|

市場調查報告書

商品編碼

1801801

封蓋機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Capping Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

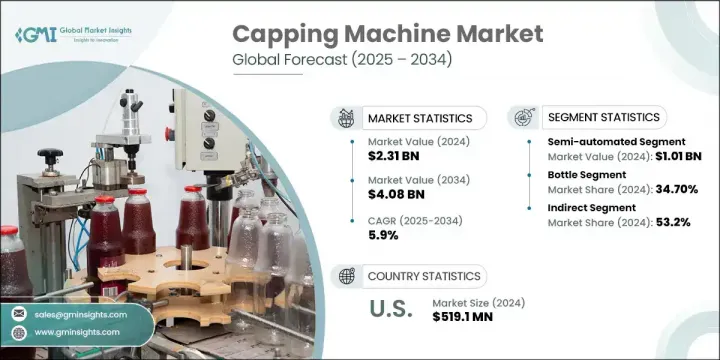

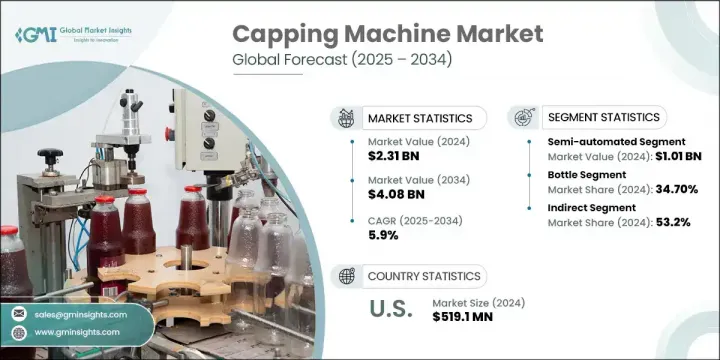

2024年,全球封蓋機市場規模達23.1億美元,預計到2034年將以5.9%的複合年成長率成長,達到40.8億美元。隨著全球各行各業對包裝商品的需求激增,該市場也穩步擴張。消費者的偏好持續轉向衛生、易用性和產品安全性,導致瓶裝食品、飲料、化妝品和藥品的消費量不斷成長。為了滿足這一需求,製造商擴大選擇能夠確保密封精度、提高貨架穩定性並防止產品被篡改的封蓋系統。這些機器在生產過程中發揮著至關重要的作用,尤其是在產品完整性監管標準日益嚴格的情況下。

自動化整合也正在改變產業格局,製造商部署先進的封蓋系統,以支援無縫操作、提高產量並減少停機時間。物聯網整合、即時監控和預測性維護等智慧功能正成為現代製造環境的標準配置。工業4.0技術的採用進一步推動了對智慧高速系統的需求,尤其是在快速消費品的裝瓶應用方面。主要製造業經濟體的投資項目正在進一步加速這些自動化包裝解決方案的採用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 23.1億美元 |

| 預測值 | 40.8億美元 |

| 複合年成長率 | 5.9% |

2024年,半自動封蓋機市場規模達10.1億美元,預計到2034年將以6%的複合年成長率成長。由於價格實惠、操作簡便,且能適應各種形狀和尺寸的容器,這類系統仍是最廣泛的應用。其緊湊的設計、低維護成本和易於安裝的特點,使其對食品、化妝品和製藥行業中佔地面積有限或生產線規模較小的小規模生產商尤其具有吸引力。

2024年,瓶裝應用領域佔34.70%的市場佔有率,預計2025年至2034年間的複合年成長率將達到6.2%。由於瓶裝包裝結構輕巧、便於攜帶且與各種瓶蓋相容,其已成為許多行業的主要包裝形式。從飲料和家用化學品到個人護理和醫用液體,瓶裝包裝都需要精密的封蓋系統來維持產品的完整性。瓶裝包裝的靈活性和成本效益持續推動對瓶裝機械的需求,這些機械可以處理各種瓶蓋設計,例如螺旋蓋、按扣蓋或壓合蓋。

2024年,美國封蓋機市場佔75.1%的市場佔有率,產值達5.191億美元。這一成長主要得益於包裝食品產業的擴張、生產線自動化程度的提高以及生產衛生和安全監管要求的不斷提高。美國製藥和食品加工產業正在投資符合FDA和現行良好生產規範(cGMP)標準的高性能封蓋系統。隨著企業大力推行預測性維護和注重效率的升級,基於人工智慧、物聯網和遠端診斷的智慧包裝技術也日益受到青睞。

全球封蓋機市場的領導者包括 Zalkin、Tetra Pak、KHS、Arol Group、IMA Group、Krones、Accutek Packaging Equipment、Federal Manufacturing Co.、A Pack、Closure Systems International、Syntegon、Filamatic、ProMach、Crown Holdings 和 E-Pak Machinery。為了在全球封蓋機市場站穩腳跟,各公司都優先考慮創新和技術整合。許多公司都在投資研發,以提高機器的多功能性,使其能夠相容於各種瓶蓋類型和容器材料。企業專注於模組化設計,以便於升級和系統可擴展性,滿足不斷成長的生產需求。與最終用戶產業建立策略合作夥伴關係有助於根據特定行業的需求客製化機器,尤其是在製藥和食品領域。參與者還透過區域製造部門和售後支援中心擴大其全球影響力,以縮短交貨時間並有效地服務當地市場。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 包裝商品產業的成長

- 轉向自動化

- 瓶裝產品需求不斷成長

- 產業陷阱與挑戰

- 高資本投入

- 複雜的維修和技術專長

- 機會

- 複雜的維修和技術專長

- 智慧包裝技術的出現

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 監管環境

- 價值鏈分析

- 原料供應商和零件製造商

- 設備製造商和原始設備製造商

- 分銷通路和銷售網路

- 最終用途領域和應用

- 售後服務供應商

- 價格趨勢

- 按地區

- 按機器類型

- 監管格局

- 標準和合規要求

- 區域監理框架

- 認證標準 貿易統計(HS 編碼 - 5)

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按機器類型,2021 - 2034 年

- 主要趨勢

- 自動的

- 半自動

- 手動的

第6章:市場估計與預測:依容量類型,2021 - 2034

- 主要趨勢

- 螺旋蓋

- 卡扣式瓶蓋

- 按壓式瓶蓋

- ROPP(防盜滾蓋)瓶蓋

- 兒童安全蓋

- 軟木蓋

- 推入式蓋帽

- 鉗口蓋

第7章:市場估計與預測:依貨櫃類型,2021 - 2034

- 主要趨勢

- 瓶子

- 罐子

- 管

- 小瓶

- 其他(例如特種容器或工業容器)

第8章:市場估計與預測:按速度類型,2021 - 2034 年

- 主要趨勢

- 低速:每分鐘約 60 個瓶蓋(cpm)

- 中速:60-300 cpm

- 高速:300-800 cpm

- 超高速:>800 cpm

第9章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 食品和飲料

- 製藥

- 化妝品/個人護理

- 化工及工業

- 其他(包括利基或新興行業)

第10章:市場估計與預測:按配銷通路2021 - 2034

- 主要趨勢

- 直銷

- 間接銷售

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第12章:公司簡介

- Accutek Packaging Equipment

- 阿帕克斯

- Arol Group

- Closure Systems International

- Crown Holdings

- E-Pak Machinery

- Federal Manufacturing Co.

- Filamatic

- IMA Group

- KHS

- Krones

- ProMach

- Syntegon

- Tetra Pak

- Zalkin

The Global Capping Machine Market was valued at USD 2.31 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 4.08 billion by 2034. This market is expanding steadily as the global demand for packaged goods surges across multiple industries. Consumer preferences continue to shift toward hygiene, ease of use, and product safety, resulting in growing consumption of bottled food, beverages, cosmetics, and pharmaceuticals. To meet this demand, manufacturers are increasingly turning to capping systems that deliver sealing accuracy, improve shelf stability, and prevent product tampering. These machines play a vital role in the production process, especially when regulatory standards for product integrity are stringent.

The integration of automation is also transforming the industry, with manufacturers deploying advanced capping systems that support seamless operations, improve throughput, and reduce downtime. The use of smart features such as IoT integration, real-time monitoring, and predictive maintenance is becoming standard in modern manufacturing environments. Adoption of Industry 4.0 technologies is further pushing demand for intelligent and high-speed systems, particularly for bottling applications in fast-moving consumer goods. Investment programs in major manufacturing economies are further accelerating the adoption of these automated packaging solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.31 Billion |

| Forecast Value | $4.08 Billion |

| CAGR | 5.9% |

In 2024, the semi-automatic capping machine segment generated USD 1.01 billion and is forecasted to grow at a CAGR of 6% through 2034. These systems remain the most widely used due to their affordability, operational simplicity, and ability to adapt to a variety of container shapes and sizes. Compact design, low maintenance, and ease of installation make them especially attractive to small-scale producers in the food, cosmetic, and pharmaceutical sectors operating with limited floor space or smaller production lines.

The bottle application segment held a 34.70% share in 2024 and is projected to grow at a CAGR of 6.2% between 2025 and 2034. Bottles dominate as the primary packaging format across numerous industries because of their lightweight construction, portability, and compatibility with various cap types. From beverages and household chemicals to personal care and medical liquids, the use of bottles requires precision capping systems to maintain product integrity. Their flexibility and cost-effectiveness continue to drive demand for bottle-focused machinery, which can handle diverse cap designs like screw, snap, or press-fit closures.

United States Capping Machine Market held 75.1% share in 2024, generating USD 519.1 million. This growth is driven by the expanding packaged foods industry, increased automation across manufacturing lines, and rising regulatory requirements for production hygiene and safety. The country's pharmaceutical and food processing sectors are investing in high-performance capping systems that meet FDA and current Good Manufacturing Practice (cGMP) standards. Smart packaging technologies powered by AI, IoT, and remote diagnostics are also gaining traction as companies push toward predictive maintenance and efficiency-focused upgrades.

Leading players in the Global Capping Machine Market include Zalkin, Tetra Pak, KHS, Arol Group, IMA Group, Krones, Accutek Packaging Equipment, Federal Manufacturing Co., A Pack, Closure Systems International, Syntegon, Filamatic, ProMach, Crown Holdings, and E-Pak Machinery. To secure a stronger foothold in the global capping machine market, companies are prioritizing innovation and technology integration. Many are investing in R&D to enhance machine versatility, enabling compatibility with various cap types and container materials. Businesses are focusing on modular designs that allow easy upgrades and system scalability to meet growing production needs. Strategic partnerships with End use industries help in tailoring machines to sector-specific requirements, especially in pharmaceuticals and food. Players are also expanding their global presence through regional manufacturing units and after-sales support centers to reduce lead times and serve local markets efficiently.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.3 Data collection methods

- 1.4 Data mining sources

- 1.4.1 Global

- 1.4.2 Regional/Country

- 1.5 Base estimates and calculations

- 1.5.1 Base year calculation

- 1.5.2 Key trends for market estimation

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Machine type

- 2.2.3 Cap type

- 2.2.4 Container type

- 2.2.5 Speed

- 2.2.6 End use industry

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth in packaged goods industries

- 3.2.1.2 Shift toward automation

- 3.2.1.3 Rising demand for bottled products

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital investment

- 3.2.2.2 Complex maintenance & technical expertise

- 3.2.3 Opportunities

- 3.2.3.1 Complex maintenance & technical expertise

- 3.2.3.2 Emergence of smart packaging technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.6 Regulatory environment

- 3.7 Value Chain Analysis

- 3.7.1 Raw material suppliers and component manufacturers

- 3.7.2 Equipment manufacturers and OEMs

- 3.7.3 Distribution channels and sales networks

- 3.7.4 End use segments and applications

- 3.7.5 After-sales service providers

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By machine type

- 3.9 Regulatory landscape

- 3.9.1 standards and compliance requirements

- 3.9.2 Regional regulatory frameworks

- 3.10 Certification standards Trade statistics (HS code - 5)

- 3.10.1 Major importing countries

- 3.10.2 Major exporting countries

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Automatic

- 5.3 Semi-automatic

- 5.4 Manual

Chapter 6 Market Estimates & Forecast, By Cap Type, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Screw caps

- 6.3 Snap-on caps

- 6.4 Press-on caps

- 6.5 ROPP (Roll-On Pilfer Proof) caps

- 6.6 Child-resistant caps

- 6.7 Cork caps

- 6.8 Push-on caps

- 6.9 Crimp caps

Chapter 7 Market Estimates & Forecast, By Container Type, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Bottles

- 7.3 Jars

- 7.4 Tubes

- 7.5 Vials

- 7.6 Others (e.g., specialty or industrial containers)

Chapter 8 Market Estimates & Forecast, By Speed Type, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Low speed: ~60 caps per minute (cpm)

- 8.3 Medium-speed: 60-300 cpm

- 8.4 High-speed: 300-800 cpm

- 8.5 Ultra-high speed: >800 cpm

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Food & Beverage

- 9.3 Pharmaceuticals

- 9.4 Cosmetics / Personal Care

- 9.5 Chemicals & Industrial

- 9.6 Others (including niche or emerging sectors)

Chapter 10 Market Estimates & Forecast, By Distribution Channel 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Accutek Packaging Equipment

- 12.2 Apacks

- 12.3 Arol Group

- 12.4 Closure Systems International

- 12.5 Crown Holdings

- 12.6 E-Pak Machinery

- 12.7 Federal Manufacturing Co.

- 12.8 Filamatic

- 12.9 IMA Group

- 12.10 KHS

- 12.11 Krones

- 12.12 ProMach

- 12.13 Syntegon

- 12.14 Tetra Pak

- 12.15 Zalkin