|

市場調查報告書

商品編碼

1801818

摩托車和踏板車市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Motorcycle and Scooter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

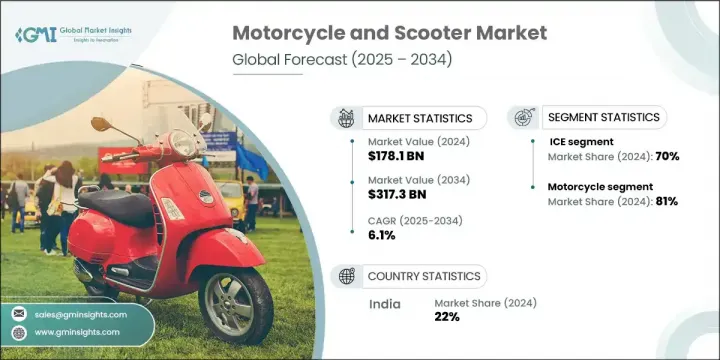

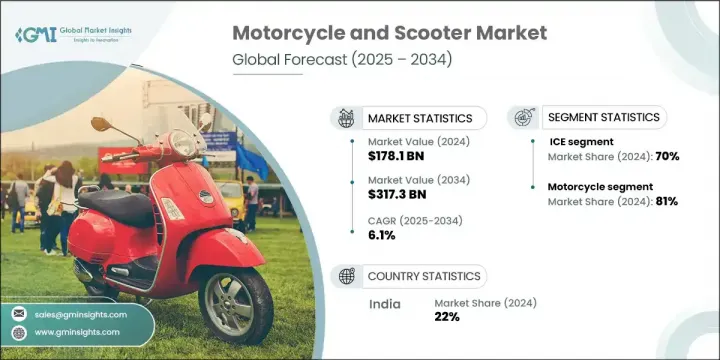

2024年,全球摩托車和踏板車市場規模達1,781億美元,預計2034年將以6.1%的複合年成長率成長,達到3,173億美元。由於城市交通需求的不斷變化、永續發展意識的不斷提升以及年輕群體偏好的轉變,該市場正在經歷重大變化。隨著消費者環保意識的增強以及政府支持綠色交通的激勵措施的實施,電動車型正穩步發展。城市交通擁擠以及對經濟高效、緊湊型出行方式的需求,正在推動二輪車的需求。

製造商正在透過融入GPS、行動互聯和診斷功能等現代功能來提升摩托車和踏板車的吸引力。此外,輕量化結構、時尚外觀和人體工學設計等趨勢正在吸引更年輕的客戶群。車輛訂閱服務和共乘等新商業模式正在逐漸重塑人們在大都市地區的個人出行方式。售後市場也在不斷發展,對騎乘者專屬客製化、性能升級和增強型安全部件的需求日益成長,進一步推動了消費者對二輪車市場的參與度。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1781億美元 |

| 預測值 | 3173億美元 |

| 複合年成長率 | 6.1% |

2024年,內燃機 (ICE) 車型佔據約 70% 的市場佔有率,預計 2025 年至 2034 年期間的複合年成長率將超過 5%。儘管電動二輪車的受歡迎程度穩步上升,但傳統的汽油車仍然是眾多騎乘者的首選。廣泛的加油基礎設施、成熟的機械可靠性以及出色的長途行駛續航里程是內燃機汽車繼續佔據全球銷售主導地位的關鍵原因。傳統引擎的強勁成長勢頭表明,目前,它們仍然能夠滿足全球眾多消費者的期望。

2024年,摩托車仍是主要產品類別,佔81%。預計到2034年,該細分市場的複合年成長率將達到6%。在全球許多地區,尤其是在新興經濟體,摩托車是最實用、最經濟的日常交通工具。摩托車的標準排氣量在100cc至250cc之間,是數百萬通勤者必備的代步工具。全球摩托車產量很大一部分來自亞太地區,價格實惠和實用性是該地區消費者購買摩托車的主要因素。

印度摩托車和踏板車市場佔22%的市場佔有率,2024年產值達296億美元。作為全球最大的摩托車生產國,印度貢獻了全球二輪車產量的約15-20%,2024會計年度產量約為2,800萬輛。與成熟市場(摩托車通常用於休閒或豪華用途)不同,印度消費者的日常旅行依賴摩托車。在這裡,關鍵的購買決策取決於成本效益、行駛里程、維護便利性和日常可靠性等因素。

塑造全球摩托車和踏板車市場的領導者包括 Classic Legends、Hero、TVS、Piaggio、Yamaha、Suzuki、Honda、Bajaj Motorcycles、OLA 和 ATHER。摩托車和踏板車行業的頂級製造商正透過專注於創新、在地化和產品多樣化來鞏固其市場地位。他們正在擴大電動車產品組合,以符合永續發展目標和消費者對清潔出行日益成長的興趣。對智慧連接功能和安全技術的投資正在幫助品牌提升用戶體驗和品牌差異化。許多公司正在透過建立區域製造中心來降低物流成本並有效滿足當地需求,從而加強其國內和出口足跡。與科技公司和行動平台的合作正在透過訂閱模式和共享行動解決方案創造新的收入來源。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 都市化進程加快,交通擁擠加劇

- 電子商務和最後一哩配送的擴張

- 燃油價格上漲

- 電動二輪車的快速普及

- 亞洲中產階級人口不斷成長

- 產業陷阱與挑戰

- 安全隱憂和事故率上升

- 充電基礎設施不足

- 供應鏈中斷

- 原料成本上漲

- 市場機會

- 電氣化和電動車普及率

- 互聯智慧行動解決方案

- 訂閱和租賃模式

- 拓展非洲、東南亞市場

- 與配送平台建立策略夥伴關係

- 摩托車和踏板車市場的發展

- 歷史市場發展與成熟度分析

- 從傳統到現代行動解決方案的轉變

- 二輪車領域的技術採用生命週期

- 市場整合與產業重組趨勢

- 成長動力

- 成長潛力分析

- 監管格局

- 波特的分析

- PESTEL分析

- 技術創新與先進功能

- 摩托車ADAS及安全技術整合

- 聯網摩托車解決方案和物聯網整合

- 先進的動力總成技術

- 自主與半自主功能開發

- 摩托車和踏板車市場轉型

- 電動二輪車技術演變

- 電池技術和續航里程最佳化

- 充電基礎設施發展和可及性

- 政府激勵和政策支持分析

- 消費者行為與市場偏好

- 人口統計資料和目標客戶分析

- 購買決策因素與購買歷程

- 使用模式和移動行為

- 品牌忠誠度和轉換模式

- 價格敏感度與價值感知分析

- 專利格局

- 價格趨勢

- 按國家

- 按產品

- 成本細分分析

- 生產統計

- 進出口

- 主要進口國家

- 主要出口國家

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 摩托車

- 巡洋艦摩托車

- 運動摩托車

- 旅行摩托車

- 標準/裸露摩托車

- 探險/雙運動摩托車

- 越野摩托車

- 踏板車

- 傳統汽油摩托車

- 電動滑板車

- 大型踏板車

- 輕型機車

第6章:市場估計與預測:以推進方式,2021 - 2034 年

- 主要趨勢

- 內燃機(ICE)

- 電動車(EV)

第7章:市場估計與預測:依引擎排氣量,2021 - 2034 年

- 主要趨勢

- 250cc以下

- 250cc-500cc

- 500cc-1000cc

- 1000cc以上

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 離線

- 線上

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 個人的

- 商業的

第10章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Global Two-Wheeler OEMs

- Bajaj

- Hero

- Honda

- Piaggio

- Suzuki

- TVS

- Yamaha

- Premium Motorcycle Brands

- BMW Motorrad

- Ducati

- Harley-Davidson

- KTM

- Royal Enfield

- Kawasaki

- Electric Two-Wheeler Manufacturers

- Ather

- Ola Electric

- Revolt

- Ultraviolette

- Yadea

- Zero Motorcycles

- Niu Technologies

- Component and System Suppliers

- Bosch

- Brembo

- Continental

- Nissin

- ZF

- Connected Mobility and Software Providers

- MapmyIndia

- Ride Vision

- Sibros

- TomTom

- Vahan

The Global Motorcycle and Scooter Market was valued at USD 178.1 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 317.3 billion by 2034. This market is undergoing major changes due to evolving urban transportation needs, rising awareness around sustainability, and shifting preferences among younger demographics. Electric variants are gaining steady traction as consumers prioritize environmental consciousness and benefit from government incentives supporting green transportation. Urban congestion and the need for cost-efficient, compact mobility options are fueling demand for two-wheelers.

Manufacturers are enhancing the appeal of motorcycles and scooters by incorporating modern features such as GPS, mobile connectivity, and diagnostic capabilities. Additionally, trends in lightweight construction, sleek aesthetics, and ergonomic design are drawing in a younger customer base. New business models like vehicle subscription services and ridesharing options are slowly reshaping how people access personal mobility in metropolitan areas. The aftermarket is also evolving, with increasing demand for rider-specific customization, performance upgrades, and enhanced safety components, and further driving consumer engagement with the two-wheeler segment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $178.1 Billion |

| Forecast Value | $317.3 Billion |

| CAGR | 6.1% |

In 2024, internal combustion engine (ICE) models held approximately 70% market share and are forecast to expand at a CAGR of over 5% from 2025 to 2034. While electric two-wheelers are steadily rising in popularity, traditional petrol-powered vehicles remain the preferred choice among many riders. The widespread availability of fueling infrastructure, well-established mechanical reliability, and superior range for longer rides are key reasons ICE vehicles continue to dominate global sales volumes. The momentum behind conventional engines demonstrates that, for now, they continue to meet the expectations of many consumers worldwide.

Motorcycles remained the leading product category in 2024, accounting for 81% share. This segment is expected to grow at a CAGR of 6% through 2034. In numerous global regions, particularly in emerging economies, motorcycles represent the most practical and economical means of daily transportation. With standard engine capacities ranging between 100cc and 250cc, these bikes serve as essential mobility tools for millions of commuters. A large share of global production originates from the Asia Pacific, where affordability and functional utility are major purchasing factors.

India Motorcycle and Scooter Market held 22% share and generated USD 29.6 billion in 2024. As the top global manufacturer of motorcycles, India contributes roughly 15-20% of worldwide two-wheeler production, with approximately 28 million units built in FY 2024. Unlike in mature markets, where motorcycles often serve recreational or luxury roles, Indian consumers rely on them for everyday use. Here, critical buying decisions are shaped by considerations like cost-efficiency, mileage, ease of maintenance, and day-to-day reliability.

Leading players shaping the Global Motorcycle and Scooter Market include Classic Legends, Hero, TVS, Piaggio, Yamaha, Suzuki, Honda, Bajaj Motorcycles, OLA, and ATHER. Top manufacturers in the motorcycle and scooter industry are reinforcing their market position by focusing on innovation, localization, and product diversification. They are expanding their electric vehicle portfolios to align with sustainability goals and growing consumer interest in cleaner mobility. Investment in smart connectivity features and safety technology is helping brands enhance user experience and brand differentiation. Many are strengthening their domestic and export footprints by establishing regional manufacturing hubs to reduce logistics costs and meet local demand efficiently. Partnerships with tech firms and mobility platforms are creating new revenue streams through subscription models and shared mobility solutions.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Propulsion

- 2.2.4 Engine Displacement

- 2.2.5 Distribution Channel

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising urbanization and traffic congestion

- 3.2.1.2 Expansion of e-commerce and last-mile delivery

- 3.2.1.3 Increasing fuel prices

- 3.2.1.4 Rapid adoption of electric two-wheelers

- 3.2.1.5 Growing middle-class population in Asia

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Safety concerns and rising accident rates

- 3.2.2.2 Inadequate charging infrastructure

- 3.2.2.3 Supply chain disruptions

- 3.2.2.4 Rising raw material costs

- 3.2.3 Market opportunities

- 3.2.3.1 Electrification and EV penetration

- 3.2.3.2 Connected and smart mobility solutions

- 3.2.3.3 Subscription and leasing models

- 3.2.3.4 Market expansion in Africa and Southeast Asia

- 3.2.3.5 Strategic partnerships with delivery platforms

- 3.2.4 Motorcycle and scooter market evolution

- 3.2.4.1 Historical market development and maturity analysis

- 3.2.4.2 Transition from traditional to modern mobility solutions

- 3.2.4.3 Technology adoption lifecycle in two-wheeler segment

- 3.2.4.4 Market consolidation and industry restructuring trends

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology innovation and advanced features

- 3.7.1 Motorcycle ADAS and safety technology integration

- 3.7.2 Connected motorcycle solutions and iot integration

- 3.7.3 Advanced powertrain technologies

- 3.7.4 Autonomous and semi-autonomous features development

- 3.8 Electric motorcycle and scooter market transformation

- 3.8.1 Electric two-wheeler technology evolution

- 3.8.2 Battery technology and range optimization

- 3.8.3 Charging infrastructure development and accessibility

- 3.8.4 Government incentives and policy support analysis

- 3.9 Consumer behavior and market preferences

- 3.9.1 Demographic profile and target customer analysis

- 3.9.2 Purchase decision factors and buying journey

- 3.9.3 Usage patterns and mobility behavior

- 3.9.4 Brand loyalty and switching patterns

- 3.9.5 Price sensitivity and value perception analysis

- 3.10 Patent landscape

- 3.11 Price trend

- 3.11.1 By country

- 3.11.2 By product

- 3.12 Cost breakdown analysis

- 3.13 Production statistics

- 3.13.1 Import and export

- 3.13.2 Major import countries

- 3.13.3 Major export countries

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly Initiatives

- 3.14.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Motorcycles

- 5.2.1 Cruiser motorcycles

- 5.2.2 Sport motorcycles

- 5.2.3 Touring motorcycles

- 5.2.4 Standard/naked motorcycles

- 5.2.5 Adventure/dual-sport motorcycles

- 5.2.6 Off-road/dirt motorcycles

- 5.3 Scooters

- 5.3.1 Traditional gasoline scooters

- 5.3.2 Electric scooters

- 5.3.3 Maxi scooters

- 5.3.4 Moped-style scooters

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Internal combustion engine (ICE)

- 6.3 Electric vehicles (EVs)

Chapter 7 Market Estimates & Forecast, By Engine Displacement, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Under 250cc

- 7.3 250cc-500cc

- 7.4 500cc-1000cc

- 7.5 Above 1000cc

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Offline

- 8.3 Online

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Personal

- 9.3 Commercial

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Two-Wheeler OEMs

- 11.1.1 Bajaj

- 11.1.2 Hero

- 11.1.3 Honda

- 11.1.4 Piaggio

- 11.1.5 Suzuki

- 11.1.6 TVS

- 11.1.7 Yamaha

- 11.2 Premium Motorcycle Brands

- 11.2.1 BMW Motorrad

- 11.2.2 Ducati

- 11.2.3 Harley-Davidson

- 11.2.4 KTM

- 11.2.5 Royal Enfield

- 11.2.6 Kawasaki

- 11.3 Electric Two-Wheeler Manufacturers

- 11.3.1 Ather

- 11.3.2 Ola Electric

- 11.3.3 Revolt

- 11.3.4 Ultraviolette

- 11.3.5 Yadea

- 11.3.6 Zero Motorcycles

- 11.3.7 Niu Technologies

- 11.4 Component and System Suppliers

- 11.4.1 Bosch

- 11.4.2 Brembo

- 11.4.3 Continental

- 11.4.4 Nissin

- 11.4.5 ZF

- 11.5 Connected Mobility and Software Providers

- 11.5.1 MapmyIndia

- 11.5.2 Ride Vision

- 11.5.3 Sibros

- 11.5.4 TomTom

- 11.5.5 Vahan