|

市場調查報告書

商品編碼

1801813

積層製造混合複合材料市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Hybrid Composite for Additive Manufacturing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

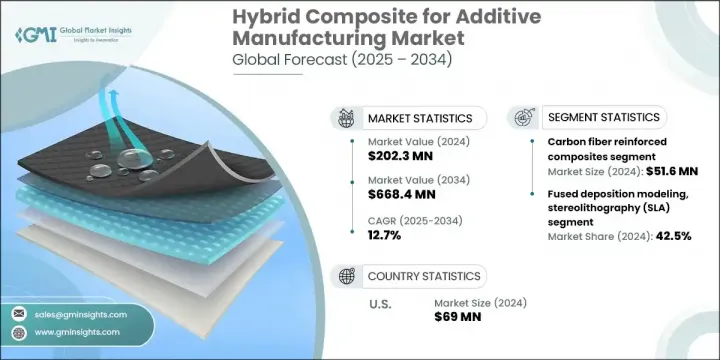

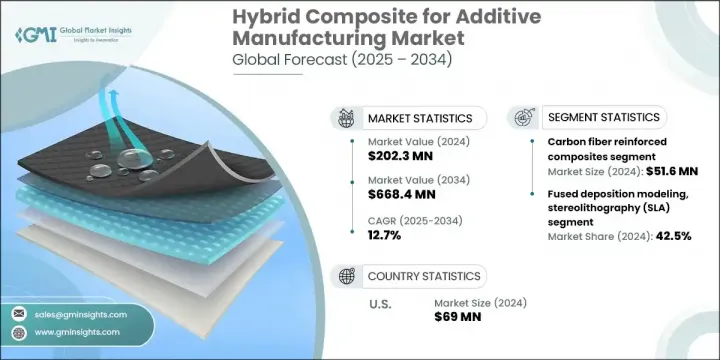

2024年,全球混合複合材料積層製造市場規模達2.023億美元,預計到2034年將以12.7%的複合年成長率成長,達到6.684億美元。由於對精密高效製造複雜、輕量化和高強度零件的需求日益成長,該市場正在快速發展。混合複合材料積層製造將傳統的減材製造方法與積層製造技術相結合,以生產滿足嚴格品質和強度要求的複雜結構。其應用涵蓋多個高需求領域,特別適用於那些需要具有卓越表面光潔度、複雜幾何形狀和最佳化機械性能的零件的領域。

航太、醫療保健和汽車等行業正在推動這一成長。尤其是在航空領域,對節油輕量化零件的關注促使製造商大力投資混合積層製造,以滿足永續發展目標和排放法規。隨著各國政府持續鼓勵綠色科技舉措,該市場也日益受到關注。隨著環境標準的日益嚴格,混合製造提供了一種可靠的解決方案,既符合全球永續發展的理念,又能提高製造速度和材料效率。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.023億美元 |

| 預測值 | 6.684億美元 |

| 複合年成長率 | 12.7% |

碳纖維增強複合材料憑藉其優異的強度重量比和回彈性,在2024年以5,160萬美元的市場規模領先該領域。其主導地位在那些需要輕量化且耐用零件的行業中尤為明顯,有助於製造商滿足日益成長的燃油經濟性和性能標準。這些複合材料正成為高階運動設備、汽車性能部件和航太結構部件等應用的基礎。

2024年,熔融沈積成型和立體光刻等技術共佔了42.5%的市場。熔融沈積成型 (FDM) 憑藉其成本效益、多功能性和跨多個行業的易用性,持續受到歡迎。 FDM 能夠更快地生產原型和最終用途零件,使其成為優先考慮快速設計迭代的行業的理想選擇,包括汽車、醫療保健和工業工具。

2024年,美國積層製造混合複合材料市場產值達6,900萬美元。憑藉強大的先進製造生態系統和終端應用領域的強勁發展,美國已成為混合複合材料創新和應用的熱點地區。政府對永續材料的支持、對清潔技術的日益重視以及對下一代製造計畫的資金投入,是推動美國市場發展的關鍵驅動力。

積層製造混合複合材料市場的領導者包括 SGL Carbon、Arris Composites、Ultimaker、EOS、3D Systems、惠普、Formlabs、Markforged、飛利浦和 Stratasys。主要企業正致力於將混合功能整合到其現有的 3D 列印平台中,以提供兼顧速度、精度和材料多功能性的解決方案。與原始設備製造商 (OEM) 和終端用戶行業的策略合作夥伴關係正幫助製造商共同開發航太和汽車領域的專用組件。各公司也加大研發投入,以開發增強聚合物和碳基複合材料等下一代材料。拓展永續產品線和遵守綠色法規是吸引環保產業的其他重要策略。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按材質

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)

(註:僅提供重點國家的貿易統計)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考慮

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按材料,2021-2034 年

- 主要趨勢

- 碳纖維增強複合材料

- 玻璃纖維增強複合材料

- 金屬-聚合物混合複合材料

- 陶瓷基複合材料

- 芳綸纖維複合材料

- 天然纖維混合複合材料

第6章:市場估計與預測:按技術,2021-2034 年

- 主要趨勢

- 熔融沈積成型

- 立體光刻 (SLA) 和數位光處理 (DLP)

- 選擇性雷射燒結(SLS)

- 混合製造系統

第7章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 航太和國防

- 商用航空部件

- 軍事和國防應用

- 太空和衛星系統

- eVTOL 和城市空中交通

- 汽車產業

- 電動汽車零件

- 油電混合車應用

- 性能和賽車應用

- 工具和製造輔助工具

- 醫療保健

- 義肢和矯形器

- 手術器械

- 醫療器材組件

- 牙科應用

- 工業和製造業

- 工裝和夾具

- 最終用途零件生產

- 原型設計與開發

- 消費品和體育器材

- 能源和再生應用

- 風力組件

- 太陽能板應用

- 儲能系統

第8章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- 3D Systems

- Arris Composites

- EOS

- Formlabs

- Hewlett-Packard

- Markforged

- Philips

- SGL Carbon

- Stratasys

- Ultimaker

The Global Hybrid Composite for Additive Manufacturing Market was valued at USD 202.3 million in 2024 and is estimated to grow at a CAGR of 12.7% to reach USD 668.4 million by 2034. This market is advancing rapidly due to the increasing need for manufacturing complex, lightweight, and high-strength components with precision and efficiency. Hybrid composite additive manufacturing brings together traditional subtractive methods with additive techniques to produce intricate structures that meet rigorous quality and strength requirements. Its applications span across several high-demand sectors, especially those that require parts with superior surface finish, complex geometries, and optimized mechanical performance.

Industries such as aerospace, healthcare, and automotive are driving this growth. In aviation, particularly, the focus on fuel-efficient, lightweight parts has pushed manufacturers to invest heavily in hybrid AM to meet sustainability goals and emission regulations. The market is also gaining traction as governments continue to encourage green technology initiatives. As environmental standards tighten, hybrid manufacturing offers a reliable solution that aligns with global sustainability efforts, while enhancing manufacturing speed and material efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $202.3 Million |

| Forecast Value | $668.4 Million |

| CAGR | 12.7% |

Carbon fiber-reinforced composites led the segment with USD 51.6 million in 2024 due to their excellent strength-to-weight ratio and resilience. Their dominance is especially visible in industries that demand lightweight yet durable components, helping manufacturers meet rising fuel economy and performance standards. These composites are becoming foundational in applications like high-end sporting gear, automotive performance parts, and structural aerospace components.

Technologies like fused deposition modeling and stereolithography collectively held 42.5% of the market in 2024. Fused deposition modeling (FDM) continues to gain popularity thanks to its cost-effectiveness, versatility, and ease of use across multiple sectors. FDM enables faster production of prototypes and End use parts, making it ideal for industries that prioritize rapid design iterations, including automotive, healthcare, and industrial tooling.

United States Hybrid Composite for Additive Manufacturing Market generated USD 69 million in 2024. With a robust ecosystem of advanced manufacturing and a strong presence of End use sectors, the U.S. has become a hotspot for innovation and adoption of hybrid composites. Government support for sustainable materials, increased focus on clean tech, and funding for next-gen manufacturing initiatives are key drivers pushing market development in the country.

Leading players in the Hybrid Composite for Additive Manufacturing Market include SGL Carbon, Arris Composites, Ultimaker, EOS, 3D Systems, Hewlett-Packard, Formlabs, Markforged, Phillips, and Stratasys. Major players are focusing on integrating hybrid capabilities into their existing 3D printing platforms to offer solutions that balance speed, accuracy, and material versatility. Strategic partnerships with OEMs and End use industries are helping manufacturers co-develop application-specific components in aerospace and automotive. Companies are also increasing R&D investment to develop next-generation materials like reinforced polymers and carbon-based composites. Expansion into sustainable product lines and compliance with green regulations are other major strategies to appeal to eco-conscious sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Material trends

- 2.2.2 Technology trends

- 2.2.3 Application trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By material

- 3.9 Future market trends

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent landscape

- 3.12 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Carbon fiber reinforced composites

- 5.3 Glass fiber reinforced composites

- 5.4 Metal-polymer hybrid composites

- 5.5 Ceramic matrix composites

- 5.6 Aramid fiber composites

- 5.7 Natural fiber hybrid composites

Chapter 6 Market Estimates and Forecast, By Technology, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Fused deposition modeling

- 6.3 Stereolithography (SLA) and digital light processing (DLP)

- 6.4 Selective laser sintering (SLS)

- 6.5 Hybrid manufacturing systems

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Aerospace and defense

- 7.2.1 Commercial aviation components

- 7.2.2 Military and defense applications

- 7.2.3 Space and satellite systems

- 7.2.4 eVTOL and urban air mobility

- 7.3 Automotive industry

- 7.3.1 Electric vehicle components

- 7.3.2 Hybrid vehicle applications

- 7.3.3 Performance and racing applications

- 7.3.4 Tooling and manufacturing aids

- 7.4 Medical and healthcare

- 7.4.1 Prosthetics and orthotics

- 7.4.2 Surgical instruments

- 7.4.3 Medical device components

- 7.4.4 Dental applications

- 7.5 Industrial and manufacturing

- 7.5.1 Tooling and fixtures

- 7.5.2 End use parts production

- 7.5.3 Prototyping and development

- 7.6 Consumer goods and sports equipment

- 7.7 Energy and renewable applications

- 7.7.1 Wind energy components

- 7.7.2 Solar panel applications

- 7.7.3 Energy storage systems

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 3D Systems

- 9.2 Arris Composites

- 9.3 EOS

- 9.4 Formlabs

- 9.5 Hewlett-Packard

- 9.6 Markforged

- 9.7 Philips

- 9.8 SGL Carbon

- 9.9 Stratasys

- 9.10 Ultimaker