|

市場調查報告書

商品編碼

1801811

生物刺激素配方材料市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Biostimulants Formulation Material Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

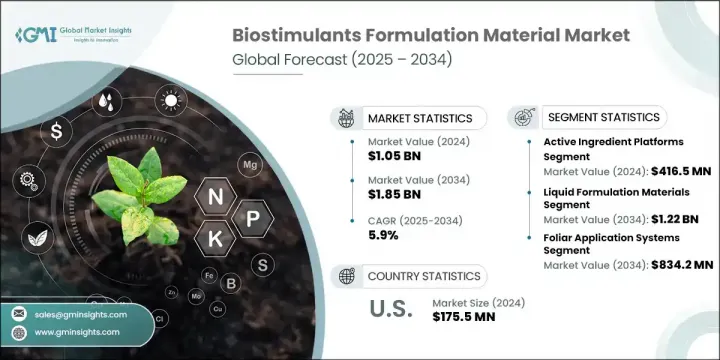

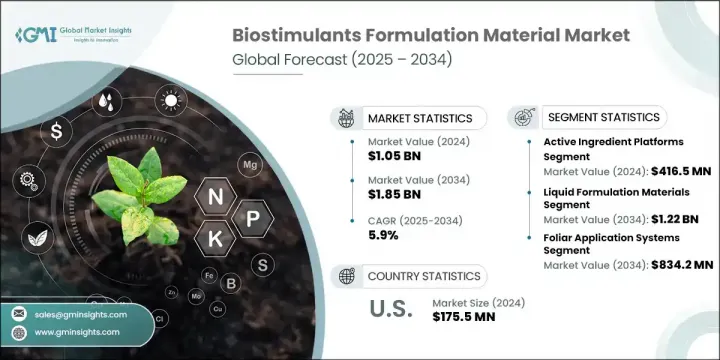

2024年,全球生物刺激素製劑材料市場規模達10.5億美元,預計2034年將以5.9%的複合年成長率成長至18.5億美元。由於全球對永續農業實踐的重視,以及對既能提高生產力又能兼顧環保的投入品的需求日益成長,生物刺激素製劑市場正獲得顯著發展。市場普遍轉向以自然和生物為基礎的作物改良解決方案,加上有利的政策環境,正在推動市場擴張。葉面施肥仍是主要的施用方式,佔所有施用方式的近一半。然而,人們對種子處理和土壤施用製劑日益成長的興趣正在重塑行業格局,尤其是在標靶施用方法的創新日益先進且應用日益廣泛的背景下。

向天然配方材料(例如微生物溶液、海藻萃取物和天然多醣)的轉變正在加速。減少化學投入的監管壓力,加上消費者對無殘留食品的偏好,正加速向永續生物刺激素的轉變。生產商正投入資源進行研發,專注於可生物分解、高效且永續的解決方案,以支持現代農業。針對特定作物類型、土壤條件和當地氣候設計的高度定製配方正日益成為一種趨勢。各公司正在利用先進的資料分析和農業見解,提供客製化的生物刺激素,以提高產量、實現溢價,並與尋求精準、高價值作物解決方案的種植者建立長期合作關係。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 10.5億美元 |

| 預測值 | 18.5億美元 |

| 複合年成長率 | 5.9% |

到2034年,穩定劑和助劑細分市場將以7.4%的複合年成長率成長,這得益於它們能夠有效保存活性成分、延長保存期限,並增強生物刺激素在各種應用中的功能性傳遞。這些成分,包括乳化劑和表面活性劑,在維持配方均勻性、確保吸收以及支持與其他農產品的兼容性方面發揮關鍵作用。它們的日益成長的使用凸顯了當今作物投入配方日益複雜且精確的要求。

至2034年,乾製劑材料市場將以4.6%的複合年成長率成長。雖然液體製劑因其易用性和創新性而日益受到青睞,但在需要長保存期限和穩定性的領域,乾製劑仍然至關重要。隨著市場的發展,預計乾製劑的佔有率將略有下降,但在某些應用情境下,需求將保持穩定。

美國生物刺激素製劑材料市場佔80.1%的市場佔有率,2024年市場規模達1.755億美元。該地區受益於完善的監管環境、持續的農業研發投入以及對環境友善農業實踐的大力推動。多醣體因其環保性和有效性在美國廣受青睞。在這個高度工業化和技術導向的市場中,穩定劑和助劑對於維持產品穩定性以及確保與其他農業化學品系統的一致性至關重要。微生物接種劑、胺基酸和海藻基材料等活性成分的廣泛使用,凸顯了現代農業對生物製劑和精準投入的日益青睞。

塑造全球生物刺激素製劑材料市場的關鍵參與者包括諾維信公司 (Novozymes A/S)、巴斯夫 (BASF SE)、瓦拉格羅公司 (Valagro SpA)、聯合磷化有限公司 (UPL Limited) 和先正達公司 (Syngenta AG)。為了在生物刺激素製劑材料市場站穩腳跟,各公司正大力投資研發永續的作物專用產品,以提高產量並符合環境標準。創新是公司發展的重點,尤其是創造可生物分解的定製配方,以適應不同的氣候和土壤條件。與農業科技公司、研究機構和種植者的策略合作,有助於公司共同開發針對特定區域的解決方案。各公司也正在拓展全球分銷網路,並進軍新興市場,以挖掘新的成長領域。對數位平台和精準農業工具的重視,支援產品供應的即時客製化。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 對永續和有機農業投入品的需求不斷成長

- 對環保作物保護產品的監管支持

- 更加重視提高作物產量和品質

- 配方和輸送系統的技術進步

- 產業陷阱與挑戰

- 農民意識和技術知識有限

- 由於環境因素導致產品功效發生變化

- 市場機會

- 開發針對特定作物的定製配方

- 與數位農業和精準農業的融合

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依材料類型

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:按材料類型,2021 - 2034 年

- 主要趨勢

- 天然多醣

- 穩定劑和佐劑

- 活性成分平台

- 海藻萃取物製劑原料

- 腐植酸和黃腐酸衍生物

- 胺基酸和蛋白質水解物鹼

- 微生物包封材料

第6章:市場估計與預測:依形式,2021 - 2034 年

- 主要趨勢

- 液體配方材料

- 乳化劑和增溶劑

- 懸浮劑和增稠劑

- 防腐劑和抗菌劑

- 凍融穩定劑

- 乾燥配方材料

- 造粒及製粒助劑

- 抗結塊劑和流動促進劑

- 粉塵控制和處理改進劑

- 防潮塗層

第7章:市場估計與預測:按應用方法,2021 - 2034 年

- 主要趨勢

- 種子處理製劑材料

- 塗料和黏合劑

- 附著力促進劑和成膜劑

- 著色劑和識別系統

- 保護性封裝材料

- 葉面施肥系統

- 噴霧佐劑和滲透促進劑

- 防漂移及沉積助劑

- 紫外線防護劑和穩定性增強劑

- 用於罐混的相容劑

- 土壤施用材料

- 造粒助劑和黏合劑

- 緩釋塗層系統

- 土壤滲透促進劑

- 濕度管理材料

- 其他

第8章:市場估計與預測:依作物類型,2021 - 2034 年

- 主要趨勢

- 穀物和穀類

- 水果和蔬菜

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 法國

- 義大利

- 西班牙

- 德國

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 埃及

- MEA 其餘地區

第10章:公司簡介

- Ashland Global Holdings Inc.

- BASF SE

- Biotechnica (UK)

- Citymax Group (China)

- Croda International Plc

- Elemental Enzymes

- Evonik Industries AG

- Fertinagro Biotech

- Genvor

- Natural Growth Biostimulants LLC

- Novozymes A/S

- SIPCAM Inagra(歐洲)

- Syngenta AG

- UPL Limited

- Valagro SpA

The Global Biostimulants Formulation Material Market was valued at USD 1.05 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 1.85 billion by 2034. The market is gaining significant traction due to the worldwide emphasis on sustainable agricultural practices and the increasing demand for productivity-boosting yet environmentally conscious inputs. The broader shift toward nature-based and biological crop enhancement solutions, combined with favorable policy environments, is propelling market expansion. Foliar application remains the dominant method of usage, accounting for nearly half of all applications. However, growing interest in seed treatments and soil-applied formulations is reshaping industry dynamics, especially as innovation in targeted delivery methods becomes more advanced and widely available.

The transition to natural formulation materials-such as microbial solutions, seaweed extracts, and natural polysaccharides-is intensifying. Regulatory pressure to reduce chemical inputs, coupled with consumer preference for residue-free food, is accelerating this move toward sustainable biostimulants. Producers are dedicating resources to research and development focused on biodegradable, effective, and sustainable solutions that support modern agriculture. There's a growing trend toward highly tailored formulations designed for specific crop types, soil conditions, and local climates. Companies are leveraging advanced data analytics and agronomic insights to offer customized biostimulants that boost yields, command premium pricing, and foster long-term relationships with growers seeking precise, high-value crop solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.05 Billion |

| Forecast Value | $1.85 Billion |

| CAGR | 5.9% |

The stabilizers and adjuvants segment will grow at a CAGR of 7.4% through 2034, supported by their ability to preserve active ingredients, improve shelf-life, and enhance the functional delivery of biostimulants across a wide range of applications. These ingredients, including emulsifiers and surfactants, play a key role in maintaining formulation uniformity, ensuring absorption, and supporting compatibility with other agricultural products. Their rising use highlights the growing complexity and precision required in today's crop input formulations.

The dry formulation materials segment will grow at a CAGR of 4.6% through 2034. While liquid formulations are becoming more prominent due to ease of use and innovation, dry forms remain critical in scenarios requiring long shelf-life and stability. As the market evolves, a slight decline in dry formulation share is anticipated, although demand will remain steady in certain use cases.

U.S. Biostimulants Formulation Material Market held 80.1% share, generating USD 175.5 million in 2024. The region benefits from a well-developed regulatory landscape, ongoing investment in agricultural R&D, and a strong push for environmentally responsible farming practices. Polysaccharides are widely favored in the U.S. due to their environmental compatibility and effectiveness. In this highly industrialized and tech-focused market, stabilizers and adjuvants are essential to maintaining product stability and ensuring alignment with other agrochemical systems. The dominant use of active ingredients such as microbial inoculants, amino acids, and seaweed-based materials underscores a growing preference for biologicals and precision inputs in modern agriculture.

Key players shaping the Global Biostimulants Formulation Material Market include Novozymes A/S, BASF SE, Valagro S.p.A., UPL Limited, and Syngenta AG. To establish a strong foothold in the Biostimulants Formulation Material Market, companies are investing heavily in research to develop sustainable, crop-specific products that enhance yield while aligning with environmental standards. A major focus lies in innovation-particularly in creating biodegradable, tailored formulations suited for varied climatic and soil conditions. Strategic collaborations with agricultural tech firms, research institutes, and growers are helping companies co-develop region-specific solutions. Firms are also expanding global distribution networks and entering emerging markets to tap into new growth areas. Emphasis on digital platforms and precision agriculture tools supports real-time customization of product offerings.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Material type

- 2.2.2 Form

- 2.2.3 Application method

- 2.2.4 Crop type

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for sustainable and organic agricultural inputs

- 3.2.1.2 Regulatory support for eco-friendly crop protection products

- 3.2.1.3 Increasing focus on crop yield and quality enhancement

- 3.2.1.4 Technological advancements in formulation and delivery systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited farmer awareness and technical knowledge

- 3.2.2.2 Variability in product efficacy due to environmental factors

- 3.2.3 Market opportunities

- 3.2.3.1 Development of crop-specific and customized formulations

- 3.2.3.2 Integration with digital agriculture and precision farming

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By material type

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, by Material Type, 2021 - 2034 (USD Bn, Tons)

- 5.1 Key trends

- 5.2 Natural polysaccharides

- 5.3 Stabilizers and adjuvants

- 5.4 Active ingredient platforms

- 5.4.1 Seaweed extract formulation materials

- 5.4.2 Humic and fulvic acid derivatives

- 5.4.3 Amino acid and protein hydrolysate bases

- 5.4.4 Microbial encapsulation materials

Chapter 6 Market Estimates & Forecast, by Form, 2021 - 2034 (USD Bn, Tons)

- 6.1 Key trends

- 6.2 Liquid formulation materials

- 6.2.1 Emulsifiers and solubilizers

- 6.2.2 Suspension agents and thickeners

- 6.2.3 Preservatives and antimicrobial agents

- 6.2.4 Freeze-thaw stabilizers

- 6.3 Dry formulation materials

- 6.3.1 Granulation and pelletization aids

- 6.3.2 Anti-caking and flow enhancement agents

- 6.3.3 Dust control and handling improvers

- 6.3.4 Moisture barrier coatings

Chapter 7 Market Estimates & Forecast, by Application Method, 2021 - 2034 (USD Bn, Tons)

- 7.1 Key trends

- 7.2 Seed treatment formulation materials

- 7.2.1 Coating materials and binders

- 7.2.2 Adhesion promoters and film formers

- 7.2.3 Colorants and identification systems

- 7.2.4 Protective encapsulation materials

- 7.3 Foliar application systems

- 7.3.1 Spray adjuvants and penetration enhancers

- 7.3.2 Anti-drift and deposition aids

- 7.3.3 UV protectants and stability enhancers

- 7.3.4 Compatibility agents for tank mixing

- 7.4 Soil application materials

- 7.4.1 Granulation aids and binding agents

- 7.4.2 Slow-release coating systems

- 7.4.3 Soil penetration enhancers

- 7.4.4 Moisture management materials

- 7.5 Others

Chapter 8 Market Estimates & Forecast, by Crop Type, 2021 - 2034 (USD Mn, Tons)

- 8.1 Key trends

- 8.2 Cereals and grains

- 8.3 Fruits and vegetables

- 8.4 Others

Chapter 9 Market Estimates & Forecast, by Region, 2021 - 2034 (USD Mn, Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Italy

- 9.3.4 Spain

- 9.3.5 Germany

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Egypt

- 9.6.5 Rest of MEA

Chapter 10 Company Profiles

- 10.1 Ashland Global Holdings Inc.

- 10.2 BASF SE

- 10.3 Biotechnica (UK)

- 10.4 Citymax Group (China)

- 10.5 Croda International Plc

- 10.6 Elemental Enzymes

- 10.7 Evonik Industries AG

- 10.8 Fertinagro Biotech

- 10.9 Genvor

- 10.10 Natural Growth Biostimulants LLC

- 10.11 Novozymes A/S

- 10.12 SIPCAM Inagra (Europe)

- 10.13 Syngenta AG

- 10.14 UPL Limited

- 10.15 Valagro S.p.A