|

市場調查報告書

商品編碼

1797865

對乙醯氨基酚市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Acetaminophen Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

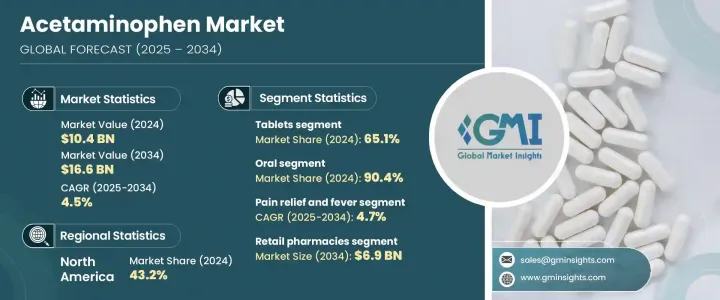

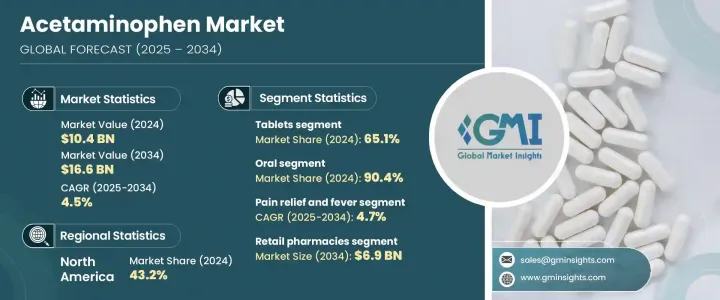

2024 年全球對乙醯氨基酚市場規模為 104 億美元,預計到 2034 年將以 4.5% 的複合年成長率成長至 166 億美元。不同年齡層慢性疼痛和反覆發燒的盛行率不斷上升,持續推動全球對乙醯氨基酚的需求。對乙醯氨基酚是一種廣泛獲取且值得信賴的非處方藥,常用於緩解輕度至中度疼痛和發燒。全球傳染病和頭痛相關疾病病例的上升進一步刺激了對乙醯氨基酚的需求。作為非鴉片類鎮痛解熱藥,對乙醯氨基酚仍然是一線治療選擇,尤其適用於因胃腸道或心血管問題而對非類固醇抗發炎藥物不耐受的患者。許多地區對自我照顧和非處方藥的依賴日益增加,也促進了市場的成長。

太陽製藥、雅培、梯瓦製藥、賽諾菲和奧羅賓多製藥等領導企業憑藉其豐富的製劑品種、廣泛的供應鏈以及在已開發經濟體和新興經濟體中保持的強大品牌認知度,發揮著至關重要的作用。這些公司持續投資於生產可擴展性,確保對乙醯氨基酚在各個治療領域持續供應。他們深厚的監管專業知識使產品核准更加順暢,而遍布全球的生產佈局則有助於緩解供應中斷。除了專注於學名藥之外,他們還透過推出緩釋劑型、兒科友善製劑以及提高患者依從性的聯合療法,脫穎而出。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 104億美元 |

| 預測值 | 166億美元 |

| 複合年成長率 | 4.5% |

2024年,片劑製劑市場佔65.1%的市佔率。這項優勢歸功於其成本效益高、易於生產以及消費者對一致劑型的偏好。片劑因其更長的保存期限、便攜性以及與大規模生產(尤其是非處方藥)的兼容性而廣受青睞。由於口服片劑在零售藥局和超市的廣泛普及,它仍然是大多數成人和兒童使用者的首選劑型。城鄉醫療保健機構的強勁需求,加上強大的製藥生產能力,繼續鞏固了該市場的領先地位。

2024年,口服給藥佔了90.4%的市場。口服劑型(包括膠囊、糖漿和片劑)由於其易於服用、體內快速吸收以及適合居家治療,仍然是首選。這些劑型順應了自我用藥的趨勢,尤其適用於治療輕度至中度疼痛或發燒,且無需專業監督。此外,咀嚼錠、緩釋劑型和兒童友善糖漿等增強型口服劑型正在改善患者體驗,並確保各年齡層患者更好地堅持用藥。

北美對乙醯氨基酚市場預計在2024年將佔據43.2%的市場。該地區的高消費量與關節炎和慢性背痛等肌肉骨骼疾病的普遍流行有關,此外,該地區居民對非處方藥的依賴程度也日益加深。此外,推廣鴉片類藥物替代品的宣傳活動和醫療保健政策進一步鞏固了對乙醯氨基酚作為首選藥物的地位。憑藉強大的公共衛生基礎設施、高度的消費者認知度以及強大的製藥業影響力,北美將繼續推動該領域的收入大幅成長和創新。

對乙醯氨基酚市場的一些頂級公司包括 Hyloris Pharmaceuticals、Granules India Limited、B. Braun Melsungen、拜耳股份公司、Dr. Reddy's Laboratories、Mallinckrodt Pharmaceuticals、諾華、葛蘭素史克製藥、Lupin、Alkem Laboratories 和 Kenvue(強生),以及其他公司,如同菲諾菲諾菲諾.,為了鞏固其在對乙醯氨基酚市場的地位,領先企業正在採取幾種關鍵策略。許多公司專注於產品組合多樣化,推出針對特定患者需求的各種配方,例如兒科滴劑、發泡錠和組合產品。他們非常重視製造可擴展性和成本最佳化,以提高發展中地區的可近性。對供應鏈效率的投資以及與零售分銷商的策略合作夥伴關係進一步確保了產品的可用性。此外,該公司繼續參與行銷活動,以提高品牌召回率並使其對乙醯氨基酚產品差異化。遵守不斷發展的監管框架以及對產品品質、安全性和臨床療效的投資仍然是其長期市場策略的重要組成部分。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 普通感冒、發燒和流感病例增加

- 慢性病和疼痛管理問題數量不斷增加

- 靜脈注射乙醯胺酚與非類固醇抗發炎藥和麻醉藥的合併使用日益增多

- 產業陷阱與挑戰

- 對乙醯氨基酚的副作用,例如血壓升高和肝毒性

- 更有效的止痛藥的可用性

- 市場機會

- 向新興市場擴張

- 開發創新且更安全的配方

- 成長動力

- 成長潛力分析

- 監管格局

- 報銷場景

- 未來市場趨勢

- 差距分析

- 管道分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按劑型,2021 - 2034 年

- 主要趨勢

- 藥片

- 液體懸浮液

- 點滴溶液

- 其他劑型

第6章:市場估計與預測:按管理路線,2021 - 2034 年

- 主要趨勢

- 口服

- 腸外

- 其他給藥途徑

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 緩解疼痛和發燒

- 普通感冒

- 頭痛

- 腹部絞痛

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 網路藥局

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 日本

- 中國

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Abbott

- Alkem Laboratories

- Aurobindo Pharma

- B. Braun Melsungen

- Bayer AG

- Dr. Reddy's Laboratories

- GlaxoSmithKline Pharmaceuticals

- Granules India Limited

- Hyloris Pharmaceuticals

- Kenvue (Johnson & Johnson)

- Lupin

- Mallinckrodt Pharmaceuticals

- Novartis

- Sanofi

- Sun Pharmaceutical Industries

- Teva Pharmaceuticals

The Global Acetaminophen Market was valued at USD 10.4 billion in 2024 and is estimated to grow at a CAGR of 4.5% to reach USD 16.6 billion by 2034. The rising prevalence of chronic pain conditions and recurring fever across various age groups continues to propel the demand for acetaminophen worldwide. As a widely accessible and trusted over-the-counter drug, acetaminophen is commonly used for mild to moderate pain and fever management. The global uptick in cases of infectious illnesses and headache-related disorders is further accelerating demand. As a non-opioid analgesic and antipyretic, acetaminophen remains a first-line treatment option, especially for patients intolerant to NSAIDs due to gastrointestinal or cardiovascular issues. The market growth is also reinforced by an increasing reliance on self-care and non-prescription medications across many regions.

Leading players such as Sun Pharmaceutical Industries, Abbott, Teva Pharmaceuticals, Sanofi, and Aurobindo Pharma play a critical role by offering a diverse range of formulations, leveraging extensive supply chains, and maintaining strong brand recognition in both developed and emerging economies. These companies continuously invest in production scalability, ensuring consistent availability of acetaminophen across various therapeutic segments. Their deep regulatory expertise allows for smoother product approvals, while global manufacturing footprints help mitigate supply disruptions. In addition to focusing on generics, they also differentiate themselves by introducing extended-release versions, pediatric-friendly formats, and combination therapies that improve patient compliance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.4 Billion |

| Forecast Value | $16.6 Billion |

| CAGR | 4.5% |

In 2024, the tablet-based formulations segment held a 65.1% share. This dominance is attributed to their cost-effectiveness, ease of manufacturing, and consumer preference for consistent dosage formats. Tablets are widely preferred for their longer shelf life, portability, and compatibility with large-scale production, especially for over-the-counter products. With broad accessibility in retail pharmacies and supermarkets, the oral tablet remains the go-to form for most users across adult and pediatric populations. Strong demand from both urban and rural healthcare settings, combined with robust pharmaceutical manufacturing capacities, continues to sustain the segment's leadership.

The oral route segment held a 90.4% share in 2024. Oral formulations-including capsules, syrups, and tablets-remain the preferred choice due to their ease of administration, rapid availability in the body, and suitability for at-home treatment. These formats support self-medication trends and are especially effective for treating low to moderate pain or fever without the need for professional supervision. Additionally, enhanced oral formulations such as chewables, extended-release variants, and child-friendly syrups are improving patient experience and ensuring better adherence across age groups.

North America Acetaminophen Market with a 43.2% share in 2024. The region's high consumption is linked to the widespread prevalence of musculoskeletal conditions such as arthritis and chronic back pain, coupled with an increased reliance on non-prescription medications for everyday ailments. Moreover, awareness campaigns and healthcare policies promoting alternatives to opioids have further established acetaminophen as a preferred option. With robust public health infrastructure, high consumer awareness, and strong pharmaceutical presence, North America continues to drive significant revenue growth and innovation in the sector.

Some of the top companies operating in the Acetaminophen Market include Hyloris Pharmaceuticals, Granules India Limited, B. Braun Melsungen, Bayer AG, Dr. Reddy's Laboratories, Mallinckrodt Pharmaceuticals, Novartis, GlaxoSmithKline Pharmaceuticals, Lupin, Alkem Laboratories, and Kenvue (Johnson & Johnson), alongside others like Sanofi and Convergent Technologies. To strengthen their position in the acetaminophen market, leading players are adopting several key strategies. Many companies focus on portfolio diversification by introducing a broad range of formulations tailored to specific patient needs, such as pediatric drops, effervescent tablets, and combination products. Strong emphasis is placed on manufacturing scalability and cost optimization to improve accessibility in developing regions. Investments in supply chain efficiency and strategic partnerships with retail distributors further ensure product availability. In addition, companies continue to engage in marketing initiatives to enhance brand recall and differentiate their acetaminophen products. Compliance with evolving regulatory frameworks and investment in product quality, safety, and clinical efficacy remain essential elements of their long-term market strategy.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Dosage form trends

- 2.2.3 Route of administration trends

- 2.2.4 Application trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising cases of common cold, fever, and influenza

- 3.2.1.2 Rising number of chronic diseases and pain management conditions

- 3.2.1.3 Increasing use of intravenous paracetamol in combination with NSAIDs and narcotics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects of paracetamol, such as a rise in blood pressure and hepatotoxicity

- 3.2.2.2 Availability of more effective painkillers

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into emerging markets

- 3.2.3.2 Development of innovative and safer formulations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Reimbursement scenario

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Pipeline analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Dosage Form, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Tablet

- 5.3 Liquid suspension

- 5.4 Infusion solution

- 5.5 Other dosage forms

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Parenteral

- 6.4 Other routes of administration

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pain relief and fever

- 7.3 Common cold

- 7.4 Headache

- 7.5 Abdominal cramps

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 Japan

- 9.4.2 China

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott

- 10.2 Alkem Laboratories

- 10.3 Aurobindo Pharma

- 10.4 B. Braun Melsungen

- 10.5 Bayer AG

- 10.6 Dr. Reddy's Laboratories

- 10.7 GlaxoSmithKline Pharmaceuticals

- 10.8 Granules India Limited

- 10.9 Hyloris Pharmaceuticals

- 10.10 Kenvue (Johnson & Johnson)

- 10.11 Lupin

- 10.12 Mallinckrodt Pharmaceuticals

- 10.13 Novartis

- 10.14 Sanofi

- 10.15 Sun Pharmaceutical Industries

- 10.16 Teva Pharmaceuticals