|

市場調查報告書

商品編碼

1797888

包裹分類系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Parcel Sorting System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

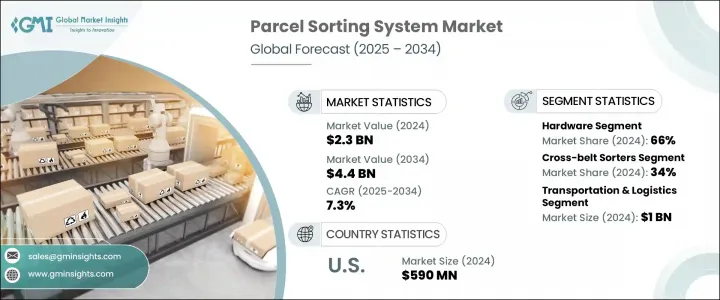

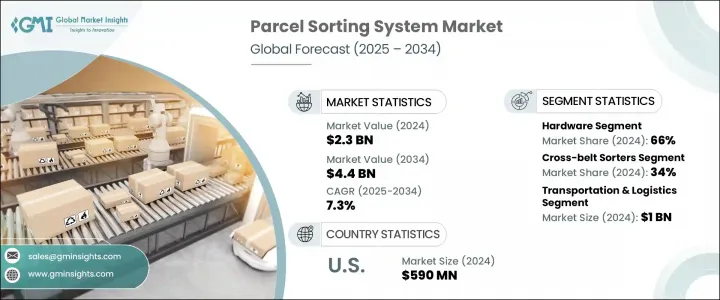

2024 年全球包裹分揀系統市場規模達 23 億美元,預計到 2034 年將以 7.3% 的複合年成長率成長,達到 44 億美元。這一穩定成長主要得益於物流和電商領域對更快、更聰明、更具成本效益的解決方案日益成長的需求。隨著包裹數量持續成長和客戶期望值不斷提高,物流業者正在從過時的手動方法轉向先進的自動化技術。人工智慧、機器學習和雲端平台的整合正在改變分類流程,從而提高速度、減少錯誤並提升整體營運效率。即時適應性和跨配送中心的無縫處理已成為核心優先事項,使得智慧自動化成為現代包裹處理策略的核心特徵。

自動化移動機器人和人工智慧驅動的系統正在縮短處理時間,提升整個物流運作的效率。企業也利用物聯網和數位孿生技術實現預測性維護,進而提高設備的正常運作時間和可靠性。性能追蹤和主動系統警報方面的創新正在不斷推出,以避免營運延誤並最大限度地提高吞吐量。這些技術驅動的進步反映了物流自動化如何從輔助任務演變為高度協作的智慧生態系統。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 23億美元 |

| 預測值 | 44億美元 |

| 複合年成長率 | 7.3% |

硬體領域在2024年佔據了66%的市場佔有率,預計到2034年將以7%的複合年成長率成長。為了處理不斷成長的包裹量,對模組化、可擴展硬體的需求不斷成長,這推動了對實體基礎設施的大量投資。這些系統專為高速、高精度操作而設計,隨著全球訂單規模和頻率的持續成長,它們對於保持高效的物流性能至關重要。

在各類分類系統中,交叉帶式分類系統在2024年的市佔率為34%,預計到2034年將以8%的複合年成長率成長。交叉帶式分類系統能夠精確分類各種形狀和尺寸的包裹,同時也能輕柔地處理易碎物品,使其成為高吞吐量物流中心的首選。交叉帶式分類系統的多功能性使物流供應商能夠處理全球電子商務成長帶來的日益多樣化的包裹類型,確保長期的適應性。

美國包裹分類系統市場佔80%的市場佔有率,2024年市場規模達5.9億美元。美國之所以能佔據市場領先地位,得益於其積極採用物流自動化技術、建構強大的電商生態系統,以及持續投資智慧倉庫基礎設施。各大公司正在部署先進的設備以及智慧軟體平台,以提高產量、管理分類能力,並最佳化龐大配送網路中的配送。

全球包裹分揀系統市場的領導者包括伯曼集團 (BEUMER Group)、范德蘭德 (Vanderlande)、柯柏 (Korber)、霍尼韋爾智慧 (Honeywell Intelligrated)、大福 (Daifuku)、英特諾集團 (Interroll Group) 和德馬泰克 (Dematic)。為了鞏固市場地位,包裹分揀系統產業的企業正在部署以創新、擴張和協作為重點的策略性舉措。他們正在透過基於人工智慧的自動化、雲端整合和即時監控功能來增強產品線。此外,各企業也正在建立全球合作夥伴關係,拓展新興市場,並投資於下一代技術,例如自主移動機器人 (AMR)、數位孿生和物聯網診斷技術。許多公司正在擴展其模組化硬體產品,並為電商、零售和第三方物流客戶量身定做解決方案,以確保更廣泛的應用。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原料生產商

- 包裹分類系統製造商

- 技術供應商和開發商

- 系統整合商和顧問

- 分銷合作夥伴和通路

- 最終用途

- 成本結構

- 利潤率

- 每個階段的增值

- 影響供應鏈的因素

- 破壞者

- 供應商格局

- 對部隊的影響

- 成長動力

- 電子商務成長和最後一哩配送需求

- 勞動成本上升和勞動力最佳化需求

- 物流營運中的自動化和人工智慧整合

- 永續性要求和環境法規

- 產業陷阱與挑戰

- 高初始資本投資和投資報酬率考慮

- 實施和維護成本高

- 市場機會

- 電子商務推動高階分類需求

- 對靈活系統進行不同尺寸包裹分類的需求日益成長

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

- 技術與創新格局

- 現有技術

- 新興技術

- 專利分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 價格趨勢

- 按地區

- 按類型

- 成本細分分析

- 永續性分析

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 硬體

- 軟體

- 服務

第6章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 推盤式分類機

- 傾斜托盤分類機

- 交叉帶式分類機

- 鞋子分類器

- 其他

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 運輸與物流

- 零售與電子商務

- 食品和飲料

- 製藥

- 其他

第8章:市場估計與預測:按地區,2021 - 2034 年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 比利時

- 荷蘭

- 瑞典

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 新加坡

- 韓國

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Amazon

- Alstef Group's

- Bastian Solutions (Toyota Advanced Logistics)

- BEUMER Group

- BOWE INTRALOGISTICS

- Daifuku

- Dematic (KION Group)

- Equinox MHE

- Falcon Autotech

- Five Group

- GBI Intralogistics

- GreyOrange

- Honeywell Intelligrated

- Interroll Group

- Korber Supply Chain (formerly Consoveyo)

- Kuecker Pulse Integration (KPI)

- MHS Global

- Okura Yusoki

- Schaefer Systems International (SSI SCHAFER)

- Vanderlande

The Global Parcel Sorting System Market was valued at USD 2.3 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 4.4 billion by 2034. This steady growth is largely driven by the increasing demand for faster, smarter, and more cost-effective solutions in the logistics and e-commerce sectors. As the volume of parcels continues to rise and customer expectations tighten, logistics operators are shifting away from outdated manual methods toward advanced automation technologies. The integration of artificial intelligence, machine learning, and cloud-powered platforms is transforming sorting operations by improving speed, minimizing errors, and enhancing overall operational efficiency. Real-time adaptability and seamless processing across distribution hubs have become core priorities, making intelligent automation a central feature in modern parcel handling strategies.

Automated mobile robots and AI-driven systems are reducing handling time and boosting efficiency across logistics operations. Companies are also leveraging IoT and digital twin technologies to enable predictive maintenance, helping to improve equipment uptime and reliability. Innovations in performance tracking and proactive system alerts are being rolled out to avoid operational delays and maximize throughput. These tech-driven advancements reflect how logistics automation is evolving from assisted tasks to highly collaborative, intelligent ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $4.4 Billion |

| CAGR | 7.3% |

The hardware segment held a 66% share in 2024 and is estimated to grow at 7% CAGR through 2034. The increased need for modular, scalable hardware to handle rising parcel volumes is driving heavy investment in physical infrastructure. These systems are engineered for high-speed, high-accuracy operations and are critical to maintaining efficient logistics performance as order sizes and frequencies continue to rise globally.

Among sorting types, the cross-belt segment held a 34% share in 2024 and is expected to grow at a CAGR of 8% through 2034. Their ability to sort packages of various shapes and sizes with precision, while maintaining gentle handling for delicate items, has made them a top choice for high-volume logistics centers. Their versatility allows logistics providers to handle the growing variety of parcel types driven by global e-commerce growth, ensuring long-term adaptability.

U.S. Parcel Sorting System Market held an 80% share and generated USD 590 million in 2024. The country's leadership stems from its aggressive adoption of logistics automation, a strong e-commerce ecosystem, and continued investments in smart warehouse infrastructure. Companies are deploying advanced equipment alongside intelligent software platforms to improve output, manage sorting capacity, and optimize distribution across vast fulfillment networks.

Leading players in the Global Parcel Sorting System Market include BEUMER Group, Vanderlande, Korber, Honeywell Intelligrated, Daifuku, Interroll Group, and Dematic. To secure a stronger market position, companies in the parcel sorting system industry are deploying strategic initiatives that focus on innovation, expansion, and collaboration. They are enhancing product lines with AI-based automation, cloud integration, and real-time monitoring features. Firms are also forming global partnerships, expanding into emerging markets, and investing in next-gen technologies like AMRs, digital twins, and IoT-enabled diagnostics. Many companies are scaling their modular hardware offerings and customizing solutions for e-commerce, retail, and third-party logistics clients to ensure broader adoption.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Data mining sources

- 1.2.1 Global

- 1.2.2 Regional/Country

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Type

- 2.2.4 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw materials manufacturer

- 3.1.1.2 Parcel sorting system manufacturer

- 3.1.1.3 Technology vendors and developers

- 3.1.1.4 System integrators and consultants

- 3.1.1.5 Distribution partners and channels

- 3.1.1.6 End use

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 E-commerce growth and last-mile delivery demands

- 3.2.1.2 Rising labor costs and workforce optimization needs

- 3.2.1.3 Automation and ai integration in logistics operations

- 3.2.1.4 Sustainability requirements and environmental regulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial capital investment and ROI considerations

- 3.2.2.2 High implementation and maintenance costs

- 3.2.3 Market opportunities

- 3.2.3.1 E-commerce driving advanced sorting needs

- 3.2.3.2 Growing need for flexible systems to sort varied parcel sizes

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Porter's analysis

- 3.5 PESTEL analysis

- 3.6 Technology & innovation landscape

- 3.6.1 Current technologies

- 3.6.2 Emerging technologies

- 3.7 Patent analysis

- 3.8 Regulatory landscape

- 3.8.1 North America

- 3.8.2 Europe

- 3.8.3 Asia Pacific

- 3.8.4 Latin America

- 3.8.5 Middle East & Africa

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By type

- 3.10 Cost breakdown analysis

- 3.11 Sustainability analysis

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New Product Launches

- 4.5.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Push tray sorters

- 6.3 Tilt-tray sorter

- 6.4 Crossbelt sorter

- 6.5 Shoe sorter

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Transportation & Logistics

- 7.3 Retail & E-commerce

- 7.4 Food & Beverage

- 7.5 Pharmaceutical

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 8.1 North America

- 8.1.1 U.S.

- 8.1.2 Canada

- 8.2 Europe

- 8.2.1 UK

- 8.2.2 Germany

- 8.2.3 France

- 8.2.4 Italy

- 8.2.5 Spain

- 8.2.6 Belgium

- 8.2.7 Netherlands

- 8.2.8 Sweden

- 8.3 Asia Pacific

- 8.3.1 China

- 8.3.2 India

- 8.3.3 Japan

- 8.3.4 Australia

- 8.3.5 Singapore

- 8.3.6 South Korea

- 8.3.7 Vietnam

- 8.3.8 Indonesia

- 8.4 Latin America

- 8.4.1 Brazil

- 8.4.2 Mexico

- 8.4.3 Argentina

- 8.5 MEA

- 8.5.1 South Africa

- 8.5.2 Saudi Arabia

- 8.5.3 UAE

Chapter 9 Company Profiles

- 9.1 Amazon

- 9.2 Alstef Group's

- 9.3 Bastian Solutions (Toyota Advanced Logistics)

- 9.4 BEUMER Group

- 9.5 BOWE INTRALOGISTICS

- 9.6 Daifuku

- 9.7 Dematic (KION Group)

- 9.8 Equinox MHE

- 9.9 Falcon Autotech

- 9.10 Five Group

- 9.11 GBI Intralogistics

- 9.12 GreyOrange

- 9.13 Honeywell Intelligrated

- 9.14 Interroll Group

- 9.15 Korber Supply Chain (formerly Consoveyo)

- 9.16 Kuecker Pulse Integration (KPI)

- 9.17 MHS Global

- 9.18 Okura Yusoki

- 9.19 Schaefer Systems International (SSI SCHAFER)

- 9.20 Vanderlande