|

市場調查報告書

商品編碼

1797875

汽油發電機組市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Gasoline Gensets Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

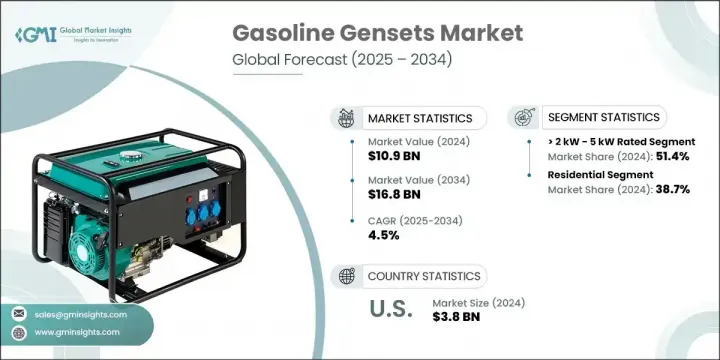

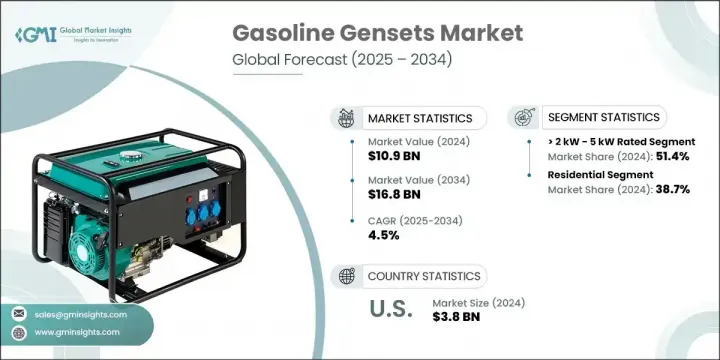

2024 年全球汽油發電機組市場價值為 109 億美元,預計到 2034 年將以 4.5% 的複合年成長率成長,達到 168 億美元。市場對攜帶式可靠電源解決方案的需求日益成長,尤其是在電網連接不穩定或電力供應暫時中斷的地區。汽油發電機因其價格實惠、燃料易得、初始成本相對較低以及設計緊湊,在各種住宅、商業和輕工業應用中越來越受歡迎。這些發電機組在緊急情況下或替代燃料選擇有限的地區提供必要的備用電源。隨著消費者對噪音污染和環境影響的認知不斷提高,製造商正致力於打造更安靜、更省油、更環保的機型。

此外,颶風、洪水和野火等極端天氣事件的發生頻率不斷上升,預計將大幅推高對備用電源解決方案的需求,進一步推動未來幾年市場的成長。隨著氣候變遷加劇,這些天災發生頻率和嚴重程度也隨之增加。在易受此類事件影響的地區,停電現像日益普遍,社區常常長時間斷電。這迫切需要可靠的備用電源系統,以確保住宅、商業和工業運作的連續性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 109億美元 |

| 預測值 | 168億美元 |

| 複合年成長率 | 4.5% |

額定功率大於 2 kW 至 5 kW 的市場在 2024 年佔據 51.4% 的市場佔有率,預計到 2034 年將以 4.5% 的複合年成長率成長。這些設備主要用於商業環境和戶外應用的攜帶式備用電源,因其緊湊的尺寸和快速啟動能力而備受青睞。停電次數的增加,尤其是在偏遠或災害多發地區,推動了這些設備的普及。

2024年,住宅領域佔據38.7%的市場佔有率,預計2025年至2034年的複合年成長率為4.5%。這類發電機尤其適用於在停電期間提供備用電源,尤其是在電網不穩定的地區。它們便攜、價格實惠且易於安裝,使其成為停電期間為家用電器供電的理想選擇。由於能夠快速為工具和小型機械供電,且易於加油,這類發電機也受到建築應用的青睞。

2024年,美國汽油發電機組市場佔89.1%的市場佔有率,產值達38億美元。由於頻繁的天氣停電以及農村電氣化需求的不斷成長,對備用電源解決方案的需求一直在穩步成長。汽油發電機組因其便攜性、簡便性和較低的初始成本而備受青睞,使其成為這些地區廣泛應用的理想選擇。

引領汽油發電機組市場的頂級公司包括 Generac Power Systems、康明斯、本田印度動力產品、迪爾公司、雅馬哈引擎等,它們在 2024 年對市場佔有率做出了重大貢獻。在汽油發電機組市場,領先的公司專注於透過加入降低噪音水平、提高燃油效率和遵守更嚴格的環境法規等先進功能來加強產品創新。這些公司正在擴大其產品範圍,以滿足住宅、商業和輕工業領域各種客戶的需求。為了進一步加強市場佔有率,企業正在投資於技術升級,例如自動化和遠端監控功能,以改善使用者體驗和營運效率。此外,與主要參與者和分銷商的合作有助於這些公司將業務範圍擴展到尚未開發的地區並增強其市場立足點。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 原料可用性和採購分析

- 製造能力評估

- 供應鏈彈性和風險因素

- 配電網路分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

- 汽油發電機組成本結構分析

- 價格趨勢分析

- 按地區

- 按功率等級

- 新興機會和趨勢

- 數位化與工業4.0融合

- 新興市場滲透

- 投資分析與財務狀況

第4章:競爭格局

- 介紹

- 按地區分析公司市場佔有率

- 北美洲

- 歐洲

- 亞太地區

- 中東

- 非洲

- 拉丁美洲

- 戰略儀表板

- 策略舉措

- 重要夥伴關係與合作

- 重大併購活動

- 產品創新與發布

- 市場擴張策略

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:依功率等級,2021 - 2034 年

- 主要趨勢

- ≤2千瓦

- > 2千瓦 - 5千瓦

- > 5千瓦 - 8千瓦

- > 8千瓦 - 15千瓦

第6章:市場規模及預測:依階段,2021 - 2034

- 主要趨勢

- 單相

- 三相

第7章:市場規模及預測:依最終用途,2021 - 2034

- 主要趨勢

- 住宅

- 商業的

- 建造

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 俄羅斯

- 英國

- 德國

- 法國

- 西班牙

- 奧地利

- 義大利

- 亞太地區

- 澳洲

- 日本

- 中國

- 印度

- 印尼

- 泰國

- 菲律賓

- 馬來西亞

- 新加坡

- 越南

- 韓國

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 土耳其

- 伊朗

- 阿曼

- 非洲

- 埃及

- 奈及利亞

- 阿爾及利亞

- 南非

- 莫三比克

- 拉丁美洲

- 墨西哥

- 智利

- 阿根廷

- 巴西

第9章:公司簡介

- Allmand Bros

- Atlas Copco AB

- Briggs & Stratton

- Cummins

- Champion Power Equipment

- Deere & Company

- DEWALT

- DuroMax Power Equipment

- FIRMAN Power Equipment

- Generac Power Systems

- GENMAC

- Gillette Generators

- Himalayan Power Machine

- Honda India Power Products

- Hyundai Power Products

- JET POWER

- Kirloskar

- Pulsar Products

- Rehlko

- WEN Products

- WINCO

- Yamaha Motor

The Global Gasoline Gensets Market was valued at USD 10.9 billion in 2024 and is estimated to grow at a CAGR of 4.5% to reach USD 16.8 billion by 2034. The market is driven by a rising need for portable and reliable power solutions, especially in regions with unreliable grid connectivity or where power supply is temporarily unavailable. Gasoline-powered generators are gaining traction across various residential, commercial, and light industrial applications due to their affordability, ease of fuel availability, relatively low initial costs, and compact design. These gensets are favored for providing essential backup power in emergencies or in areas where alternative fuel options are limited. As consumer awareness around noise pollution and environmental impact grows, manufacturers are focusing on creating quieter, more fuel-efficient, and eco-friendly models.

Additionally, the rising frequency of extreme weather events such as hurricanes, floods, and wildfires is expected to significantly boost the demand for backup power solutions, further fueling the market's growth in the coming years. As climate change intensifies, the likelihood of these natural disasters occurring more frequently and with greater severity increases. In areas prone to such events, power outages are becoming more common, often leaving communities without electricity for extended periods. This creates an urgent need for reliable backup power systems to ensure continuity in residential, commercial, and industrial operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.9 Billion |

| Forecast Value | $16.8 Billion |

| CAGR | 4.5% |

The > 2 kW - 5 kW rated segment accounted for a 51.4% share in 2024 and is expected to grow at a rate of 4.5% CAGR until 2034. These units are primarily in demand for portable backup power in commercial settings and outdoor applications, valued for their compact size and quick-start capabilities. The increasing number of power outages, especially in remote or disaster-prone regions, is driving the adoption of these units.

The residential segment held a 38.7% share in 2024, with an expected growth rate of 4.5% CAGR from 2025 to 2034. These generators are particularly popular for providing backup power during electricity outages, particularly in areas where the power grid is unstable. Their portability, affordability, and ease of installation make them ideal for supplying essential household appliances during power disruptions. These generators are also favored for construction applications due to their ability to power tools and small machinery quickly, as well as their ease of refueling.

U.S. Gasoline Gensets Market held 89.1% share in 2024, generating USD 3.8 billion. The demand for backup power solutions has been steadily rising, driven by frequent weather-related power outages and the growing need for rural electrification. Gasoline gensets are favored for their portability, simplicity, and low initial cost, making them ideal for a wide range of applications in these regions.

Top companies leading the Gasoline Gensets Market include Generac Power Systems, Cummins, Honda India Power Products, Deere & Company, Yamaha Motor, and others, contributing significantly to the market share in 2024. In the gasoline genset market, leading companies focus on enhancing product innovation by incorporating advanced features like reduced noise levels, improved fuel efficiency, and adherence to stricter environmental regulations. These companies are expanding their product ranges to cater to various customer needs across residential, commercial, and light industrial sectors. To further strengthen their market presence, businesses are investing in technological upgrades such as automation and remote monitoring capabilities to improve user experience and operational efficiency. Additionally, partnerships with key players and distributors help these companies expand their reach to untapped regions and enhance their market foothold.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1.1 Raw material availability & sourcing analysis

- 3.1.1.2 Manufacturing capacity assessment

- 3.1.1.3 Supply chain resilience & risk factors

- 3.1.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of gasoline gensets

- 3.8 Price trend analysis

- 3.8.1 By region

- 3.8.2 By power rating

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization & industry 4.0 integration

- 3.9.2 Emerging market penetration

- 3.10 Investment analysis & financial landscape

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East

- 4.2.5 Africa

- 4.2.6 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021 - 2034 (USD Million & '000 Units)

- 5.1 Key trends

- 5.2 ≤ 2 kW

- 5.3 > 2 kW - 5 kW

- 5.4 > 5 kW - 8 kW

- 5.5 > 8 kW - 15 kW

Chapter 6 Market Size and Forecast, By Phase, 2021 - 2034 (USD Million & '000 Units)

- 6.1 Key trends

- 6.2 Single phase

- 6.3 Three phase

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million & '000 Units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Construction

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & '000 Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Russia

- 8.3.2 UK

- 8.3.3 Germany

- 8.3.4 France

- 8.3.5 Spain

- 8.3.6 Austria

- 8.3.7 Italy

- 8.4 Asia Pacific

- 8.4.1 Australia

- 8.4.2 Japan

- 8.4.3 China

- 8.4.4 India

- 8.4.5 Indonesia

- 8.4.6 Thailand

- 8.4.7 Philippines

- 8.4.8 Malaysia

- 8.4.9 Singapore

- 8.4.10 Vietnam

- 8.4.11 South Korea

- 8.5 Middle East

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Turkey

- 8.5.5 Iran

- 8.5.6 Oman

- 8.6 Africa

- 8.6.1 Egypt

- 8.6.2 Nigeria

- 8.6.3 Algeria

- 8.6.4 South Africa

- 8.6.5 Mozambique

- 8.7 Latin America

- 8.7.1 Mexico

- 8.7.2 Chile

- 8.7.3 Argentina

- 8.7.4 Brazil

Chapter 9 Company Profiles

- 9.1 Allmand Bros

- 9.2 Atlas Copco AB

- 9.3 Briggs & Stratton

- 9.4 Cummins

- 9.5 Champion Power Equipment

- 9.6 Deere & Company

- 9.7 DEWALT

- 9.8 DuroMax Power Equipment

- 9.9 FIRMAN Power Equipment

- 9.10 Generac Power Systems

- 9.11 GENMAC

- 9.12 Gillette Generators

- 9.13 Himalayan Power Machine

- 9.14 Honda India Power Products

- 9.15 Hyundai Power Products

- 9.16 JET POWER

- 9.17 Kirloskar

- 9.18 Pulsar Products

- 9.19 Rehlko

- 9.20 WEN Products

- 9.21 WINCO

- 9.22 Yamaha Motor