|

市場調查報告書

商品編碼

1801832

混合無人機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Hybrid UAV Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

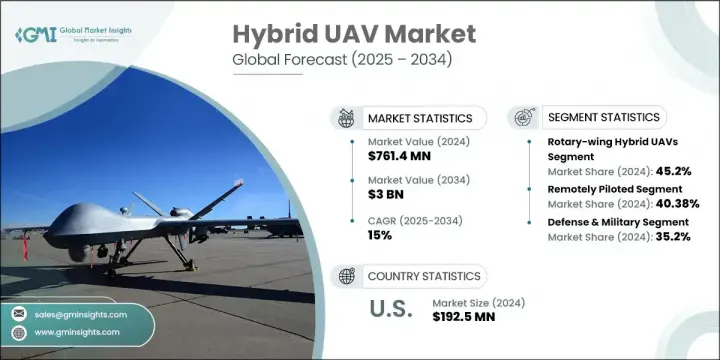

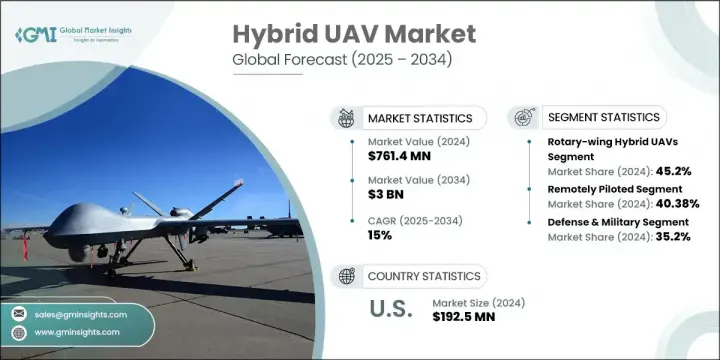

2024 年全球混合無人機市場價值為 7.614 億美元,預計到 2034 年將以 15% 的複合年成長率成長,達到 30 億美元。推動這一成長的最大因素之一是監視和偵察行動對延長飛行時間的需求不斷成長。傳統的電池供電無人機根本無法滿足大規模或偏遠地區覆蓋所需的續航時間。混合無人機結合了電力和燃油推進系統,正在填補這一空白,提供通常超過 10 至 12 小時的飛行時間。它們能夠提供連續的即時資料,這使其在戰場監視、海上巡邏、邊境監視和災難應變等各個領域都具有價值。它們在農業領域的應用也迅速擴大,它們可協助進行作物監測、土壤分析、灌溉規劃和病蟲害檢測。由於能夠在廣闊和不規則的地形上高效作業,混合無人機正成為精準農業和環境監測的首選工具。

在眾多類別中,旋翼混合無人機的成長速度最快,預計2025-2034年的複合年成長率為15.2%。其懸停、垂直起飛和在狹小空間飛行的能力使其成為人口稠密和基礎設施密集環境下的首選。政府和商業部門對這類無人機的需求持續成長,尤其是在緊急服務、巡視和戰術監視領域。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.614億美元 |

| 預測值 | 30億美元 |

| 複合年成長率 | 15% |

2024年,遙控混合無人機市場收入達3.075億美元。這些系統仍然是需要人類直接參與的任務的重要組成部分。在國防和緊急應變等領域,由於手動控制無人機操作靈活且成本相對較低,其需求強勁。它們在監視和安全行動中的重要性持續成長,尤其是在人類判斷至關重要的任務中。

2024年,美國混合無人機市場規模達1.925億美元,複合年成長率達15.5%。美國正加速推進國防能力現代化,並擴大各領域自動化程度。研發投入、有利的監管支持以及重大國防舉措正在推動混合無人機系統的普及。這些飛機正積極部署於物流、智慧農業、基礎設施評估和緊急應用領域。旨在將無人機融入商業和民用營運的項目預計將在未來幾年進一步推動成長。

影響混合無人機市場的關鍵參與者包括洛克希德馬丁、AeroVironment、萊昂納多公司、以色列航太工業公司 (IAI)、大疆創新、通用原子公司、BAE 系統公司、波音公司、泰雷茲集團、埃爾比特系統公司、派諾特公司、空中巴士公司、薩博公司、德事系統公司和諾斯羅·格魯曼公司。為了鞏固市場地位,混合無人機領域的公司正大力注重創新和技術整合。領先的參與者正在開發具有增強燃油效率、雙推進能力和基於人工智慧的資料處理能力的無人機平台,以延長續航時間和性能。許多公司正在投資模組化無人機設計,以便根據從農業到安全的不同任務情況進行客製化。與政府機構和國防組織的戰略合作夥伴關係正在實現更深入的市場滲透。此外,企業正在擴大生產能力並建立全球供應鏈以滿足不斷成長的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 長航時監視和偵察任務的需求不斷增加

- 無人機在商業農業的應用日益增多

- 無人機在最後一哩配送物流的應用日益增多

- 擴大國防預算以支持先進無人機採購

- 加速對混合動力無人機技術的投資

- 產業陷阱與挑戰

- 混合動力系統的開發與維護成本高

- 對超視距飛行 (BVLOS) 和自主無人機操作的監管限制

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 歷史價格分析(2021-2024)

- 價格趨勢促進因素

- 區域價格差異

- 價格預測(2025-2034年)

- 定價策略

- 新興商業模式

- 合規性要求

- 永續性措施

- 永續材料評估

- 碳足跡分析

- 循環經濟實施

- 永續性認證和標準

- 永續性投資報酬率分析

- 全球消費者情緒分析

- 專利分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 市場集中度分析

- 按地區

- 關鍵參與者的競爭基準

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理位置比較

- 全球足跡分析

- 服務網路覆蓋

- 各區域市場滲透率

- 競爭定位矩陣

- 領導者

- 挑戰者

- 追蹤者

- 利基市場參與者

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年關鍵發展

- 併購

- 夥伴關係和合作

- 技術進步

- 擴張和投資策略

- 永續發展舉措

- 數位轉型舉措

- 新興/新創企業競爭對手格局

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 固定翼混合無人機

- 旋翼混合無人機

- VTOL(垂直起降)混合無人機

第6章:市場估計與預測:依營運模式,2021 年至 2034 年

- 主要趨勢

- 遙控駕駛

- 可選駕駛

- 完全自主

第7章:市場估計與預測:按電源,2021 - 2034 年

- 主要趨勢

- 汽油-電動混合動力

- 太陽能-電力混合

- 燃料電池-電動混合動力

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 監視與偵察

- 測繪與測量

- 農業(例如作物監測、噴灑)

- 配送與物流

- 其他

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 國防與軍事

- 固定翼混合無人機

- 旋翼混合無人機

- VTOL(垂直起降)混合無人機

- 商業的

- 固定翼混合無人機

- 旋翼混合無人機

- VTOL(垂直起降)混合無人機

- 政府與執法部門

- 固定翼混合無人機

- 旋翼混合無人機

- VTOL(垂直起降)混合無人機

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第 11 章:公司簡介

- 全球參與者

- AeroVironment

- Alpha Unmanned Systems

- Autel Robotics

- BAE Systems

- Boeing

- Delair

- DJI Innovations

- EHang

- Elbit Systems

- General Atomics

- Israel Aerospace Industries (IAI)

- Kratos Defense & Security Solutions

- Leonardo SpA

- Lockheed Martin

- Northrop Grumman

- Parrot SA

- Quantum Systems

- Saab AB

- Skyfront

- Textron Systems

- Thales Group

- Zipline

- 區域參與者

- American Robotics

- AgEagle Aerial Systems

- Draganfly Inc.

- Airbus SE

- Delair SAS

- Ehang Holdings Ltd.

- Turkish Aerospace Industries

- 新興玩家

- Anduril Industries

- Shield AI

- Skydio

The Global Hybrid UAV Market was valued at USD 761.4 million in 2024 and is estimated to grow at a CAGR of 15% to reach USD 3 billion by 2034. One of the biggest factors fueling this expansion is the rising demand for extended flight time in surveillance and reconnaissance operations. Traditional battery-powered drones simply can't match the endurance needed for large-scale or remote area coverage. Hybrid UAVs, with their combination of electric and fuel propulsion systems, are stepping in to bridge this gap, offering flight times that often exceed 10 to 12 hours. Their ability to deliver continuous real-time data makes them valuable in various sectors such as battlefield monitoring, maritime patrolling, border surveillance, and disaster response. Their presence is also expanding rapidly in agriculture, where they assist with crop monitoring, soil analysis, irrigation planning, and pest detection. With their capability to operate over large and irregular landscapes efficiently, hybrid UAVs are becoming a preferred tool for precision farming and environmental monitoring.

Among the various categories, the rotary-wing hybrid UAVs are witnessing the fastest growth, with an expected CAGR of 15.2% during 2025-2034. Their ability to hover, take off vertically, and navigate tight spaces has made them a top choice for use in densely populated and infrastructure-heavy environments. Demand from both government and commercial sectors for these UAVs continues to rise, particularly for use in emergency services, inspections, and tactical surveillance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $761.4 Million |

| Forecast Value | $3 Billion |

| CAGR | 15% |

The remotely piloted hybrid UAVs segment generated USD 307.5 million in 2024. These systems remain a vital component of missions that require direct human involvement. In sectors such as defense and emergency response, the demand for manually controlled UAVs is strong due to their operational flexibility and relatively low cost. Their importance in surveillance and security operations continues to grow, especially for tasks where human judgment is critical.

United States Hybrid UAV Market was valued at USD 192.5 million in 2024, growing at a CAGR of 15.5%. The country is accelerating efforts to modernize its defense capabilities and expand automation across sectors. Investments in R&D, favorable regulatory support, and major defense initiatives are boosting the adoption of hybrid UAV systems. These aircraft are being actively deployed in logistics, smart agriculture, infrastructure assessment, and emergency applications. Programs aimed at integrating drones into commercial and civilian operations are expected to further drive growth in the years ahead.

Key players shaping the Hybrid UAV Market include Lockheed Martin, AeroVironment, Leonardo S.p.A., Israel Aerospace Industries (IAI), DJI Innovations, General Atomics, BAE Systems, Boeing, Thales Group, Elbit Systems, Parrot SA, Airbus, Saab AB, Textron Systems, and Northrop Grumman. To solidify their market position, companies in the hybrid UAV space are focusing heavily on innovation and technological integration. Leading players are developing UAV platforms with enhanced fuel efficiency, dual-propulsion capabilities, and AI-based data processing to extend endurance and performance. Many firms are investing in modular UAV designs that allow customization for different mission profiles, from agriculture to security. Strategic partnerships with government agencies and defense organizations are enabling deeper market penetration. Additionally, businesses are expanding production capacity and establishing global supply chains to meet rising demand.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Packaging type trends

- 2.2.2 Material trends

- 2.2.3 Application trends

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspective: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for long-endurance surveillance and reconnaissance missions

- 3.2.1.2 Rising adoption of UAVs in commercial agriculture

- 3.2.1.3 Growing use of drones for last-mile delivery logistics

- 3.2.1.4 Expansion of defense budgets supporting advanced UAV procurement

- 3.2.1.5 Accelerating investment in hybrid propulsion drone technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and maintenance costs of hybrid systems

- 3.2.2.2 Regulatory restrictions on BVLOS and autonomous UAV operations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 Historical price analysis (2021-2024)

- 3.8.2 Price trend drivers

- 3.8.3 Regional price variations

- 3.8.4 Price forecast (2025-2034)

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.12.1 Sustainable materials assessment

- 3.12.2 Carbon footprint analysis

- 3.12.3 Circular economy implementation

- 3.12.4 Sustainability certifications and standards

- 3.12.5 Sustainability roi analysis

- 3.13 Global consumer sentiment analysis

- 3.14 Patent analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Fixed-Wing Hybrid UAVs

- 5.3 Rotary-Wing Hybrid UAVs

- 5.4 VTOL (Vertical Take-Off and Landing) Hybrid UAVs

Chapter 6 Market Estimates and Forecast, By Mode of Operation, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Remotely Piloted

- 6.3 Optionally Piloted

- 6.4 Fully Autonomous

Chapter 7 Market Estimates and Forecast, By Power Source, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Gasoline-Electric Hybrid

- 7.3 Solar-Electric Hybrid

- 7.4 Fuel Cell-Electric Hybrid

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Surveillance & Reconnaissance

- 8.3 Mapping & Surveying

- 8.4 Agriculture (e.g., crop monitoring, spraying)

- 8.5 Delivery & Logistics

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 Defense & Military

- 9.2.1 Fixed-Wing Hybrid UAVs

- 9.2.2 Rotary-Wing Hybrid UAVs

- 9.2.3 VTOL (Vertical Take-Off and Landing) Hybrid UAVs

- 9.3 Commercial

- 9.3.1 Fixed-Wing Hybrid UAVs

- 9.3.2 Rotary-Wing Hybrid UAVs

- 9.3.3 VTOL (Vertical Take-Off and Landing) Hybrid UAVs

- 9.4 Government & Law Enforcement

- 9.4.1 Fixed-Wing Hybrid UAVs

- 9.4.2 Rotary-Wing Hybrid UAVs

- 9.4.3 VTOL (Vertical Take-Off and Landing) Hybrid UAVs

- 9.5 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 AeroVironment

- 11.1.2 Alpha Unmanned Systems

- 11.1.3 Autel Robotics

- 11.1.4 BAE Systems

- 11.1.5 Boeing

- 11.1.6 Delair

- 11.1.7 DJI Innovations

- 11.1.8 EHang

- 11.1.9 Elbit Systems

- 11.1.10 General Atomics

- 11.1.11 Israel Aerospace Industries (IAI)

- 11.1.12 Kratos Defense & Security Solutions

- 11.1.13 Leonardo S.p.A.

- 11.1.14 Lockheed Martin

- 11.1.15 Northrop Grumman

- 11.1.16 Parrot SA

- 11.1.17 Quantum Systems

- 11.1.18 Saab AB

- 11.1.19 Skyfront

- 11.1.20 Textron Systems

- 11.1.21 Thales Group

- 11.1.22 Zipline

- 11.2 Regional Players

- 11.2.1 American Robotics

- 11.2.2 AgEagle Aerial Systems

- 11.2.3 Draganfly Inc.

- 11.2.4 Airbus SE

- 11.2.5 Delair SAS

- 11.2.6 Ehang Holdings Ltd.

- 11.2.7 Turkish Aerospace Industries

- 11.3 Emerging Players

- 11.3.1 Anduril Industries

- 11.3.2 Shield AI

- 11.3.3 Skydio