|

市場調查報告書

商品編碼

1801819

即時診斷 CT 影像系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Point-of-care CT Imaging Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

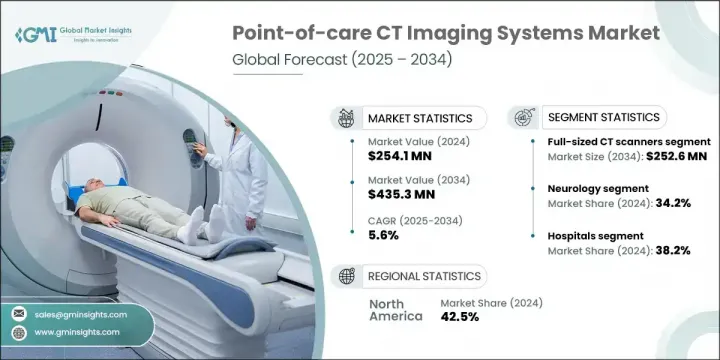

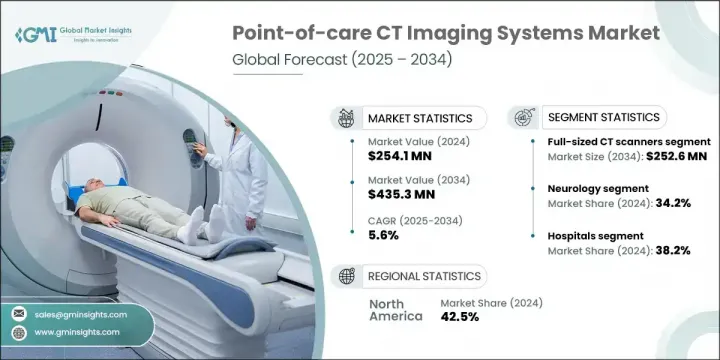

2024年,全球床邊CT影像系統市場規模達2.541億美元,預計到2034年將以5.6%的複合年成長率成長,達到4.353億美元。該市場的成長主要得益於慢性病發病率的上升和全球人口老化的快速成長。這些因素推動了對即時便捷診斷解決方案的需求。床邊CT系統是一種緊湊的行動平台,可提供快速便捷的影像,使其成為急診、門診和重症監護環境中的必備設備。隨著醫療模式轉向以患者為中心的診斷,攜帶式CT技術因其能夠支持呼吸評估並提供即時成像而無需依賴集中式醫院系統而日益受到青睞。

呼吸系統疾病病例的不斷增加進一步增強了市場,因為早期準確的診斷對於控制病情結果仍然至關重要。造成這一趨勢的主要因素之一是病毒感染的季節性激增,這大大加重了呼吸系統衛生系統的負擔。因此,在需要快速評估以指導即時治療決策的臨床環境中,床邊CT系統的應用日益廣泛。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.541億美元 |

| 預測值 | 4.353億美元 |

| 複合年成長率 | 5.6% |

2024年,全尺寸CT掃描器市場規模達1.493億美元。預計到2034年,該市場規模將成長至2.526億美元,複合年成長率為5.5%。這些系統因其高解析度輸出和全面的診斷功能而備受青睞,成為重症監護和急診護理的首選。全尺寸CT掃描儀通常用於手術室、創傷科和重症監護科室,在這些科室,影像速度和細節對患者的預後至關重要。它們能夠支援各種臨床需求,是醫院工作流程中不可或缺的一部分。

2024年,醫院細分市場佔據38.2%的市場佔有率,仍是該細分市場中最大的終端用戶群。醫院的主導地位歸功於其完善的診斷基礎設施和訓練有素的放射科醫護人員。這些機構通常處理神經內科、創傷科和肺部護理領域的複雜病例,而快速的即時影像解決方案則為這些病例提供了便利。隨著醫院不斷提升診斷速度和服務水平,對行動CT系統的需求也日益成長。

2024年,美國即時診斷CT影像系統市場規模達1.019億美元,持續維持全球領先地位。美國慢性病和癌症的高發生率,加上其強大的醫療服務體系,推動了該技術的持續應用。此外,良好的監管環境、日益提升的早期診斷意識以及對先進醫學影像技術的大量投資,也為市場持續擴張提供了支持。

積極影響即時診斷 CT 影像系統市場的關鍵參與者包括 Carestream Dental、Planmed、Xoran Technologies、CurveBeam、西門子醫療、NeuroLogica、Epica International、SOREDEX、Stryker 和 Arineta。即時診斷 CT 成像系統市場的領先公司正在大力投資創新,以提高影像品質、便攜性和系統可用性。為了脫穎而出,許多公司都專注於開發人工智慧整合平台,以提高診斷速度和準確性。與醫院、診斷中心和遠距醫療提供者的策略合作有助於提高採用率,尤其是在分散的護理環境中。一些製造商正在透過為門診、ICU 和農村護理環境量身定做的緊湊型無線系統來擴展其產品組合。公司也正在利用監管部門的批准和快速通道核准,更快地將先進型號推向市場。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 慢性病盛行率不斷上升

- 人口老化日益加劇

- 越來越重視早期診斷和治療

- 成像系統的技術進步

- 產業陷阱與挑戰

- 成像系統成本高

- 監管和報銷障礙

- 市場機會

- 向農村和偏遠地區擴張

- 與人工智慧和遠距醫療的融合

- 成長動力

- 成長潛力分析

- 監管格局

- 技術進步

- 當前的技術趨勢

- 新興技術

- 供應鏈分析

- 報銷場景

- 2024年定價分析

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 緊湊型CT掃描儀

- 全尺寸CT掃描儀

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 神經病學

- 呼吸系統

- 肌肉骨骼

- 耳鼻喉科

- 其他應用

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 診所

- 其他最終用途

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Arineta

- Carestream Dental

- CurveBeam

- Epica International

- NeuroLogica

- Planmed

- Siemens Healthineers

- SOREDEX

- Stryker

- Xoran Technologies

The Global Point-of-care CT Imaging Systems Market was valued at USD 254.1 million in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 435.3 million by 2034. Growth in this market is primarily fueled by the increasing rates of chronic health conditions and a rapidly aging global population. These factors are driving higher demand for immediate and convenient diagnostic solutions. Point-of-care CT systems are compact, mobile platforms that offer fast and accessible imaging, making them essential in emergency care, outpatient centers, and intensive care environments. As healthcare models shift toward patient-centric diagnostics, portable CT technologies are gaining traction for their ability to support respiratory evaluations and deliver real-time imaging without depending on centralized hospital systems.

Rising cases of respiratory conditions are further strengthening the market, as early and accurate diagnosis remains critical in managing outcomes. One of the major contributors to this trend is the seasonal spike in viral infections, which significantly adds to the burden on respiratory health systems. As a result, there's growing adoption of point-of-care CT systems across clinical settings where fast assessments are needed to inform immediate treatment decisions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $254.1 Million |

| Forecast Value | $435.3 Million |

| CAGR | 5.6% |

In 2024, the full-sized CT scanners segment generated USD 149.3 million. This segment is projected to grow to USD 252.6 million by 2034, advancing at a CAGR of 5.5%. These systems are favored for their high-resolution output and comprehensive diagnostic capabilities, making them the preferred option for critical and emergency care. Full-sized models are commonly used in surgical theaters, trauma units, and intensive care departments where speed and detail in imaging play a vital role in patient outcomes. Their ability to support a wide range of clinical needs makes them indispensable in hospital workflows.

The hospitals segment held a 38.2% share in 2024, remaining the largest End user group in this segment. The dominance of hospitals is attributed to their established diagnostic infrastructure and the availability of trained radiology staff. These institutions routinely handle complex cases in neurology, trauma, and pulmonary care, all of which benefit from rapid point-of-care imaging solutions. As hospitals continue to enhance their diagnostic speed and service delivery, the demand for mobile CT systems grows stronger.

U.S. Point-of-care CT Imaging Systems Market generated USD 101.9 million in 2024, maintaining its leadership in the global space. The country's high incidence of chronic illnesses and cancer, paired with its robust healthcare delivery systems, drives ongoing adoption. Furthermore, a favorable regulatory landscape, increasing awareness of early diagnostics, and substantial investments in advanced medical imaging technologies support sustained market expansion.

Key players actively shaping the Point-of-care CT Imaging Systems Market include Carestream Dental, Planmed, Xoran Technologies, CurveBeam, Siemens Healthineers, NeuroLogica, Epica International, SOREDEX, Stryker, and Arineta. Leading companies in the point-of-care CT imaging systems market are investing heavily in innovation to improve image quality, portability, and system usability. To differentiate themselves, many are focusing on the development of AI-integrated platforms that enhance diagnostic speed and accuracy. Strategic collaborations with hospitals, diagnostic centers, and telehealth providers help boost adoption, particularly in decentralized care settings. Several manufacturers are expanding their product portfolios with compact, wireless systems tailored for outpatient, ICU, and rural care environments. Companies are also leveraging regulatory approvals and fast-track clearances to bring advanced models to market faster.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic disorders

- 3.2.1.2 Growing aging population

- 3.2.1.3 Rising emphasis on early diagnosis and treatment

- 3.2.1.4 Technological advancements in imaging system

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of imaging systems

- 3.2.2.2 Regulatory and reimbursement barriers

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into rural and remote areas

- 3.2.3.2 Integration with AI and telemedicine

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Compact CT scanners

- 5.3 Full-sized CT scanners

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Neurology

- 6.3 Respiratory

- 6.4 Musculoskeletal

- 6.5 ENT

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgery centers

- 7.4 Clinics

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Arineta

- 9.2 Carestream Dental

- 9.3 CurveBeam

- 9.4 Epica International

- 9.5 NeuroLogica

- 9.6 Planmed

- 9.7 Siemens Healthineers

- 9.8 SOREDEX

- 9.9 Stryker

- 9.10 Xoran Technologies