|

市場調查報告書

商品編碼

1801807

BREEAM 合規材料市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測BREEAM-Compliant Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

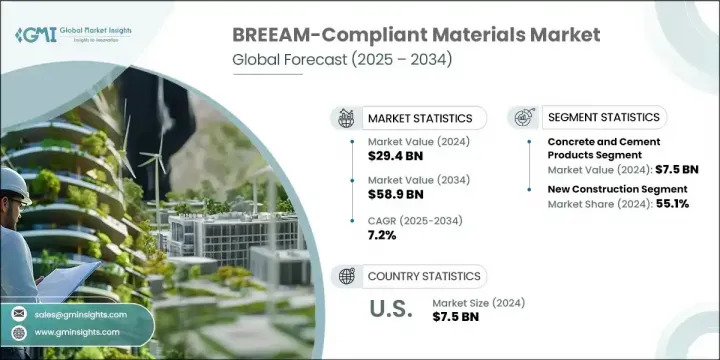

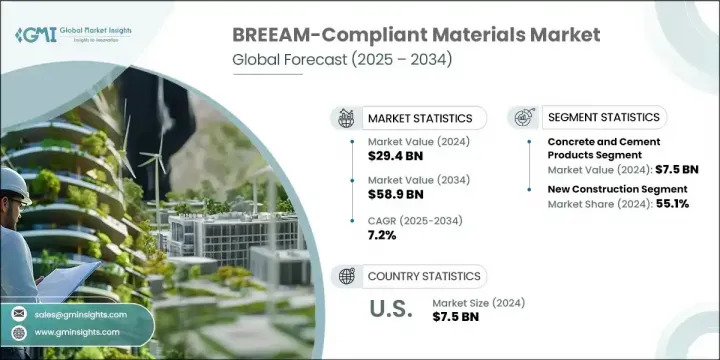

2024年,全球符合BREEAM標準的材料市場規模達294億美元,預計2034年將以7.2%的複合年成長率成長,達到589億美元。這些材料的設計符合BREEAM的永續性要求,確保其從採購、製造到報廢處置的整個生命週期對環境的影響最小化。日益增強的環保意識、日益增加的監管義務以及企業對永續發展承諾的不斷加強,極大地推動了對這些環保建築產品的需求。隨著各行各業和政府努力減少碳足跡,BREEAM認證材料正成為現代建築實踐中不可或缺的一部分。

隨著環境挑戰日益加劇,企業和政策制定者正齊心協力,在建築領域實施綠色解決方案,加速這些永續替代方案的普及。在強而有力的監管支持下,市場持續成長,尤其是在環境政策較嚴格、綠建築受到大力激勵的地區。隨著永續建築從一種趨勢演變為一種標準,符合 BREEAM 標準的材料也日益受到追捧,並進一步強化了其在創建環保基礎設施方面的作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 294億美元 |

| 預測值 | 589億美元 |

| 複合年成長率 | 7.2% |

2024年,混凝土和水泥基材料產值達75億美元,因其在基礎和結構建設中的關鍵作用,在符合BREEAM標準的領域中處於領先地位。這些產品因其成本效益和適應性,無論是在新建建築還是以生態為重點的改造中,都被廣泛採用。隨著城鎮化進程的推進和基礎設施項目的增加,尤其是在注重永續發展的地區,對低碳替代品的需求日益成長。為了滿足不斷變化的綠建築需求,製造商越來越重視這些材料的環保性能。

2024年,新建專案領域佔55.1%的佔有率,成為最大的應用領域。致力於滿足高環境績效標準的專案數量不斷增加,使新建專案成為市場成長的核心驅動力。儘管如此,隨著開發商和業主希望根據目前的能源效率基準升級老舊建築,舊建築的改造和翻新也日益受到關注。隨著設計專業人士尋求酒店、零售和辦公環境的永續解決方案,裝修和室內應用也在成長,尤其是在商業房地產領域。

2024年,美國符合BREEAM標準的材料市場規模達75億美元,憑藉其對永續建築的高度重視和鼓勵使用綠色材料的監管框架,成為該市場的主要參與者。環保建築實踐日益受到重視,這推動了商業、住宅和機構項目對BREEAM認證產品的採用。由於積極的政府政策以及學術機構與建築業的通力合作,加拿大也正在經歷加速成長,進一步推動了關鍵產業的永續發展。

塑造全球 BREEAM 合規材料市場的知名企業包括 EcoCocon、Kingspan、Holcim、Owens Corning、Amorim Cork、Saint-Gobain、Concrete Centre 和 BRE Global Ltd.。這些公司在製定永續發展基準和提供創新建築材料方面發揮著重要作用。為了提升其在 BREEAM 合規材料市場的地位,領先公司正在大力投資產品創新,重點是降低碳排放、提高能源效率和提高可回收性。許多公司正在重新設計現有產品線,以達到或超過 BREEAM 標準,並推出針對結構和室內應用的新型環保解決方案。與永續發展認證機構的合作以及建築價值鏈內的策略協作正在幫助品牌獲得信任和知名度。該公司也利用數位平台向客戶介紹 BREEAM 合規產品的優勢,同時擴大製造能力以滿足不斷成長的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按材質

- 未來市場趨勢

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)

(註:僅提供重點國家的貿易統計數據

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考慮

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按材料,2021-2034 年

- 主要趨勢

- 混凝土及水泥製品

- 預拌混凝土

- 預製混凝土構件

- 水泥替代品和混合料

- 鋼鐵和金屬產品

- 結構鋼

- 鋼筋

- 金屬覆層和屋頂

- 再生金屬含量產品

- 絕緣材料

- 木纖維隔熱材料

- 軟木基隔熱材料

- 大麻和生物基絕緣材料

- 再生材料絕緣材料

- 木材和木製品

- 認證永續木材

- 工程木製品

- 再生木材

- 竹子和替代木材材料

- 地板和裝飾材料

- 永續地板解決方案

- 低VOC油漆和塗料

- 再生材料瓷磚和表面

- 生物基飾面材料

- 屋頂和圍護結構材料

- 綠色屋頂系統

- 高性能玻璃

- 永續包覆材料

- 防風雨系統

第6章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 新建築

- 商業建築

- 住宅建築

- 工業設施

- 基礎設施項目

- 翻新和改造

- 文物建築修復

- 能源效率升級

- 永續改造項目

- 提升建築性能

- 裝修和室內應用

- 辦公室裝修

- 零售空間

- 醫療保健設施

- 教育建築

第7章:市場估計與預測:依最終用途領域,2021-2034

- 主要趨勢

- 商業地產

- 辦公大樓

- 零售和購物中心

- 飯店及餐飲業

- 混合用途開發項目

- 住宅領域

- 獨棟住宅

- 多戶住宅

- 經濟適用房項目

- 豪華住宅開發項目

- 機構建築

- 醫療保健設施

- 教育機構

- 政府大樓

- 文化和社區中心

- 工業和基礎設施

- 生產設施

- 倉庫和配送中心

- 交通基礎設施

- 公用事業和能源項目

第8章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Amorim Cork

- BRE Global Ltd

- Concrete Centre

- EcoCocon

- Holcim

- Kingspan

- Owens Corning

- Saint-Gobain

The Global BREEAM-Compliant Materials Market was valued at USD 29.4 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 58.9 billion by 2034. These materials are designed to align with BREEAM's sustainability requirements, ensuring minimal environmental impact throughout their lifecycle-from sourcing and manufacturing to end-of-life disposal. Growing environmental awareness, increased regulatory obligations, and the push toward stronger corporate sustainability commitments are significantly fueling demand for these eco-conscious construction products. As industries and governments strive to reduce their carbon footprints, BREEAM-certified materials are becoming an essential component in modern building practices.

With environmental challenges intensifying, companies and policymakers are working in unison to implement green solutions in construction, accelerating the adoption of these sustainable alternatives. The market is seeing continuous growth due to strong regulatory support, especially in regions where environmental policies are more rigorous and green construction is heavily incentivized. As sustainable construction evolves from a trend into a standard, the momentum behind BREEAM-compliant materials continues to grow rapidly, reinforcing their role in creating eco-friendly infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.4 Billion |

| Forecast Value | $58.9 Billion |

| CAGR | 7.2% |

The concrete and cement-based materials generated USD 7.5 billion in 2024, leading the BREEAM-compliant segment due to their pivotal role in foundational and structural construction. These products are widely adopted thanks to their cost-efficiency and adaptability in both newly built structures and eco-focused retrofits. As urbanization expands and infrastructure projects increase, especially in regions focused on sustainable development, demand for low-carbon alternatives is gaining pace. Manufacturers are increasingly prioritizing environmentally responsible versions of these materials to meet evolving green building expectations.

The new construction projects segment held 55.1% share in 2024, emerging as the top application segment. The rise in projects committed to meeting high environmental performance standards has made new builds a central driver of market growth. Nonetheless, retrofitting and refurbishing older buildings are gaining traction as developers and owners look to upgrade outdated structures in line with current energy efficiency benchmarks. Fit outs and interior applications are also on the rise, particularly in the commercial real estate space, as design professionals seek sustainable solutions for hospitality, retail, and office environments.

U.S. BREEAM-Compliant Materials Market generated USD 7.5 billion in 2024, positioning itself as a major player due to a strong focus on sustainable construction and regulatory frameworks that encourage the use of green materials. The increasing prioritization of eco-friendly building practices is boosting the adoption of BREEAM-certified products across commercial, residential, and institutional projects. Canada is also witnessing accelerated growth thanks to proactive governmental policies and collaborative efforts between academic institutions and the construction industry, further promoting sustainability across key sectors.

Prominent players shaping the Global BREEAM-Compliant Materials Market include EcoCocon, Kingspan, Holcim, Owens Corning, Amorim Cork, Saint-Gobain, Concrete Centre, and BRE Global Ltd. These companies are instrumental in setting sustainability benchmarks and delivering innovative construction materials. To enhance their presence in the BREEAM-compliant materials market, leading companies are investing significantly in product innovation focused on lowering carbon emissions, boosting energy efficiency, and improving recyclability. Many are reengineering existing product lines to meet or exceed BREEAM standards and are introducing new eco-conscious solutions tailored to both structural and interior applications. Partnerships with sustainability certifying bodies and strategic collaborations within the construction value chain are helping brands secure trust and visibility. Companies are also leveraging digital platforms to educate customers on the benefits of BREEAM-compliant products while expanding manufacturing capabilities to meet growing demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Material trends

- 2.2.2 Application trends

- 2.2.3 End use sector trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By material

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Concrete and Cement Products

- 5.2.1 Ready-Mix Concrete

- 5.2.2 Precast Concrete Elements

- 5.2.3 Cement Alternatives and Blends

- 5.3 Steel and Metal Products

- 5.3.1 Structural Steel

- 5.3.2 Reinforcing Steel

- 5.3.3 Metal Cladding and Roofing

- 5.3.4 Recycled Metal Content Products

- 5.4 Insulation Materials

- 5.4.1 Wood Fiber Insulation

- 5.4.2 Cork-based Insulation

- 5.4.3 Hemp and Bio-based Insulation

- 5.4.4 Recycled Content Insulation

- 5.5 Timber and Wood Products

- 5.5.1 Certified Sustainable Timber

- 5.5.2 Engineered Wood Products

- 5.5.3 Reclaimed and Recycled Wood

- 5.5.4 Bamboo and Alternative Wood Materials

- 5.6 Flooring and Finishing Materials

- 5.6.1 Sustainable Flooring Solutions

- 5.6.2 Low-VOC Paints and Coatings

- 5.6.3 Recycled Content Tiles and Surfaces

- 5.6.4 Bio-based Finishing Materials

- 5.7 Roofing and Envelope Materials

- 5.7.1 Green Roofing Systems

- 5.7.2 High-Performance Glazing

- 5.7.3 Sustainable Cladding Materials

- 5.7.4 Weather Barrier Systems

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 New construction

- 6.2.1 Commercial buildings

- 6.2.2 Residential buildings

- 6.2.3 Industrial facilities

- 6.2.4 Infrastructure projects

- 6.3 Refurbishment and retrofit

- 6.3.1 Heritage building restoration

- 6.3.2 Energy efficiency upgrades

- 6.3.3 Sustainable renovation projects

- 6.3.4 Building performance improvements

- 6.4 Fit-out and interior applications

- 6.4.1 Office fit-outs

- 6.4.2 Retail spaces

- 6.4.3 Healthcare facilities

- 6.4.4 Educational buildings

Chapter 7 Market Estimates and Forecast, By End Use Sector, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Commercial real estate

- 7.2.1 Office buildings

- 7.2.2 Retail and shopping centers

- 7.2.3 Hotels and hospitality

- 7.2.4 Mixed-use developments

- 7.3 Residential sector

- 7.3.1 Single-family homes

- 7.3.2 Multi-family housing

- 7.3.3 Affordable housing projects

- 7.3.4 Luxury residential developments

- 7.4 Institutional buildings

- 7.4.1 Healthcare facilities

- 7.4.2 Educational institutions

- 7.4.3 Government buildings

- 7.4.4 Cultural and community centers

- 7.5 Industrial and infrastructure

- 7.5.1 Manufacturing facilities

- 7.5.2 Warehouses and distribution centers

- 7.5.3 Transportation infrastructure

- 7.5.4 Utilities and energy projects

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Amorim Cork

- 9.2 BRE Global Ltd

- 9.3 Concrete Centre

- 9.4 EcoCocon

- 9.5 Holcim

- 9.6 Kingspan

- 9.7 Owens Corning

- 9.8 Saint-Gobain