles require unmatched braking control and thermal balance at high speeds. The segment is seeing ongoing product development with rotors offering reduced thermal distortion and enhanced ventilation to manage prolonged high-performance use. Riders prefer carbon ceramic for its consistent stopping power, even under aggressive conditions, contributing to its rising adoption across track-inspired models.

Germany Motorcycle Carbon Ceramic Brake Rotors Market held a 50% share and generated USD 8.5 million in 2024. The country's leadership is anchored in its robust motorsports culture and strong OEM-supplier networks. Innovation in ceramic composites is being accelerated by the demand for lighter and more heat-tolerant materials, especially for electric motorcycles. Advanced R&D centers are emerging, pushing the limits of rotor technology, with an emphasis on efficiency and safety, making Germany a major contributor to global product evolution.

Key players shaping the Motorcycle Carbon Ceramic Brake Rotors Market include AP Racing, Braketech, SICOM Brakes, Galfer Brakes, Sunstar, Brembo S.p.A., and EBC Brakes. Manufacturers in this market are expanding their product portfolios with advanced rotor technologies that focus on thermal stability, lightweight construction, and improved airflow. Strategic collaborations with OEMs have helped brands secure long-term supply deals while aligning with evolving motorcycle designs. Several players are investing in R&D to develop rotor materials with extended life cycles and enhanced performance at high operating temperatures. Companies are also enhancing their global distribution networks, particularly in motorsport-dominant regions, to improve aftermarket accessibility.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Motorcycle

- 2.2.4 Application

- 2.2.5 Sales Channel

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for high-performance motorcycles

- 3.2.1.2 Superior heat resistance & reduced brake fade

- 3.2.1.3 Rising popularity of motorsport & track racing

- 3.2.1.4 Technological advancements in rotor manufacturing

- 3.2.1.5 Lightweight and improved handling

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of carbon ceramic rotors

- 3.2.2.2 Limited compatibility with standard motorcycles

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into mid-range motorcycles

- 3.2.3.2 Growth in electric motorcycles (EVs)

- 3.2.3.3 Technological advancements in material science

- 3.2.3.4 Growth in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.8 Statistical overview

- 3.8.1 Global premium motorcycle production statistics

- 3.8.1.1 Carbon ceramic adoption rates by segment

- 3.8.1.2 Performance comparison vs traditional rotors

- 3.8.1.3 Cost analysis and price premium assessment

- 3.8.1 Global premium motorcycle production statistics

- 3.9 Technology and material analysis

- 3.9.1 Material composition and structure

- 3.9.1.1 Carbon fiber reinforcement systems

- 3.9.1.2 Ceramic matrix compositions

- 3.9.1.3 Binding agents and additives

- 3.9.1.4 Microstructure and performance relationship

- 3.9.2 Manufacturing processes

- 3.9.2.1 Preform preparation and layup

- 3.9.2.2 Chemical vapor infiltration (CVI)

- 3.9.2.3 Liquid silicon infiltration (LSI)

- 3.9.2.4 Machining and finishing operations

- 3.9.3 Performance characteristics

- 3.9.3.1 Thermal properties and heat dissipation

- 3.9.3.2 Mechanical strength and durability

- 3.9.3.3 Friction coefficient and wear resistance

- 3.9.3.4 Weight reduction and density analysis

- 3.9.1 Material composition and structure

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By product

- 3.11 Cost breakdown analysis

- 3.12 Patent analysis

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.13.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Brand analysis and market perception

- 4.4.1 Brand strength and recognition

- 4.4.2 Customer loyalty and satisfaction

- 4.4.3 Racing heritage and performance credibility

- 4.4.4 Technology leadership perception

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Front brake rotors

- 5.3 Rear brake rotors

- 5.4 Full set (Front & Rear)

Chapter 6 Market Estimates & Forecast, By Motorcycle, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Sport & racing motorcycles

- 6.3 Cruisers & touring motorcycles

- 6.4 Dirt & off-road motorcycles

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 On-road

- 7.3 Off-road

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Professional racing teams

- 9.3 Individual motorcycle owners

- 9.4 Motorcycle manufacturers

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 North America

- 10.1.1 U.S.

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Russia

- 10.2.7 Nordics

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 South Korea

- 10.3.5 ANZ

- 10.3.6 Southeast Asia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 UAE

- 10.5.2 Saudi Arabia

- 10.5.3 South Africa

Chapter 11 Company Profiles

- 11.1 Alth Brakes

- 11.2 AP Racing

- 11.3 Braketech

- 11.4 BRAKING

- 11.5 Brembo

- 11.6 Carbon Lorraine

- 11.7 EBC Brakes

- 11.8 Ferodo

- 11.9 Galfer Brakes

- 11.10 Galfer USA

- 11.11 Moto-Master

- 11.12 NG Brakes

- 11.13 Nissin Kogyo

- 11.14 SBS Friction

- 11.15 SICOM Brakes

- 11.16 Sunstar Engineering

- 11.17 TRW Automotive

- 11.18 Yutaka Giken